It’s a relatively calm day today despite all the high profile events. At the time of writing, Euro is trading as the weakest one after ECB delivered a dovish shift as expected. In short, 2019 growth and inflation forecasts are lowered, and Draghi said balance of risks are moving to the downside. But it will take more time to see if Euro is really reversing for the near term. Swiss Franc trades mixed after SNB retained negative interest rate policy and pledged to stay active in intervention. Sterling is the strongest one so far. After winning yesterday’s leadership challenger, UK PM May is now in Brussels, with no expectation of a breakthrough though.

Technically, EUR/USD, EUR/JPY, EUR/GBP, EUR/AUD are staying in familiar range despite today’s up and downs. EUR/GBP and EUR/AUD are bullish with 0.8931 and 1.5596 support intact. But EUR/USD and EUR/JPY are near term bearish with 1.1472 and 130.14 resistance intact. Meanwhile, GBP/USD is staying well below 1.2811 resistance and keeps bearish outlook. But GBP/JPY could have a taken on 144.02 resistance as early indication of bullish reversal.

In other markets, major European indices are mixed for the time being. FTSE is down -0.18%, DAX up 0.19% but CAC down -0.09%. German 10 year yield is up 0.0002 at 0.282. But Italian 10 year yield drops notably today and is now down -0.082 at 2.932. Earlier in Asia, Nikkei rose 0.99%, Hong Kong HSI rose 1.29%, Shanghai SSE rose 1.23%, Singapore Strait Times rose 0.36%.

ECB lowered 2019 growth and inflation forecast, continuing confidence with increasing caution

ECB let interest rates unchanged today as widely expected. That is, main refinancing rate, marginal lending facility and deposit facility rates are held at 0.00%, 0.25% and -0.40% respectively. ECB maintained forward guidance that interest rates will “remain at their present levels at least through the summer of 2019”. Also, the asset purchase program will end this month as scheduled.

In the post meeting press conference, ECB President Mario Draghi said the assessment of risks was a focal point in the discussion during the meeting. And he’d summarize the discussions with “continuing confidence with increasing caution”.

ECB lowered both 2018 and 2019 growth forecast. Growth is now projected to be at 1.9% in 2018 (prior 2.0%), 1.7% in 2019 (1.8% prior), 1.7% in 2020 (unchanged) and 1.5% in 2021 (new). Draghi said that risks are “broadly balanced” but balance of risks is “moving to the downside”. He noted “persistence uncertainties” related to geopolitical factors, the threat of protectionism, vulnerabilities in emerging markets and financial market volatility”, as reasons.

On HICP inflation, it’s now projected to be at 1.8% in 2018 (1.7% prior), 1.6% in 2019 (1.7% prior), 1.7% in 2020 (unchanged), 1.8% in 2021 (new). ECB noted that headline inflation is likely to fall over the coming months “On the basis of current futures prices for oil”. Underlying inflation remains “generally muted”. Though, “domestic cost pressures are continuing to strengthen and broaden”.

SNB held negative rate, pledge to intervene when needed, revised down inflation forecasts

SNB kept sight deposit rate unchanged at -0.75% as widely expected. Three month Libor target range is held at -1.25% to -0.25% correspondingly. SNB also pledged to “remain active in the foreign exchange market as necessary”.

SNB also noted that Swiss Franc is “still highly valued, and the situation on the foreign exchange market continues to be fragile.” Negative interest rate and the willingness to intervene “remains essential”. Theses measures “keep the attractiveness of Swiss franc investments low and reduce upward pressure on the currency.

Near term inflation forecast was revised lower due to “drop in oil prices”. Medium term inflation forecast is also revised lower due to “more moderate growth prospects”.

- For 2018, inflation is forecast to be at 0.9%, unchanged

- For 2019, inflation is forecast to be at 0.5%, revised down from 0.8%

- For 2020, inflation is forecast to be at 1.0%, revised down from 1.2%

Slow down in Q3 is seen as temporary by SNB. And it anticipates “solid growth in the coming quarters”. For the near term, world economy will continue to expand “somewhat above potential”. But “gradual slowdown is likely in the medium term”. SNB pointed out some significant risks including “political uncertainties and protectionist tendencies” For 2018, growth is projected to be at 2.5%, slightly revised down. For 2019, growth is projected to slow to 1.5%

SNB Chairman Thomas Jordan warned in the post meeting press conference that “surveys indicate that trade tensions have prompted companies to reassess their investment plans and value chains.” Also, Brexit “uncertainty remains high following the postponement of the vote in the UK parliament.” He also pointed to the “tension surrounding Italy’s fiscal policy also persists”. Jordan said “all these risks could lead to turbulence in the financial markets, jeopardize global economic growth, and also influence monetary policy.” He added that Swiss Franc remains highly valued. At the same time, FX situation is still fragile.

Also from Swiss, PPI dropped -0.3% mom, rose 1.4% yoy in November.

Ifo slashed German 2019 growth forecast from 1.9% to 1.1%, auto weakness to continue

Ifo slashed German economy growth forecast in the Winter report released today. 2018 growth forecast is revised down from 1.9% to 1.5%. 2019 growth forecast is revised down from 1.9% to 1.1%. For 2020, growth forecast is revised down from 1.7 to 1.6%. Ifo warned that “the weakness triggered by the automotive industry will continue until 2019. A wide range of uncertainties are also curbing the global economy, and especially Brexit, Italy and US trade policy to name but a few.”

In the report, Ifo said downside risks for global economy “grew markedly” compared to autumn. US has imposed customs duties on a “large number of imports”, followed by retaliation from China and the EU. And “it is impossible to predict the direction that the trade dispute will take”. In case of escalation, Ifo warned “global trade in goods and overall economic production can be expected to suffer a major setback.”

Also, trade dispute will lead to faster rise in inflation. And if advanced economies central banks opt for “far more restrictive measures”, this may prompt a “return to capital outflows from emerging markets.” Hard Brexit “represents another risk for the economy both in Britain and in the euro area.” Besides, high risk premium on Italian government bonds also pose a threat to economic development in the Eurozone.

Released from Germany, November CPI was finalized at 0.1% mom, 2.3% yoy.

EU reiterates no Brexit negotiation, May seeks legal and political assurances on the backstop

European Union Budget Commissioner Guenther Oettinger reiterated the commission’s stance on Brexit negotiation. That is, ” final clarification yes, but further negotiations no”. Oettinger went further and emphasized that there won’t be a time limit for the backstop solution on Irish border. He added “that doesn’t work. We need to have clear rules for people, products and goods at the border of Ireland, Northern Ireland, Belfast and Dublin.”

Separately, it’s reported the EU is ready to provide further assurance regarding the backstop. Reuters reported after seeing a six-point document for today’s summit. The assurance would include that “The European Council underlines that the backstop does not represent a desirable outcome for the Union. The backstop is only intended as an insurance policy … It is the Union’s firm determination to work speedily on a subsequent agreement.”

And even if triggered EU would say the backstop would “apply only temporarily unless and until it is superseded by a subsequent agreement.” EU would also commit to “best endeavours” to agree on a new EU-UK deal if the backstop is triggered “so that it would only be in place for a short period and only as long as strictly necessary.”

UK Prime Minister Theresa May survived the leadership challenge yesterday. She’s now in Brussels for the EU summit. She told reporters that “I don’t expect an immediate breakthrough, but what I do hope is that we can start to work as quickly as possible on the assurances that are necessary.” And those include both legal and political assurances on the backstop.

Also, May confirmed that she will not lead the Conservatives into 2022 election.

Italian yield drops to lowest since Sep after Italy offered budget concessions

Italy 10 year yield drops notably again today on news that the coalition government offered major concession to EU regarding its budget. Italian Prime Minister Giuseppe Conte told reports after meeting European Commission President Jean-Claude Juncker that 2019 budget deficit target from 2.4% to 2.04%.

Conte emphasized that “We are not betraying the trust of Italians and we respect the commitments made with the measures which have the most impact.” He added that “growth will be above our expectations” and the structural deficit will fall. Economy Minister Giovanni Tria will travel to Brussels today to guide the remaining parts of the budget talks with EU.

Italy 10 year yield hits as low as 2.887 and is now down -0.099 at 2.914 at the time of writing. That’s the lowest level since September.

US initial claims dropped to 206k vs expectation 227k

US initial jobless claims dropped -27k to 206k in the week ending December 8, better than expectation of 227k. Four-week moving average dropped -3.75k to 224.75k. Continuing claims rose 25k to 1.661M in the week ending December 1. Four week moving average of continuing claims dropped -2.5k to 1.66575M.

Also released, US import price index dropped -1.6% mom in November, Canada new housing price index rose 0.0% mom in October.

EUR/USD Mid-Day Outlook

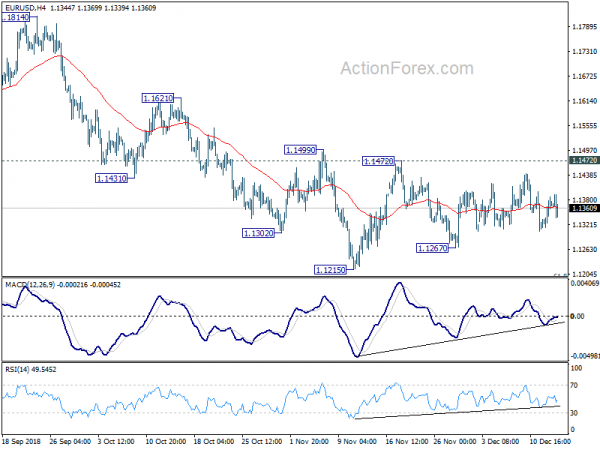

Daily Pivots: (S1) 1.1327; (P) 1.1357; (R1) 1.1399; More…..

No change in EUR/USD’s outlook as it’s bounded in consolidation in range of 1.1267/1472. Intraday bias remains neutral for the moment. On the downside, break of 1.1267 will target 1.1215 low first. Firm break there will resume larger down trend from 1.2555 for 1.1186 fibonacci level next. However, considering bullish convergence condition in daily MACD, firm break of 1.1472 will be suggest medium term bottoming and turn outlook bullish for 1.1814 resistance instead.

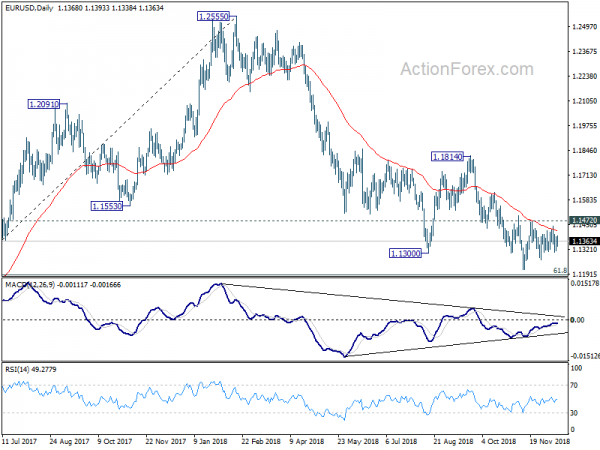

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | AUD | Consumer Inflation Expectation Dec | 4.00% | 3.60% | ||

| 00:01 | GBP | RICS House Price Balance Nov | -11% | -9% | -10% | |

| 07:00 | EUR | German CPI M/M Nov F | 0.10% | 0.10% | 0.10% | |

| 07:00 | EUR | German CPI Y/Y Nov F | 2.30% | 2.30% | 2.30% | |

| 08:15 | CHF | Producer & Import Prices M/M Nov | -0.30% | 0.00% | 0.20% | |

| 08:15 | CHF | Producer & Import Prices Y/Y Nov | 1.40% | 2.30% | ||

| 08:30 | CHF | SNB Sight Deposit Interest Rate | -0.75% | -0.75% | -0.75% | |

| 08:30 | CHF | SNB 3-Month Libor Lower Target Range | -1.25% | -1.25% | -1.25% | |

| 08:30 | CHF | SNB 3-Month Libor Upper Target Range | -0.25% | -0.25% | -0.25% | |

| 12:45 | EUR | ECB Bank Rate Decision | 0.00% | 0.00% | 0.00% | |

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | CAD | New Housing Price Index M/M Oct | 0.00% | 0.00% | 0.00% | |

| 13:30 | USD | Import Price Index M/M Nov | -1.60% | -1.00% | 0.50% | |

| 13:30 | USD | Initial Jobless Claims (DEC 8) | 206K | 227K | 231K | 233K |

| 15:30 | USD | Natural Gas Storage | -81B | -63B |