Dollar is under broad based selling pressure on falling treasury yields, globally. In particular, 10 year yield drops below 3% level for the first time since September. Canadian Dollar and Swiss Franc are following as the next weakest. On the other hand, return to risk aversion and falling global yields pop up Yen as the strongest. Sterling follows as second strongest, lifted by news that it could get a “get of of jail” card for revoking Brexit unilaterally.

In the bond markets, US 10 year yields hits as low as 2.962 in early trading, back below 3%. German 10 year bund yield is trading down -0.015 at 0.293, below 0.3 handle for the first time since July. Japan 10 year JGB dropped -0.014 to 0.069, lowest since July too.

In other markets, at the time of writing, FTSE is down -0.51%, DAX is down -0.53%, CAC is down -0.35%. DOW futures point to slightly lower open. Earlier in Asia, Nikkei dropped -538.71 pts or -2.39% to 22036.05. Singapore Strait Times dropped -0.72% to 3167.79. But Hong Kong HSI rose 0.29% to 27260.44. China Shanghai SSE rose 0.425 to 2665.95

Technically, Sterling’s rebound today after breaching near term support suggests that it’s not ready to resume recent down trend yet. The keys to watch for the rest of today are EUR/USD and USD/CHF. EUR/USD is in range of 1.1267/1472. USD/CHF is in range of 0.9908/1.0006. Break out of the ranges would reveal the broad direction in Dollar.

ECJ advocate general said UK can withdraw Brexit unilaterally

European Court of Justice’s advocate general said today that UK has the right to withdraw Brexit notice unilaterally, up to the point of formal conclusion of the deal. ECJ usually follow the advocate general’s opinions in its final rulings even though they’re not binding.

To be more exact, ECJ said “Advocate General (Manuel) Campos Sanchez-Bordona proposes that the Court of Justice should declare that Article 50 … allows the unilateral revocation of the notification of the intention to withdraw from the EU”. And, “That possibility continues to exist until such time as the withdrawal agreement is formally concluded.”

But the UK Prime Minister Theresa May’s spokesman quickly come out and said the government position on Brexit article 50 will not be revoked.

BoE Carney: Brexit worst-case scenarios were low-probability events

BoE Governor Mark Carney testified in the parliament today on the Brexit economic analysis today. Carney said the worst-case scenarios were “low-probability events in the context of Brexit” that BoE has to prepare the banking system for. But he also said “we’re already sleeping soundly at night, because we have the financial sector, the core of the financial sector, in a position that it needs to be for a tough scenario.”

Carney also defended the analysis and said “There’s no exam crisis. We didn’t just stay up all night and write a letter to the Treasury Committee. And, “You asked for something that we had, and we brought it, and we gave it to you.”

UK PMI construction rose to 53.4, job accelerates with upward pressure on wages

UK PMI construction rose to 53.4 in November, up from 53.2 and beat expectation of 52.5. That’s also the highest level in four months. Markit noted there is solid expansion of overall construction output. Residential work reclaims its place as best performing area of construction activity. Job creation accelerates to its fastest since December 2015.

Tim Moore, Economics Associate Director at IHS Markit, noted that “UK construction sector remains in expansion mode, with resilient business activity trends seen for housing, commercial and civil engineering activity. The latest overall rise in construction output was the fastest since July, helped by a stronger contribution to growth from house building activity.

Also released in from Europe, UK BRC retail sales monitor dropped -0.5% yoy in November. Swiss CPI dropped -0.3% mom, rose 0.9% yoy in November, versus expectation of -0.1% mom, 1.1% yoy. Eurozone PPI rose 0.8% mom, 4.9% yoy in October, above expectation of 0.5% mom, 4.5% yoy.

Italian PM Conte to submit new budget with lower deficit target, within hours

Avvenire daily newspaper reported that Italian Prime Minister Giuseppe Conte said he will submit a new 2019 Draft Budget Plan to EU in the next few hours. There is no detail about the new plan yet. But Conte said new proposal could reasonably include a deficit lower than previously forecast. That is, it would be lower than the deficit target of 2.4% of GDP 2019.

European Commission for for Economic and Financial Affairs Pierre Moscovici said the Commission is waiting for concrete and credible moves from Italy on the budget. He noted that talks were now proceeding at an intense pace, but emphasized that the Commission was “waiting for more details”.

Aussie steady after RBA stands pat at 1.50%, reactions muted

Australian Dollar trades mildly firmer against dollar after RBA left cash rate unchanged at 1.50%. But it’s overall steady and mixed as reaction to RBA is rather muted. In short, RBA maintained that fall in unemployment rate will eventually lift inflation to target. But again, the central bank expected the progress to be “gradual”, implying that there is no urgency to lift interest rate any time soon.

On the economy, the central scenario for GDP growth is to average around 3.5% in 2018 and 2019. Then it would slow to 2020 due to slower growth in export of resources. Outlook for labor market remains “positive”. Improvement in the economy should see “some further lift in wages growth” over time, gradually. CPI is expected to pick up over the next couple of years gradually to. And, the central scenario if for inflation to be at 2.25% in 2019 and a bit higher in 2020.

More on RBA:

- RBA More Concerned about Housing Markets, Disinflation Likely Keeps Policy Rate Unchanged for 2019

- RBA Keeps Cash Rate on hold; Cites Risks around Trade but Confirms Strong Growth Outlook

Also release in Asia Pacific, Japan monetary base rose 6.1% yoy in November versus expectation of 5.7% yoy. Australia current account deficit narrowed to AUD -10.7B in Q3.

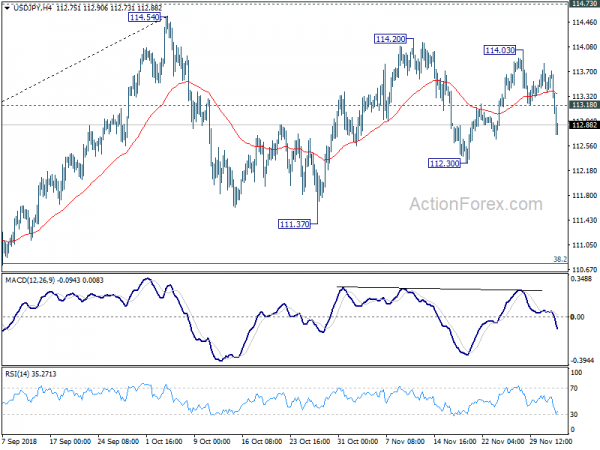

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 113.40; (P) 113.61; (R1) 113.86; More..

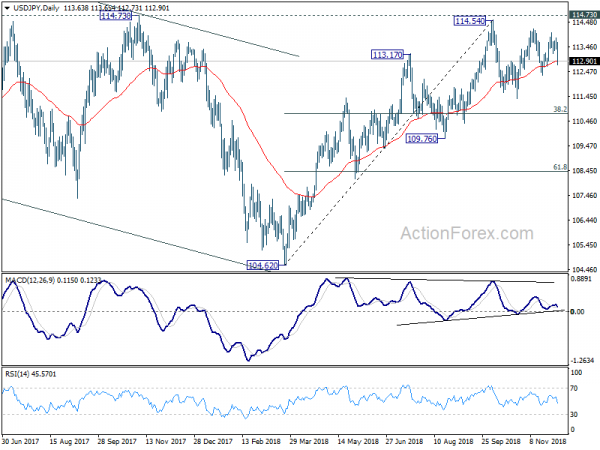

Intraday bias in USD/JPY remains on the downside as fall from 114.03 is in progress for 112.30. Break there will target 111.37 and below. On the upside, above 113.18 minor resistance will turn intraday bias neutral first. And, break of 114.03 will resume the rise from 111.37 to 114.73 resistance. Overall, price actions from 114.54 are seen as a consolidation pattern. Hence, even in case of deep decline, downside should be contained by 38.2% retracement of 104.62 to 114.54 at 110.75 to bring rebound.

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds. However, decisive break of 109.76 will dampen this bullish view and turns outlook mixed again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Nov | 6.10% | 5.70% | 5.90% | |

| 00:01 | GBP | BRC Retail Sales Monitor Y/Y Nov | -0.50% | 0.10% | ||

| 00:30 | AUD | Current Account Balance (AUD) Q3 | -10.7 | -10.2B | -13.5B | -12.1B |

| 03:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 08:15 | CHF | CPI M/M Nov | -0.30% | -0.10% | 0.20% | |

| 08:15 | CHF | CPI Y/Y Nov | 0.90% | 1.10% | 1.10% | |

| 09:30 | GBP | Construction PMI Nov | 53.4 | 52.5 | 53.2 | |

| 10:00 | EUR | Eurozone PPI M/M Oct | 0.80% | 0.40% | 0.50% | 0.60% |

| 10:00 | EUR | Eurozone PPI Y/Y Oct | 4.90% | 4.50% | 4.50% | 4.60% |

| 13:30 | CAD | Labor Productivity Q/Q Q3 | 0.30% | 0.40% | 0.70% |