Dollar tumbled steeply overnight on Fed chair Jerome Powell’s awkward dovish turn. Within a matter of weeks, interests rate went from being “long way from” to “just below” neutral. Markets took that as a sign Fed is nearing a pause in the current hike cycle. DOW staged a decisive 617.7 pts or 2.50% rally. Minutes of November FOMC minutes could reveal whether Powell has turned during that meeting. Plus, we might see whether other policymakers thought interest rate was just below neutral.

The greenback stays weak in Asian session and fresh selling is seen after lunch. On the other hand, Yen is surprisingly picking up some buying together with Swiss Franc and Euro. For the week, though, Yen is the weakest one, followed by Canadian Dollar. Kiwi and Aussie are the strongest.

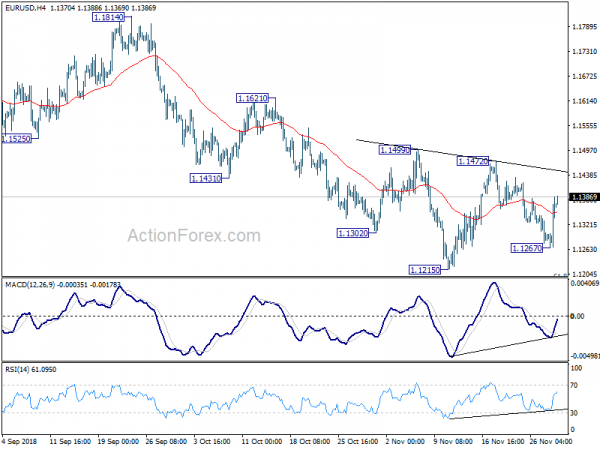

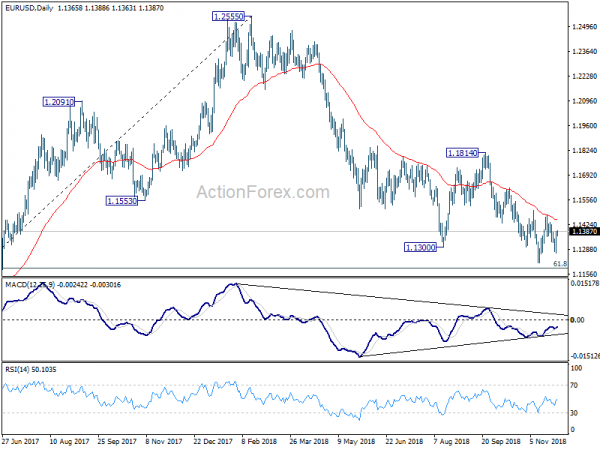

Technically, more downside is now in favor in Dollar for the near term, except versus Canadian. In particular, 1.1472 resistance in EUR/USD, while far, is a key resistance level to watch. Break could complete a head and shoulder bottom pattern and indicate reversal in the pair. AUD/UD is now back pressing 0.7314 and sustained break will also indicate bullish reversal.

In other markets, major US indices recorded solid gains overnight. DOW rose 2.5%, S&P 500 jumped 2.30% and NASDAQ gained 2.95%. Treasury yields were mixed though. Five-year yield closed down -0.029 at 2.856. 10-year yield dropped -0.011 to 3.044. But 30-year yield rose 0.010 to 3.329. Asian markets followed with Nikkei trading up 0.69%, China Shanghai SSE up 0.28% and Singapore Strait Times up 0.83% at the time of writing. But Hong Kong HSI is down -0.13%.

Fed Powell said rate “just” below neutral

Dollar dived sharply as Fed Chair Jerome Powell seems to be backing down from his monetary stance, facing political pressure from Trump. The key take away is that Powell said ” Interest rates are still low by historical standards, and they remain just below the broad range of estimates of the level that would be neutral for the economy‑‑that is, neither speeding up nor slowing down growth.” That is, in Powell’s view, federal funds rate at 2.00-2.25% is “just below” neutral.

However, it should be noted that in September projections, median longer run projected federal funds rate was 3.0%. Central tendency was at 2.8-3.0%. And the range was from 2.5-3.5%. 2.00-2.25% couldn’t be considered being “just below” 3.0%, nor 2.8-3.0%. Also, back on October 3, Powell said “We may go past neutral, but we’re a long way from neutral at this point, probably” Powell in his own words on October 3 in this video. Just in case, start at 8:00.

More in Fed Chair Powell’s U-Turn on Interest Rates?

Trump studying auto tariffs again after GM plants closure

Trump blamed other car exporting countries for taking advantage of the US for decades. And he claimed that if the 25% “chicken tax” is imposed on cars, GM would not be closing their plants in Ohio, Michigan and Maryland. And because of GM event, auto tariff is being studied now.

He tweeted. “The reason that the small truck business in the U.S. is such a go to favorite is that, for many years, Tariffs of 25% have been put on small trucks coming into our country. It is called the “chicken tax.” If we did that with cars coming in, many more cars would be built here …..and G.M. would not be closing their plants in Ohio, Michigan & Maryland. Get smart Congress. Also, the countries that send us cars have taken advantage of the U.S. for decades. The President has great power on this issue – Because of the G.M. event, it is being studied now!”

BoE projects GDP to be 1.75% higher in close partnership with EU after Brexit

Following the UK Government, BoE also released it’s economic analysis of different Brexit scenarios yesterday .

In short, in case of economic partnership with EU after Brexit, and relative to November Inflation Report (IR), by end of 2023:

- GDP is 1.75% higher in the close partnership scenario

- GDP is -0.75% lower in the less close partnership scenario

- Unemployment rate will be at 4%, slightly lower than the IR

- Inflation is a little lower reflecting appreciation of Sterling and peat at 2.25%

In case of no deal, no transition, relative to November IR, by the end of 2023, in worst case:

- GDP is -4.75 to -7.75% lower

- Unemployment rate will jump to 5.75-7.50%

- Inflation will peak at 4.25 to 6.25%

BoJ Masai: Best to sustain current ultra-loose monetary policy

Bank of Japan board member Takako Masai said price growth remained weak in Japan even though growth was solid. And, “as such, the best approach would be to sustain the current ultra-loose monetary policy. With that “the positive momentum is not disrupted,” regarding inflation moving back to 2% target.

She also noted that “Monetary easing can stimulate the economy. On the other hand, prolonged low rates could have adverse effects on bond market functions and financial institutions’ profits”. Thus, “in guiding monetary policy, the BOJ must thoroughly scrutinize the costs and benefits of its policy from various perspectives.”

On BoJ’s move to allow 10-year JGB yield to move from -0.1% to 0.1%, she that “Such flexible measures the BOJ took will help sustain sound market functions.”

New Zealand business confidence unchanged, main threat to growth is offshore

New Zealand ANZ business confidence was unchanged at -37.1 in November. Activity outlook rose 0.2 to 7.6. ANZ noted that “Left well enough alone, the New Zealand economy can muddle through. Population growth is cooling, and household debt is very high, but interest rates are stimulatory, the terms of trade are high, and dairy production is off to a boomer.”

“The main threat to growth is in fact offshore, with mounting evidence that global growth is slowing (particularly in export powerhouses such as China and Germany), which is an unhelpful backdrop for already-wobbly equity and credit markets. New Zealand is a small, open economy reliant on foreign capital, and what happens offshore can have a big impact.”

Elsewhere

Japan retail sales rose 3.5% yoy in October versus expectation of 2.7% yoy. Australia private capital expenditure dropped -0.5% in Q3, below expectation of 2.0%.

The economic calendar is rather busy ahead. Swiss will release Q3 GDP. France will also release Q3 GDP. Germany will release CPI and unemployment. Eurozone will release confidence indicators. UK will release mortgage approvals and M4.

Later in the day, US will release personal income and spending, jobless claims and pending home sales. But FOMC minutes will catch most focus. Markets would like to see whether there are other FOMC members seeing interest rates as “just below” neutral too.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1290; (P) 1.1341; (R1) 1.1417; More…..

EUR/USD rebounded strongly after hitting 1.1267 and intraday bias is turned neutral first. Focus is now on 1.1472 resistance. Decisive break there will complete a head and shoulder bottom pattern (ls: 1.1302; h: 1.1215; rs: 1.1267). That will indicate near term reversal and bring stronger rise back to 1.1814 resistance. On the downside, below 1.1267 will turn bias back to the downside for 1.1215 low.

In the bigger picture, down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 resistance is now needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Retail Trade Y/Y Oct | 3.50% | 2.70% | 2.10% | 2.20% |

| 0:00 | NZD | ANZ Business Confidence Nov | -37.1 | -37.1 | ||

| 0:30 | AUD | Private Capital Expenditure Q3 | -0.50% | 2.00% | -2.50% | -0.90% |

| 6:45 | CHF | GDP Q/Q Q3 | 0.50% | 0.70% | ||

| 7:45 | EUR | French GDP Q/Q Q3 P | 0.40% | 0.40% | ||

| 8:55 | EUR | German Unemployment Change Nov | -10K | -11K | ||

| 8:55 | EUR | German Unemployment Claims Rate s.a. Nov | 5.00% | 5.10% | ||

| 9:30 | GBP | Mortgage Approvals Oct | 65K | 65K | ||

| 9:30 | GBP | Money Supply M4 M/M Oct | 0.30% | -0.30% | ||

| 10:00 | EUR | Eurozone Business Climate Indicator Nov | 0.96 | 1.01 | ||

| 10:00 | EUR | Eurozone Economic Confidence Nov | 109 | 109.8 | ||

| 10:00 | EUR | Eurozone Industrial Confidence Nov | 2.3 | 3 | ||

| 10:00 | EUR | Eurozone Services Confidence Nov | 13 | 13.6 | ||

| 10:00 | EUR | Eurozone Consumer Confidence Nov F | -3.9 | -3.9 | ||

| 13:00 | EUR | German CPI M/M Nov P | 0.00% | 0.20% | ||

| 13:00 | EUR | German CPI Y/Y Nov P | 2.20% | 2.50% | ||

| 13:30 | CAD | Current Account Balance (CAD) Q3 | -15.9B | |||

| 13:30 | USD | Personal Income Oct | 0.40% | 0.20% | ||

| 13:30 | USD | Personal Spending Oct | 0.40% | 0.40% | ||

| 13:30 | USD | PCE Deflator M/M Oct | 0.20% | 0.10% | ||

| 13:30 | USD | PCE Deflator Y/Y Oct | 2.10% | 2.00% | ||

| 13:30 | USD | PCE Core M/M Oct | 0.20% | 0.20% | ||

| 13:30 | USD | PCE Core Y/Y Oct | 1.90% | 2.00% | ||

| 13:30 | USD | Initial Jobless Claims (NOV 24) | 221K | 224K | ||

| 15:00 | USD | Pending Home Sales M/M Oct | 0.80% | 0.50% | ||

| 15:30 | USD | Natural Gas Storage | -134B | |||

| 19:00 | USD | FOMC Minutes |