The British Pound makes a strong come back today and is trading as the strongest one at the time of writing. UK government released its long term Brexit economic analysis, showing that Prime Minister Theresa May’s Brexit deal could bring as little as -0.1% drag in GDP in 15 years. Though, Sterling’s rebound today is more due to lack of negative developments and technical, rather than the PM.

Thanks to rebound in the stock markets, Australian Dollar is the second strongest one for today. Dollar is following as the third strongest but it could be vulnerable. Trump just renewed his personal attack on Fed chair Jay Powell and said he’s “not even a little bit” happy with him. Powell’s speech today will be closely watched for any responses, or change in tone. Meanwhile, Canadian Dollar is weakest followed by Yen and then Euro.

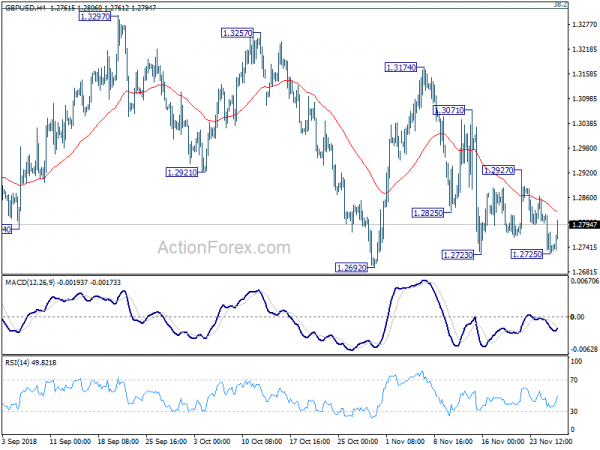

Technically, GBP/USD’s rebound ahead of 1.2723 support suggests temporary bottoming at least. Focus is back to 1.2927 minor resistance. ERU/GBP’s break of 0.8824 minor support indicates rejection by 0.8939 resistance. And risks is now skewed to the downside for 0.8655 support. GBP/JPY will be eying 145.99 minor resistance to confirm short term bottoming.

In other markets, FTSE is current down -0.10%, mainly due to Pound’s strength. DAX is up 0.15% and CAC is up 0.26%. German 10 year yield is down -0.001 at 0.351. Italian 10 year yield is down -0.027 at 3.264. German-Italian spread remains below 300. Italy’s willingness to tweak its budget plan helps sentiments. Earlier in Asia, Nikkei rose 1.02%. Hong Kong HSI rose 1.33%. China Shanghai SSE rose 1.05%. Singapore Strait Times rose 0.13%. It seems that Asian investors are cautiously optimistic that Trump and Xi could make a deal of some sort in Argentina later this week.

Released from the US, trade deficit widened to USD -77.2B in October, above expectation of USD -76.7B. Wholesale inventories rose 0.7% mom versus expectation of 0.5%. Q3 GDP growth was unrevised at 3.5% annualized, below expectation of 3.6%. Earlier today, Eurozone M3 rose 3.9% yoy in October, above expectation of 3.5% yoy. German Gfk consumer climate for December dropped -0.2 to 10.4, slightly below expectation of 10.6. UK BRC shop price rose 0.1% yoy in November. Australia construction work done dropped -2.8% in Q3

UK government Brexit scenario analysis, from -10.7% GDP contraction to -0.1% in 15 years

The UK Government released a series of five papers on Brexit today. The most anticipated in the one on long term economic analysis of Brexit. In short, according the government, in 15 years by 2034 after Brexit:

- GDP could contract as much as -10.7% in case of no-deal Brexit with zero net inflow of EEA workers

- GDP would contract just -1.4% if it’s modelled after EEA-type (European Economic Area) of deal, that is, Norway kind of deal.

- Under Prime Minister Theresa’s Plan, GDP would contract only -0.6% if there is no change in migration arrangement. Or, in the best case scenario, GDP could just contract -0.1%.

The EU Exit: Long-term economic analysis report here. And, all five papers here.

In the parliament, Prime Minister Theresa May hailed her own plan and said “What the analysis shows, it does show that this deal that we have negotiated is the best deal for our jobs and our economy which delivers on the results of the referendum.”

Earlier, Chancellor of Exchequer Philip Hammond told BBC that “If the only consideration, the only consideration, was the economy, then the analysis shows clearly remaining in the European Union would be a better outcome for the economy, but not by much. But he also noted that “The prime minister’s deal delivers an outcome that is very close to the economic benefits of remaining in.”

ECB de Guindos: Challenges remain in the form of low trend growth

ECB Vice President Luis de Guindos said in a speech that Eurozone economy is “continuing to grow” and the growth is “broad-based across countries and sectors”. He added that “during this recovery, the countries that were most affected by the crisis have regained competitiveness thanks to a combination of accommodative monetary policy, fiscal consolidation and structural reforms.”

However, de Guindos warned that “challenges remain in the form of low trend growth compared with other advanced economies, and persistently high public and private debt levels in a number of euro area countries.”. He urged further efforts to “strengthen productivity growth and boost productive investments to lift long-term potential growth.”

Italy to tweak budget, balance growth and public accounts

Italian Economy Minister Giovanni Tria said today that the coalition government is seeking to adjust its 2019 budget plan. They’d still have to support economic growth, but at the same time need to avoid disciplinary actions by European Commission. Tria said “we are attentively seeing if there is financial space to improve the balance between the need to support growth and the need to solidify the sustainability of the public accounts.”

Separately, Deputy Prime Minister Luigi Di Maio, leader of Five-Star Movement, said “we must talk with the EU to find a solution, but we cannot betray the promises we made, otherwise we will become like all the other (governments).”

China Xi in Spain, pledges to open markets access to foreign investments

Chinese President Xi Jinping is visiting Spain today and he’s supposed to meet Trump later in the week in Argentina as sideline of G20 summit. Xi repeated his messages to the Spanish upper house of parliament that China planned to import USD 10T worth of goods over the next five years.

Also, Xi pledged that “China will make efforts to open, even more, its doors to the exterior world and we will make efforts to streamline access to markets in the areas of investment and protect intellectual property.”

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.2703; (P) 1.2765; (R1) 1.2803; More…

GBP/USD formed a temporary low at 1.2725, ahead of 1.2723 support and recovered. Intraday bias is turned neutral again. On the upside, above 1.2927 resistance will bring stronger rebound to 1.3071 and possibly above. On the downside, break of 1.2725 should extend recent fall to retest 1.2661 key support. After all, price actions from 1.2661 are viewed as a consolidation pattern. Even in case of strong rebound, upside should be limited by 1.3316 fibonacci level to bring down trend resumption eventually.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | BRC Shop Price Index Y/Y Nov | 0.10% | -0.20% | ||

| 00:30 | AUD | Construction Work Done Q3 | -2.80% | 1.00% | 1.60% | 1.80% |

| 06:00 | EUR | German GfK Consumer Confidence Dec | 10.4 | 10.6 | 10.6 | |

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Oct | 3.90% | 3.50% | 3.50% | 3.60% |

| 13:30 | USD | Trade Balance (USD) Oct | -77.2B | -76.7B | -76.0B | -76.3B |

| 13:30 | USD | Wholesale Inventories M/M OCt P | 0.70% | 0.50% | 0.40% | |

| 13:30 | USD | GDP Annualized Q/Q Q3 S | 3.50% | 3.60% | 3.50% | |

| 13:30 | USD | GDP Price Index Q3 S | 1.70% | 1.70% | 1.70% | |

| 15:00 | USD | New Home Sales Oct | 583K | 553K | ||

| 15:00 | USD | Richmond Fed Manufacturing Index Nov | 16 | 15 | ||

| 15:30 | USD | Crude Oil Inventories | 0.6M | 4.9M |