Australian Dollar leads commodity currencies mildly higher as week starts, following rebound in Asian markets. On the other hand, Yen, Dollar and Swiss Fran turn softer. Nevertheless, Chinese stock lack behind other hand Asian indices and struggle to gain. There’s a risk of a turn in market sentiment later in the day. Sterling and Euro are mixed for the moment. EU’s formal endorsement of the Brexit withdrawal agreement provides little support to both currencies.

In other markets, Japan Nikkei closed up 0.76% at 21812.00. Hong Kong HSI is up 1.56% at the time of writing. Singapore Strait Times is up 0.81%. But China Shanghai SSE is down -0.14%. WTI crude oil is back above 51 as it’s trying to defend 50 psychological level. gold continues to consolidate around 1225.

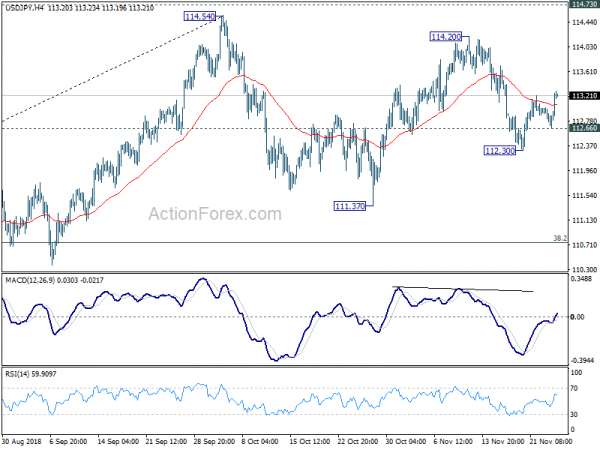

Technically, USD/JPY’s break of 113.21 minor resistance today suggests more upside for 114.20 resistance. EUR/USD recovers mildly, but fall from 1.1472 should still be in progress for 1.1215 support. However, Dollar’s strength is not that apparent elsewhere. USD/CHF is held below 1.0006 resistance. GBP/USD is kept above 1.2764 minor support and AUD/USD above 0.7164 support. These are the levels to watch today. In addition, Euro will have to defend minor support at 0.8825 in EUR/GBP and 1.5643 in EUR/AUD too.

EU endorsed Brexit deal, Juncker urges UK Commons to ratify

On Sunday, EU27 leaders swiftly approve the Brexit deal after just taking less than an hour in the special EU summit in Brussels today. They endorsed both the Brexit withdrawal agreement, and the political declaration on future EU-UK relations. The European Council’s full statement here

European Council President Donald Tusk said in the press conference that “Ahead of us is the difficult process of ratification as well as further negotiations. But regardless of how it will all end, one thing is certain: we will remain friends until the end of days, and one day longer.”

European Commission President Jean-Claude Juncker said, “Sad day, no cause for celebrations. I salute unity of EU27 during the negotiations. We stood by Spain on Gibraltar, they have our solidarity. I’m proud of the work of our negotiating team. This is the only deal possible.”

And, “This is the best deal possible. I invite those who have to ratify it in the U.K. House of Commons, to do so. This is the best deal for Britain. This is the best deal for Europe. It is the only deal possible.”

UK PM May: Take the Brexit deal or go back to square one with more division and uncertainty

UK Prime Minister Theresa May is expected to warn lawmakers today that they either take her agreed Brexit deal with the EU, or crush out with no deal at all. According to the excerpts of her statement to the parliament today, May would say “this has been a long and complex negotiation. It has required give and take on both sides. That is the nature of a negotiation”.

And she will add “I can say to the House with absolute certainty that there is not a better deal available”. May would call the Commons to back the deal that allows UK to “move on”. Or, “this House can choose to reject this deal and go back to square one … It would open the door to more division and more uncertainty, with all the risks that will entail.”

The last step is for the UK parliament to ratify the agreement. This remaining 1% is probably the most challenging task for the whole Brexit deal. The key date to remember now is January 21, 2019. There is a UK legal requirement that the government has to reach an agreement with the EU by then. If the parliament rejects the deal, the Government has until that day to put forward a new plan. The government is likely to use the brinkmanship strategy, threatening to leave the EU with no-deal on March 29, 2019, if the parliament rejects the current agreement.

More in Brexit Update – The Remaining 1%, The Most Challenging

Japan PMI manufacturing dropped to 51.8, underlying trend skewed to the downside

Japan PMI manufacturing dropped to 51.8 in November, down from 52.9 and missed expectation of 53.0. That’s also a two-year low. Joe Hayes, Economist at IHS Markit, noted in the release that “October’s six-month peak seems to have been just a transitory month-to-month rebound”. And, “the underlying trend appears to be skewed to the downside.”. “Indeed, the fall in new orders is a worrying development as easing global growth momentum coupled with a weak domestic backdrop could spell further demand woes for Q4.”

Looking ahead – FOMC minutes a highlight of a busy week

Looking ahead, the calendar is relatively light at the beginning of the week. But it starts to be rather busy from Wednesday onwards. FOMC minutes will be a key to watch to gauge how worried Fed policy makers are on growth risks. PCE inflation is another key data to watch from the US. Other notable data include swiss GDP, Eurozone CPI, China PMIs, Canada GDP etc. Here are some highlights of the week:

- Monday: Japan PMI manufacturing; German Ifo business climate; UK BBA mortgage approvals

- Tuesday: New Zealand trade balance; Japan corporate services prices; UK CBI realized sales; US house price indices, consumer confidence

- Wednesday: Australia construction work done; Eurozone M3 money supply; German Gfk consumer climate; US GDP revision, trade balance, wholesale inventories, new home sales

- Thursday: Japan retail sales; New Zealand ANZ business confidence; Australia private capital expenditure; Swiss GDP; German CPI, unemployment; UK mortgage approvals, M4 money supply; Canada current account; US personal income and spending, jobless claims, pending home sales; FOMC minutes

- Friday: New Zealand building permits; Tokyo CPI core, Japan unemployment rate, industrial production, consumer confidence, housing starts; China PMIs; UK Gfk consumer confidence; German import prices, retail sales; Swiss KOF leading indicator; Eurozone CPI, unemployment rate; Canada GDP, RMPI, IPPI; US Chicago PMI

USD/JPY Daily Outlook

Daily Pivots: (S1) 112.75; (P) 112.88; (R1) 113.10; More..

USD/JPY’s rebound and break of 113.21 minor resistance suggests that rise from 112.30 is resuming. Intraday bias is turned to he upside for 114.20/73 key resistance zone. Decisive break there will resume larger rally from 104.62. On the downside, break of 112.66 minor support will extend the fall from 114.20, likely towards 111.37 support. But after all, price actions from 114.54 are seen as a consolidation pattern. Hence, even in case of deep decline, should be contained by 38.2% retracement of 104.62 to 114.54 at 110.75 to bring rebound.

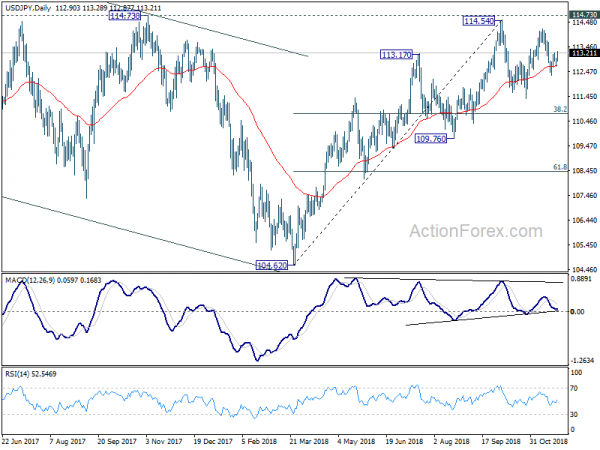

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds. However, decisive break of 109.76 will dampen this bullish view and turns outlook mixed again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Retail Sales Ex Inflation Q/Q Q3 | 0.00% | 1.00% | 1.10% | |

| 0:30 | JPY | PMI Manufacturing Nov P | 51.8 | 53 | 52.9 | |

| 9:00 | EUR | German IFO Business Climate Nov | 102.3 | 102.8 | ||

| 9:00 | EUR | German IFO Expectations Nov | 99.3 | 99.8 | ||

| 9:00 | EUR | German IFO Current Assessment Nov | 105.6 | 105.9 | ||

| 9:30 | GBP | BBA Mortgage Approvals Oct | 38.9K | 38.5K |