Trading is rather subdued in Asian session today as the markets are already in holiday mood. For now, Euro is trading generally higher, followed by Sterling. Australia and New Zealand turned soft again. But most pairs and crosses are just bounded inside yesterday’s strength. For the week, Swiss Franc remains the strongest one, followed by Dollar and then Yen. Aussie and Kiwi are the worst performing ones.

The rebound in US stocks overnight was rather disappointing. DOW hit day high at 24669.79 but eventually closed flat at 24464.69. S&P 500 rose 0.3% to 2649.93. NASDAQ closed up 0.92% at 6972.25. These three indices did nothing to indicate they’re bottoming in near term and recent selloff will likely extend after the US markets are back from holiday. Treasury yields, closed slightly higher with 10 year yield rose 0.013 to 3.061.

Asian markets are mixed. Nikkei is currently up 0.62%. Hong Kong HSI fluctuate between gains and losses in very tight range. China SSE is down -0.45%. Singapore Strait Times is up merely 0.10%. WTI crude oil is consolidating at around 54.4. Gold is in tight range around 1225.

ECB accounts as the focus of the day

ECB accounts of October 25 monetary policy meeting will be the main focus today. ECB is so far sticking with its plan to end asset purchase program after December. Also, interest rates are expected to stay at current level at least through summer of 2019. There is little chance of any hint in the accounts for a change in the policy path. The forward guidance is also flexibility enough that there is no need for the slightest change.

Nevertheless, Eurozone economy is clearly slowing down. Q3’s dismal 0.2% growth, as well as the contraction in Germany, are generally viewed as due to temporary factors. But we’d still be eager to see if ECB policy makers are maintaining this view.

Also, a number of ECB officials are lining up for speeches today. Most notably, there could be some comments on monetary policy from Bundesbank Jens Weidmann, Dutch central bank Klass Knot, Bank of Italy Ignazio Visco and Luxembourg central bank Yves Mersch.

UK May: Some further issues needed resolutions on future relationship with EU

UK Prime Minister Theresa May concluded her meeting with European Commission President Jean-Claude Juncker without any breakthrough. And she’s set to fly to Brussels again on Saturday to continue with the work. The objective of the talk now is for finalizing a political blueprint on future relationship between the UK and the EU after Brexit.

May told BBC after the meeting that “I will be returning on Saturday for further meetings, including again with President Juncker, to discuss how we can ensure that we can conclude this process in the way which is in interests in all our people.” And, “there were some further issues that needed resolution, we’ve given further direction to our negotiators this evening. I believe we’ve given sufficient direction for them to be able to resolve those remaining issues. An European Commission spokesman said that “Very good progress was made in the meeting between President Juncker and Prime Minister Theresa May. Work is continuing.”

UK Hammond: Extension to Brexit transition has to be proportional

UK Chancellor of Exchequer Philip Hammond warned again yesterday that it the Brexit deal is not approved by Parliament, “we will have a political chaotic situation”. And, “we don’t know what the outcome of that will be”.

On extension to the transition period, Hammond emphasized that “it would have to be proportional”. And, ” it certainly wouldn’t be more than that, but it would depend on what we were getting in return.” He added “When we look at the economy and the operation of the economy, getting a smooth exit from the European Union, doing this in an orderly fashion, is worth tens of billions of pounds to our economy.”

Looking ahead

The economic calendar is light today with US on Thanksgiving holiday. Nevertheless, ECB monetary policy meeting accounts are important and would be watched. Eurozone will also release consumer confidence.

AUD/USD Daily Outlook

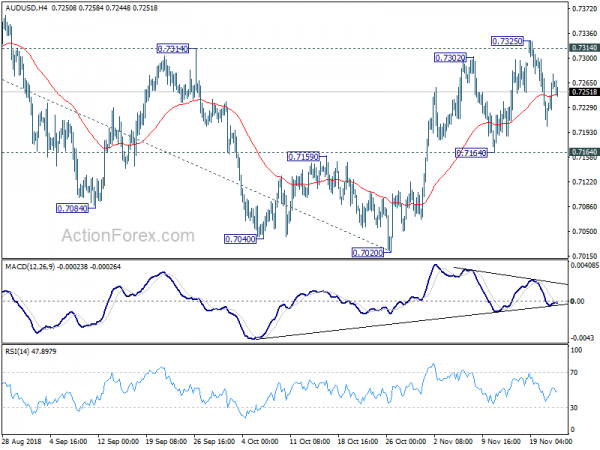

Daily Pivots: (S1) 0.7219; (P) 0.7248; (R1) 0.7295; More…

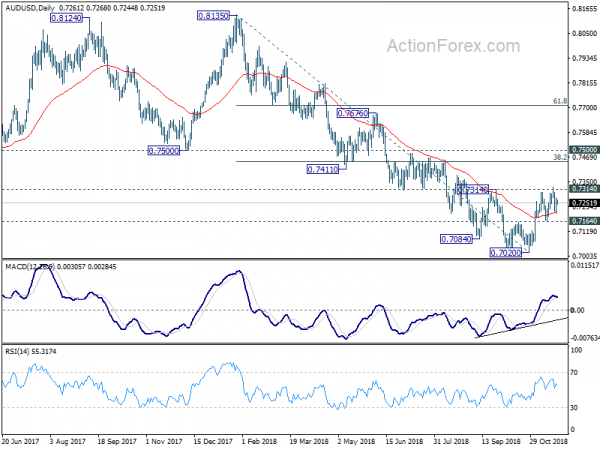

AUD/USD is staying in range of 0.7164/7325 and intraday bias remains neutral first. On the upside, sustained break of 0.7314 resistance will indicate medium term reversal. Further rally should be seen to 38.2% retracement of 0.8135 to 0.7020 at 0.7446 next. Nevertheless, failure to sustain above 0.7314, and break of 0.7164 support will retain bearishness and turn bias back to the downside for retesting 0.7020 low.

In the bigger picture, AUD/USD’s decline from 0.8135 could have completed at 0.7020 already, ahead of 0.6826 key support (2016 low). Break of 0.7314 will confirm and bring strong rebound. But for now, we’d expect strong resistance from 0.7500 support turned resistance to limit upside. Medium term fall from 0.8135 should extend to take on 0.6826 low at a later stage.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Oct | 1.00% | 1.00% | 1.00% | |

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 15:00 | EUR | Eurozone Consumer Confidence Nov A | -3 | -3 |