Sterling rebounds solidly today and there is new wave of buying coming in at early part of US session. Positive news regrading Brexit negotiation is the key driver of the Pound. It’s reported that the Brexit agreement is now closer than ever. And, there are only a small number of issues that. Further than that, the texts regarding Irish backstop are even reported to be ready. Prime Minister Theresa May has told her Cabinet to get ready to sign the agreement tomorrow, or by latest Thursday. While these are unconfirmed news from unnamed sources, Sterling traders don’t care how real they are and jump in.

New Zealand and Australian Dollar follow as the second and third strongest. They’re clearly lifted by optimism that US and China are moving in the right direction to solve trade conflicts. Chinese Vice Premier Liu He would travel to the US shortly, to work with Treasury Secretary Steven Mnuchin on preparing the summit between Trump and Xi at the G20 summit on November 30. And it’s believed that certain set of things would be agreed to avert further escalation of the tariff war. On the other hand, Yen is trading as the weakest one, followed by Dollar, as market sentiments stabilized, and lifted.

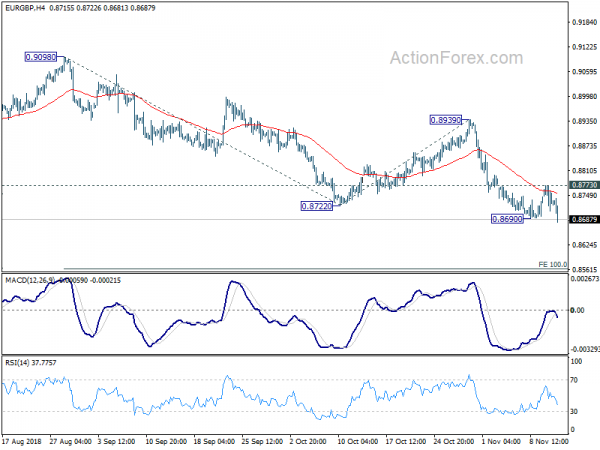

Technically, EUR/GBP’s break of 0.8690 now confirms resumption of recent fall from 0.9098. GBP/JPY’s strong rebound also put focus back to 149.70 resistance. GBP/USD might recover further but there is no sign of breaking 1.3174 resistance yet. Dollar has clearly lost some momentum and would consolidate for a while first.

UK unemployment rate rose to 4.1%, but wage growth accelerated

UK unemployment rate rose 0.1% to 4.1% in the three months ended September, above expectation of 4.0%. But wage growth showed clear acceleration. Average weekly earnings including bonus rose 3.0% 3moy in September, up from 2.7% and matched expectation. Weekly earnings excluding bonus rose 3.2% 3moy, up from 3.1%, beat expectation of 3.1%. Jobless claims rose 20.2k in October, higher than expectation of 4.3k.

German ZEW: No speedy recovery after current weak development, Eurozone even worse

German ZEW Economic Sentiment improved to -24.1 in November, up from -24.7 and beat expectation of -24.2. Current Situation index, however, dropped sharply to 58.2, down from 70.1 and missed expectation of 65.0. Eurozone ZEW Economic Sentiment dropped to -22.0, down from -19.4 and missed expectation of -17.3. Eurozone Current Situation dropped sharply by -13.8 to 18.2. ZEW noted that “the outlook for the Eurozone has deteriorated even more than it has for Germany.”

ZEW President Professor Achim Wambach noted in the release “The figures for industrial production, retail sales and foreign trade in Germany all point towards a weak development of the German economy in the third quarter. This is reflected by the fact that the assessment of the current situation has experienced a decline. The expectations of the survey participants for the coming six months do not show any improvement. This means that, at the moment, they do not expect to see a speedy recovery of the currently weak development of the economy”.

Also from Germany, CPI was finalized at 0.2% mom, 2.5% yoy in October. From Swiss, PPI rose 0.2% mom, 2.3% yoy in October.

ECB Praet: Some slowdown in Eurozone growth, significant stimulus still needed

ECB Chief Economist Peter Praet admitted in a speech that recent developments in the Eurozone “point to some slowdown in the pace of economic growth”. The slowdown reflects “a loss of momentum in global activity”. And, the retreat from strong growth of 2017 was “compounded by short term country-specific of sector-specific factors. Nevertheless, domestic demand “remained resilient” and sentiment indicators remained in “expansionary territory”. He added that the underlying strength of the economy “continues to support our confidence that the sustained convergence of inflation to our aim will proceed.” But “significant monetary policy stimulus is still needed”.

On monetary policy, Praet emphasized that “winding-down of net asset purchases is not tantamount to a withdrawal of monetary policy accommodation.” The “rotation” from net asset purchase towards enhanced forward guidance has “preserved the ample degree of monetary policy accommodation”. And looking ahead, the key policy rates and forward guidance will become an “anchor” for monetary policy as end of asset purchase is nearing. The communications and the rate path will be “calibrated to ensure that inflation remains on a sustained adjustment path.”

BoJ assets rose to JPY 553.6T, larger than Q2 GDP annualized

Latest data from BoJ showed that the central bank is holding JPY 553.6T of assets as of November 10. Among them, JPY 469.1T are Japanese government securities, accumulated through over five years of the Quantitative and Qualitative easing program.

The total assets now surpassed the countries’ GDP. Based on Q2 (April to June) data, Japan’s nominal GDP was annualized at JPY 552.8T. Q3’s data might, due on Wednesday, might come in a bit lower due to natural disasters. Nevertheless, Japan is now the first among G7 countries to own a pool of assets larger than its own GDP.

The situation drew criticism that the ultra loose monetary policy is clearly not sustainable. Some noted that BoJ would suffer losses if it would have to raise interest rate. But that’s not so much of an immediate problem. The bigger risk is that in case of real emergency, like a full blown disaster, BoJ will not be able to finance government bonds any more.

Australia business confidence dragged down by employment, wage growth constrained

Australia NAB Business Confidence dropped 2pts from 6 to 4 in October. Business Conditions also dropped 2pts from 14 to 12. Alan Oster, NAB Group Chief Economist noted that “the decline in the month was driven by weakness in the employment component – though at these levels the survey still suggests ongoing employment growth at around 20k per month. At this rate we should see recent labour market gains maintained”.

Also, it’s noted in the release that “surveyed wage bill measures and the official wage price index suggest that enough spare capacity has remained in the labour market to constrain a significant pickup in wage growth”. Hence, “September quarter wage data to be released later this week will show a small rise in the pace of growth but that overall wage growth will remain low relative to history.”

The data certainly supports the “no rush” stance of RBA.

EUR/GBP Mid-Day Outlook

Daily Pivots: (S1) 0.8701; (P) 0.8738; (R1) 0.8766; More…

EUR/GBP’s break of 0.8690 temporary low indicates resumption of whole decline form 0.9098. Intraday bias is back on the downside for 0.8620 support first. Break will target 100% projection of 0.9098 to 0.8722 from 0.8939 at 0.8563 next. However, break of 0.8773 minor resistance will turn focus back to 0.8939 resistance instead.

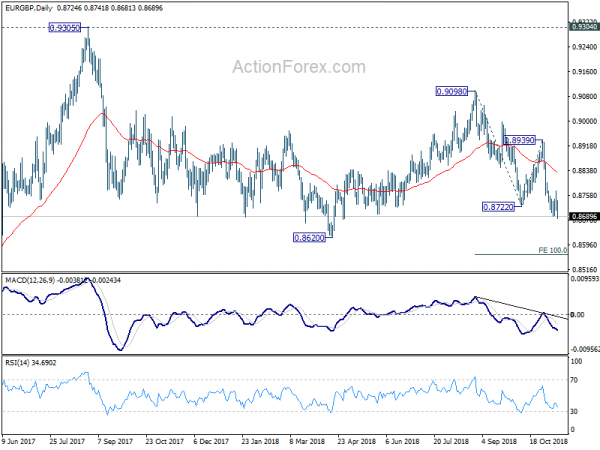

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Medium term fall from 0.9305 is possibly in progress and could extend through 0.8620. On the upside, break of 0.8939 resistance is needed to indicate medium term reversal. Otherwise, outlook will remain cautiously bearish even in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 0:30 | AUD | NAB Business Confidence Oct | 4 | 6 | ||

| 0:30 | AUD | NAB Business Conditions Oct | 12 | 15 | ||

| 7:00 | EUR | German CPI M/M Oct F | 0.20% | 0.20% | 0.20% | |

| 7:00 | EUR | German CPI Y/Y Oct F | 2.50% | 2.50% | 2.50% | |

| 8:15 | CHF | Producer & Import Prices M/M Oct | 0.20% | 0.10% | -0.20% | |

| 8:15 | CHF | Producer & Import Prices Y/Y Oct | 2.30% | 2.60% | ||

| 9:30 | GBP | Jobless Claims Change Oct | 20.2K | 4.3K | 18.5K | 23.2K |

| 9:30 | GBP | Claimant Count Rate Oct | 2.70% | 2.60% | ||

| 9:30 | GBP | Average Weekly Earnings 3M/Y Sep | 3.00% | 3.00% | 2.70% | |

| 9:30 | GBP | Weekly Earnings ex Bonus 3M/Y Sep | 3.20% | 3.10% | 3.10% | |

| 9:30 | GBP | ILO Unemployment Rate 3Mths Sep | 4.10% | 4.00% | 4.00% | |

| 10:00 | EUR | German ZEW Economic Sentiment Nov | -24.1 | -24.2 | -24.7 | |

| 10:00 | EUR | German ZEW Current Situation Nov | 58.2 | 65 | 70.1 | |

| 10:00 | EUR | Eurozone ZEW Economic Sentiment Nov | -22 | -17.3 | -19.4 | |

| 19:00 | USD | Monthly Budget Statement (USD) Oct | -116.6B | 119.1B |