Sterling opens the week sharply and broadly lower as it’s getting less and less likely to complete a Brexit deal within November. Yen is the second weakest as Asian stocks recover mildly after last week’s selloff. Meanwhile, Euro is following as the third weakest at the time of writing. On other hand, Canadian Dollar is the strongest one, helped by rebound in oil prices. New Zealand Dollar and Dollar follow. Nevertheless it’s still early in the week and trading is usually subdued in Monday Asian session. The picture could change quite drastically as the day goes on.

In other markets, Nikkei is currently up 0.14%. Hong Kong HSI is up 0.31%. China Shanghai SSE is up 0.67%. But Singapore Strait Times is down -0.22%. 10 year JGB yield is nearly unchanged at 0.126. WTI crude oil is up 1.25%, pressing 61. Gold is back pressing 1210 after defending 1200 for now.

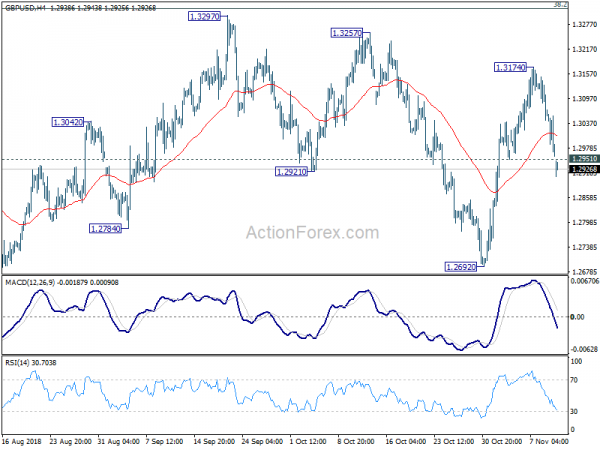

Technically, GBP/USD’s break of 1.2951 minor support now suggests that rebound from 1.2692 has completed. Deeper fall is in favor to retest 1.2661/92 key support zone. Otherwise, there is no significant development so far. Focuses will stay on 1.1300 key support in EUR/USD and 1.0094 resistance in USD/CHF to confirm underlying strength of Dollar. Also, 128.60 in EUR/JPY and 146.28 in GBP/JPY will be watched to see if Yen is staging a near term reversal.

Sterling gaps down as UK PM May cancels emergency cabinet meeting on Brexit

Sterling gaps down the week and stays the weakest one as it’s getting more unlikely for a Brexit deal within November. There was originally a planned emergency cabinet meeting today to approve a Brexit deal. But UK Prime Minister Theresa May dropped the plan due to resistance within her own cabinet. And it’s unlikely for May to come up with something by Tuesday’s regular meeting to secure enough support.

Irish backstop remains the sticky point. But now, it’s over the right for UK to unilaterally exit the backstop. EU and Ireland have been explicit that UK cannot do that. On the other hand, it’s unacceptable for some Tories that UK would have to be locked into the customs arrangement of the backstop forever.

Additionally, May is facing more rebellion even within the remain camp of the Tories. It’s rumored that four more pro-Europe ministers are on the brink of resignation, following ex-transport minister Jo Johnson’s departure last week.

Italy Tria to lower growth forecast to meet EU budget demand

Italy was requested by the European Commission to submit a new or revised draft budget plan (DBP) by November 13, tomorrow, after rejection. Ahead of that, it’s reported that Economy Minister Giovanni Tria is considering to tweak the plan by lowering 2019 growth forecast.

According to Italian coalition government’s own budget, 2019 GDP growth is projected at 1.5%. And, the budget deficit target is 2.4% of GDP. Tria has pledged last week to maintain the “pillars” of the budget. And clearly, the pillars don’t necessarily include growth forecast.

La Repubblica reported that Tria could cut the growth estimate to 1.0%. On the other hand, Il Messaggero said he could cut the forecast to 1.2%. According to European Commission’s own projections, Italy’s growth would be at 1.2% in 2019. Also Tria might also look at automatic mechanism to cut public expenses to keep deficit under the 2.4% cap.

Japan PM Abe to boost infrastructure spending to ensure recovery continues

Japanese Prime Minister Shinzo Abe is pushing for more public infrastructure spending in the upcoming fiscal year. At the Council on Economic and Fiscal Policy (CEFP) meeting today, Abe requested his cabinets to draw out plans with focuses strengthening infrastructure to withstand earthquakes and frequent flooding.

Economy Minister Toshimitsu Motegi said after the CEFP that “the prime minister asked me to take firm measures to ensure that our economic recovery continues.” Motegi added that Abe also said “public works spending program expected at the end of this year should be compiled with this point in mind.”

A preliminary public works plan will be compiled by the end of this month and the final version would be ready by the end of the year.

WTI oil back above 60 as Saudi Arabia cuts oil exports starting Dec

WTI crude oil opened the week higher and is back above 60. Saudi Arabia announced during the weekend to cut oil exports by 500k bpd in December. Its Energy Minister Khalid Al-Falih said on Sunday that demand for Saudi oil is “tapering off” partly due to seasonal factors. And, he pledged that “we as responsible producers are going to work, and work hard, to balance the market within a reasonable corridor.”

The OPEC+ also said in a post-meeting statement that it might need new strategies onwards. It said “the committee reviewed current oil supply and demand fundamentals and noted that 2019 prospects point to higher supply growth than global requirements.” And, weaker global economic growth “could lead to widening the gap between supply and demand.”

WTI crude oil topped at 77.06 back in early October but then persistently dropped to as low as 59.37 last week. A key factor driving the free fall was the erratic sanction policy of the US on Iran. Trump initially insisted to restrict all Iranian exports to the world. But it turned out that waivers were granted to eight countries on oil trade with Iran, including Taiwan.

Technically, today’s recovery is so far not strong enough to warrant a change in near term down trend.

Economic data as main focuses of the week

The week starts with a light calendar today, with US and Canada on holiday today. Looking ahead, economic data will be the major focuses. In particular, US will release CPI and retail sales. UK will release employment, CPI and retail sales. Eurozone will release GDP and German ZEW. Australia will have wage price and employment; China will also have some growth data. Here are some highlights for the week.

- Tuesday: Australia NAB business confidence; German CPI final, ZEW ; Swiss PPI; UK employment;

- Wednesday: Australia wage price index; China retail sales, unemployment, fixed asset investment, industrial production; Japan industrial production, tertiary industry index; Germany GDP; Eurozone GDP, industrial production; UK CPI, PPI; US CPI

- Thursday: Australia employment; UK retail sales; Eurozone trade balance; US retail sales, Empire state manufacturing, Philly Fed manufacturing, import prices, jobless claims, business inventories

- Friday: New Zealand BusinessNZ manufacturing; Eurozone CPI final; Canada manufacturing sales, foreign securities purchases; US industrial production

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2928; (P) 1.3003; (R1) 1.3047; More…

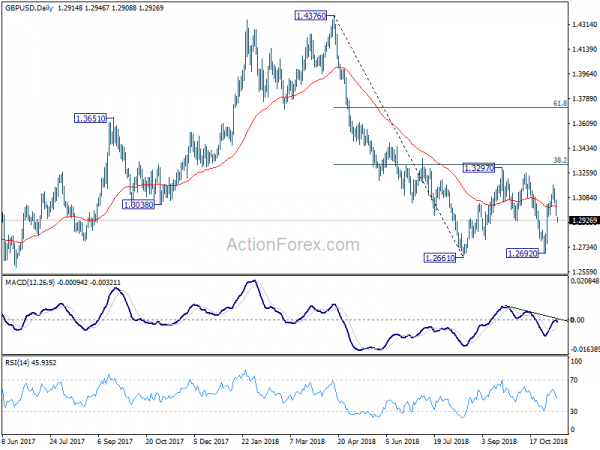

GBP/USD’s break of 1.2951 support now suggests that rebound from 1.2692 has already completed at 1.3174 already. Intraday bias is turned back to the downside for 1.2661/92 key support zone. Decisive break there will resume larger down trend from 1.4376. On the upside, in case of another rise, strong resistance should be seen at 1.3316 fibonacci level to limit upside to bring down trend resumption eventually. Overall, price actions from 1.2661 are seen as a consolidation pattern. Fall from 1.4376 will resume after such consolidation completes.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Domestic CGPI Y/Y Oct | 2.90% | 2.80% | 3.00% | |

| 06:00 | JPY | Machine Tool Orders Y/Y Oct P | 2.90% |