Dollar turns a bit firmer again in early US session after stronger than expected PPI readings. For now it’s on of the strongest one today, along with Yen and Swiss Franc. But still, more technical breakthrough is needed in the greenback to prove its underlying bullishness. USD/JPY and USD/CAD took the lead yesterday, and surged through 113.81 and 1.3170 resistance respectively. On the other hand, at this point, USD/CHF is still held below 1.0094 resistance and EUR/USD is kept well above 1.1300 low. Sterling is the weakest one on disappointing September GDP and Brexit impasse.

In other markets, major European indices are trading in red at the time of writing. FTSE is down -0.66%, DAX is down -0.23% and CAC is down -0.53%. German 10 year yield is down -0.0307 at 0.429. Italian 10 year yield is up 0.034 at 3.435. That is, spread is back above 300. Earlier today, Hong Kong HSI led Asian indices lower, closed down -2.39%. Nikkei dropped -1.05%, China Shanghai SSE down -1.39% and Singapore Strait Times dropped -0.49%.

Released from the US, headline PPI rose 0.6% mom, 2.9% yoy in October, above expectation of 0.2% mom, 2.7% yoy. PPI core rose 0.5% mom, 2.6% yoy, above expectation of 0.2% mom, 2.5% yoy.

UK Q3 GDP growth fastest since 2016, but September weakness clouds

UK Q3 GDP growth accelerated to 0.6% qoq, matched market expectations. That’s also the fastest rate since Q4 2016. Head of National Accounts Rob Kent-Smith noted that “The economy saw a strong summer, although longer-term economic growth remained subdued. There are some signs of weakness in September with slowing retail sales and a fall-back in domestic car purchases. However, car manufacture for export grew across the quarter, boosting factory output. Meanwhile, imports of cars dropped substantially helping to improve Britain’s trade balance.”

However, it should be noted that the rolling three month growth rate slowed from 0.7% in both May-Jul and Jun-Aug periods. This is in line with the above comment that there were some weakness in September. Indeed, monthly GDP growth in September was at 0.0% mom, missed expectation of 0.1% mom.

UK Chancellor of Exchequer Philip Hammond hails today’s GDP release with his tweet. He tweeted “Our economy grew 0.6% between July and September – proof of its underlying strength. That’s 8 straight years of economic growth, 3.3 million more people in jobs and wages growing at their fastest pace in almost a decade.”

Also released from UK, trade deficit narrowed to GBP -9.7B in September versus expectation of GBP -11.4B. Industrial production rose 0.0% mom, 0.0% yoy in September versus expectation of 0.1% mom, 0.5% yoy. Manufacturing production rose 0.2% mom, 0.5% yoy versus expectation of 0.1% mom 0.4% yoy. Construction output rose 1.7% mom in September versus expectation of 0.2% mom.

Italy Tria to keep the main pillars of budget, EU Dombrovskis said assumptions overly optimistic

Italy Economy Minister Giovanni Tria said today that the coalition government is “busy drafting the answer to the European Commission with regards to the most contentious points of the budget.” Italy is requested to present a new or revised draft budget plan to the Commission by November 13. Despite the the requests, Tria told the parliament today that they will confirm the budget plan’s “Main pillar”. Tria reiterated the commitment to cap 2019 budget deficit at 2.4% of GDP. But based on the Commission’s projection released yesterday, Italy’s budget deficit would hit 2.9%.

European Commission Vice President Valdis Dombrovskis blasted Italy’s projections were based on “overly optimistic assumptions.” He added, “Basically the assumption is that if they … increase public spending, it will stimulate the economy and thus will help to reduce budget deficit. We see that this is actually not materializing.”

RBA paints better outlook, but still nowhere near rate hike

Despite painting a slightly more upbeat picture on economic outlook in the quarterly monetary statement, RBA maintained the stance that it’s no where near a move interest rate. 2018 year-average GDP growth projection was raised slightly from 3.25% to 3.50%. 2019 GDP growth projection was kept unchanged at 3.25%. Meanwhile, 2020 year-average GDP growth projection was raised slightly from 3.00% to 3.25% too. Unemployment rate is forecast to drop to 5.00% by end of 2018, stay there through 2019 and then drop further to 4.75% in by June 2020.

Headline inflation by December 2018 was raised from 1.75% to 2.00%, indicating that the temporary drag was less severe than expected. CPI would then climb further to 2.25% by December 2019 and stay there still December 2020, unrevised. Core inflation is projected to be at 1.75% by the end of 2018. Core CPI would then rise to 2.25% by December 2019, revised up from 2.00%. For December 2020, core CPI is projected to stay at 2.25%, unrevised.

RBA pointed out that “household income remains a key uncertainty around this forecast, especially in the context of high household debt and a slowing housing market.” It added further that the uncertainty is on “outlook for household income growth” and “how households may respond to significant housing price declines”.

But after all, RBA maintained that “given the expected gradual nature of that progress,” if reducing unemployment and improving inflation, “the Board does not see a strong case to adjust the cash rate in the near term.”

EUR/USD Mid-Day Outlook

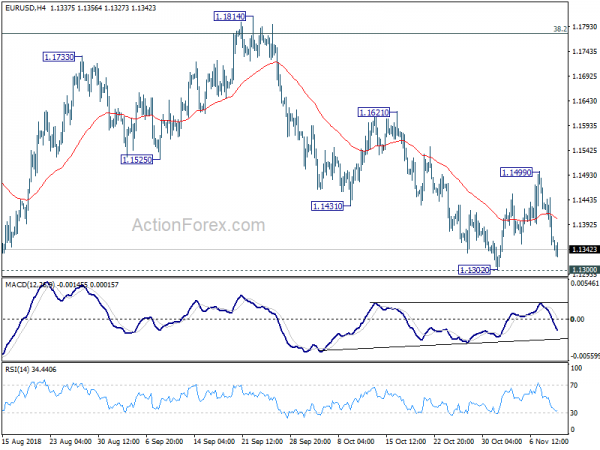

Daily Pivots: (S1) 1.1329; (P) 1.1388; (R1) 1.1423; More….

Intraday bias in EUR/USD remains on the downside for 1.1300 low. Decisive break there will resume down trend from 1.2555 to 1.1186 fibonacci level next. On the upside, break of 1.1499 will resume the rebound from 1.1302 to 1.1621 resistance instead.

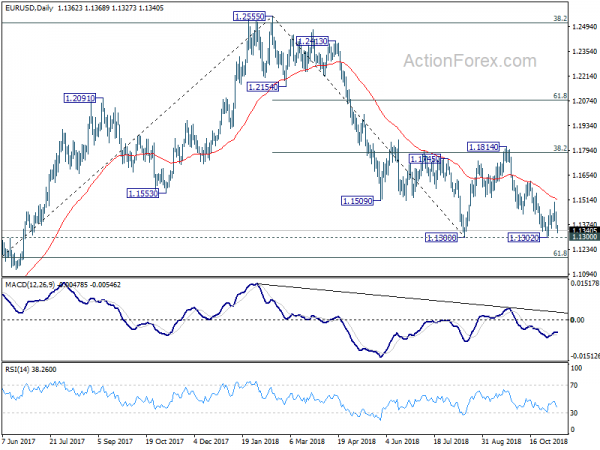

In the bigger picture, price actions from 1.1300 is seen as a corrective pattern. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. In case the consolidation from 1.1300 extends, upside should be limited by 1.1814 and 38.2% retracement of 1.2555 to 1.1300 at 1.1779. to bring down trend resumption eventually.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Oct | 2.70% | 2.80% | 2.80% | |

| 00:30 | AUD | RBA Monetary Policy Statement | ||||

| 00:30 | AUD | Home Loans M/M Sep | -1.00% | -1.10% | -2.10% | -2.20% |

| 01:30 | CNY | CPI Y/Y Oct | 2.50% | 2.50% | 2.50% | |

| 01:30 | CNY | PPI Y/Y Oct | 3.30% | 3.40% | 3.60% | |

| 09:30 | GBP | Visible Trade Balance (GBP) Sep | -9.7B | -11.4B | -11.2B | |

| 09:30 | GBP | Industrial Production M/M Sep | 0.00% | 0.10% | 0.20% | |

| 09:30 | GBP | Industrial Production Y/Y Sep | 0.00% | 0.50% | 1.30% | 1.00% |

| 09:30 | GBP | Manufacturing Production M/M Sep | 0.20% | 0.10% | -0.20% | |

| 09:30 | GBP | Manufacturing Production Y/Y Sep | 0.50% | 0.40% | 1.30% | |

| 09:30 | GBP | Construction Output M/M Sep | 1.70% | 0.20% | -0.70% | -0.30% |

| 09:30 | GBP | GDP M/M Sep | 0.00% | 0.10% | 0.00% | |

| 09:30 | GBP | GDP Q/Q Q3 P | 0.60% | 0.60% | 0.40% | |

| 09:30 | GBP | Index of Services 3M/3M Sep | 0.40% | 0.50% | 0.50% | |

| 13:30 | USD | PPI M/M Oct | 0.60% | 0.20% | 0.20% | |

| 13:30 | USD | PPI Y/Y Oct | 2.90% | 2.70% | 2.60% | |

| 13:30 | USD | PPI Core M/M Oct | 0.50% | 0.20% | 0.20% | |

| 13:30 | USD | PPI Core Y/Y Oct | 2.60% | 2.50% | 2.50% | |

| 15:00 | USD | Wholesale Inventories M/M (SEP F) | 0.30% | 0.30% | ||

| 15:00 | USD | U. of Mich. Sentiment Nov P | 98 | 98.6 |