Australian Dollar trades broadly higher today after RBA stood pat but raised growth forecast a little. Though, it’s being held below last week’s high against both Dollar and Euro. More evidence is needed to prove its strength. Sterling, on the other hand, shows a bit promises by extending recent rebound. Brexit noises continued to float around but there isn’t anything concrete regarding the progress of negotiation. New Zealand Dollar is trading as the weakest one for now, followed by Yen and then Swiss France. Dollar is mixed while the Americans are busy with their mid-term elections.

US markets closed mixed overnight after some dull trading. DOW gained 0.76%, S&P 500 rose 0.56% but NASDAQ dropped -0.38%. 10-year yield retreated slightly by -0.013 to 3.201. 30-year yield dropped -0.021 to 3.432 but stayed above recent resistance at 3.424, which it broke last week. In Asia, Nikkei rebounds today and is trading up 1.08%. But Hong Kong HSI, Shanghai SSSE and Singapore Strait Times are all in red.

Technically, the levels to watch remain unchanged in a slow market. Break of 113.38 in USD/JPY will resume rebound from 111.37. EUR/GBP is heading to 0.8722 and break will resume whole decline from 0.9097. Though, one development to note is that GBP/CHF, yesterday’s top mover, breached 1.3115 resistance already. It should be resuming whole rise from 1.2457 for 1.3413 projection level.

RBA kept cash rate at 1.5%, raised growth forecast a little

RBA left cash rate unchanged at 1.50% as widely expected. Overtone is affirmative but as the improve in wages growth and inflation would be gradual, RBA is in no rush to raise interest rate. The central bank provided a glimpse of the new economic forecasts in the statement. We’ll have to wait for the full Monetary Policy Statement on Friday for the details.

RBA noted that GDP growth forecasts for 2018 and 2019 were “revised up a little” to around 3.5%. GDP growth would slow in 2020 due to “slower export growth or resources”. Growth in household consumption is “one continuing source of uncertainty” due to low income growth, high debt levels and some decline in asset prices. Stronger than expected terms of trade are expected to “decline over time” but stay at relatively high level.

Labor market outlook “remains positive” and unemployment rate is expected to drop further to around 4.75% in 2020. Rise is wages growth is “still expected to be a gradual process”. Inflation outcomes were inline with expectations. CPI is expected to pickup over the next couple of years, gradually. CPI is forecast to be at 2.25% in 2019 and a bit higher in 2020.

Eurozone finance minister rejected Italy budget, new or revised DBP a necessity

Eurozone finance ministers showed united stance against Italy’s budget in the meeting in Brussels yesterday. In a statement, they said “we agree with the Commission assessment” on Italy’s draft budget plan (DBP). And, the group “look forward for Italy and the Commission to engage in an open and constructive dialogue and for Italy to cooperate closely with the Commission in the preparation of a revised budgetary plan which is in line with the SGP (Stability and Growth Pact).”

At the post meeting press conference, Commissioner for Economic Affairs Pierre Moscovici reiterated that a “new” or “revised” DBP was requested by November 13, and “that is a necessity”.

However, Italian Economy Minister Givoanni Tria said after the meeting that the his government wasn’t in the process of changing the budget. Instead, he added, “We hope that the spread will narrow when the market understands our strategy.”

European Parliament Trade Committee approved EU-Japan trade deal

Yesterday, the European Parliament’s international trade committee voted 25-10 today to approve the EU-Japan trade deal signed back in July 17, 2018. The deal could now be sent to the full chamber for a vote in December plenary session. And, if it’s approved, the deal could enter into force as soon as the Japanese Diet ratifies it.

In short, the EU-Japan trade deal will create a trade zone of 600m people, covering a third of of global GDP and around 40% of global trade. Eventually, the deal will remove almost all customs duties, worth roughly EUR 1B annually on European products and services exported to Japan.

The European Parliament’s Trade Committee MEPs emphasized that the agreement “represents a timely signal in support of open, fair, values-based and rules-based trade, while promoting high standards, at a time of serious protectionist challenges to the international order”.

European businesses increasingly desensitized to China Xi Jinping’s constant repetition of empty promises

The European Chamber of Commerce in China blasted Chinese President Xi Jinping’s speech regarding opening up the markets yesterday. In the keynote speech at the China International Import Expo (CIIE), Xi introduced five initiatives, including stimulating potential for imports, broadening market access for foreign investment, creating a world-class business environment, exploring new horizons of opening up, and promote international cooperation multilaterally and bilaterally.

In a statement, the Chamber criticized that much of the content delivered by Xi just “echoed” what was previously announced at Boao in April. And, this was just “constant repetition”, without “sufficient concrete measures or times lines”. And Xi has left the European business community “increasingly desensitized” to these kinds of promises.

Chinese VP Wang: Ready to work for trade solution with US

The US and China will hold a top-level security meeting on Friday in Washington. Secretary of State Mike Pompeo, Defense Secretary Jim Mattis, Chinese politburo member Yang Jiechi and Defense Minister Wei Fenghe will be involved in the meeting. And it’s generally seen as a sign of warming-up ahead of the meeting between Trump and Xi in the upcoming G20 summit later in the month.

Talking about the Trump-XI meeting, Chinese Vice President Wang Qishan said in Singapore today that “both China and the U.S. would love to see greater trade and economic cooperation.” Wang added “the Chinese side is ready to have discussions with the U.S. on issues of mutual concern and work for a solution on trade acceptable to both side.”

On the data front

Japanese household spending dropped sharply by -1.6% yoy in September versus expectation of 1.6% yoy. UK BRC retail sales monitor rose merely 0.1% yoy in October. German factory orders will be released in European session. Eurozone will release PMI services final and PPI. Later in the day, Canada will release building permits. The US calendar is empty for mid-term elections.

AUD/USD Daily Outlook

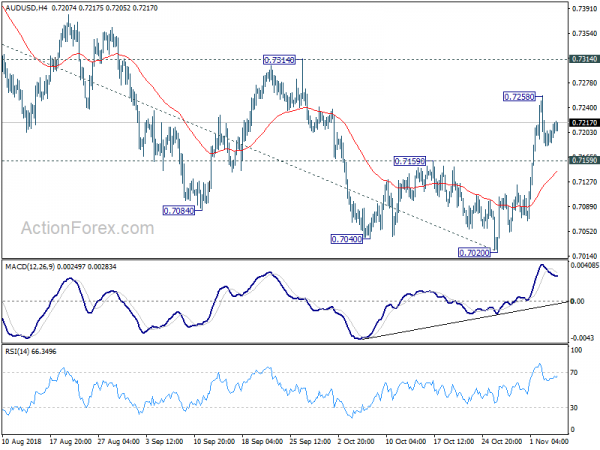

Daily Pivots: (S1) 0.7188; (P) 0.7203; (R1) 0.7224; More…

AUD/USD is staying in tight range below 0.7258 temporary top. Intraday bias remains neutral and outlook is unchanged. With 0.7159 minor support intact, another rise is in favor. Current development argues that a medium term bottom might be in place at 0.7020. On the upside, above 0.7258 will target 0.7314 key resistance. Firm break of 0.7314 will confirm this bullish case and target 38.2% retracement of 0.8135 to 0.7020 at 0.7446 next. However, sustained break of 0.7159 will turn focus back to 0.7020 low instead.

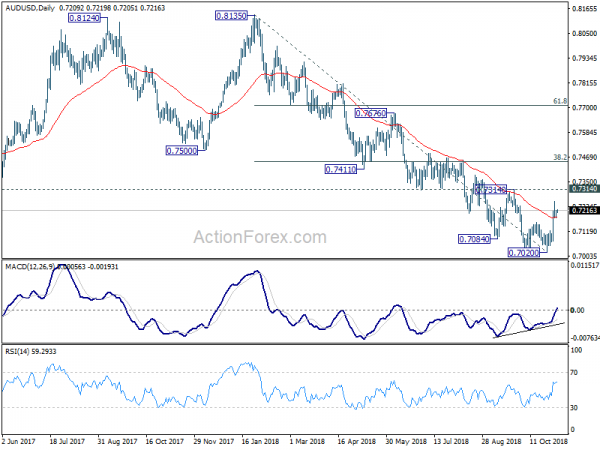

In the bigger picture, as long as 0.7314 resistance holds, fall from 0.8135 is tentatively treated as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 will target 0.6008 key support next (2008 low). However, firm break of 0.7314 will suggest that whole decline from 0.8135 has completed. And, the corrective pattern from 0.6826 (2016 low) is extending with another rising leg towards 0.8135 before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Overall Household Spending Y/Y Sep | -1.60% | 1.60% | 2.80% | |

| 0:01 | GBP | BRC Retail Sales Monitor Y/Y Oct | 0.10% | 0.60% | -0.20% | |

| 3:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 7:00 | EUR | German Factory Orders M/M Sep | -0.40% | 2.00% | ||

| 8:45 | EUR | Italy Services PMI Oct | 52.1 | 53.3 | ||

| 8:50 | EUR | France Services PMI Oct F | 55.6 | 55.6 | ||

| 8:55 | EUR | Germany Services PMI Oct F | 53.6 | 53.6 | ||

| 9:00 | EUR | Eurozone Services PMI Oct F | 53.3 | 53.3 | ||

| 10:00 | EUR | Eurozone PPI M/M Sep | 0.30% | 0.30% | ||

| 10:00 | EUR | Eurozone PPI Y/Y Sep | 4.20% | 4.20% | ||

| 13:30 | CAD | Building Permits M/M Sep | 0.30% | 0.40% |