The forex markets open the week rather quietly. Sterling and Dollar are generally firmer but are both kept below Friday’s high. The Pound did attempt to rise against Euro at open but quickly retreated back into familiar range. On the other hand, New Zealand Dollar and Australian Dollar are mildly lower. Chinese President Xi Jinping’s unambitious pledge on import triggered little reactions, nor did BoJ Governor Kuroda’s message on easing that we’ve heard a thousand times. Traders will look into UK services PMI and US ISM services for more inspirations, as well as comment out of EU on Italy.

In other markets, Nikkei closed down -1.57% at 21895.22. Other Asian markets are in red, with Hong Kong HSI down -2.35%, Shanghai SSE down -0.98%, Singapore Strait Times down -1.81%. Gold is hovering at 1230 after rebounding off 1210 last week. The more interesting move is seen in WTI crude oil, which is dropping further to 62.79 at the time of writing. Oil was sold off after the US granted temporary exemptions on Iranian oil sanctions to eight countries, including China, India, South Korea, Turkey, Italy, the United Arab Emirates, Japan. Taiwan is also exempted.

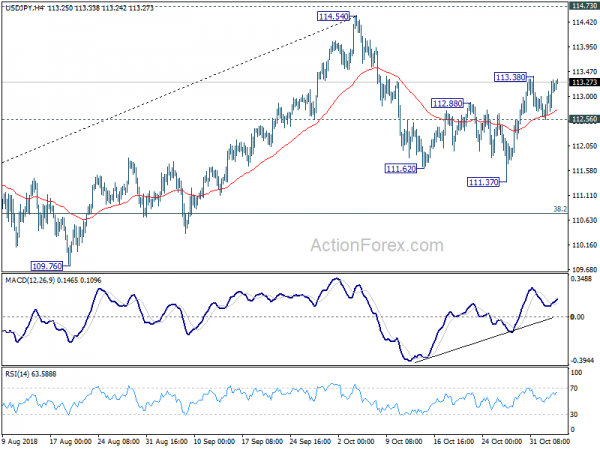

Technically, the main focus today is on whether Dollar could extend Friday’s late rebound. In particular, USD/JPY is closing in on 113.38 temporary top. Even though there’s some hesitation, EUR/GBP looks set to take on 0.8722 low.

China Xi pledged unambitious USD 30T imports at CIIE

China is holding a week-long China International Import Expo, or CIIE, in Shanghai, starting today. President Xi Jinping said “CIIE is a major initiative by China to pro-actively open up its market to the world.” And, he noted “economic globalization is facing setbacks, multilateralism and the free trade system is under attack, factors of instability and uncertainty are numerous, and risks and obstacles are increasing.” That’s the usual rhetorics that China has been using to position itself as defender of free trade.

Nevertheless, Xi also pledged to cut import taxes further and spend more on foreign goods and services. He said China’s goods import will exceed USD 30T over the next 15 years. Meanwhile, Services import will exceed USD 10T. The figure on goods was somewhat raised from Xi’s prior promise of USD 24T. But the fact is, USD 30T over 15 years means only USD 2T per annum, which Chin has already nearly met back in 2013 and 2014. After a dip to USD 1.6T in 2016, import has already bounced back to USD 1.8T in 2017. So, Xi’s target is not that ambitious.

China Caixin PMI composite dropped to 28-month low, mounting downward pressure on the economy

China Caixin PMI services dropped to 50.8 in October, down from 53.1 and missed expectation of 52.9. That’s the lowest level in 13 months. PMI composite output index dropped from 51.2 to 50.5, hitting a 28-month low, lowest since June 2016.

Dr. Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said in the release that the fall in PMI composite indicated “mounting downward pressure on China’s economy”. Employment edged up but stayed negative, which ” could possibly be due to government efforts”. Future output index edged down, “reflecting weakening confidence among companies.”

BoJ Kuroda: It’s necessary to persistently continue with powerful monetary easing

BoJ Governor Haruhiko Kuroda delivered a speech to business leaders in Nagoya today. There he acknowledged that “the BOJ fully recognizes that, by continuing monetary easing, financial institutions’ strength will be cumulatively affected.” And, even though, “these risks are judged as not significant at this point”, he pledged to “scrutinize developments and encourage financial institutions to take action as necessary.”

US-China trade war is one of the risks surrounding Japan’s outlook. Kuroda said “the impact of such problems on Japan’s economy is limited for now … ut if the problems persist, the effect on Japan’s economy could become bigger”.

Overall, Kuroda reiterated that “it’s necessary to persistently continue with powerful monetary easing, while considering both the positive effects and side effects in a balanced manner.” But BoJ will “of course” exit ultra-easy monetary policy when the 2% price target is reached.

BoJ minutes: Need to explain thoroughly the intention to continue with powerful easing

Separately, BoJ also released minutes of September 18-19 monetary policy meeting. The minutes reiterated that the measures taken back in July, including introduction of forward guidance, were for strengthening the framework for “continuous” powerful monetary easing. However, A few members noted some market participants still viewed BoJ’s intention as “unclear”. Thus, “it was important to continue to thoroughly explain that the measure was intended to make clearer the Bank’s policy stance that it would persistently continue with powerful monetary easing while taking into account its side effects.

One member also pointed out that allowing long term yields to move in a “more flexible manner” prompted “heightened” volatility in JGB market. And, since it’s only two months past that meeting, with small transactions volume of JGB in summer, “it was necessary to continue to carefully examine the effects on financial markets”.

Eurozone FM to discuss Italy’s recipe for reviving growth

Italy’s budget will certainly be a hot topic in the summit of Eurozone finance minister meeting in Brussels today. It comes at time time after European Commission rejected the country’s 2019 budget, with deficit target at 2.4% of GDP. The Commission demand Italy to revise the plan by November 13, But Prime Minister Giuseppe Conte insisted there is no “Plan B” for the program and indicated no intention to comply with EU’s demand.

Italian Deputy Prime Minister Luigi Di Maio, leader of the 5 Star Movement, said over the weekend that the coalition government “will not cede an inch” on the budget. He also hailed that their own plan will become a “recipe” for reviving European growth.

Three central banks to meet but politics could be more market moving

Three central banks will meet this week. RBA, RBNZ and Fed are all expected to keep monetary policies unchanged. They’re unlikely to reveal anything new to the markets. Though, RBA’s monetary policy statement on Friday could be a point of interest. ECB will also release monthly economic bulletin. Some important economic data are also scheduled, in particular form UK including services PMI, GDP and productions. IN addition, US ISM services, New Zealand employment; China trade balance will also be featured.

Nevertheless, Brexit negotiations, Italy budget, US-China trade talk, and US mid-term election will likely be bigger market movers.

- Monday: BoJ minutes; Eurozone Sentix investor confidence; UK services PMI; US ISM non-manufacturing

- Tuesday: RBA rate decision; Japan household spending; German factory orders; Eurozone PMI services final, PPI

- Wednesday: New Zealand employment, labor costs, inflation expectation; Japan average cash earnings, leading indicators; German industrial production; Eurozone retail sales; Canada Ivey PMI

- Thursday: RBNZ rate decision; BoJ summary of opinions, Japan machine orders, current account; China trade balance; Swiss unemployment rate; German trade balance; ECB monthly bulletin; Canada housing starts, new housing price index; US jobless claims, FOMC rate decision

- Friday: RBA monetary policy statement, Australia home loans; China CPI and PPI; UK GDP, industrial and manufacturing productions, trade balance; US PPI, U of Michigan sentiments

USD/JPY Daily Outlook

Daily Pivots: (S1) 112.71; (P) 113.01; (R1) 113.51; More..

Intraday bias in USD/JPY remains neutral at this point. Another rise is mildly in favor as long as 112.56 minor support holds. On the upside, break of 113.38 will resume the rebound from 113.37 to o retest 114.54/73 key resistance zone. On the downside, break of 112.56 will likely extend the correction from 114.54 to 38.2% retracement of 104.62 to 114.54 at 110.75 before completion.

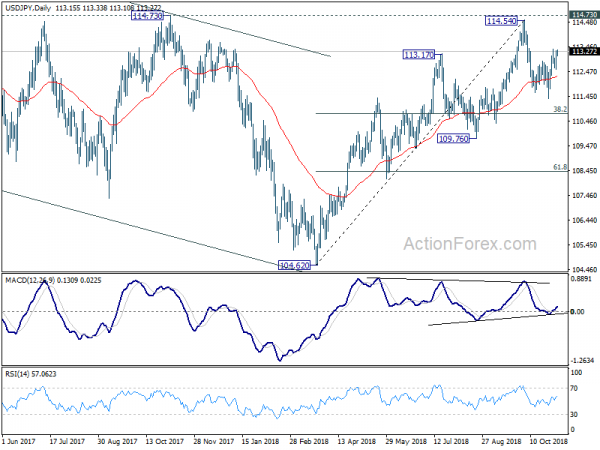

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds. However, decisive break of 109.76 will dampen this bullish view and turns outlook mixed again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Minutes of Policy Meeting | ||||

| 0:00 | AUD | TD Securities Inflation M/M Oct | 0.10% | 0.30% | ||

| 1:45 | CNY | Caixin PMI Services Oct | 50.8 | 52.9 | 53.1 | |

| 9:30 | GBP | Services PMI Oct | 53.4 | 53.9 | ||

| 9:30 | EUR | Eurozone Sentix Investor Confidence Nov | 9.9 | 11.4 | ||

| 14:45 | USD | Services PMI Oct F | 54.7 | 54.7 | ||

| 15:00 | USD | ISM Non-Manufacturing/Services Composite Oct | 59.5 | 61.6 |