After being pressured for most of the day, Dollar is trying to recover in early US session after better than expected job data. Though, momentum remains weak so far, and the greenback is trading mixed only. On the other hand, there is little change in Yen’s fortune, which remains the weakest one on return of global risk appetite. Canadian Dollar is the second weakest after employment data missed expectations. Swiss Franc and Euro are the strongest ones today as they’re paring losses against Australian and New Zealand Dollar. Also, Euro is lifted as German-Italian yield spread narrows.

Global risk appetite is boosted by the positive developments in US-China trade war after the phone call between Trump and Xi. In addition to nice words, both sides are working towards a the meeting of the two presidents as sideline of G20 summit in Argentina on Nov 30 – Dec 1. Ahead of that, it’s also reported that Trump asked his key cabinet secretaries to draw up a potential agreement to sign during the meeting, as cease-fire in escalating trade war. Multiple agencies are believed to be involved in drafting the plan.

At the time of writing, US futures point to another day of strong rebound. Major European indices are trading in black, with FTSE up 0.75%, DAX up 1.56%, CAC up 1.34%. German 10 year yield is up 0.0253 at 0.427. Italian 10 year yield is down -0.054 at 3.326. Spread continues to narrow. Earlier in Asia, Nikkei closed up 2.56%, Hong Kong HSI rose 4.21%, China Shanghai SSE gained 2.70%, Singapore Strait Times added 1.81.

US NFP rose 250k, unemployment rate at 3.7%, average hourly earnings rose 0.2% mom

US non-farm payrolls rose 250k in October, above expectation of 200k. Prior month’s figure was revised down from 134k to 118k. Unemployment rate was unchanged at 3.7%, matched expectations. Average hourly earnings rose 0.2% mom in October, matched expectations. Also from US, trade deficit widened to USD -54.0B in September.

From Canada, employment market grew 11.2k in October, below expectation of 25.0k. Unemployment rate dropped to 5.8%, below expectation of 5.9%. Trade deficit narrowed to CAD -0.4B but missed expectation of CAD 0.2B surplus.

UK construction PMI rose to 53.2, but underlying data paints less rosy picture

UK PMI construction rose to 53.2 in October, up from 52.1 and beat expectation of 52.1. Markit noted “fastest growth in civil engineering since July 2017”. However, there was “slower rise in new projects at construction companies:” and “business optimism weakest in nearly six years”. Trevor Balchin, Economics Director at IHS Markit said in the release “although total UK construction activity rose at a stronger pace in October, the underlying survey data paint a less rosy picture for the sector towards the end of the year.”

Eurozone PMI manufacturing finalized at 52.0, risks shifting to the downside

Eurozone PMI manufacturing was finalized at 52.0 in October, down from prior month’s 53.2. Markit noted “fall in order books as exports decline for the first time in nearly five-and-a-half years”. Also, “trade concerns push confidence down to lowest level since December 2012”. Among the countries, Italy PMI manufacturing dropped to contraction at 49.2, hit a 46-month low. France reading dropped to 51.2, a 25-month low. German reading dropped to 52.2, a 29-month low.

Chris Williamson, Chief Business Economist at IHS Markit said in the release, “concerns about the Eurozone manufacturing sector intensified at the start of the fourth quarter.” And, “the combination of destocking, deteriorating order books and drop in business optimism will add to concerns that growth risks are shifting to the downside rather than being “broadly balanced”, as indicated by the ECB.”

Japan PM Abe: Won’t proceed with sales tax hike if there’s global crisis

Japanese Prime Minister Shinzo Abe appeared to be backing down on his stance regarding the planned sales tax hike next year. For now, he’s still on track to raise sales tax from 8% to 10% in October 2019. He also pledged to mitigate any impact on the economy by providing counter measures.

However, he told parliament that “Our basic stance is that we will proceed with the sales tax hike. But it’s wrong to be too rigid about this and raise the tax rate no matter what.” And, “we will proceed with the tax hike unless the economy is hit by a shock of the scale of the collapse of Lehman Brothers”, which “would be something like a global economic crisis or a huge earthquake.”

Elsewhere

Swiss retail sales dropped -2.7% yoy in September. Japanese Prime Minister Shinzo Abe appeared to be backing down on his stance regarding the planned sales tax hike next year. For now, he’s still on track to raise sales tax from 8% to 10% in October 2019. He also pledged to mitigate any impact on the economy by providing counter measures.

USD/CAD Mid-Day Outlook

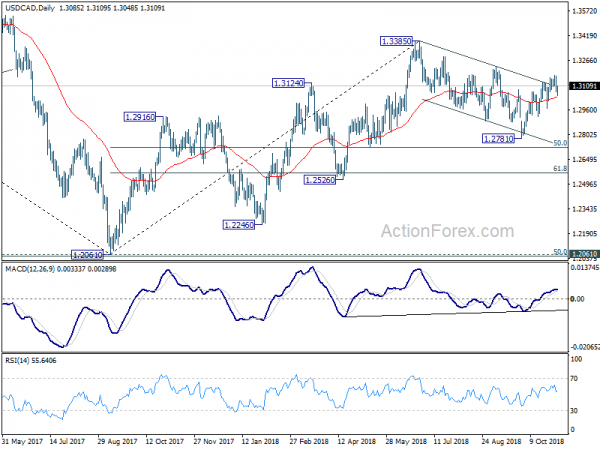

Daily Pivots: (S1) 1.3047; (P) 1.3109; (R1) 1.3149; More…

Despite breaching 1.3068 minor support to 1.3048, USD/CAD quickly recovered. Intraday bias stays neutral first. On the upside, break of 1.3170 will reaffirm the bullish case and target 1.3225 key near term resistance. Break will confirm completion of choppy fall from 1.3385 and target a retest on this high. Though, break of 1.3048 will turn focus to 1.2969 support. Firm break there will indicate completion of whole rebound from 1.2781. In that case, whole fall from 1.3385 might extend through 1.2781 support before completion.

In the bigger picture, current development revives the case that corrective fall from 1.3385 has completed at 1.2781 already. And whole up trend from 1.2061 (2016 low) is ready to resume. Break of 1.3385 will target 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685. This will now be the favored case as long as 1.2781 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Oct | 5.90% | 6.20% | 5.90% | |

| 00:30 | AUD | PPI Q/Q Q3 | 0.80% | 0.20% | 0.30% | |

| 00:30 | AUD | PPI Y/Y Q3 | 2.10% | 1.50% | ||

| 00:30 | AUD | Retail Sales M/M Sep | 0.20% | 0.30% | 0.30% | |

| 08:15 | CHF | Retail Sales Real Y/Y Sep | -2.70% | -0.30% | 0.40% | |

| 08:45 | EUR | Italy Manufacturing PMI Oct | 49.2 | 49.7 | 50 | |

| 08:50 | EUR | France Manufacturing PMI Oct F | 51.2 | 51.2 | 51.2 | |

| 08:55 | EUR | Germany Manufacturing PMI Oct F | 52.2 | 52.3 | 52.3 | |

| 09:00 | EUR | Eurozone Manufacturing PMI Oct F | 52 | 52.1 | 52.1 | |

| 09:30 | GBP | UK Construction PMI Oct | 53.2 | 52 | 52.1 | |

| 12:30 | CAD | Net Change in Employment Oct | 11.2K | 25.0K | 63.3K | |

| 12:30 | CAD | Unemployment Rate Oct | 5.80% | 5.90% | 5.90% | |

| 12:30 | CAD | International Merchandise Trade (CAD) Sep | -0.4B | 0.2B | 0.5B | -0.6B |

| 12:30 | USD | Change in Non-farm Payrolls Oct | 250K | 200K | 134K | 118K |

| 12:30 | USD | Unemployment Rate Oct | 3.70% | 3.70% | 3.70% | |

| 12:30 | USD | Average Hourly Earnings M/M Oct | 0.20% | 0.20% | 0.30% | |

| 12:30 | USD | Trade Balance Sep | -54.0B | -53.4B | -53.2B | -53.3B |

| 14:00 | USD | Factory Orders Sep | 0.30% | 2.30% |