Dollar is trading broadly higher today. In particular, new buying emerges after stronger than expected ADP employment report. USD/CHF breaches 1.0067 key resistance. Meanwhile, EUR/USD is also closing in on 1.1300 key support. Nonetheless, Dollar is overwhelmed by Sterling, which is the strongest one today. There is practically no special news regarding the Pound. However, as it’s rather oversold, traders could be lightening up their position ahead of tomorrow’s BoE Super Thursday. Euro receives little support from inflation data, which showed acceleration in October. Meanwhile, commodity currencies are the weakest ones.

Technically, first focus will be on whether USD/CHF can sustain above 1.0067. If that happens, next target will be key resistance level at 1.0342. Similar, EUR/USD will be watched on whether it could break through 1.1300 key support decisively to resume the medium term down trend from 1.2555. GBP/USD’s recovery is just a recovery for now. Near term outlook stays bearish as long as 1.2921 resistance holds, and 1.2661 low should at least be tested.

In other markets, major European stock indices are trading in black at the time of writing. FTSE is up 1.7%, DAX up 1.32% and CAC is up 2.21%. German 10 year yield is up 0.0164 at 0.386. Italian 10 year yield is down -0.063 at 3.408. German-Italian spread is still larger than 300. Major Asian indices also closed higher. Nikkei rose 2.16%, Hong Kong HSI rose 1.60%, China SSE rose 1.35%, Singapore Strait Times rose 1.76%. Japan 10 year JGB yield closed up 0.0081 at 0.13. Gold dips notably today and is now pressing 1215. Overall, there are signs of improvements in sentiments.

US ADP employment grew 227k, significant gains across all industries

US ADP report showed private sector employment grew 227k in October, higher than expectation of 190k. ADP vice president Ahu Yildirmaz noted in the release that there were “significant gains across all industries with trade and leisure and hospitality leading the way”. Also, “larger employers benefit in this environment as they are more apt to provide the competitive wages and strong benefits employees desire.”

Moody’s Analytics chief economist Mark Zandi said “The job market bounced back strongly last month despite being hit by back-to-back hurricanes. Testimonial to the robust employment picture is the broad-based gains in jobs across industries. The only blemish is the struggles small businesses are having filling open job positions.”

Also from US, employment cost index rose 0.8% in Q3.

Canada GDP grew 0.1%, oil and gas extraction, finance, insurance led

Canada GDP grew 0.1% mom in August, above expectation of 0.0% mom. 12 of 20 industrial sectors declined. But the con centred growth in oil and gas extraction and finance and insurance, was more than enough to offset. In the main industries, mining and oil and gas extraction grew 0.07%, utilities grew 0.02%, finance and concentrated grew 0.07%, public sector grew 0.03%. Manufacturing suffered most by dropped -0.06%.

Also from Canada, IPPI rose 0.1% mom, RMPI dropped -0.9% mom in September.

Eurozone CPI accelerated to 2.2%, core up to 1.1%, unemployment rate unchanged at 8.1%

Eurozone CPI accelerated to 2.2% yoy in October, up from 2.1% yoy and matched expectations. Core CPI accelerated to 1.1% yoy, up from 0.9% yoy and beat expectation of 1.0% yoy. Among the components, energy jumped 10.6% yoy (accelerated from 9.5%). Food, alcohol & tobacco rose 2.2% yoy (slowed from 2.6%). Services rose 1.5% yoy (accelerated from 1.3%). Non-energy industrial goods rose 0.3% yoy (up from 0.3%).

Eurozone (EA19) unemployment rate was unchanged at 8.1% in September, matched expectations, staying as the lowest since November 2008. EU28 unemployment rate was unchanged at 6.7%, lowest since January 2000. Among EU member states, lowest unemployment rate is found in Czechia at 2.3%, then Germany and Poland at 3.4%. Highest unemployment rate is observed in Greece at 19.0%, then Spain at 14.9% and then Italy at 10.1%.

ECB official talk down Q3 GDP slowdown

ECB Governing Council member Ardo Hansson urged not to read too much in to the weaker than expected Q3 GDP figure (0.2% qoq released yesterday). He said, “these were preliminary numbers, maybe they were a bit slower than some expected.” And, “we have to wait and see what was behind this.” Also, he said “as there have been no significant, material change in one way or the other I would not make major conclusions” regarding monetary policy or economic outlook. He also emphasized the need to look at ECB’s own staff projections to be updated in December instead.

Another Governing Council member Olli Rehn said “after a decade of exceptional measures, prospects for returning to a more conventional interest rate environment and a more normal Eurosystem balance sheet have slowly strengthened.” Ewald Nowotny also said the slow down was due to temporary factors like German auto industry only.

BoJ stands pat, lowers inflation forecasts once again

BoJ left monetary policy unchanged today as widely expected, by 7-2 vote again. Short term policy interest rate is held at -0.1%. On long term interest rate, BoJ will continue with asset purchases to keep 10 year JGB yield at around 0%. G. Kataoka dissented again, pushing for more monetary easing due to “heightening uncertainties regarding development in economic activity and prices”. Y. Harada dissented because “allowing the long-term yields to move upward and downward to some extent was too ambiguous”.

In the Outlook for Economic Activity and Prices report, BoJ noted that the economy is likely to continue to grow above potential in fiscal 2018. For fiscal 2019 and 2020, the economy is expected to continue on an “expanding trend”, partly supported by “external demand”. But growth is projected to decelerate due to a “cyclical slowdown” in business fixed investments and the scheduled sales tax hike.

CPI continued to show “relatively weak developments” comparing to growth and labor market. Though, BoJ maintained that “further price rises are likely to be observed widely and then medium- to long-term inflation expectations are projected to rise gradually”. Thus, CPI will gradually increase towards 2% target. On risks, BoJ said both economic and prices risks are “skewed to the downside”.

In the updated economic projects, fiscal 2018 growth forecast was downgraded from 1.5% to 1.4%. Growth forecasts for 2018 and 2019 were kept unchanged at 0.8%. Fiscal 2018 core CPI projection was lowered notably to 0.9%, down from 1.1%. For fiscal 2019 and 2020, ex-sales-tax-hike core CPI projections were also lowered, to 1.4% and 1.5%, down from 1.5% and 1.6% respectively. Also, note that the ex-sales-tax-hike core CPI projections are notably lower than April’s forecasts, at 1.8% in fiscal 2019 and fiscal 2020 respectively.

Also from Japan, consumer confidence dropped to 43 in October. Housing starts dropped -1.5% yoy in September. Industrial production dropped -1.1% mom.

Australia CPI slowed to 1.9% yoy in Q3

Australia CPI rose 0.4% qoq, 1.9% yoy in Q3, versus expectation of 0.5% qoq, 1.9% yoy. The annual rate slowed quite notably from 2.1% yoy. Trimmed mean CPI was unchanged at 1.8% yoy. Weighted median CPI was also unchanged at 1.7% yoy.

Chief Economist for the ABS, Bruce Hockman said: “Annual growth in the CPI fell back below 2 per cent in the September quarter 2018. Modest rises in housing costs, including rents, utilities and property rates, and a fall in child care out-of-pocket expenses, saw a subdued rise in the CPI this quarter.”

New Zealand ANZ business confidence rose to -37.1, next RBNZ move more likely a cut

New Zealand ANZ Business Confidence improved to -37.1 in October, up from -38.3. Confidence is weakest in agriculture (-62.8) and best in construction (-14.8). Activity Outlook index dropped -0.4 to 7.4. Manufacturing (16.2) is the strongest, possibly due to lower New Zealand Dollar exchange rate. Services ranks second (12.6). Retail (-7.8) and agriculture (-2.3) are weakest.

On monetary policy, ANZ noted that “The Reserve Bank argued in the August Monetary Policy Statement that ticking along wasn’t going to do the job, in terms of getting CPI inflation sustainably back to target. We therefore continue to believe that while the impacts of higher wage growth, higher oil prices, and the weaker currency certainly mean there’s no hurry, it remains the case that an eventual OCR cut is more likely than a hike.

Also from New Zealand, building permits dropped -1.5% mom in September.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1328; (P) 1.1358; (R1) 1.1375; More….

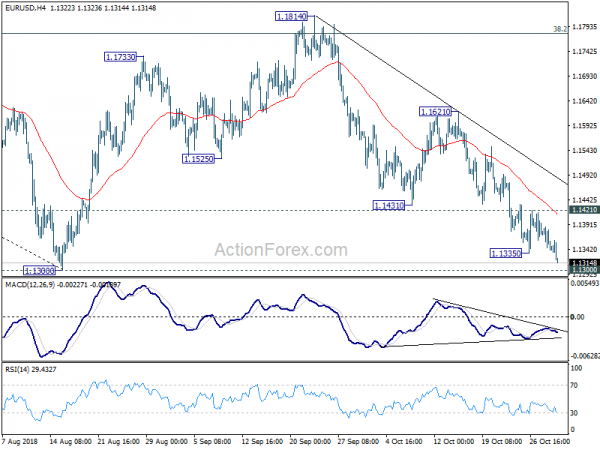

EUR/USD’s break of 1.1335 suggests resumption of fall from 1.1814. Intraday bias is back on the downside for 1.1300 key support level. Decisive break there will resume whole down trend from 1.2555 and target 1.1186 fibonacci level next. On the upside, however, break of 1.1421 resistance will indicate short term bottoming, with bullish convergence condition in 4 hour MACD. Intraday bias will be turned back to the upside for 1.1621 resistance instead.

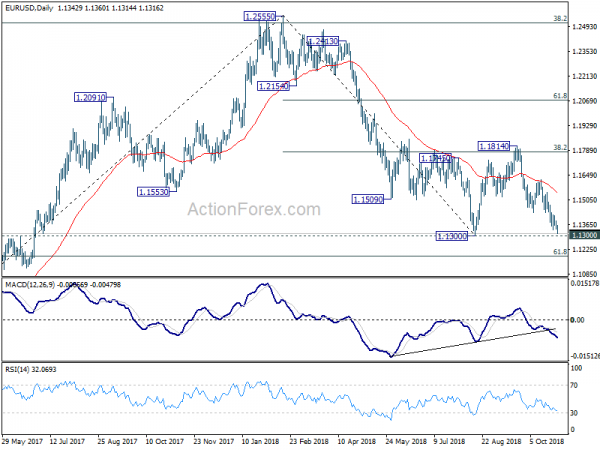

In the bigger picture, corrective pattern from 1.1300 could have completed at 1.1814 after hitting 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 will delay the bearish case and extend the correction from 1.1300 with another rise before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | Building Permits M/M Sep | -1.50% | 7.80% | 6.80% | |

| 23:50 | JPY | Industrial Production M/M Sep P | -1.10% | -0.20% | 0.20% | |

| 00:00 | NZD | ANZ Business Confidence Oct | -37.1 | -38.3 | ||

| 00:01 | GBP | GfK Consumer Confidence Oct | -10 | -10 | -9 | |

| 00:01 | GBP | BRC Shop Price Index Y/Y Oct | -0.20% | 0.20% | ||

| 00:30 | AUD | CPI Q/Q Q3 | 0.40% | 0.50% | 0.40% | |

| 00:30 | AUD | CPI Y/Y Q3 | 1.90% | 1.90% | 2.10% | |

| 00:30 | AUD | CPI RBA Trimmed Mean Q/Q Q3 | 0.40% | 0.40% | 0.50% | 0.40% |

| 00:30 | AUD | CPI RBA Trimmed Mean Y/Y Q3 | 1.80% | 1.90% | 1.90% | 1.80% |

| 00:30 | AUD | CPI RBA Weighted Median Q/Q Q3 | 0.30% | 0.40% | 0.50% | 0.40% |

| 00:30 | AUD | CPI RBA Weighted Median Y/Y Q3 | 1.70% | 1.90% | 1.90% | 1.70% |

| 01:00 | CNY | Manufacturing PMI Oct | 50.2 | 50.6 | 50.8 | |

| 01:00 | CNY | Non-manufacturing PMI Oct | 53.9 | 54.9 | 54.9 | |

| 03:08 | JPY | BOJ Rate Decision | -0.10% | -0.10% | -0.10% | |

| 05:00 | JPY | Consumer Confidence Index Oct | 43 | 43.5 | 43.4 | |

| 05:00 | JPY | Housing Starts Y/Y Sep | -1.50% | -0.50% | 1.60% | |

| 10:00 | EUR | Eurozone Unemployment Rate Sep | 8.10% | 8.10% | 8.10% | |

| 10:00 | EUR | Eurozone CPI Core Y/Y Oct A | 1.10% | 1.00% | 0.90% | |

| 10:00 | EUR | Eurozone CPI Estimate Y/Y Oct | 2.20% | 2.20% | 2.10% | |

| 12:15 | USD | ADP Employment Change Oct | 227K | 190K | 230K | 218K |

| 12:30 | CAD | Industrial Product Price M/M Sep | 0.10% | 0.00% | -0.50% | |

| 12:30 | CAD | Raw Materials Price Index M/M Sep | -0.90% | -0.50% | -4.60% | |

| 12:30 | CAD | GDP M/M Aug | 0.10% | 0.00% | 0.20% | |

| 12:30 | CAD | GDP Y/Y Aug | 2.50% | 2.40% | 2.40% | |

| 12:30 | USD | Employment Cost Index Q3 | 0.80% | 0.80% | 0.60% | |

| 13:45 | USD | Chicago PMI Oct | 60.5 | 60.4 | ||

| 14:30 | USD | Crude Oil Inventories | 6.3M |