Yen trades broadly lower today as stock markets stabilized in both Asian and Europe. Meanwhile, Sterling, and Euro are following as the weakest. There is no sign of breakout of any kind in Brexit negotiation. Economic data out of Eurozone were also disappointing and point to further slow down. Commodity currencies, on the other hand, are generally higher, as led by Australian Dollar. The greenback is mixed for the moment. It was lifted briefly yesterday by news that Trump is going to impose new round of tariffs on China should the summit with President Xi Jinping fails. But there was no follow through buying.

Technically, USD/JPY’s breach of 112.88 minor resistance is seen as an indication of near term reversal. USD/CHF and GBP/USD have just resumed recent moves. GBP/AUD’s decline also accelerates today and breaks 1.8014 key support. One of the focuses in US session is 1.5984 support in EUR/AUD. Decisive break there will be an early indication of medium term trend reversal.

In other markets, at the time of writing, FTSE is up 0.36%, DAX is flat, CAC is up 0.03%. German 10 year yield is up 0.0054 at 0.386. Italian 10 year yield is up 0.090 at 3.428. German-Italian spread is back above 300. Earlier today in Asia, Nikkei closed up 1.45% at 21457.29. Singapore Strait Times closed down -0.51% at 2966.45. Hong Kong HSI closed down -0.91% at 24585.53. But China Shanghai SSE rose 1.02% to 2568.05

Eurozone GDP growth halved to 0.2% qoq, confidence deteriorated

Eurozone GDP growth slowed notably to 0.2% qoq in Q3, down from 0.4% qoq and missed expectation of 0.4% qoq. For the year, GDP growth slowed to 1.7% yoy, down from 2.2% yoy and missed expectation of 1.9% yoy. For EU28, Q3 GDP growth slowed to 0.3% qoq, down from 0.5% qoq. For the year, EU 28 GDP growth slowed to 1.9% yoy, down from 2.1% yoy.

Italy Q3 GDP stalled, grew 0.0% qoq, slowed from prior 0.2% qoq and missed expectation of 0.2% qoq. There were positive contribution from agriculture, forestry, fishing and services. But there was decrease in industry. With regard to Q3 2017, GDP increased by 0.8% yoy. Carry-over annual GDP growth for 2018 stood at 1.0%. French GDP rose by 0.4% qoq in Q3, accelerated from Q2’s 0.2% qoq, matched expectations.

Also released, Eurozone business climate dropped to 1.01, down from 1.21 and missed expectation of 1.15. Economic confidence dropped to 109.8, down from 110.9, missed expectation of 110.0. Industrial confidence dropped to 2.0, down from 4.7 and missed expectation of 3.9. Services confidence dropped to 13.6, down fro 14.7 and missed expectation of 14.0. Consumer confidence was finalized at -2.7. That is, all confidence indicators deteriorated, and worse than expected.

German unemployment dropped -11k in October, unemployment rate was unchanged at 5.1%.

Swiss KOF dropped to 100.1, economy to grow with average rates in coming months

Swiss KOF Economic Barometer dropped to 100.1 in October, down from 102.2 and missed expectation of 100.8. It sits just above long-term average of 100, and suggests that the Swiss economy is likely to “grow with average rates” in the coming months.

KOF noted that the “decline is quite broadly visible in various indicator bundles.” But the fall in manufacturing sector is “particularly striking”. And inside the sector, “downward tendency was led by the machinery and vehicle manufacturers as well as the chemicals, pharmaceuticals and plastics industry”.

Japan unemployment rate dropped to 2.3%, BoJ meeting starts

Japan’s unemployment rate dropped for the second month by -0.1% to 2.3% in September, better than expectation of 2.4%. That’s also just 0.1% above May’s low at 2.2%. Unemployment rate has been in steady decline in recent years.

BoJ monetary policy meeting starts today. It’s widely expected that the central bank will stand pat in the announcement tomorrow. Interest rate will be held unchanged at -0.1%. A major focus is the new economic forecasts but a majority of economists expect them to be largely unchanged.

A major change in BoJ’s communications this year was the explicit allowance of 10 year JGB yield to move in a range of -0.1% to 0.1%. And, JGB is has already moved more than that. Hence, there is possibly unnecessary for BoJ to widen that band further.

Also release in Asian session, Australia building approvals rose 3.3% mom in September, below expectation of 3.9% mom.

USD/JPY Mid-Day Outlook

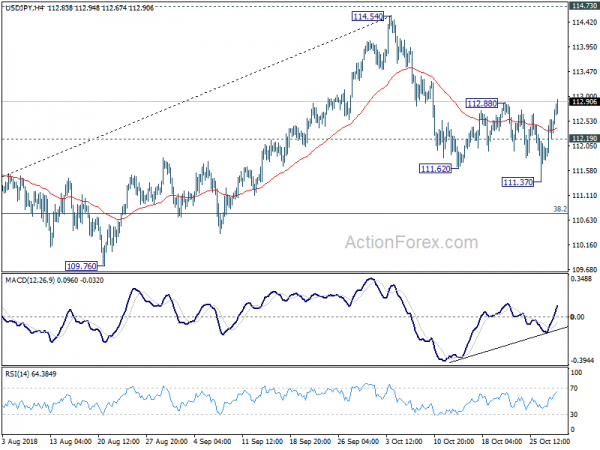

Daily Pivots: (S1) 111.92; (P) 112.24; (R1) 112.70; More..

USD/JPY’s rebound from 111.37 extends today. Breach of 112.88 resistance argues that corrective fall from 114.54 has completed earlier than expected, on bullish convergence condition in 4 hour MACD. Intraday bias is turned back to the upside for retesting 114.54.73 key resistance zone. On the downside, break of 112.19 minor support will turn bias back to the downside and will likely extend the fall from 114.54. IN that case, next target is 38.2% retracement of 104.62 to 114.54 at 110.75. As such fall is seen as part of medium term correction, we’ll look for bottoming signal above 109.76 key support.

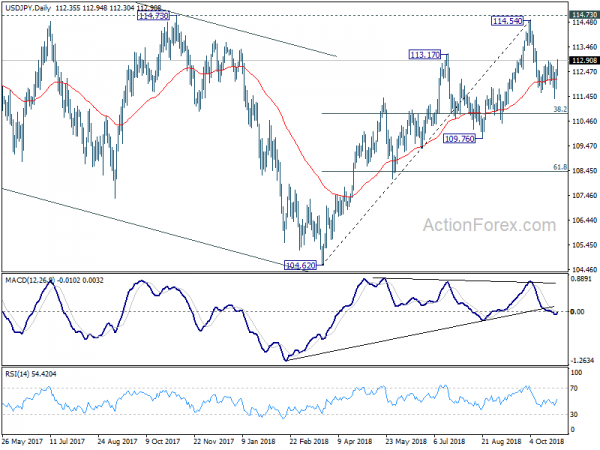

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds. However, decisive break of 109.76 will dampen this bullish view and turns outlook mixed again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Jobless Rate Sep | 2.30% | 2.40% | 2.40% | |

| 0:30 | AUD | Building Approvals M/M Sep | 3.30% | 3.90% | -9.40% | -8.10% |

| 6:30 | EUR | French GDP Q/Q Q3 A | 0.40% | 0.40% | 0.20% | |

| 8:00 | CHF | KOF Leading Indicator Oct | 100.1 | 100.8 | 102.2 | |

| 8:55 | EUR | German Unemployment Change Oct | -11K | -12K | -23K | |

| 8:55 | EUR | German Unemployment Claims Rate Oct | 5.10% | 5.10% | 5.10% | |

| 9:00 | EUR | Italian GDP Q/Q Q3 P | 0.00% | 0.20% | 0.20% | |

| 10:00 | EUR | Eurozone Business Climate Indicator Oct | 1.01 | 1.15 | 1.21 | |

| 10:00 | EUR | Eurozone Economic Confidence Oct | 109.8 | 110 | 110.9 | |

| 10:00 | EUR | Eurozone Industrial Confidence Oct | 3 | 3.9 | 4.7 | |

| 10:00 | EUR | Eurozone Services Confidence Oct | 13.6 | 14 | 14.6 | 14.7 |

| 10:00 | EUR | Eurozone Consumer Confidence Oct F | -2.7 | -2.7 | -2.7 | |

| 10:00 | EUR | Eurozone GDP Q/Q Q3 A | 0.20% | 0.40% | 0.40% | |

| 10:00 | EUR | Eurozone GDP Y/Y Q3 A | 1.70% | 1.90% | 2.10% | 2.20% |

| 13:00 | EUR | German CPI M/M Oct P | 0.10% | 0.40% | ||

| 13:00 | EUR | German CPI Y/Y Oct P | 2.40% | 2.30% | ||

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Aug | 5.80% | 5.90% | ||

| 14:00 | USD | Consumer Confidence Index Oct | 135 | 138.4 |