Dollar remains the strongest major currency for the week as markets await a bunch of key economic data from US. The list include CPI which is expected to slowed to 2.3% yoy in April. Core CPI is expected to be unchanged at 2.0% yoy. Retail sales is expected to show 0.6% growth while ex-auto sales would show 0.5% rise. U of Michigan consumer sentiment and business inventories will also be released.

Recent comments from Fed officials generally affirmed the markets that the central bank is on track for a June hike. Fed fund futures are pricing in 83% chance for that. Indeed, comments started to lean a bit towards the hawkish side as Boston Fed Eric Rosengren urged three more hikes. But judging from the reactions in the financial markets, investors are still hesitating to bet on a faster path for stimulus removal. Dollar index is struggling to find buying through 100 handle. 10 year yield also lost upside momentum after hitting 2.4.

Released in Asian session today, New Zealand business NZ manufacturing index dropped to 56.8 in April, down fro 58. Japan M2 rose 4.3% yoy in April. Germany GDP will be a major focus in European session and is expected to show 0.6% qoq growth in Q1. Germany will also release CPI final and Eurozone will release industrial production.

G7 finance chiefs will start a two day meeting in Italy today. It’s reported that Europe, Japan and Canada are seeking to get a clearer picture of US President Donald Trump’s policies, through Treasury Secretary Steven Mnuchin. According to a Treasury spokesman, Mnuchin will brief G7 on the still evolving tax and regulatory reforms. However, trade and protectionism seem to be off the meeting’s agenda. In addition, there will be a discussion of Greece’s debt ahead of the May 22 meeting of Eurozone finance ministers,. with presence of representatives of ECB and IMF. IMF is believed to be pushing for debt relief measures for Greece which is objected by Eurozone governments for the time being.

Yesterday, BOE left the Bank rate unchanged at 0.25% and the QE program at 435B pound. While this had been widely anticipated, BOE’s downgrade of GDP growth outlook was disappointing. Policymakers also raised its inflation forecast for this year, warning that rising inflation begins to hurt consumers, but lowered the forecasts for 2018 and 2019. Expectations of a "smooth" Brexit led members to believe that interest rate may need to go up around the time the UK leaves the EU in 2019.

The market viewed the downgrade of GDP growth this year and inflation outlook in 2018 and 2019 as dovish. We were a bit surprised by the 7-1 vote (Kristin Forbes the only dissenter) to maintain the monetary policy status quo. We had expected a more divided committee with one more member joining the rate hike camp.

More in Dovish BoE Sent British Pound Lower

AUD/USD Daily Outlook

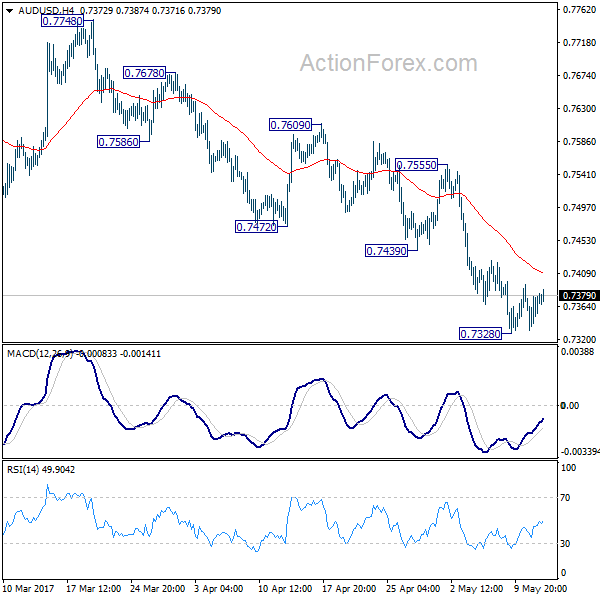

Daily Pivots: (S1) 0.7347; (P) 0.7365; (R1) 0.7396; More…

Intraday bias in AUD/USD is turned neutral with a temporary low formed at 0.7328. Some consolidations would be seen. But upside of recovery should be limited well below 0.7555 resistance and bring another fall. Break of 0.7382 will extend the decline from 0.7748 to retest 0.7144/7158 support. We’ll be cautious on bottoming there as there is no clear sign of larger down trend resumption yet. Meanwhile, firm break of 0.7555 will argue that fall from 0.7748 is completed and turn bias back to the upside.

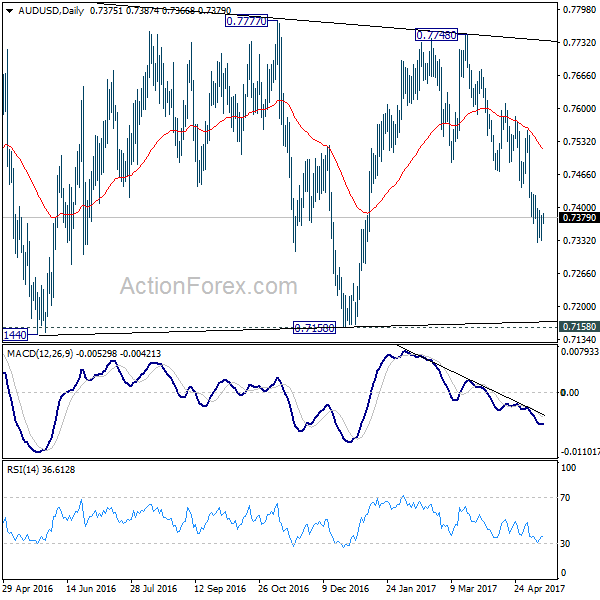

In the bigger picture, we’re still treating price actions from 0.6826 low as a correction pattern. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seen to 55 month EMA (now at 0.8115) and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | Business NZ Manufacturing Index Apr | 56.8 | 57.8 | 58 | |

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Apr | 4.30% | 4.30% | 4.30% | 4.20% |

| 6:00 | EUR | German GDP Q/Q Q1 P | 0.60% | 0.40% | ||

| 6:00 | EUR | German CPI M/M Apr F | 0.00% | 0.00% | ||

| 6:00 | EUR | German CPI Y/Y Apr F | 2.00% | 2.00% | ||

| 9:00 | EUR | Eurozone Industrial Production M/M Mar | 0.30% | -0.30% | ||

| 12:30 | USD | CPI M/M Apr | 0.20% | -0.30% | ||

| 12:30 | USD | CPI Y/Y Apr | 2.30% | 2.40% | ||

| 12:30 | USD | CPI Core M/M Apr | 0.20% | -0.10% | ||

| 12:30 | USD | CPI Core Y/Y Apr | 2.00% | 2.00% | ||

| 12:30 | USD | Advance Retail Sales Apr | 0.60% | -0.20% | ||

| 12:30 | USD | Retail Sales Less Autos Apr | 0.50% | 0.00% | ||

| 14:00 | USD | U. of Michigan Confidence May P | 97 | 97 | ||

| 14:00 | USD | Business Inventories Mar | 0.10% | 0.30% |