Despite initial steep selloff, US equities staged a strong rebound before close and closed just slightly lower. The turnaround in sentiments carried on in Asian session with major indices all trading in black. With receding risk aversion, Australian and New Zealand Dollar are trading as the strongest one for today so far, followed by Canadian Dollar. Yen is naturally the weakest one for today, but European majors are also weak.

For the week, Sterling is so far the weakest one as weighed down by Brexit uncertainty. Euro is trading as the third weakest as the EU and Italy have now formally started the budget clash. That could also be reflected in the strength of swiss Franc. Canadian Dollar pares back some of last week’s post CPI losses. BoC is expected to raise interest rate today. The accompanying statement would determine the next direction for the Loonie. Dollar is the third strongest for the week so far even though it’s struggling to extend gains despite hawkish Fed comments.

Technically, we’ve pointed out before that Yen bulls refused to commit despite yesterday’s rally attempt. That’ clearly reflected in USD/JPY’s recovery from 111.94 minor support and the lack of follow through selling in EUR/JPY and GBP/JPY. To a certain extent, Dollar bulls already refused to commit too. The greenback is for now struggling in tight range against dollar ahead of near term resistance. USD/CAD and USD/CHF are also staying in tight range. Focuses for the rest of the week will be on which sides Dollar and Yen would finally take.

In other markets, DOW closed down -0.50% at 25191.43 after diving to 24768.79. S&P 500 lost -0.55%, NASDAQ dropped -0.42%. Similarly, 10 year yield dropped to as low as 3.111, but closed 3.166, down just -0.030. In Asia, Nikkei is trading up 0.70% at the time of writing, Singapore Strait Times up 0.46%, Hong Kong HSI up 0.13% and China Shanghai SSE up 0.88%. Gold breached 1236/8 cluster resistance yesterday but quickly dipped back, it’s now trading at around 1231/2, struggling to find follow through buying to overcome mentioned key resistance zone.

Fed Bostic: With strong economy, rate hikes to neutral appropriate

Atlanta Fed President Raphael Bostic said is a speech that the US economy is “in a good place”, and he “struggled to come up with sufficient variations on the word ‘strong'”. And to him strong economy means “able to withstand great force or pressure”. “Tariffs, trade restrictions, and market volatility” are the headwinds. But there are also tailwinds in “recent tax reform and fiscal stimulus”. And because of strong GDP numbers in Q2 and Q3, he’s revised up 2018 and 2019 growth projections.

On monetary policy, he said “unless the data talk me out of it, I view a continued, gradual removal of policy accommodation as appropriate until we get to a neutral policy rate.” And he emphasized that the current Fed policy rate “has not yet reached a neutral stance” and Fed is “still providing accommodation”. The Fed has “yet to pump the brakes”.

Trump unsure if he regrets on Fed Powell

Trump repeated his attack on Fed and its Chair Jerome Powell again yesterday. He told WSJ that “I’m very unhappy with the Fed because Obama had zero interest rates”. And, referring to Powell, Trump added, “every time we do something great, he raises the interest rates”, and Powell “almost looks like he’s happy raising interest rates.”

Asked if he regrets nominating Powell, Trump said it’s “too early to tell, but maybe”. Further, when asked on what circumstances would lead him to remove Powell, Trump said “I don’t know”. That’s already a shift in stance from “I’m not going to fire him” on October 11.

House Brady agreed to work on 10% middle class tax cut.

House Ways and Means Committee Chairman Kevin Brady, Republican, said in a statement to work with the White House on delivering the 10% tax cut for the middle class. In the statement, he said “resident Trump believes American families deserve to keep more of what they work so hard to earn. We agree. After all, it’s your money – not Washington’s.”

Brady added “We will continue to work with the White House and Treasury over the coming weeks to develop an additional 10 percent tax cut focused specifically on middle-class families and workers, to be advanced as Republicans retain the House and Senate.”

European Commission rejected Italy’s budget, Italy Di Maio demands respect

European Commission formally rejected Italy’s budget after its regular meeting yesterday. Vice President For the Euro Valdis Dombrovskis said in a press conference that “today, for the first time, the Commission is obliged to request a euro area country to revise its draft budget plan.” He added, “we see no alternative than to request the Italian government to do so. We have adopted an opinion giving Italy a maximum of three weeks to provide a revised Draft Budgetary Plan for 2019,”

Regarding Italy’s letter to the Commission on Monday, Dombrovskis said “Unfortunately, the clarifications received yesterday were not convincing to change our earlier conclusions of a particularly serious non-compliance with the recommendation addressed to Italy by the Council on the 13th of July.” And, “the Italian Government is openly and consciously going against the commitments it made.”

Italian Deputy Prime Minister, leader of the Five-Star Movement Luigi Di Maio said in his Facebook page that European Commission’s rejection of the country’s budget is not a surprise. He said, “this is the first Italian budget that the EU doesn’t like. I am not surprised. This is the first Italian budget that was written in Rome and not in Brussels.”

And he added “with the damage they had done before, we could not continue with their policies”, referring to the European commission”. Di Maio pledged to ” continue to tell the European commission what we want to do with respect. But equally respect must be for the Italian people and the government that represents it today.”

Japan PMI manufacturing rose to 53.1, upbeat start to Q4

Japan PMI manufacturing rose to 53.1 in October, up from 52.5 and beat expectation of 52.6. Markit noted that “growth of key macroeconomic variables (output, new orders and employment) all accelerate”, and “rates of input cost and output price inflation both quicken to multi-year highs.”

Joe Hayes, Economist at IHS Markit said in the release that the “manufacturing sector looks set to start Q4 on a more upbeat note”. And, “the latest survey indicated stronger expansions in all the key barometers of macroeconomic health”. Also, “export sales rose for the first time since May” despite global trade tensions.

BoC to raise interest rate, focus on forward guidance

BoC rate decision is a major focus today. The market has fully priced in that BoC would raise its policy rate by 25 bps to 1.75%. Despite a mixed employment market and moderating inflation in September, clarity of the trade relationship with the US still warrants a rate hike. Indeed, if macroeconomic developments continue to evolve according to BOC’ projections, two more rate hike a probably justified in 1H19. But for now, BoC would at most be cautiously optimistic, retaining the stance of gradual and data-dependent tightening.

More in BOC Preview – Rate Hike Fully Priced but Future Decision Still Data- Dependent

Looking ahead

Eurozone PMIs will be the major feature in European session, together with M3 money supply. UK will release BBA mortgage approvals. Later in the day, US will release PMIs, house price index and new homes sales. Fed will also release Beige Book economic report. But major focus will be on BoC rate hike.

USD/JPY Daily Outlook

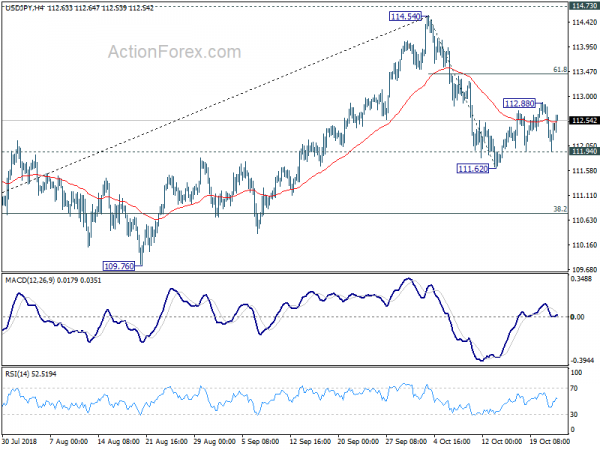

Daily Pivots: (S1) 112.01; (P) 112.44; (R1) 112.93; More..

USD/JPY recovered ahead of 111.94 minor support but it’s held below 112.88. Intraday bias remains neutral first. Outlook is unchanged that fall from 114.54 is part of medium term correction. Below 111.94 will likely extend such fall through 111.62 to 38.2% retracement of 104.62 to 114.54 at 110.75. In that case, we’ll look for bottoming signal above 109.76 key support. On the upside, above 112.88 will target 61.8% retracement of 114.54 to 111.62 at 113.42 instead.

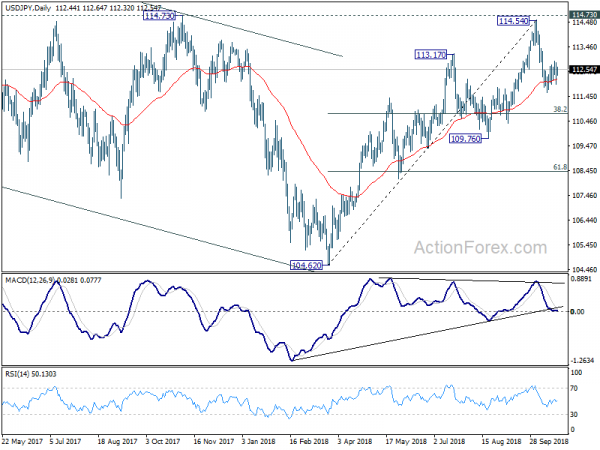

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds. However, decisive break of 109.76 will dampen this bullish view and turns outlook mixed again.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | PMI Manufacturing Oct P | 53.1 | 52.6 | 52.5 | |

| 7:15 | EUR | France Manufacturing PMI Oct P | 52.4 | 52.5 | ||

| 7:15 | EUR | France Services PMI Oct P | 54.7 | 54.8 | ||

| 7:30 | EUR | Germany Manufacturing PMI Oct P | 53.5 | 53.7 | ||

| 7:30 | EUR | Germany Services PMI Oct P | 55.5 | 55.9 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Oct P | 53.1 | 53.2 | ||

| 8:00 | EUR | Eurozone Services PMI Oct P | 54.5 | 54.7 | ||

| 8:00 | EUR | Eurozone M3 Money Supply Y/Y Sep | 3.50% | 3.50% | ||

| 8:30 | GBP | BBA Mortgage Approvals Sep | 39.0K | 39.4K | ||

| 13:00 | USD | House Price Index M/M Aug | 0.30% | 0.20% | ||

| 13:45 | USD | US Manufacturing PMI Oct P | 55.5 | 55.6 | ||

| 13:45 | USD | US Services PMI Oct P | 54.1 | 53.5 | ||

| 14:00 | CAD | BoC Rate Decision | 1.75% | 1.50% | ||

| 14:00 | USD | New Home Sales Sep | 630K | 629K | ||

| 14:30 | USD | Crude Oil Inventories | 6.5M | |||

| 15:15 | CAD | BoC Press Conference | ||||

| 18:00 | USD | Federal Reserve Beige Book |