Dollar and Yen trade broadly higher in early US session as investors turn cautious again. Minutes of September FOMC meeting where there was another 25bps hike would catch much attention. But we’re not expecting anything dramatic from there. All the markets need to know should have been delivered in the economic projections and press conference already.

Sterling is trading as the weakest one for today after weaker than expected consumer inflation data. Also, UK Prime Minister Theresa May will face the “moment of truth” in the EU summit in Brussels today. For now, it’s uncertain whether there would be enough progress even to go on with the unscheduled November Brexit summit. The Pound could suffers some more volatility as Brexit headlines hit the wire. Euro is trading as the second weakest one for now.

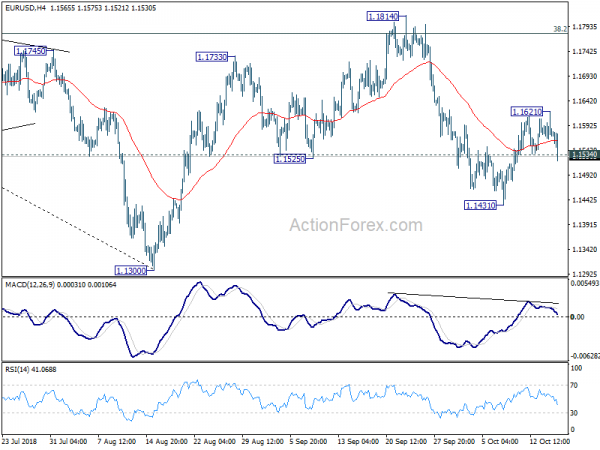

Technically, EUR/USD’s break of 1.1534 minor support is taken as a sign that recent consolidation is finally over. Deeper fall is now in favor to retest 1.1431 low. But for now, Dollar’s strength is far from being certain. We’d have to see break of 0.9954 resistance in USD/CHF, 1.3081 minor support in GBP/USD and 0.7098 minor support in AUD/USD to give us more confidence.

In other markets, European indices are trading in red after reversing initial gains. At the time of writing, DAX is down -0.60%, CAC down -0.37%, FTSE up 0.14%. German 10 year yield is down -0.037 at 0.457. Italian 10 year yield is up 0.071 at 3.531. That is German-Italian spread is back above 300 alarming level. Earlier in Asia, China Shanghai SSE staged a late rebound to close up 0.60% at 2561.61. Nikkei gained 1.29%, Hong Kong HSI rose 0.07% and Singapore Strait Times added 1.21%.

Released in US session, Canada manufacturing sales dropped -0.4% mom in August. US housing starts dropped to 1.20m annualized rate in September. Building permits dropped to 1.24m.

Sterling weakens after September CPI miss

Sterling drops notably after September consumer inflation data came in lower than expected. Headline CPI slowed to 2.4% yoy, down from 2.7% yoy and missed expectation of 2.8% yoy. Core CPI slowed to 1.9% yoy, down from 2.1% yoy and missed expectation of 2.1% yoy.

The ONS noted that “The largest downward contribution to the change in the CPIH 12-month rate came from food and non-alcoholic beverages, where prices fell by 0.1% between August and September 2018 compared with a rise of 0.8% between the same two months a year ago. The main effects came from meat where prices fell, between August and September, this year but rose a year ago and from chocolate.”

Also released, RPI slowed to 3.3% yoy versus prior 3.5% yoy and expectation of 3.5% yoy. PPI input rose to 10.3% yoy from 9.4% yoy. PPI output rose to 3.1% yoy from 2.9% yoy. PPI output core rose to 2.4% yoy from 2.2% yoy.

USTR Lighthizer singles out automobiles, agriculture and services for trade talk with Japan

The US Trade Representative Robert Lighthizer issued a statement notifying the Congress on the intentions of negotiation three separate trade agreements with Japan, the EU and the UK. Three separate letters were also sent to the Congress covering the relationships. He repeated in the letters that the aim aim in negotiations is to “address both tariff and non-tariff barriers to achieve fairer and more balanced trade”. And the USTR are “committed to concluding these negotiations with timely and substantive results for US consumers, businesses, farmers, ranchers and workers”.

On Japan, Lighthizer criticized that exporters in automobiles, agriculture and services have been “challenged by multiple tariff and non-tariff barriers for decades”. And that lead to “chronic US trade imbalances with Japan”, at USD 68.9B in 2017. Also, Japan “is an important but still too often underperforming market for U.S. exporters of goods,”

On EU, Lighthizer said the economic relationship is the “largest and most complex” in the world. He also said exporters faced “multiple tariff and non-tariff barriers for decade” without naming the sectors like with Japan.

With the UK, Lighthizer said there is “broad and deep trade and investment relationship”. UK cannot negotiate the trade agreements yet until after Brexit, a Trade and Investment Working Group was already launched to provide the ground work for an FTA.

USTR statement here. Letters to Congress on Japan, EU and UK.

Japan Chief Cabinet Secretary Yoshihide Suga said “It will not be an easy negotiation … But we would like to proceed with talks in line with our stance that we will push where necessary and defend our position where necessary, in a way that protects our national interests.”

EU Malmstrom: US not shown any big interest in trade negotiation yet

EU Trade Commissioner Cecilia Malmstrom responded to questions on US Trade Representative’s statement on starting negotiation with Japan, EU and UK. Malmstrom said the EU “see this merely as preparations being made by the U.S. to negotiate with them and others.” And she added “we have not started negotiating yet”.

Also, Malmstrom said “we are prepared to start the scoping exercise on a limited agreement focus on industrial goods … so far the U.S. has not shown any big interest.”

Regarding UK, she said “the U.K. cannot negotiate any trade agreement as long as they are a member of the European Union.”

Released from Eurozone, CPI was finalized at 2.1% yoy in September, core CPI at 0.9% yoy.

RBA Debelle: Unemployment rate might drop further before material rise in wages growth

RBA Deputy Governor Guy Debelle welcomed the developments in the Australian labor market in a speech. He noted that “employment has grown strongly, the participation rate is close to its highest level on record and the unemployment rate has declined to be at a six-year low.” And, that is “consistent with the above-trend GDP growth in the economy.”

However, he also noted again there was “little” change in long term unemployment rate and “wages growth remains low”. Above averaged demand for labor and growth in economy should “gradually reduce the spare capacity in the labour market.” And that will lead to “gradual increase in wages growth and, in turn, inflation.” But the extend and timing are uncertain. Unemployment rate could drop further than historical experience before material increases in wages growth.

Debelle also noted that the drag on the economy from lower house prices is still unclear and RBA is paying close attention.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1552; (P) 1.1587; (R1) 1.1609; More…..

EUR/USD’s break of 1.1534 minor support argues that corrective rebound from 1.1431 has completed at 1.1621 already. Intraday bias is turned back to the downside. Break of 1.1431 will resume whole decline from 1.1814 and target a test on 1.1300 low. On the upside, above 1.1621 will delay the bearish case and bring another rebound. But then, upside should be limited by 1.1779/1814 resistance zone to bring down trend resumption eventually.

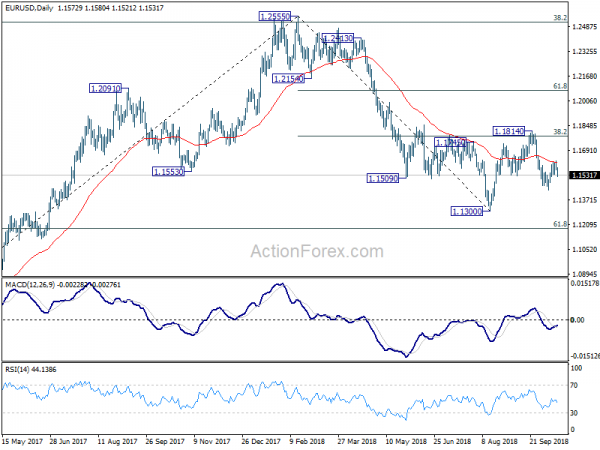

In the bigger picture, corrective pattern from 1.1300 could have completed at 1.1814 after hitting 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 will delay the bearish case and extend the correction from 1.1300 with another rise before completion.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 20:00 | USD | Net Long-term TIC Flows (USD) Aug | 131.8B | 50.3B | 74.8B | 66.7B |

| 23:30 | AUD | Westpac Leading Index M/M Sep | -0.10% | 0.10% | 0.00% | |

| 08:30 | GBP | CPI M/M Sep | 0.10% | 0.50% | 0.70% | |

| 08:30 | GBP | CPI Y/Y Sep | 2.40% | 2.80% | 2.70% | |

| 08:30 | GBP | Core CPI Y/Y Sep | 1.90% | 1.80% | 2.10% | |

| 08:30 | GBP | RPI M/M Sep | 0.00% | 0.20% | 0.90% | |

| 08:30 | GBP | RPI Y/Y Sep | 3.30% | 3.20% | 3.50% | |

| 08:30 | GBP | PPI Input M/M Sep | 1.30% | 0.20% | 0.50% | 1.20% |

| 08:30 | GBP | PPI Input Y/Y Sep | 10.30% | 5.70% | 8.70% | 9.40% |

| 08:30 | GBP | PPI Output M/M Sep | 0.40% | 0.20% | 0.20% | |

| 08:30 | GBP | PPI Output Y/Y Sep | 3.10% | 2.90% | 2.90% | |

| 08:30 | GBP | PPI Output Core M/M Sep | 0.10% | 0.10% | 0.10% | 0.20% |

| 08:30 | GBP | PPI Output Core Y/Y Sep | 2.40% | 2.10% | 2.10% | 2.20% |

| 08:30 | GBP | House Price Index Y/Y Aug | 3.20% | 3.50% | 3.10% | 3.40% |

| 09:00 | EUR | Eurozone CPI M/M Sep | 0.50% | 0.20% | 0.20% | |

| 09:00 | EUR | Eurozone CPI Y/Y Sep F | 2.10% | 2.10% | 2.10% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep F | 0.90% | 1.00% | 0.90% | |

| 12:30 | CAD | Manufacturing Sales M/M Aug | -0.40% | -0.10% | 0.90% | 1.20% |

| 12:30 | USD | Housing Starts Sep | 1.20M | 1.21M | 1.28M | 1.27M |

| 12:30 | USD | Building Permits Sep | 1.24M | 1.28M | 1.25M | 1.25M |

| 14:30 | USD | Crude Oil Inventories | 1.6M | 6.0M | ||

| 18:00 | USD | FOMC Minutes |