New Zealand Dollar tumbles sharply today after RBNZ left official cash unchanged at 1.75% but issued a dovish statement. There were anticipations that the central bank would raise the outlook on inflation after Q1’s figure. But instead, RBNZ Governor Graeme Wheeler said in the statement that the increase in headline inflation in Q1 was "temporary", mainly due to "higher tradables inflation, particularly petrol and food prices." Meanwhile, "non-tradables and wage inflation remain moderate but are expected to increase gradually." That will bring future headline inflation to midpoint of target band "over the medium term". And, longer-term inflation expectation remained "well anchored at around 2 percent". The OCR outlook was basically unchanged from the February MPS. And the implication is that OCR will be unchanged till at least early 2019 with chance of a rate hike later in that year.

NZD/USD’s drops to as low as 0.6816 so far and resumed recent decline from 0.7374 and 0.7484. Near term outlook will now stay bearish as long as 0.6949 resistance holds. Further fall should be seen to 100% projection of 0.7484 to 0.6860 from 0.7374 at 0.6750. At this point, we’re slightly favoring the case that price actions from 0.6102 medium term bottom (2015 low) are developing into a corrective pattern. Hence, firm break of 0.6750 projection level will show downside acceleration and would pave the way back to retest 0.6102. We’ll assess the outlook again when NZD/USD hits 0.6750.

Sterling firm ahead of BoE

Sterling is so far the second strongest major currency for the week, next to Dollar, as markets await BoE rate decision. Markets are speculating a mild hawkish twist in BoE’s inflation outlook as CPI was back in target rate at 2.3% yoy in March. However, on the other hand, weaker than expected Q1 growth and uncertainties surrounding Brexit negotiation would keep policy makers on guard. The National Institute of Economic and Social Research said earlier that BoE won’t change its monetary policies before conclusion of Brexit negotiation with EU. But it should be noted again that Sterling launched this round of rally against Dollar and Euro after Kristin Forbes surprised the markets by voting for a rate hike back in March. Currently, markets are pricing in less than 60% chance of any move by BoE before end of 2018. The pound would be given another boost if there is anything in today’s announcements that suggests BoE would act earlier than that.

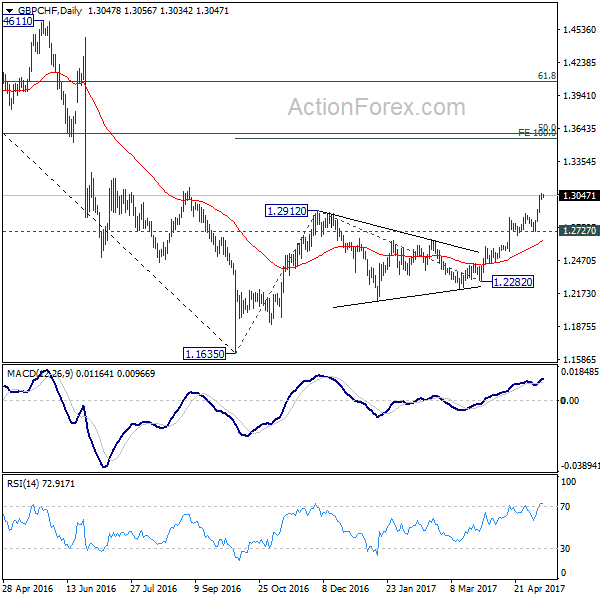

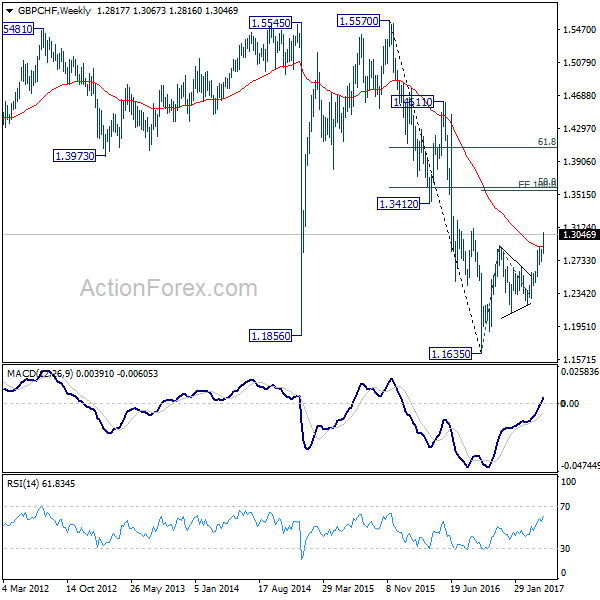

GBP/CHF is one of the top movers this week thanks to receding political risks in Europe after French election. The strong break of 1.2912 resistance confirmed resumption of the rebound from 1.1635 medium term bottom. The decisive break of 55 week EMA also indicates underlying strength. near term outlook will remain bullish as long as 1.2727 support holds. Current rise should target cluster level at 100% projection of 1.1635 to 1.2912 from 1.2282 at 1.3559 and 50% retracement of 1.5570 to 1.1635 at 1.3603. We’ll look at the reaction from this 1.3559/3603 cluster level, and the structure of the rise from 1.1635, later to determine whether it’s corrective of impulsive.

Boston Fed Rosengren mapped out more hawkish path

Boston Fed President Eric Rosengren mapped out a more hawkish policy path for Fed this year. He noted that Fed should hike three more times this year. In parallel, Fed should also start shrinking the balance sheet. That is, he doesn’t advocate a "brief pause". Rosengren said that "along with a gradual reduction in the level of the balance sheet, it would still be reasonable to have three rate increases over the remainder of this year." And "I do not regard the weakness in first quarter data as a harbinger of softness in the underlying economy, and the strength of the labor market report on Friday provides some strong confirmation of that view."

On the data front…

UK RICS house price balance was unchanged at 22 in April. Swiss will release CPI in European session. UK will also release industrial and manufacturing production and trade balance. Canada will release new housing price index later in the day. US will release PPI and jobless claims.

USD/JPY Daily Outlook

Daily Pivots: (S1) 113.81; (P) 114.09; (R1) 114.56; More…

While upside momentum in USD/JPY remains unconvincing, there is no sign of topping yet. Intraday bias stays on the upside as current rise would target 115.49 resistance next. Outlook remains unchanged that correction from 118.65 has completed with three waves down to 108.12. Break of 115.49 will resume larger rally from 98.97 to 125.85 high. On the downside, below 113.62 minor support will turn bias neutral and bring consolidations before staging another rally.

In the bigger picture, price actions from 125.85 high are seen as a corrective pattern. It’s uncertain whether it’s completed yet. But in case of another fall, downside should be contained by 61.8% retracement of 75.56 to 125.85 at 94.77 to bring rebound. Meanwhile, break of 115.49 resistance will extend the rise from 98.97 to retest 125.85. Overall, rise from 75.56 is still expected to resume later after the correction from 125.85 completes.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% | 1.75% | |

| 23:01 | GBP | RICS House Price Balance Apr | 22% | 20% | 22% | |

| 05:00 | JPY | Eco Watchers Survey Current Apr | 47.8 | 47.4 | ||

| 06:00 | EUR | German Wholesale Price Index M/M Apr | 0.00% | |||

| 07:15 | CHF | CPI M/M Apr | 0.20% | 0.20% | ||

| 07:15 | CHF | CPI Y/Y Apr | 0.50% | 0.60% | ||

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 08:30 | GBP | Industrial Production M/M Mar | -0.40% | -0.70% | ||

| 08:30 | GBP | Industrial Production Y/Y Mar | 1.90% | 2.80% | ||

| 08:30 | GBP | Manufacturing Production M/M Mar | -0.20% | -0.10% | ||

| 08:30 | GBP | Manufacturing Production Y/Y Mar | 3.00% | 3.30% | ||

| 08:30 | GBP | Construction Output M/M Mar | 0.30% | -1.70% | ||

| 08:30 | GBP | Visible Trade Balance (GBP) Mar | -11.6B | -12.5B | ||

| 09:00 | EUR | European Commission Economic Forecasts | ||||

| 11:00 | GBP | BoE Rate Decision | 0.25% | 0.25% | ||

| 11:00 | GBP | BoE Asset Purchase Target May | 435B | 435B | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 1–0–8 | 1–0–8 | ||

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 11:00 | GBP | BoE Inflation Report | ||||

| 12:00 | GBP | NIESR GDP Estimate Apr | 0.40% | 0.50% | ||

| 12:30 | CAD | New Housing Price Index M/M Mar | 0.30% | 0.40% | ||

| 12:30 | USD | PPI M/M Apr | 0.20% | -0.10% | ||

| 12:30 | USD | PPI Y/Y Apr | 2.20% | 2.30% | ||

| 12:30 | USD | PPI Core M/M Apr | 0.20% | 0.00% | ||

| 12:30 | USD | PPI Core Y/Y Apr | 1.70% | 1.60% | ||

| 12:30 | USD | Initial Jobless Claims (MAY 06) | 245K | 238K | ||

| 14:30 | USD | Natural Gas Storage | 67B |