Sterling trades broadly higher today as boosted by stronger than expected wage growth data. While the gains are impressive, upside is limited against Dollar, Euro and Yen so far. UK Prime Minister Theresa May’s fortunate in the EU summit tomorrow is a factor capping the Pound. Also, there will be inflation and retail sales data upcoming on Wednesday and Thursday. It’s natural for Sterling bulls to say cautious.

New Zealand Dollar is trading taking turn to be the strongest with the Pound, as lifted by CPI. Meanwhile, as stock markets stabilized and turned mixed, Yen and Swiss Franc are the weakest ones, followed by Dollar.

Technically, the forex markets is rather mixed elsewhere. Dollar continues to engage in consolidative trading against everyone, possibly just except Sterling. EUR/USD is bounded in tight range of 1.1534 and 1.1610. A break out from this range could be the guide for other pairs.

In other markets, DAX is up 0.71% at the time of writing, CAC up 0.78%. FTSE is nearly flat and up 0.04%. German 10 year bund yield is down -0.0112 at 0.494. Italian 10 year yield is down -0.068 at 3.486. Earlier today, Nikkei closed up 1.25%, Hong Kong HSI rose 0.07%. But Singapore Strait Times lost -0.38%. China Shanghai SSE dropped -0.85% to close at 2546.33. SSE has indeed breached last week’s low at 2536.66 to 2536.44.

Sterling jumps after stronger than expected wage growth, upside limited

UK unemployment rate was unchanged at 4.0% in August, matched expectations. Wage growth, on the other hand, is an upside surprise. Average weekly earnings including bonus rose 3.7% 3moy in August, above expectation of 2.4% 3moy. Average weekly earnings excluding bonus rose 3.1% 3moy, above expectation of 2.8% 3moy. In September, claimant counts rose 18.5k, above expectation of 4.5k.

UK PM May to hold cabinet meeting on Brexit today, meet EU leaders tomorrow

UK Prime Minister Theresa May is going to meet her cabinet today to unify a stance on Brexit negotiation, in particular the Irish backstop. Ahead of the cabinet meeting, Housing Minister James Brokenshire urged other fellow ministers to support May in “making further progress this week”. And he emphasized that “whilst making sure that it is our entire United Kingdom that leaves the European Union, the single market and the customs union because it is our UK that is just so important.”

Speaking to the parliament yesterday, May urged EU for not letting the stand-off over backstop to derail Brexit negotiation. However, an unnamed official was quoted by Reuters complaining that May’s messages “demonstrate that finding an agreement will be even more difficult than one could have expected.”

French minister for European Affairs Nathalie Loiseau said that “we want a good deal and we think it is possible.” But she also said that France was preparing for a no-deal Brexit and have already made legislative proposals on the scenario. An unnamed official was quoted by Reuters saying that the government “need to prepare faster” for no-deal. And ” it is in the interests of citizens and businesses to wrap up the exit agreement as swiftly as possible.”

May is expected to tell EU leaders her views at the summit dinner tomorrow in Brussels. EU Chief negotiator Michel Barnier said today that withdrawal agreement with Britain had to be “orderly for everyone and all the subjects, including Ireland.” And he pledged to “take this time, calmly and seriously, to reach this overall accord in the next weeks.” Though, “we need more time to find this deal … and to reach this decisive progress.”

German ZEW declined significantly on trade war and Brexit

German ZEW economic sentiment dropped to -23.7 in October, down from -10.6 and missed expectation of -12.3. That’s also the lowest level since 2012. Current situation index also dropped to 70.1, down from 76 and missed expectation of 72. Eurozone ZEW economic sentiment dropped to -19.4, down form -7.2 and missed expectation of -9.2. Current situation index rose 0.3 to 32.0.

ZEW President Achim Wambach said in the release: “Expectations for the German economy are dampening above all due to the intensifying trade dispute between the USA and China. The resulting negative expectations on German exports are now beginning to show in the actual development of exports. A further negative influence on economic and export expectations is the danger of a ‘hard Brexit’, which is becoming ever more likely. Last but not least, the situation of the governing coalition in Berlin is perceived to have become more unstable, which also weighs on economic sentiment.”

Also released from Eurozone, trade surplus widened to EUR 16.6B in August versus expectation of EUR 15.0B.

New Zealand Dollar surges after CPI beat expectations

New Zealand CPI rose 0.9% qoq in Q3, and beat expectation of 0.7% qoq. Annual rate accelerated to 1.9% yoy, up from 1.5% yoy in Q2, and beat expectation of 1.7% yoy. StatsNZ noted that the 1.9% annual increase in CPI was mainly due to the housing and household utilities group (3.1% yoy). The group was influenced by higher prices for construction, rents, local authority rates, electricity, and property maintenance services. though for the quarter, increases in fuel prices edged out housing. Transport prices rose 2.4% qoq, driven by petrol prices which is up 5.5% qoq.

Trimmed-mean CPI, which exclude extreme price movements – ranged from 1.8 to 1.9 percent for the year, which is roughly equivalent to the 1.9 percent overall rise in the CPI. CPI ex-petrol rose 1.2% yoy, CPI ex-food rose 2.3% yoy, CPI ex-household energy and vehicle fuels rose 0.9% yoy.

RBA minutes: USD appreciation raised risks for emerging economies, but helpful to Australia

In the minutes of October 2 meeting, RBA noted that global economic conditions had continued to be positive for Australia, despite risks including trade policies. Also, elevated energy and bulk commodity prices supported its terms of trade. Broad based appreciation of the US dollar “had raised risks for some economies, particularly the more fragile emerging market economies”. But the “resultant modest depreciation of the Australian dollar was likely to have been helpful for domestic economic growth.

Domestically, RBA maintained that GDP growth would be “above potential over the following two years”. Forward-looking indicators of labour demand continued to point to above-average growth”. And wage growth is expected increase “gradually”. However, subdued household income growth remained an “important source of uncertainty for the outlook for consumption and inflation.”

Overall, RBA also maintained that ” the next move in the cash rate was more likely to be an increase than a decrease.” However, “since progress on unemployment and inflation was likely to be gradual, they also agreed there was no strong case for a near-term adjustment in monetary policy.”

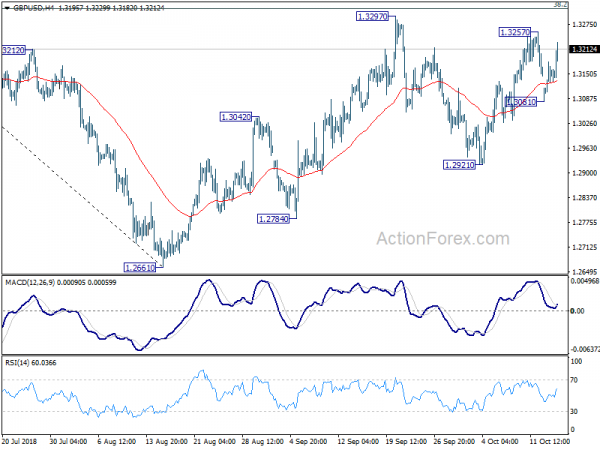

GBP/USD Mid-Day Outlook

Daily Pivots: (S1) 1.3097; (P) 1.3140; (R1) 1.3193; More…

GBP/USD rebounds further to as high as 1.3229 so far. The development argues that further rise is in progress for 1.3257 and above. But for now, we’d continue to expect strong resistance from 1.3316 key fibonacci level to bring down trend resumption eventually. On the downside, below 1.3081 minor support will turn bias to the downside for 1.2921 support first. However, sustained break of 1.3316 would pave the way to next fibonacci level at 1.3721.

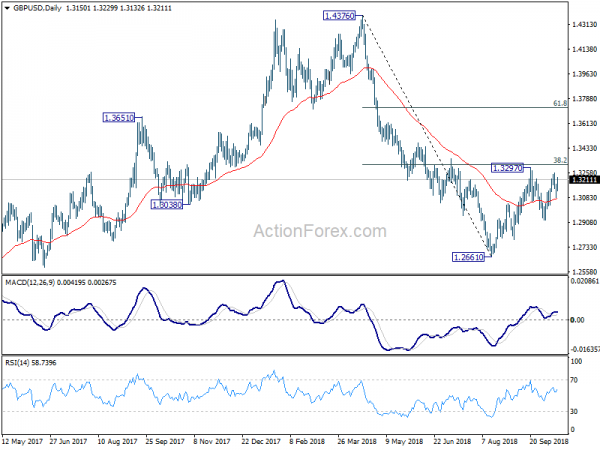

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:45 | NZD | CPI Q/Q Q3 | 0.90% | 0.70% | 0.40% | |

| 21:45 | NZD | CPI Y/Y Q3 | 1.90% | 1.70% | 1.50% | |

| 00:30 | AUD | RBA Minutes | ||||

| 01:30 | CNY | CPI Y/Y Sep | 2.50% | 2.50% | 2.30% | |

| 01:30 | CNY | PPI Y/Y Sep | 3.60% | 3.60% | 4.10% | |

| 08:30 | GBP | Jobless Claims Change Sep | 18.5K | 4.5K | 8.7K | |

| 08:30 | GBP | Claimant Count Rate Sep | 2.60% | 2.60% | ||

| 08:30 | GBP | ILO Unemployment Rate 3Mths Aug | 4.00% | 4.00% | 4.00% | |

| 08:30 | GBP | Average Weekly Earnings 3M/Y Aug | 2.70% | 2.40% | 2.60% | |

| 08:30 | GBP | Weekly Earnings ex Bonus 3M/Y Aug | 3.10% | 2.80% | 2.90% | |

| 09:00 | EUR | Eurozone Trade Balance (EUR) Aug | 16.6B | 15.0B | 12.8B | |

| 09:00 | EUR | German ZEW Economic Sentiment Oct | -24.7 | -12.3 | -10.6 | |

| 09:00 | EUR | German ZEW Current Situation Oct | 70.1 | 72 | 76 | |

| 09:00 | EUR | Eurozone ZEW Economic Sentiment Oct | -19.4 | -9.2 | -7.2 | |

| 12:30 | CAD | International Securities Transactions (CAD) Aug | 2.82B | 10.05B | 12.65B | |

| 13:15 | USD | Industrial Production M/M Sep | -0.10% | 0.40% | ||

| 13:15 | USD | Capacity Utilization Sep | 78.00% | 78.10% | ||

| 14:00 | USD | NAHB Housing Market Index Oct | 68 | 67 |