Dollar retreats mildly today but remains the strongest major currency for the week. The greenback is firmly supported by expectation of a June Fed hike. And comments from Fed officials indicate that they are looking through the weakness in Q1 and maintain their preference on the policy path for the year. A total of three rate hikes is the base case and Fed will start shrinking the balance sheet by the end of the year. This expectation is also reflected in treasury yields. 10 year yield rose 0.031 to close at 2.407 overnight, above 2.391 near term resistance. The development now opens up the case for a retest of March high at around 2.62. Meanwhile, Swiss Franc and Japanese Yen remain the weakest ones as political risks in Europe eased.

Kansas City Fed George and Dallas Fed Kaplan support more accommodation removal

Kansas City Fed President Esther George said yesterday the US economy is on track to grow at "a slightly above-trend rate". And, weakness in Q1 didn’t change her view on that. She noted that "all told, while the recent GDP report and auto sales may be flashing yellow, numerous other indicators remain solid green." Hence, "continuing the gradual removal of monetary accommodation is the appropriate course for the Fed." Also, FOMC "must begin to adjust the size and composition of its securities holdings" later in the year. And, "once it begins, however, the runoff in the portfolio should be on autopilot and not reconsidered at each subsequent Fed meeting."

Dallas Fed President Robert Kaplan said that "the base case for removal of accommodation is three times this year". He also noted that he is "very cognizant of the fact that inflation pressures have been more muted." But he sees risks as "pretty balanced" and "it could easily be the case that the economy will unfold in a stronger way than I expect and we could do more."

NIESR: No BoE move before completing Brexit deal

In UK, the National Institute of Economic and Social Research said that BoE won’t chance its monetary policies before conclusion of Brexit negotiation with EU. NIESR head of macroeconomic modeling and forecasting Simon Kirbay said that "we assume that interest rates remain unchanged until we exit the European Union." And, "if the chance of a transitional deal does begin to materialize, it might well be that the Bank of England brings forward the point at which it raises interest rates, but at the moment, that doesn’t appear to be on the cards." In a report published today, NIESR left 2017 and 2018 UK growth forecast unchanged, at 1.7% and 1.9% respectively. Inflation is projected to peak at 3.4% at the end of 2017. BoE will have its Super Thursday tomorrow and is widely expected to keep monetary policies unchanged.

BoJ might release calculations on impact of stimulus exit

BoJ Governor Haruhiko Kuroda said today that BoJ might release the details of the study of stimulus withdrawal and the impact on its balance sheet. And he emphasized that "it is very important to explain in easy-to-understand terms how monetary policy could affect the BOJ’s financial health". Regarding monetary policies, Kuroda said that he’s "not thinking about changing the policy mix right now". And "the amount of our bond purchases may vary depending on financial market conditions at the time. But this has no implications for monetary policy going forward." Regarding the economy, Kuroda said that "while global economic growth is gaining momentum, various uncertainties remain".

China CPI accelerated

China’s headline CPI accelerated to 1.2% yoy in April, up from 0.9% a month ago, as mainly driven by the recovery of food disinflation. Food price contracted -3.5% yoy, following a -4.4% drop in March. Non-food inflation rose to 2.4% yoy in April from 2.3% a month ago. Core inflation (excluding food and energy) improved to 2.1% yoy from 2% in March. Such level should be in line with the government’s target. PPI moderated to 6.4% in April from 7.6% in March. The deceleration came in more than expectations. A key contributor to the slowdown was commodity prices which slowed further in April as low base effects dissipated. Global prices also pulled back after the strong rally earlier in the year.

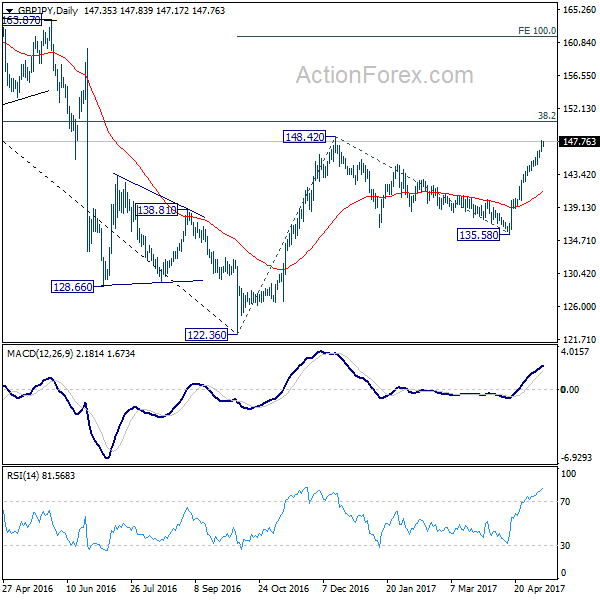

GBP/JPY Daily Outlook

Daily Pivots: (S1) 146.62; (P) 147.25; (R1) 148.06; More….

GBP/JPY’s rally extends to as high as 147.86 so far and intraday bias remains on the upside for 148.20 resistance. As noted before, whole rally should 122.36 is resuming. Break of 148.20 will target 150.42 long term fibonacci level first. Break there will pave the way to 100% projection of 122.36 to 148.42 from 135.58 at 161.64. On the downside, below 145.64 minor support will turn bias neutral and bring consolidation before staging another rise.

In the bigger picture, based on current momentum, rise from 122.36 bottom should be developing into a medium term move. Break of 38.2% retracement of 195.86 to 122.36 at 150.42 should pave the way to 61.8% retracement at 167.78. This will now be the favored case as long as 135.58 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Summary of Opinions at April 26-27 Meeting | ||||

| 1:30 | CNY | CPI Y/Y Apr | 1.20% | 1.10% | 0.90% | |

| 1:30 | CNY | PPI Y/Y Apr | 6.40% | 6.70% | 7.60% | |

| 5:00 | JPY | Leading Index Mar P | 105.5 | 104.8 | ||

| 12:30 | USD | Import Price Index M/M Apr | 0.20% | -0.20% | ||

| 14:30 | USD | Crude Oil Inventories | -0.9M | |||

| 18:00 | USD | Monthly Budget Statement Apr | -176.2B | |||

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% |