Dollar’s pull back extends in Asian session today after yesterday’s rally attempts failed. Retreat in treasury yields is a factor weighing down the greenback. The late rebound in Italian bond was another factor. Though, Yen is even weaker as risk sentiments stabilized. On the other hand, Australian Dollar and New Zealand Dollar are the stronger ones today. For the week up to this point, Euro is the weakest one, followed by Dollar, Australian Dollar is the strongest, followed by New Zealand Dollar.

US indices closed lower overnight but losses were limited. DOW dropped -0.21%, S&P 500 declined -0.14% and NASDAQ indeed gained 0.03%. Also, al three indices were kept above Monday’s lows. Retreat in US yields was a factor supporting stocks. Five year yield closed down -0.016 to 3.057, 10-year yield down -0.025 at 3.208, 30 year yield down -0.035 at 3.368. In Asia, Nikkei is down -0.08% at the time of writing. Singapore Strait Times down -0.76%. Hong Kong HSI is up 0.43% and China Shanghai SSE is down -0.18%.

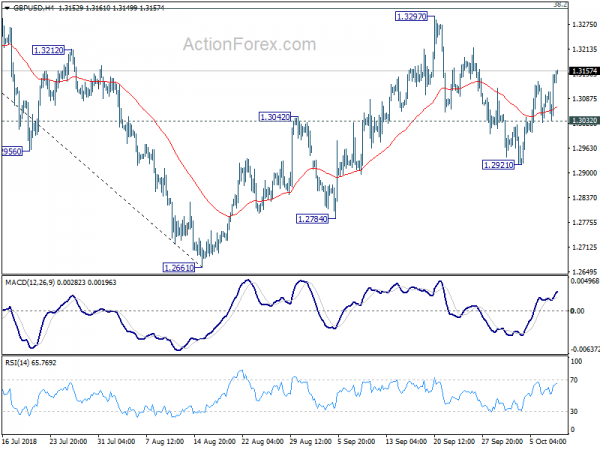

Technically, the consolidation for more Dollar consolidations seems to be set. EUR/USD has clearly lost momentum despite yesterday’s dip to 1.1431. GBP/USD is extending the rebound from 1.2921. USD/CHF is likely heading lower after rejection by 0.9954. And AUD/USD’s rebound from 0.7040 is extending. It’s again, a focus on whether USD/JPY would take out 112.94. fibonacci level firmly or rebound from there.

Trump reiterated his criticism on Fed hikes

Trump criticized Fed’s rate hikes again in a CNBC interview from the south lawn of the White House. He said “I think we don’t have to go as fast”. And, he was “worried about the fact that they seem to like raising interest rates, we can do other things with the money.”

On the economy, Trump said “the numbers we’re producing are record-setting,” apparently referring the lowest unemployment rate in around 40 years. And, he added “I don’t want to slow it down, even a little bit, especially when you don’t have the problem of inflation”. And, on inflation he said “you don’t see that inflation coming back. Now, at some point it will and you go up”.

Though, he also repeated that he had no discussed the concerns personally with Fed Chair Jerome Powell and he likes to “stay uninvolved”.

Fed Williams: Fed is nearing end of monetary policy normalization

New York Fed President John Williams said in speech that recent FOMC statement well summarized the current US economy, with the word “strong” appeared five times. And Fed “has attained its dual mandate objectives of maximum employment and price stability about as well as it ever has.” He added that “most indicators point to a very strong labor market” while “inflation is right on target:”

He expected fiscal stimulus and favorable financial conditions to provide “tailwinds” to the economy for more strong growth. He expected real GDP to grow by 3.0% in 2018 and 2.5% in 2019. Unemployment rate is expected to edge down to slightly below 3.% next year. Price inflation is expected to move up a bit above 2%. But he added that “I don’t see any signs of greater inflationary pressures on the horizon.”

Regarding removal of “accommodative” language in latest FOMC statement, Williams said “these more concise statements do not signify a shift in our monetary policy approach.” And, they just “represent the natural evolution of the language describing the factors influencing our policy decisions “. And the changes in communications are signs that Fed is “nearing the end of the process of normalizing monetary policy”.

Fed Kaplan: Inflation to stay around target next year and fiscal stimulus fades

Dallas Fed President Robert Kaplan said Fed is reaching its dual mandate of price stability and full employment. He saw strong GDP growth this year. Nonetheless, he also pointed to recent surged in 10-year Treasury yield and said it’s “telling me that prospects for future U.S. growth are somewhat sluggish (and) that outward growth is looking a little more uncertain.”

Besides also expected inflation to just stay around Fed’s target as the impact of fiscal stimulus fades in 2019. He added “to the extent that (inflation) gets above our target, our base case is that that move will be more gradual than something more sudden or substantial.”

UK Raab hinted at no Brexit deal in October, targeting November

UK Brexit Minister Dominic Raab told the parliament yesterday that the European Council meeting next week will be an ” important milestone” for Brexit negotiation. And he expected it to be “a moment where we will make some progress”. He added that ” negotiations were always bound to be tough in the final stretch”. But he remained “confident we will reach a deal this autumn.” His refrained comments suggested that he is targeting to complete the deal in November rather than October, as not enough progress was made. Raab also reiterated the Chequers proposal will deliver “frictionless trade with the EU that we have now”. But he urged the EU to “meet us half way”.

Separately, ITV reported that Prime Minister Theresa May’s chief negotiation Olly Robbins has made “meaningful progress” with EU Brexit negotiator Michel Barnier on Irish border issue. But no detail on the so called progress was revealed, nor the source. The Times reported that May is planning to have an extended discussion on Brexit at next Tuesday’s cabinet meeting to warp things up before the EU summit.

Italian bond could have passed selling climax temporarily

Italian 10 year yield breached 3.7 handle yesterday but reversed from there to close at 3.511. The development gave Euro a roller-coaster ride against Dollar. But against others, Euro stays weak. Italian Prime Minister Giuseppe Conte said he’s not pleased with German-Italian yield spread has widened to 315. But he expressed his confidence that when investors have thoroughly read the budget, markets will calm down. It’s unsure if markets have listened to him. After all, Italian bonds could have passed the selling climax for now, but it’s certainly not out of the woods yet as rating agencies’ actions are lining up towards the end of the month.

On the data front

Australia Westpac consumer confidence rose 1.0% in October. Japan machine orders rose strongly by 6.8% mom in August versus expectation of -3.6% mom fall.

UK data will be major focus in European session. Monthly GDP, trade balance, industrial and manufacturing production will be released.

Later in the day, Canada will release building permits. US will release PPI inflation.

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.3068; (P) 1.3110; (R1) 1.3186; More…

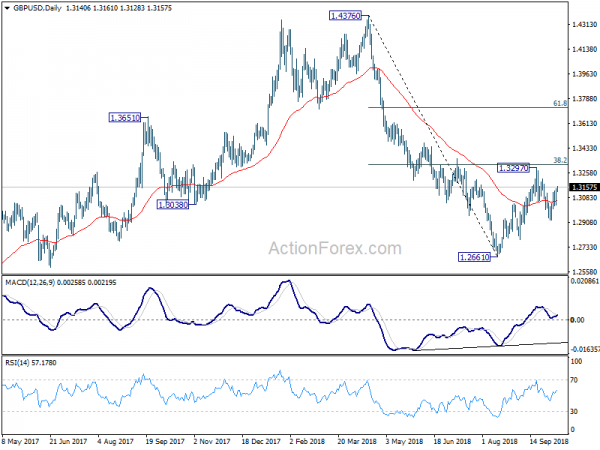

GBP/USD’s rebound from 1.2921 resumed by taking our 1.3131 and hit as high as 1.3161 so far. Intraday bias is back on the upside for retesting 1.3297 high. But still, we’d expect strong resistance from 1.3316 key fibonacci level to limit upside to bring down trend resumption eventually. On the downside, below 1.3032 minor support will turn bias back to the downside for 1.2921 first.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4062). The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Oct | 1.00% | -3.00% | ||

| 23:50 | JPY | Machine Orders M/M Aug | 6.80% | -3.60% | 11.00% | |

| 06:00 | JPY | Machine Tool Orders Y/Y (Sep P) | 5.10% | |||

| 08:30 | GBP | Visible Trade Balance (GBP) Aug | -10.9B | -10.0B | ||

| 08:30 | GBP | Industrial Production M/M Aug | 0.10% | 0.10% | ||

| 08:30 | GBP | Industrial Production Y/Y Aug | 1.10% | 0.90% | ||

| 08:30 | GBP | Manufacturing Production M/M Aug | 0.20% | -0.20% | ||

| 08:30 | GBP | Manufacturing Production Y/Y Aug | 1.50% | 1.10% | ||

| 08:30 | GBP | Construction Output SA M/M Aug | -0.40% | 0.50% | ||

| 08:30 | GBP | GDP M/M Aug | 0.10% | 0.30% | ||

| 08:30 | GBP | Index of Services 3M/3M Aug | 0.60% | 0.60% | ||

| 12:30 | CAD | Building Permits M/M Aug | 1.30% | -0.10% | ||

| 12:30 | USD | PPI M/M Sep | 0.20% | -0.10% | ||

| 12:30 | USD | PPI Y/Y Sep | 2.80% | 2.80% | ||

| 12:30 | USD | PPI Core M/M Sep | 0.20% | -0.10% | ||

| 12:30 | USD | PPI Core Y/Y Sep | 2.40% | 2.30% | ||

| 14:00 | USD | Wholesale Inventories M/M Aug F | 0.80% | 0.80% |