Dollar firm up mildly together with Yen as markets await non-farm payroll report today. The greenback suffered brief setback overnight as traders turned a bit cautious ahead of job report. But Dollar quickly find footing from surging treasury yields. Canadian Dollar also firm up slightly today. BoC is widely expected to hike again this month. Today’s job data shouldn’t deter the path but might add to speculations of more down the road, it it’s strong. Australian and New Zealand remain the weakest ones, on monetary policy divergence and risk aversion in Asia.

US treasury yields extended the strong march overnight. 10-year yield closed up 0.036 at 3.197. 30-year yield closed up 0.036 at 3.355. Stocks were apparently troubled by that as DOWN lost -0.75% to 26627.48. S&P 500 dropped -0.82% while NASDAQ declined even worse by -1.81%. In Asia, Nikkei is down -0.52% at the time of writing, Hong Kong HSI is down -0.42%, Singapore Strait Times is down -0.94%. China is still on holiday and it’s definitely an interesting thing to see next week, on how bad their market performs. Japan JGB 10 year yield drops slightly by -0.0065 to 0.153. Let’s see how far it can go beyond BoJ’s allowed band of -0.1 to 0.1%.

Technically, while Dollar treated against Euro and Sterling overnight, it’s kept well above minor near term support level. These are, 1.1623 in EUR/USD and 1.3115 in GBP/USD. Both are technically still bearish for the near term. The tricky part is indeed USD/JPY, which lost much momentum ahead of 114.73 key resistance. A break of 113.51 will likely bring more consolidation. AUD/USD took out 0.7084 to resume medium term down trend yesterday. EUR/AUD also took out 1.16252 minor resistance, which suggests that medium term up trend is resuming. Break of 1.6353 high will confirm.

Another solid non-farm payrolls report awaited

Markets are expecting NFP report to show 188k job growth in September. Unemployment rate is expected to drop 0.1% to 3.8%. Wage growth will again be a major focus. Average hourly earnings are expected to rise 0.3% mom.

Related pre-NFP job data were generally solid. ADP report showed 230k growth in private sector jobs, well above exceptiones. ISM manufacturing employment rose 0.3 to 58.8. ISM non-manufacturing was jumped notably by 5.7 to 62.4, which is very impressive. Initial jobless claims and continuing claims hit multi decade record lows.

So overall, we’d expect NFP to give a set of decent to strong data. The main question is how fast wage growth has been. Meanwhile, the reaction in forex markets is not that straight forward. We’ll have to see how treasury yield and stocks respond to the data at the same time.

Here are some other NFP previews:

- NFP Preview: Stocks Succumb To Surging Bond Yields

- US Jobs Data Unlikely A Game Changer, Still Likely To Generate Short-Term Volatility

- Special Report: Insights About US- NFP Data

ECB Coeure: Eurozone economy in best shape for many years

ECB Governing Council Benoit Coeure said in a speech yesterday that “the euro area economy has now enjoyed five years of uninterrupted growth”. And, GDP is “well above the levels we observed before the great financial crisis.”

He also pointed out that labor market has “improved notably” in recent years. Employment has risen by 9.2m since mid-2013. Unemployment rate dropped to 8.1% in August and hit the lowest level in 10years. Participation rate also rose 1.5 to 64% from a decade ago.

On inflation, Coeure added that “with stronger growth and rising employment, we also see a gradual build-up in price pressures”. Employee compensation have “finally started to recover” Also, he noted that as they are growing faster than the rate of inflation, many people are seeing their real incomes rising.

Overall, he said, it is fair to say that the euro area economy is in the best shape it has been in for many years.

Australia retail sales grew 0.3% in August, South Australia led the way up

Australia retail sales grew 0.3% in August in seasonally adjusted term, matched expectations. There were rises in five of the six industries, except that food retailing was relatively unchanged at 0.0%.

Sales in South Australia led the way by rising 0.8%, followed by Tasmanian by 0.5%, New South Wales by 0.5%, Victoria and Australian Capital Territory both by 0.2%, Queensland by 0.1%. Sales i Western Australia was unchanged at 0.0% whilst there was a fall in the Northern Territory by -1.3%.

Also release in Asian session, Japan overall household spending rose 2.8% yoy in August, versus expectation of 0.2% yoy. Labor cash earnings rose 0.9% yoy versus expectation of 1.3% yoy.

Looking ahead

Germany will release factory orders and PPI in European session. Swiss will release foreign currency reserves and CPI. US non-farm payroll will be the main focus and trade balance will also be featured. Canada job data will be another focus and trade balance will be released too.

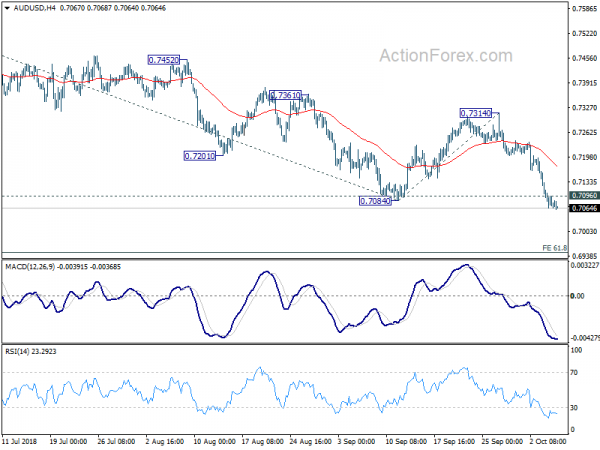

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7058; (P) 0.7085; (R1) 0.7105; More…

AUD/USD’s decline is still in progress and edges lower to 0.7061 so far. Intraday bias stays on the downside. Current down trend from 0.8135 is in progress for 61.8% projection of 0.7676 to 0.7084 from 0.7314 at 0.6948 next. On the upside, break of 0.7096 minor resistance will turn intraday bias neutral and bring consolidations first, before staging another fall.

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). Current downside momentum as seen in weekly MACD support this bearish case. Firm break of 0.6826 will target 0.6008 key support next (2008 low). On the upside, break of 0.7361 resistance, however, argues that a medium term bottom is possibly in place, and stronger rebound could follow. We’ll assess the medium term outlook later if this happens.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | Overall Household Spending Y/Y Aug | 2.80% | 0.20% | 0.10% | |

| 0:00 | JPY | Labor Cash Earnings Y/Y Aug | 0.90% | 1.30% | 1.50% | 1.60% |

| 1:30 | AUD | Retail Sales M/M Aug | 0.30% | 0.30% | 0.00% | |

| 5:00 | JPY | Leading Index CI Aug P | 104.30% | 103.90% | ||

| 6:00 | EUR | German Factory Orders M/M Aug | 0.70% | -0.90% | ||

| 6:00 | EUR | German PPI M/M Aug | 0.20% | 0.20% | ||

| 6:00 | EUR | German PPI Y/Y Aug | 2.90% | 3.00% | ||

| 7:00 | CHF | Foreign Currency Reserves Sep | 731B | |||

| 7:15 | CHF | CPI M/M Sep | 0.00% | 0.00% | ||

| 7:15 | CHF | CPI Y/Y Sep | 1.20% | 1.20% | ||

| 12:30 | CAD | Net Change in Employment Sep | 32.5K | -51.6k | ||

| 12:30 | CAD | Unemployment Rate Sep | 5.90% | 6.00% | ||

| 12:30 | CAD | International Merchandise Trade (CAD) Aug | -1.4B | -0.1B | ||

| 12:30 | USD | Trade Balance Aug | -52.3B | -50.1B | ||

| 12:30 | USD | Change in Non-farm Payrolls Sep | 188K | 201K | ||

| 12:30 | USD | Unemployment Rate Sep | 3.80% | 3.90% | ||

| 12:30 | USD | Average Hourly Earnings M/M Sep | 0.30% | 0.40% |