Dollar surged sharply overnight as boosted by hawkish Fedspeaks, strong rally in treasury yields as well as, solid services data. The greenback is paring some gains in Asian session, to Yen and Swiss Franc on risk aversion. But overall, Dollar remains firm, awaiting tomorrow’s non-farm payroll report for more upside acceleration. Australian Dollar and New Zealand Dollar are the weakest ones, pressured by monetary policy divergence as well as falling Asian stocks.

DOW hit record high at 26951.81 overnight but pared back much gain to close at 26828.39, up only 0.20%. S&P 500 closed up 0.07% and NASDAQ gained 0.32%. The biggest movers were in bond markets. 10-year yield closed up 0.105 at 3.161, broken 3.115 key resistance with much conviction. Risk sentiments turned sour in Asia though. Nikkei is currently down -0.60%, Hong Kong HSI is down -1.68%. Singapore Strait Times is down -0.98%. China is still on holiday.

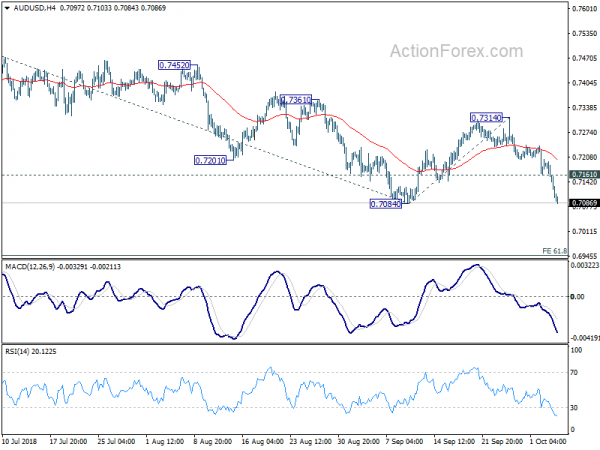

Technically, the immediately focus now is on 0.7084 in AUD/USD. Firm break there will resume the medium term down trend from 0.8135, January high. Another focus is 114.73 key medium term structural resistance in USD/JPY, which the pair could take on before end of the week.

10 year yield breached multi-decade channel resistance

Rally in treasury yield carries much significance. 10-year yield has now breached multi-decade channel resistance. Of course, for now it’s just a slight breach and confirms nothing considering the time frame. But the US economy is in an excellent shape which suggests more upside lies ahead in treasury yields. And sustained break of the channel would more likely be seen than not.

Powell led a chorus of hawkish Fedspeaks

Fed Chair Jerome Powell repeated his upbeat comments today. He said the US is experiencing “a remarkably positive set of economic circumstances, and we’re working hard to try to sustain the expansion and keep unemployment low and keep inflation right on target”. And, “there’s really no reason to think that this cycle can’t continue for quite some time.” On interest rates, he said they are “still accommodative” and “we’re gradually moving to a place where they’ll be neutral.” He added that “we may go past neutral. But we’re a long way from neutral at this point, probably.”

Other comments from Fed officials were generally hawkish. Chicago Fed President Charles Evans said “getting policy up to a slightly restrictive setting — 3, 3.25 percent — would be consistent with the strong economy and good inflation that we are looking at.”

Philadelphia Fed President Patrick Harker said he preferred Fed’s rate hike schedule to avoid inverting the yield curve and “it’s just a question of timing”. He added there is no need to “rush the normalization process”. For now his forecasts are “”three this year, two next year, two year after.”

Cleveland Fed President Loretta Mester said she supported a gradual pace of hiking. But she also noted that “if we end up having inflation move high up” or if it goes too much above target, “then we need to move policy faster.”

Richmond Fed President Tom Barkin said “growth is solid, unemployment is low, and inflation is at target”. He didn’t touch directly on monetary policy but struck a tone of caution on flattening yield curve which “could suggest markets are losing confidence in the outlook.”

Italy PM Conte hailed budget respected commitments, it’s courageous and serious

Italian Prime Minister Giuseppe Conte confirmed the budget deficits plan after meeting of ministers yesterday. The deficit targets are now 2.4% of GDP in 2019, 2.1% in 2020 and 1.8% in 2021. Conte predicted debt-to-GDP ratio to fall slightly from the current 131% to 130% in 2019, and then drop further to 126.5% by 2021.

Conte hailed the budget as “respected commitments, it is courageous and serious”. And he added “we will show courage above all in 2019, because we believe that our country needs a budget that calls for strong growth”.

Economy Minister Giovanni Tria said there would be additional investments of 0.2% in 2019, 0.3% in 2020, and 0.4% in 2021. And, he added “this describes the quality of the budget: we’re aiming to have public investments as principal instrument to work on growth”.

On the data front

Australia trade surplus widened to AUD 1.60B in August. Later in the day, US will release Challenger job cuts, jobless claims and factory orders. Canada will release Ivey PMI.

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7070; (P) 0.7134; (R1) 0.7166; More…

AUD/USD drops to as low as as 0.7084 so far as fall from 0.7314 extends. Intraday bias remains on the downside. Larger decline from 0.8135 is likely resuming. Break of 0.7084 will target 61.8% projection of 0.7676 to 0.7084 from 0.7314 at 0.6948 next. On the upside, break of 0.7161 minor resistance is needed to indicate short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). Current downside momentum as seen in weekly MACD support this bearish case. Firm break of 0.6826 will target 0.6008 key support next (2008 low). On the upside, break of 0.7361 resistance, however, argues that a medium term bottom is possibly in place, and stronger rebound could follow. We’ll assess the medium term outlook later if this happens.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | Trade Balance Aug | 1.60B | 1.45B | 1.55B | |

| 11:30 | USD | Challenger Job Cuts Y/Y Sep | 13.70% | |||

| 12:30 | USD | Initial Jobless Claims (SEP 29) | 206K | 214K | ||

| 14:00 | CAD | Ivey PMI Sep | 61.4 | 61.9 | ||

| 14:00 | USD | Factory Orders Aug | 0.90% | -0.80% | ||

| 14:30 | USD | Natural Gas Storage | 46B |