Dollar is back in control today and it’s trading as the second strongest one in early US session, next to Sterling. Stronger than expected ADP employment report, which showed 230k growth in September, gives the greenback an extra push. Sterling is rather steady as UK Prime Minister Theresa May’s Conservative Party conference speech is ignored. At least, it isn’t a disaster like last year. Euro’s recovery lose some momentum as the lift from Italian budget rumor fades. Nonetheless, the common currency is still way better than Australian and Zealand Dollar, which are the worst performing one today.

In other markets, DAX is on holiday. CAC is trading up 0.56% while FTSE is up 0.50% at the time of writing. German 10 year bund yield trades up 0.0293 at 0.454. Italian 10 year yield trades down -0.113 at 3.331. German-Italian spread narrows today but remains huge. Earlier today, Nikkei closed down -0.66%< Hong Kong HSI down -0.13%. But Singapore Strait Times gained 0.76%. One development to note is that Japan 10 year JGB yield added another 0.0126 to close at 0.142. It’s now notably outside BoJ’s band of -0.1% to 0.1%. Gold’s rally lose momentum ahead of 1214 resistance and retreated. But for now, it’s holding above 1200 handle.

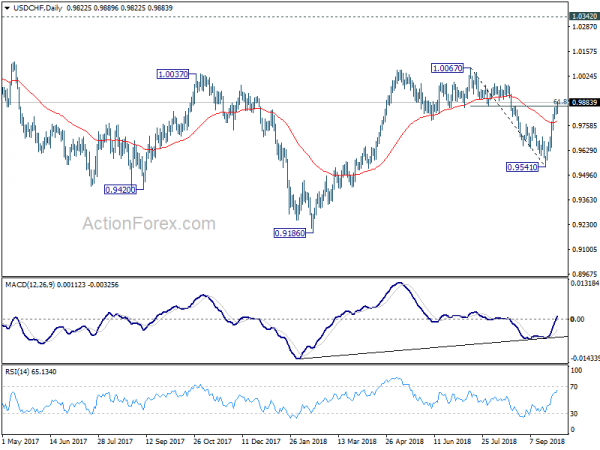

Technically, USD/CHF takes out 0.9866 resistance rather firmly today. Rebound from 0.9541 could now be on course for retesting 1.0067 resistance. AUD/USD is pressing 0.7143 support. Break will be a strong signal of larger down trend resumption through 0.7084 low.

Italy EM Tria: Gradual reduction in deficit after 2019

Italy Economy Minister Giovanni Tria said today that the while the budget deficit will increased compared with previous forecast in 2019, “there will be a gradual reduction in the following years”. His comments echo reports that the populist government has revised their original plan after strong pressure from the EU.

Originally, the plan was to have budget deficit target at 2.4% of GDP in the three years from 2019. But according to unnamed government sources, the plan now is to keep 2.4% in 2019, but lower to 2.2% in 2020 and then 2% in 2021. Prime Minister Giuseppe Conte is due to meet with key ministers today. The details could then be defined after the meeting.

But even in case of this watered down version, Italy still risks downgrade by credit rating agencies. More in Italy Rating Downgrade Inevitable Although Government Might Water Down Stimulus.

Eurozone PMI services finalized at 54.7, points to 0.5% Q3 GDP growth

Eurozone PMI services was finalized at 54.7 in September, unrevised, up from August’s 54.4. PMI composite was finalized at 54.1, down from August’s 54.4. Among the countries, German PMI services hit 2-month low at 55.0. France PMI services dropped to 21-month low at 54.0. Spain PMI services dropped to 58-month low t 52.5. But Italy PMI services improved slightly to 2-month high at 52.4.

Chris Williamson, Chief Business Economist at IHS Markit noted that the survey data are equivalent to 0.5% GDP growth in Q3. However, he warned that Q4 is “unlikely to see such robust growth, as recent months have seen a clear loss of momentum in terms of both output and new order gains.” In particular, “the most worrying signs come from exports”.

Also from Eurozone, retail sales dropped -0.2% mom in August versus expectation of 0.2% mom rise.

UK PMI services dropped to 53.9, clarity on Brexit needed to sustain growth

UK PMI services dropped to 53.9 in September, down from 54.3 and matched expectations. The key points are “growth of business activity eases only slightly since August”, “job creation edges up to seven-month high”, “higher fuel prices lead to sharp rise in input costs”.

Chris Williamson, Chief Business Economist at IHS Markit said the released that the ” service sector continued to report solid steady business growth”. And, along with other survey results, the UK economy could had expanded by just under 0.4% in Q3. Though, “Brexit worries continue to dominate the outlook”, and “clarity on Brexit arrangements is therefore needed as soon as possible to help sustain growth.”

Fed Evans: A slightly restrictive policy could keep extremely well economy going

Chicago Fed President Charles Evans said the US economy is doing “extremely well”, the “fundamentals are strong, the labor market is doing terrific.” He added that “I spent quite a long time indicating that I think inflation needs to get up to 2 percent, and here we are.” Evans also noted “by setting the policy rate just a little above neutral, that will continue to keep things going for quite some time” referring to the “very well” state the economy is in.

Though, he also indicated that “Long-term inflation expectations are now, in my opinion, a little bit too low.” Therefore, “we don’t have to raise the funds rate as restrictively as we may have in the past.”. And, “if the outlook continues to be as good as it is, at a slightly restrictive level and then hold there for quite some time until we begin to see signs that we need to make an adjustment.”

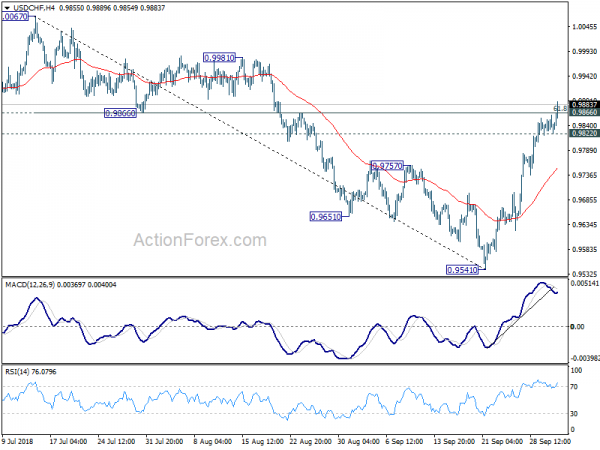

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9821; (P) 0.9842; (R1) 0.9862; More…

USD/CHF’s extends today by taking out 0.9866 cluster resistance and hits as high as 0.9889 so far. Intraday bias is back on the upside. Sustained trading above 0.9866 will pave the way to retest 1.0067 high. On the downside, though, break of 0.9822 minor support will indicate short term topping and bring lengthier consolidations, before staging another rally.

In the bigger picture, focus is now back on 0.9866 support turned resistance. Decisive break there will suggests that pull back from 1.0067 has completed at 0.9541. And larger rise from 0.9186 low is ready to resume. Decisive break of 1.0067 will pave the way to 1.0342 key resistance next. Meanwhile, break of 0.9541 will extend the decline but we don’t expect a break of 0.9186 low even in that case.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Service Index Sep | 52.5 | 52.2 | ||

| 23:01 | GBP | BRC Shop Price Index Y/Y Sep | 0.20% | 0.10% | ||

| 01:30 | AUD | Building Approvals M/M Aug | -9.40% | -2.50% | -5.20% | -4.60% |

| 07:45 | EUR | Italy Services PMI Sep | 53.3 | 52.4 | 52.6 | |

| 07:50 | EUR | France Services PMI Sep F | 54.8 | 54.3 | 54.3 | |

| 07:55 | EUR | Germany Services PMI Sep F | 55.9 | 55.3 | 55.3 | |

| 08:00 | EUR | Eurozone Services PMI Sep F | 54.7 | 54.7 | 54.7 | |

| 08:30 | GBP | Services PMI Sep | 53.9 | 53.9 | 54.3 | |

| 09:00 | EUR | Eurozone Retail Sales M/M Aug | -0.20% | 0.20% | -0.20% | -0.60% |

| 12:15 | USD | ADP Employment Change Sep | 230K | 185K | 163K | |

| 13:45 | USD | US Services PMI Sep F | 53.6 | 52.6 | ||

| 14:00 | USD | ISM Non-Manufacturing/Services Composite Sep | 58.3 | 58.5 | ||

| 14:30 | USD | Crude Oil Inventories | 1.9M |