Euro suffered heavy selling today as Italy and EU stepped up rhetorics on budget clashes. But even heavier selling is seen in Australian, New Zealand Dollar and Sterling. Steep decline in Hong Kong stocks hints that China markets will likely come back from holiday next week facing much troubles. Sterling, on the other hand, is pressured as PM Theresa May faces criticisms on from all sides, including EU and her own Brexiteers over her Chequers Plan. Yen is so far the strongest ones, followed by Swiss Franc and Canadian. Dollar is mixed.

Risk aversion clearly dominates the European markets today. DAX dropped to as low as 12203.6 and is now at 12255, down -0.68%. CAC is trading down -0.75% while FTSE is down -0.37%. Italian 10 year yield hit 4-year high at 3.444 before dipping mildly. It’s currently up 0.058 at 3.364. German 10 year bund yield dropped to as low as 0.41and is now down -0.032 at 0.444. That is. German-Italian yield at 300 level is again closer than ever.

Earlier in Asia, Nikkei closed up 0.1% after paring all earlier gains. Singapore Strait Times dropped -0.39%. Hong Kong HSI tumbled -2.38% to close at 27126.38. USD/CNH hit as high as 6.9047 earlier today and breached 6.8959 resistance. Though, it’s now back at 6.8848. All in all, the markets in Hong Kong and Yuan could hit that China market will respond negatively to the USMCA trade deal.

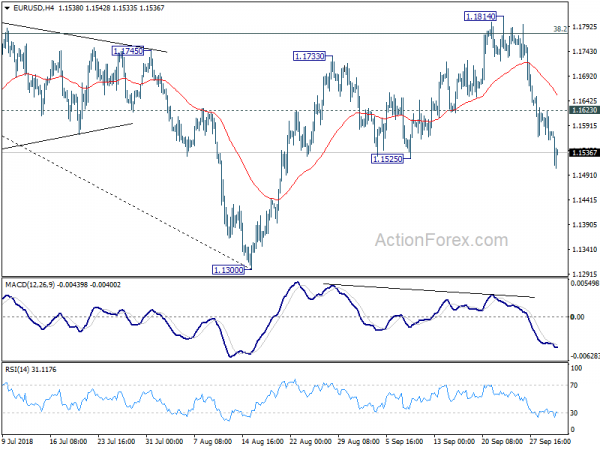

Technically, EUR/USD’s break of 1.1525 should have confirmed our bearish view and the pair is heading back to 1.1300 low. There are two developments to watch that would tell how weak the Euro is. Firstly, we’ll see if EUR/GBP could stage a sustainable rebound ahead of 0.8847 support. That would reaffirm that Sterling is the more pathetic one. Secondly, EUR/CHF is losing much upside momentum ahead of 1.1452 near term resistance. Break of 1.1280 will invalidate the bullish reversal case and turn focus back to 1.1178 low. That is, Euro won’t be too much better than the Pound in this case.

Fresh selling in Euro in budget spats, slowed after PM Conte’s calming messages

Fresh selling in Euro was triggered earlier today after president of the lower house budget committee Claudio Borghi, economics spokesman of the League, told Reuters that ” I am personally convinced that Italy would be better off with its own currency”. Though, he also repeated again and again that “leaving the euro is not in the government’s program and it has no plans to do so.” Borghi’s position is well known and it’s actually nothing new.

5-Star Movement Leader, Deputy PM Luigi Di Maio, insisted that “We are not turning back from that 2.4 percent target, that has to be clear … We will not backtrack by a millimetre”. Another Deputy PM Matteo Salvini, leader of the League also said yesterday that “No-one in Italy is taken in by Juncker’s threats.”

However, the selloff slowed a bit after Prime Minister Giuseppe Conte’s Facebook post. He said “the euro is our currency and it is for us indispensable. ” He emphasized that “any other declaration that makes a different assessment is to be regarded as a free and arbitrary opinion that has nothing to do with the government policy I chair”.

Also, he defended the budget plan and said “the package of measures that we are developing aims to combine fairness and efficiency”. Also, he added large investment plan is set up to “give the country modern and secure infrastructure, making it a permanent laboratory for innovation and development.”

Conte also added “We respect our sovereign prerogatives and we also respect the institutions of the European Union that we have helped to establish and remain our common home.” And, “We are going to talk to the European institutions with serenity and respect for roles, confident that we can prove, hand cards, the goodness of work so far.

EU clearly reject Italy’s 2.4% budget deficit target

On the EU side, European Commission Vice President Valdis Dombrovskis reiterated today that “what we see currently now seems to be not compliant with the Stability and Growth Pact but we are open to dialogue with the Italian authorities and hope that the budget will be brought in line with the requirements of the Stability and Growth Pact.”

European Commission President Jean-Claude Juncker said yesterday that “Italy is distancing itself from the budgetary targets we have jointly agreed at EU level.” He warned “one crisis was sufficient, one crisis was enough” and “after the toughest management of the Greece crisis, we have to do everything to avoid a new Greece — this time an Italy — crisis.” He added “we have to prevent Italy from being able to get a special treatment here that, if everybody were to get it, would mean the end of the euro.”

The chairman of Eurozone finance ministers Mario Centeno said after the group’s meeting that “recent announcements by the Italian government have raised concerns over its budgetary course, concerns that need to be addressed soon.” He added “we are all bound by the euro and we need sound policies to protect it. It is up to the Italian government to show it has a sustainable and credible budgetary plan.”

Sterling pressured as Brexit rebels gather at alternative conference against May’s Chequers plan

Sterling is pressured on report that while UK Prime Minister Theresa May is trying to unite her party at the Conservatives annual conference, Brexit rebels are gathering a few streets away on an “alternative Brexit Advance Coalition Conference”. May’s Chequer’s plan was brutally criticized by the Brexiteers as “failing to deliver the referendum mandate”. And the rebels threatened to vote down the deal even if May could agree to one with the EU. In the meeting, it’s reported that 96% of those attended opposed to the Chequer’s plan.

Perhaps words from Andrea Jenkyns, a former parliamentary private secretary, best described the situation. “Our party members don’t want it, the public doesn’t want it, the opposition aren’t going to vote for it, the EU doesn’t want it, so we must chuck Chequers,” she said.

UK PMI construction: Year-ahead business outlook at second lowest since 2013

UK PMI construction dropped to 52.1 in September, down fro 52.9 and missed expectation of 52.6. The key points are “all three sub-sectors record a loss of momentum”, “solid increases in new work and employment”, but “business optimism at second-lowest level since February 2013”.

Tim Moore, Associate Director at IHS Markit, noted in the release that “latest data showed that overall confidence about the year-ahead business outlook was among the lowest seen since the start of 2013.” “Construction companies continued to note that political uncertainty acted a key drag on decision-making, with Brexit worries encouraging a wait-and-see approach to spending among clients.”

RBA left cash rate unchanged at 1.50%, maintained neutral stance

The accompanying statement is very much a carbon copy of the prior one. A change is in noting the cause of pickup in global inflation on higher oil prices and wage growth. And further pickup is expected on tightening labor markets and the sizeable fiscal stimulus of the US. But RBA also reiterated that risk to global outlook from “direction of international trade policy in the United States.”

Domestically, RBA said latest data confirmed strong growth in the past year. And GDP is expected to average a bit above 3% in 2018 and 2019. Meanwhile, “one continuing source of uncertainty is the outlook for household consumption. Labor market outlook remains “positive” and lift in wage growth will be a “gradual process”. Inflation is expected to decline in September quarter due to once-off factors, but should climb to above 2% in 2019 and 2020.

Overall, the RBA maintained a neutral stance with the statement and hinted again that it’s in no rush to rate hike.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1552; (P) 1.1588; (R1) 1.1616; More…..

EUR/USD reaches as low as 1.1504 so far. Break of 1.1525 support confirms that corrective rise from 1.1300 has completed with three waves up to 1.1814 already. Intraday bias stays on the downside for retesting 1.1300 low first. On the upside, above 1.1623 minor resistance will turn intraday bias neutral and bring recovery. But upside should be limited well below 1.1814 to bring fall resumption.

In the bigger picture, a medium term bottom should be in place at 1.1300, on bullish convergence condition in daily MACD and some consolidations would be seen. But still, note that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Thus, we’d expect fall from 1.2555 high to resume after consolidation completes. Below 1.1300 should send EUR/USD through 61.8% retracement of 1.0339 to 1.2555 at 1.1186. And, in that case, EUR/USD would head to retest 1.0339 (2017 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Monetary Base Y/Y Sep | 5.90% | 5.40% | 6.90% | |

| 4:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 5:00 | JPY | Consumer Confidence Index Sep | 43.4 | 43.4 | 43.3 | |

| 8:30 | GBP | Construction PMI Sep | 52.1 | 52.6 | 52.9 | |

| 9:00 | EUR | Eurozone PPI M/M Aug | 0.30% | 0.00% | 0.40% | 0.70% |

| 9:00 | EUR | Eurozone PPI Y/Y Aug | 4.20% | 3.90% | 4.00% | 4.30% |