Dollar rides on a bunch of strong economic data and surges broadly. CPI rose 0.6% mom, 2.5% yoy in January, above consensus of 0.3% mom, 2.3% yoy. The headline annual consumer inflation rate was the highest since March 2012. Meanwhile, headline retail sales rose 0.4% in January versus expectation of 0.1%. Ex-auto sales rose 0.8% versus expectation of 0.4%. Empire state manufacturing index also jumped to 18.7, up from 6.5 and beat expectation of 7. The dollar index jumps to as high as 101.76 so far. The development affirms the case for the index to retest January high at 103.82. The greenback has now turned into the strongest major currency for the week while Japanese yen remains the weakest.

Dollar boosted by Fed Yellen

Dollar’s rally this week was triggered by hawkish comments from Fed chair Janet Yellen yesterday, at the testimony before the Senate Banking Committee. Yellen will have the second day of testimony before the House today. While reiterating that all meetings are ‘live’ for a rate hike, Yellen warned that waiting too long to remove accommodation would be unwise’. Meanwhile, she cautioned over the uncertainty over the economic policy under Donald Trump’s administration. Yellen emphasized the Fed’s monetary policy stance is not based on ‘speculations’ about fiscal policy. The economy’s ‘solid progress’ is what is ‘driving the policy decisions’. More in Yellen Raised Hopes Of March Rate Hike.

Sterling lower on weak wage growth

UK claimant counts dropped sharply by -42.4k in January, much better than expectation of 1k rise. Claimant count rate dropped to 2.1%. ILO unemployment rate was unchanged at 4.8% in December as expected. However, average weekly earnings slowed to 2.6% 3moy versus expectation of 2.8% 3moy. The weak wage growth agreed to BoE’s cautious stance on monetary policies. There were some speculations that BoE could raise interest rate by the end of the weak. But the CPI miss earlier this week and today’s weak wage growth data should have done much to damp such speculations. Sterling is trading as the weakest major currency today and mixed for the week.

EUR/USD Mid-Day Outlook

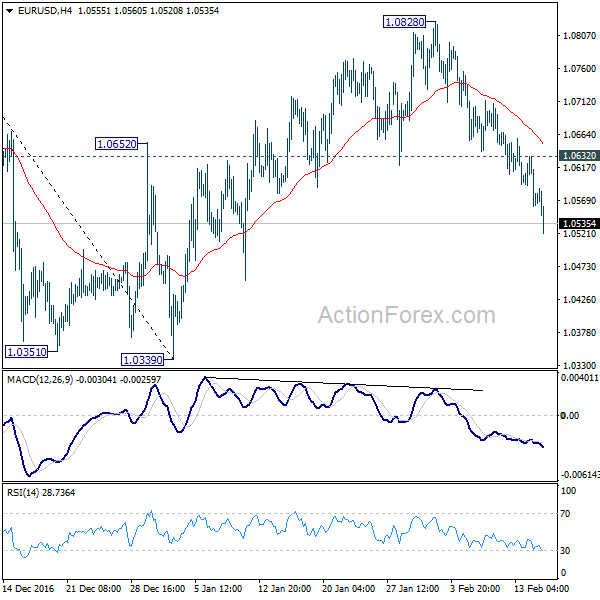

Daily Pivots: (S1) 1.0548; (P) 1.0590 (R1) 1.0621; More…..

EUR/USD dives to as low as 1.0520 so far today and intraday bias remains on the downside. As corrective rise from 1.0339 is finished at 1.0828 already, fall from there is tentatively viewed as resuming larger down trend. Deeper fall should now be seen back to retest 1.0339. Decisive break there will confirm our bearish view and target parity. On the upside, above 1.0632 will turn bias neutral first. But recovery should be limited well below 1.0828 and bring another decline.

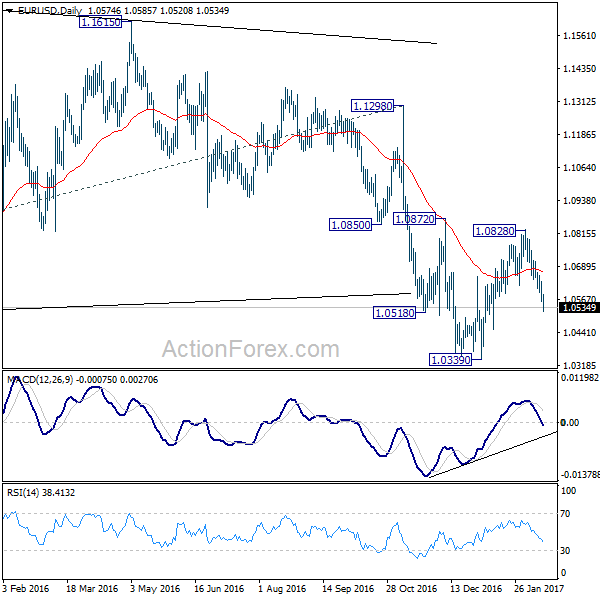

In the bigger picture, whole down trend from 1.6039 (2008 high) is in progress. Such down trend is expected to extend to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. On the upside, break of 1.1298 resistance is needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | AUD | Westpac Consumer Confidence Feb | 2.30% | 0.10% | ||

| 09:30 | GBP | Jobless Claims Change Jan | -42.4k | 1.0k | -10.1k | -20.5k |

| 09:30 | GBP | Claimant Count Rate Jan | 2.10% | 2.30% | 2.30% | |

| 09:30 | GBP | ILO Unemployment Rate 3M Dec | 4.80% | 4.80% | 4.80% | |

| 09:30 | GBP | Average Weekly Earnings 3M/Y Dec | 2.60% | 2.80% | 2.80% | |

| 10:00 | EUR | Eurozone Trade Balance (EUR) Dec | 24.5B | 22.5B | 22.7B | 22.2B |

| 13:30 | CAD | Manufacturing Shipments M/M Dec | 0.30% | 1.50% | ||

| 13:30 | USD | Empire State Manufacturing Feb | 18.7 | 7 | 6.5 | |

| 13:30 | USD | CPI M/M Jan | 0.60% | 0.30% | 0.30% | |

| 13:30 | USD | CPI Y/Y Jan | 2.50% | 2.40% | 2.10% | |

| 13:30 | USD | CPI Core M/M Jan | 0.30% | 0.20% | 0.20% | |

| 13:30 | USD | CPI Core Y/Y Jan | 2.30% | 2.10% | 2.20% | |

| 13:30 | USD | Advance Retail Sales Jan | 0.40% | 0.10% | 0.60% | 1.00% |

| 13:30 | USD | Retail Sales Less Autos Jan | 0.80% | 0.40% | 0.20% | 0.40% |

| 14:15 | USD | Industrial Production Jan | 0.00% | 0.80% | ||

| 14:15 | USD | Capacity Utilization Jan | 75.50% | 75.50% | ||

| 15:00 | USD | NAHB Housing Market Index Feb | 67 | 67 | ||

| 15:00 | USD | Business Inventories Dec | 0.40% | 0.70% | ||

| 15:00 | USD | Fed Chair Yellen Testimony | ||||

| 15:30 | USD | Crude Oil Inventories | 13.8M | |||

| 21:00 | USD | Net Long-term TIC Flows Dec | $30.8b |

Subscribe to our daily and mid-day newsletter to get this report delivered to your mail box