A long list of economic data are released today. But the main focus is on Italy. The coalition government’s decision to target budget deficit at 2.4% of GDP for the next three years drew heavy criticism from EU. Also, financial market reactions are overwhelmingly negative. European stocks decoupled from risk appetite in Asian and trade deeply in red. Italian yield surged to the level at the beginning of the month while German 10 year bund is back deep below 0.5.

Euro suffered broad based selling and is trading as the weakest one for the day. Sterling follows as the second weakest and New Zealand Dollar as the third weakest. Canadian Dollar is boosted by stronger than expected GDP data and is now the strongest one for the day. It’s followed by Australian Dollar and than Swiss Franc. Meanwhile, Dollar is mixed as post FOMC rally lost momentum while PCE provided no inspirations.

In other markets, at the time of writing, DAX leads European decline and is down -1.79%, CAC down -1.19%. FTSE is down -0.55%. Italian 10 year yield is trading up 0.364 at 3.256. German 10 year bund yield is down -0.700 at 0.462, well below 0.5 handle now. Risk appetite was strong in Asia though. Nikkei reached as high as 24286 and breached 24129.34 resistance. But it closed at 24120.04, up 1.36%. Hong Kong HSI was up 0.26%, China Shanghai SSE up 1.06% and Singapore Strait Times was up 0.64%.

US personal income and spending missed expectations, core PCE unchanged at 2%

US personal income rose 0.3% in August, below expectation of 0.4%. Spending rose 0.3%, below expectation of 0.4%. Headline PCE slowed to 2.2% yoy, down from 2.3% yoy and missed expectation of 2.3% yoy. Core PCE was unchanged at 2.0% yoy, matched expectations.

Canadian Dollar jumps as GDP grew 0.2%, led by manufacturing

Canadian Dollar surges after stronger than expected GDP data. GDP grew 0.2% mom in July versus expectation of 0.1% mom. The growth was “concentrated” as 12 of 20 sectors were up, led by manufacturing, wholesale trade, utilities and transportation and warehousing. Good-producing industries grew 0.3% mom while services-producing industries grew 0.2% mom. Also from Canada, IPPI dropped -0.5% mom in August. RMPI dropped -4.6% mom.

Italian bond yield jumps on budget deficit target, 5-star Maio not worried

European Commission said today that it would assess the draft budget plan of Italy before end of November. But it’s spokesman emphasized it’s just “part of the normal European Semester process, the EU’s economic policy coordination cycle, and happens each year.”

European Economics Commissioner Pierre Moscovici noted that nothing would be gained from a clash with Italy but added “we don’t have any interest either that Italy does not respect the rules and does not reduce its debt, which remains explosive.”

5-Star Movement leader Luigi Di Maio, also Deputy Prime Minister of Italy, said he was not worried by market reaction and will meet investors soon.

Eurozone CPI rose to 2.1% but core slowed to 0.9%

Eurozone headline CPI rose to 2.1% yoy in September, up from 2.0% yoy and matched expectation. However, Core CPI slowed to 0.9% yoy, down from 1.0% yoy and missed expectation of 1.1% yoy. Energy inflation remained strong, at 9.5% yoy, followed by food, alcohol & tobacco at 2.7%. The reading is likely unwelcome by ECB.

Also released, Germany unemployment rose 23k in September, unemployment rate dropped 0.1% to 5.2%.

UK Q2 GDP finalized at 0.4% qoq, unrevised

UK Q2 GDP was finalized at 0.4% qoq, unrevised. Growth were driven by services sector, which increased by 0.6%, partly on retail sales. Household spending grew 0.4% but business investment dropped notably by -0.7%. ONS noted that “the recent narrative on UK GDP remains unchanged – the underlying trend is still one of slowing real GDP growth.” Also from UK, current account deficit widened to GBP -20.3B in Q2.

Swiss KOF rose to 102.2, down trend halted

Swiss KOF Economic Barometer rose notably to 102.2 in September, up 3.3 pts from 98.9. It also beat expectation of 100.1. KOF noted the this may imply that the downward trend, which has been visible since the beginning of 2018, might have come to a halt.

The strongest positive contributions came from manufacturing sector. And among manufacturing, “positive development can be attributed mainly to the metal processing industry, followed by the machine building and the food processing as well as the textile industries and finally the chemical industry.” Meanwhile, overall improvement in manufacturing is driven by “a more optimistic assessment of employment, followed by the assessments of production and the overall business situation”.

BoJ: Growing downside risks stemming from trade frictions

In the summary of opinions of September 18-19 BoJ meeting, it’s noted that the “he underlying trend in Japan’s economic activity has not changed significantly”. But there were growing downside risks “stemming from trade friction between such economies as the United States and China as well as from fluctuations in financial markets.”

On inflation, the summary noted “it is gradually becoming clear that the delay in a rise in inflation is affected by not only a mere demand shortage, but also various factors such as the persistent deflationary mindset and improvement in productivity stemming from expansion in supply capacity.”

On monetary policy, the summary noted both then need to “persistently maintain highly accommodative financial conditions” and “carefully examining the positive effects and side effects” of easing. Also, there is “room” to make policy “more flexible” for “market functioning”.

A batch of economic data is also released from Japan. Tokyo CPI core accelerated to 1.0% yoy in September versus expectation of 0.9% yoy Unemployment rate dropped to 2.4% in August versus expectation of 2.5%. Retail sales rose more than expected by 2.7% yoy. However, industrial production missed and rose only 0.7% mom.

EUR/USD Mid-Day Outlook

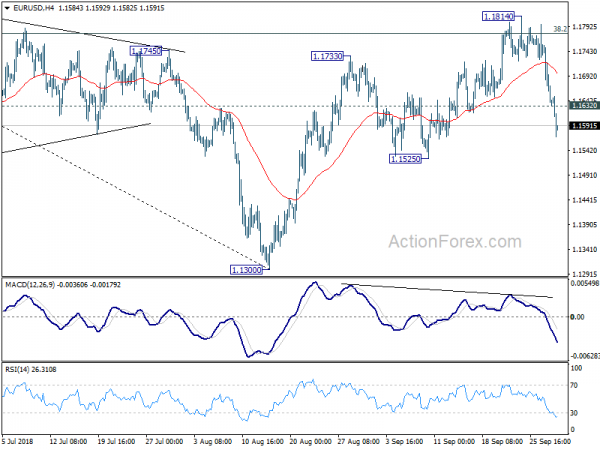

Daily Pivots: (S1) 1.1601; (P) 1.1680; (R1) 1.1721; More…..

EUR/USD’s decline from 1.1814 accelerates to as low as 1.1569 so far today. Intraday bias remains on the downside for 1.1525 support. . As noted before, corrective rise from 1.1300 should have completed at 1.1814, after meeting strong resistance from 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Break of 1.1525 support will confirm this bearish view and target a test on 1.1300 low. On the upside, above 1.1632 minor resistance will turn intraday bias neutral and bring recovery. But upside should be limited well below 1.1814 to bring fall resumption.

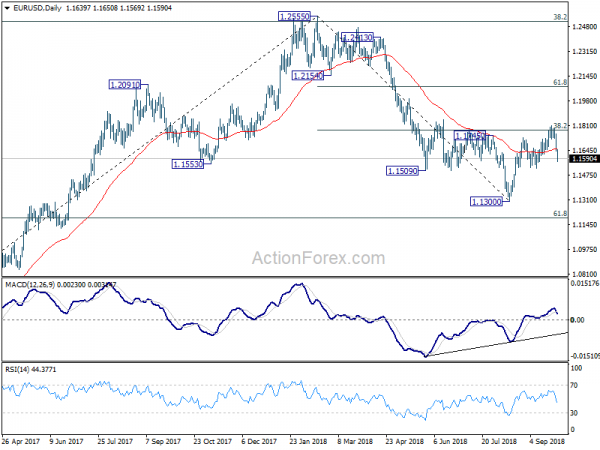

In the bigger picture, a medium term bottom should be in place at 1.1300, on bullish convergence condition in daily MACD and some consolidations would be seen. But still, note that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Thus, we’d expect fall from 1.2555 high to resume after consolidation completes. Below 1.1300 should send EUR/USD through 61.8% retracement of 1.0339 to 1.2555 at 1.1186. And, in that case, EUR/USD would head to retest 1.0339 (2017 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Aug | 7.80% | -10.30% | -10.80% | |

| 23:01 | GBP | GfK Consumer Confidence Sep | -9 | -8 | -7 | |

| 23:30 | JPY | Unemployment Rate Aug | 2.40% | 2.50% | 2.50% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Sep | 1.00% | 0.90% | 0.90% | |

| 23:50 | JPY | BOJ Summary of Opinions | ||||

| 23:50 | JPY | Industrial Production M/M Aug P | 0.70% | 1.50% | -0.10% | -0.20% |

| 23:50 | JPY | Retail Trade Y/Y Aug | 2.70% | 2.20% | 1.50% | |

| 05:00 | JPY | Housing Starts Y/Y Aug | 1.60% | 0.40% | -0.70% | |

| 07:00 | CHF | KOF Leading Indicator Sep | 102.2 | 100.1 | 100.3 | 98.9 |

| 07:55 | EUR | German Unemployment Change Sep | 23K | -9K | -8K | |

| 07:55 | EUR | German Unemployment Claims Rate Sep | 5.10% | 5.20% | 5.20% | |

| 08:30 | GBP | Current Account Balance (GBP) Q2 | -20.3B | -19.4B | -17.7B | -15.7B |

| 08:30 | GBP | GDP Q/Q Q2 F | 0.40% | 0.40% | 0.40% | |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y Sep | 2.10% | 2.10% | 2.00% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Sep A | 0.90% | 1.10% | 1.00% | |

| 12:30 | CAD | Industrial Product Price M/M Aug | -0.50% | 0.60% | -0.20% | |

| 12:30 | CAD | Raw Materials Price Index M/M Aug | -4.60% | 0.80% | 0.70% | |

| 12:30 | CAD | GDP M/M Jul | 0.20% | 0.10% | 0.00% | |

| 12:30 | USD | Personal Income Aug | 0.30% | 0.40% | 0.30% | |

| 12:30 | USD | Personal Spending Aug | 0.30% | 0.40% | 0.40% | |

| 12:30 | USD | PCE Deflator M/M Aug | 0.10% | 0.20% | 0.10% | |

| 12:30 | USD | PCE Deflator Y/Y Aug | 2.20% | 2.30% | 2.30% | |

| 12:30 | USD | PCE Core M/M Aug | 0.00% | 0.20% | 0.20% | |

| 12:30 | USD | PCE Core Y/Y Aug | 2.00% | 2.00% | 2.00% | |

| 13:45 | USD | Chicago PMI Sep | 63.8 | 63.6 | ||

| 14:00 | USD | U. of Mich. Sentiment Sep F | 96 | 100.8 |