The case for bullishness in Dollar continued to build up with yesterday’s rally. The greenback is now the strongest one for the week followed by Sterling. In particular, USD/JPY’s firm break of 113.17 resistance confirmed larger up trend resumption. Now, GBP/USD is the only one who’s yet to break 1.3042 minor support. Swiss Franc remains the weakest one for the week and there is no sign of a turnaround. Even though Australian and New Zealand Dollar recover in Asia, they are the favorite the end the week as the second weakest.

In other markets, US stocks ended higher overnight. DOW gained 0.21%, S&P 500 rose 0.28% and NASDAQ added 0.65%. Long term treasury yields were soft with 10 year yield closed down -0.005, 30-year yield down -0.008. In Asian, Nikkei is currently up 1.25%, Hong Hong HSI up 1.73%, China Shanghai SSE Up 0.93 and back above 2800, Singapore Strait Times up 1.17%. 10 year JGB yield is up slightly at 0.124. Gold stays weak at 1183 after breaking 1187.58 near term support yesterday. It should be heading back towards 1160.36 low in near term.

Technically, 1.3042 minor support in GBP/USD is a level to watch today, to see when the pair catches up with other Dollar pairs. Or instead, GBP/USD will recover ahead of this level again as the greenback pares gains before weekly close. PCE inflation data from US might be the trigger for the moves.

Italy to target budget deficit at 2.4% of GDP for the next three years

Italian government confirmed raising budget deficit, which would put them at odds with the EU. After the highly anticipated cabinet meeting, they decided to target budget deficit at 2.4% of GDP for the next three years. That is, Economy Minister Giovanni Tria, an unaffiliated technocrat, conceded his push for lowering deficit to just 1.6% of GDP, and then 2.0% in 2019.

“There is an accord within the whole government for 2.4 percent, we are satisfied, this is a budget for change,” 5-Star Movement leader Luigi Di Maio and League leader Matteo Salvini, both Deputy Prime Ministers, said in a joint statement after meetings with Tria.

Prime Minister Giuseppe Conte said the budget goals were “considered, reasonable and courageous” and would “ensure more robust economic growth and significant social progress for our country.” He added the budget plan included “the biggest program of public investments ever carried out in Italy.”

While the 2.4% deficit target remains below EU rule of 3.0%, EU might find a lack of commitment on Italy’s side to cut its massive debt.

BCC: 20% UK business will move to EU in case of no-deal Brexit

According to a survey by the British Chambers of Commerce, investment and recruitment would be cut in the event of ‘no deal’ Brexit. The survey found that:, 21% of businesses will cut investment, 20% will move part of all of their business to EU, 18% will cut recruitment. Also, 62% of businesses still haven’t completed a Brexit risk assessment.

Adam Marshall, Director General of BCC, warned that “our evidence is clear – failure to reach a political agreement would have real-world consequences, with significant decreases in both investment and recruitment. Larger firms and those active in international trade would suffer the most from a disorderly and sudden exit from the EU, but there will be impacts across the board.” And, he added “most concerning of all, a materially significant number of businesses are considering moving part or all of their operations to the EU in the event of ‘no deal'”.

Separately, UK Gfk consumer confidence dropped -2 to -9 in September. Joe Staton, Client Strategy Director at GfK, noted “when respondents talk about their personal finances, the scores are still positive. But for the general economy, they can only reflect on the obvious uncertainty surrounding Brexit.”

BoC Poloz: Gradual rate hike to continue

Bank of Canada Governor Stephen Poloz said in a speech that the economic models suggested the economy is “operating essentially right around capacity”. Still, “there is a great deal of uncertainty about the state of the economy and the prospects for growth and inflation.”

But at the same time, he emphasized that the central bank cannot operate monetary policy “mechanically”, but policy “becomes a matter of risk management”. And, “being uncertain about the future does not justify inaction.”

Poloz said “today, we continue to judge that higher interest rates will be warranted to achieve our inflation target.” And, “the Bank will continue to follow a gradual approach to raising interest rates, and remain dependent on incoming data and other sources of information to guide our decisions.”

BoJ: Growing downside risks stemming from trade frictions

In the summary of opinions of September 18-19 BoJ meeting, it’s noted that the “he underlying trend in Japan’s economic activity has not changed significantly”. But there were growing downside risks “stemming from trade friction between such economies as the United States and China as well as from fluctuations in financial markets.”

On inflation, the summary noted “it is gradually becoming clear that the delay in a rise in inflation is affected by not only a mere demand shortage, but also various factors such as the persistent deflationary mindset and improvement in productivity stemming from expansion in supply capacity.”

On monetary policy, the summary noted both then need to “persistently maintain highly accommodative financial conditions” and “carefully examining the positive effects and side effects” of easing. Also, there is “room” to make policy “more flexible” for “market functioning”.

A batch of economic data is also released from Japan. Tokyo CPI core accelerated to 1.0% yoy in September versus expectation of 0.9% yoy Unemployment rate dropped to 2.4% in August versus expectation of 2.5%. Retail sales rose more than expected by 2.7% yoy. However, industrial production missed and rose only 0.7% mom.

Looking ahead

Inflation data will be the main focuses of today. Eurozone will release September CPI flash. Germany unemployment, Swiss CPI, UK GDP final and current account will also be featured in European session.

Later in the day. US will release personal income and spending with PCE inflation. Chicago PMI will also be released. Canada will release July GDP, IPPI and RMPI.

USD/JPY Daily Outlook

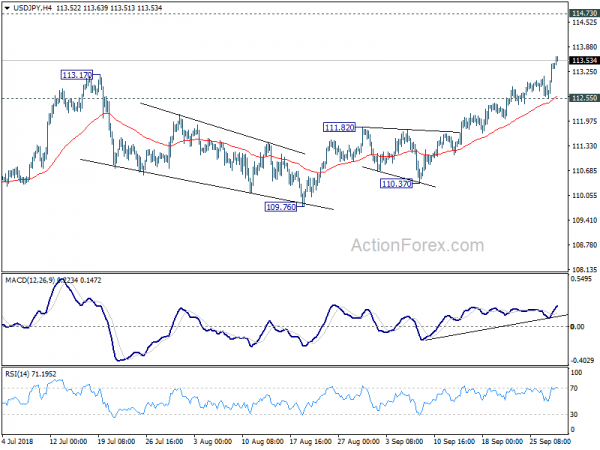

Daily Pivots: (S1) 112.82; (P) 113.15; (R1) 113.73; More…

USD/JPY rises to as high as 113.63 so far today. The break of 113.17 resistance confirms resumption of whole rally from 104.62. Intraday bias is back on the upside for 114.73 key resistance next. Decisive break there will should confirm larger bullish case. On the downside, break of 112.55 support is needed to indicate short term topping. Otherwise, near term outlook will remain bullish in case of retreat.

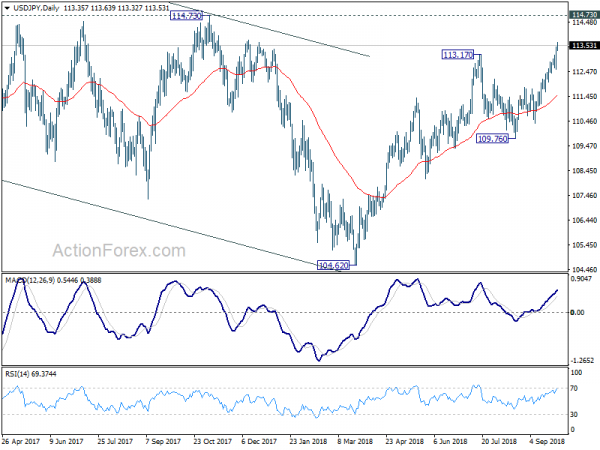

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.76 support holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Aug | 7.80% | -10.30% | -10.80% | |

| 23:01 | GBP | GfK Consumer Confidence Sep | -9 | -8 | -7 | |

| 23:30 | JPY | Unemployment Rate Aug | 2.40% | 2.50% | 2.50% | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Sep | 1.00% | 0.90% | 0.90% | |

| 23:50 | JPY | BOJ Summary of Opinions | ||||

| 23:50 | JPY | Industrial Production M/M Aug P | 0.70% | 1.50% | -0.10% | -0.20% |

| 23:50 | JPY | Retail Trade Y/Y Aug | 2.70% | 2.20% | 1.50% | |

| 5:00 | JPY | Housing Starts Y/Y Aug | 0.40% | -0.70% | ||

| 7:00 | CHF | KOF Leading Indicator Sep | 100.1 | 100.3 | ||

| 7:55 | EUR | German Unemployment Change Sep | -9K | -8K | ||

| 7:55 | EUR | German Unemployment Claims Rate Sep | 5.20% | |||

| 8:30 | GBP | Current Account Balance (GBP) Q2 | -19.4B | -17.7B | ||

| 8:30 | GBP | GDP Q/Q Q2 F | 0.40% | 0.40% | ||

| 9:00 | EUR | Eurozone CPI Estimate Y/Y Sep | 2.10% | 2.00% | ||

| 9:00 | EUR | Eurozone CPI Core Y/Y Sep A | 1.10% | 1.00% | ||

| 12:30 | CAD | Industrial Product Price M/M Aug | 0.60% | -0.20% | ||

| 12:30 | CAD | Raw Materials Price Index M/M Aug | 0.80% | 0.70% | ||

| 12:30 | CAD | GDP M/M Jul | 0.10% | 0.00% | ||

| 12:30 | USD | Personal Income Aug | 0.40% | 0.30% | ||

| 12:30 | USD | Personal Spending Aug | 0.40% | 0.40% | ||

| 12:30 | USD | PCE Deflator M/M Aug | 0.20% | 0.10% | ||

| 12:30 | USD | PCE Deflator Y/Y Aug | 2.30% | 2.30% | ||

| 12:30 | USD | PCE Core M/M Aug | 0.20% | 0.20% | ||

| 12:30 | USD | PCE Core Y/Y Aug | 2.00% | 2.00% | ||

| 13:45 | USD | Chicago PMI Sep | 63.8 | 63.6 | ||

| 14:00 | USD | U. of Mich. Sentiment Sep F | 96 | 100.8 |