Dollar strengthens further and broadly, in early US session as post FOMC rally extends. As we aruged in prior report, there were hawkish elements in Fed’s projections and overall announcement should be Dollar positive. Today’s rally showed that this view is shared by other participants. In particular, EUR/USD’s break of 1.1723 minor support carries bearish implication and could now target 1.1525 support. USD/CHF also resumed recent rebound from 0.9541 by taking out 0.9700 after brief retreat. AUD/USD has taken out 0.7228 support already and should be heading to 0.7143 support. USD/CAD also surges through 1.3063 resistance, further affirm the case of bullish reversal.

Yen is following as the second strongest. For now, EUR/JPY and GBP/JPY are seen as in consolidation only, rather than bearish near term reversal. Swiss Franc is extending this week’s deep decline and is trading as the weakest one. Euro follows as the second weakest, taking over Australian Dollar’s place, on Italy budget jitters. Aussie is now the third weakest one for today.

In other markets, European stocks reversed earlier decline and are trading higher for now. FTSE is up 0.44%, DAX up 0.29%, CAC up 0.19%. Earlier in Asia, major indices all closed in red. Nikkei was down -0.99%, Hong Hong HSI down -0.36%, China Shanghai SSE down -0.36%, Singapore Strait Times also down -0.09%. Gold picks up downside momentum in early US session. Break of 1187.58 now could pave the way back to retest 1160.36 low.

US jobless claims rose 12k to 214k, headline durables jumped 4.5% but ex-transport missed

A batch of mixed data is released from the US today. Initial jobless rose 12k to 214k in the week ended September 22, above expectation of 208k but stayed low. Four-week moving average of initial claims rose 250 to 206.25k. Continuing claims rose 16k to 1.611m in the week ended September 15. Four-week moving average of continuing claims dropped -12.25k to 1.6915m, lowest since November 10, 1973.

Headline durable goods order jumped sharply by 4.5% in August, above expectation of 1.5%. But ex-transport orders rose only 0.1%, missed expectation of 0.3%. Wholesale inventories rose 0.8% mom in August, above expectation of 0.3% mom. Trade deficit widened to USD -75.8B in August.

Q2 GDP was finalized at 4.2% annualized, unrevised. GDP price index was revised up to 3.3%, from 3.0%. .

Euro pressured as Italy budget back in spotlight

Italy is occupying a lot of headlines today on the topic of 2019 budget. There are a lot of numbers flying around, without confirmation on how true are day. But one thing for sure is that the coalition partners of the League and Five-Star movements are pushing a higher budget deficit in terms of GDP for 2019, possibly at 2.4%. That’s for funding for fulfilling their election promises.

On the other hand, Economy Minister Giovanni Tria, who belongs to neither party of the coalition, insists on capping 2019 budget deficit, possibly at 2.0% of GDP. It’s believed the the Treasury already forecasts that deficit above 1.9% of GDP would risk debt containment.

The cabinet will have a meeting on the budget issue today. Out of that, we’d likely know whether EU would like the final compromised deficit number. Or, whether Tria will stay, quit voluntarily or be forced out.

Released from Eurozone, business climate was unchanged at 1.21 in September below expectation of 1.39. Industrial confidence dropped to 4.7, below expectation of 5.2. Services confidence rose to 14.6 but missed expectation of 15.3. economic confidence dropped to 110.9 and missed expectation of 111.5. Consumer confidence was finalized at -2.9. M3 rose 3.5% yoy in August. From Germany, CPI accelerated to 2.3% yoy in September, above expectation of 2.0%. Gfk consumer confidence rose 0.1 to 10.6 in October.

EU Barnier: Continues to work for an orderly Brexit

EU’s chief Brexit negotiator Michel Barnier said today “the EU continues to work for an orderly Brexit and an ambitious future partnership with the UK that should include a close economic relationship.”

Separately, UK opposition Labour party leader Jeremy Corbyn visits Brussels today and warned that “crashing out of Europe with no deal risks being a national disaster.” Corbyn also urged EU to “do all they can to avoid a “no-deal” outcome, which would be so damaging to jobs and living standards in both the UK and EU countries.”

European Commission spokesman Margaritis Schina said today that “keep calm and keep negotiating,” but he also noted “we are ready for all scenarios.”

NZD/USD range bound after non-eventful RBNZ rate decision

NZD/USD trades steadily in range after RBNZ kept OCR unchanged at 1.75% as widely expected and delivered no surprise to the markets. Governor Adrian Orr reiterated in the statement that “we expect to keep the OCR at this level through 2019 and into 2020.” He also kept the options open and indicated the next move could be “up or down”. Economic projections are “little changed” from the August MPS. Even though Q2 GDP was stronger than anticipated, Orr noted “downside risks to the growth outlook remain”. He concluded the statement by repeating “we will keep the OCR at an expansionary level for a considerable period to contribute to maximising sustainable employment, and maintaining low and stable inflation.”

BoJ Kuroda: Allowing JGB yield to move strengthens effect of monetary easing

BoJ Governor Haruhiko Kuroda said today the measures taken in July, allowing 10 year JGB yield to move between -0.1% and 0.1%, “would strengthen the effect of monetary easing as a whole”. It’s because, it “would allow us to continue powerful monetary easing.” And he’s optimistic that “the steps will help accelerate inflation to 2 percent at the earliest date possible, while ensuring financial market stability.”

Meanwhile, Kuroda also warned that “we need to be vigilant of the potential impact of recent protectionist moves, though the economy is likely to sustain a moderate expansion”.

WTO lowered 2018 trade growth projections significantly

The World Trade Organization warned today that “escalating trade tensions and tighter credit market conditions in important markets will slow trade growth for the rest of this year and in 2019”. WTO now projects growth in global merchandise trade volume of 3.9% in 2018 and 3.7% in 2019. The 2018 figure is notably lower than April’s projection of 4.4%. Though, it still falls within April’s range of 3.1-5.5%. The new range is lowered to 3.4-4.4%.

It noted that some of the downside risks identified in April have materialized. These include “most notably a rise in actual and proposed trade measures targeting a variety of exports from large economies”. While the direct economic effects are “modest” but the uncertainty they generate may already be having an impact through reduced investment spending. In addition, it noted “monetary policy tightening in developed economies has also contributed to volatility in exchange rates and may continue to do so in the coming months.”

WTO Director General Roberto Azevêdo also warned “while trade growth remains strong, this downgrade reflects the heightened tensions that we are seeing between major trading partners”.

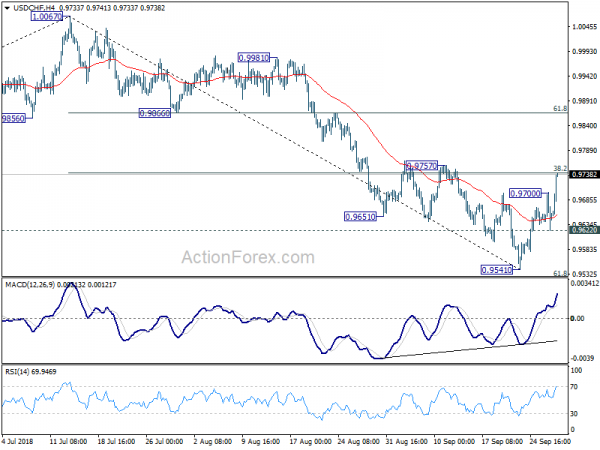

USD/CHF Mid-Day Outlook

Daily Pivots: (S1) 0.9620; (P) 0.9661; (R1) 0.9699; More…

USD/CHF’s rally from 0.9541 resumed after very brief retreat and hits as high as 0.9741 so far. Intraday bias is back on the upside for 0.9757 resistance first. Break will target 0.9866 key resistance level, 61.8% retracement of 1.0067 to 0.9541 at 0.9866. On the downside, break of 0.9622 minor support is needed to indicate completion of the rebound. Otherwise, near term outlook will stay cautiously bullish even in case of retreat.

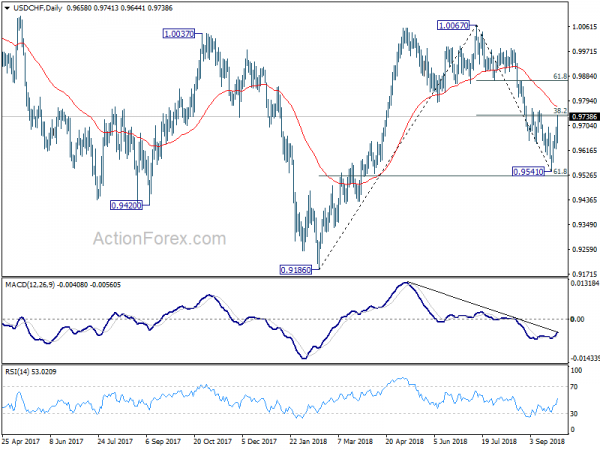

In the bigger picture, rise from 0.9186 low has completed at 1.0067, after failing to sustain above 1.0037 resistance. Fall from 1.0067 could extend to 61.8% retracement of 0.9816 to 1.0067 at 0.9523 and possibly below. But for now, we don’t expect a break of 0.9186 low. On the upside, firm break of 0.9866 support turned resistance will suggest that fall from 1.0067 has completed and rise from 0.9186 is resuming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | RBNZ Official Cash Rate | 1.75% | 1.75% | 1.75% | |

| 06:00 | EUR | German GfK Consumer Confidence Oct | 10.6 | 10.6 | 10.5 | |

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Aug | 3.50% | 3.80% | 4.00% | |

| 08:00 | EUR | ECB Economic Bulletin | ||||

| 09:00 | EUR | Eurozone Business Climate Indicator Sep | 1.21 | 1.39 | 1.22 | 1.21 |

| 09:00 | EUR | Eurozone Economic Confidence Sep | 110.9 | 111.5 | 111.6 | |

| 09:00 | EUR | Eurozone Industrial Confidence Sep | 4.7 | 5.2 | 5.5 | 5.6 |

| 09:00 | EUR | Eurozone Services Confidence Sep | 14.6 | 15.3 | 14.7 | 14.4 |

| 09:00 | EUR | Eurozone Consumer Confidence Sep F | -2.9 | -2.5 | -2.9 | -1.9 |

| 12:00 | EUR | German CPI M/M Sep P | 0.40% | 0.20% | 0.10% | |

| 12:00 | EUR | German CPI Y/Y Sep P | 2.30% | 2.00% | 2.00% | |

| 12:30 | USD | Advance Goods Trade Balance (USD) Aug | -75.83B | -70.6B | -72.0B | |

| 12:30 | USD | Wholesale Inventories M/M Aug P | 0.80% | 0.30% | 0.60% | |

| 12:30 | USD | GDP Annualized Q2 T | 4.20% | 4.20% | 4.20% | |

| 12:30 | USD | GDP Price Index Q2 T | 3.30% | 3.00% | 3.00% | |

| 12:30 | USD | Durable Goods Orders Aug P | 4.50% | 1.50% | -1.70% | -1.20% |

| 12:30 | USD | Durables Ex Transportation Aug P | 0.10% | 0.30% | 0.10% | 0.20% |

| 12:30 | USD | Initial Jobless Claims (SEP 22) | 214K | 208K | 201K | 202K |

| 14:00 | USD | Pending Home Sales M/M Aug | -0.20% | -0.70% | ||

| 14:30 | USD | Natural Gas Storage | 64B | 86B |