Swiss Franc is trading as the strongest major currency today, but it’s now followed by Dollar as the second weakest, who’s paring some of the steep losses this week. Sterling is the weakest one after Prime Minister Theresa May’s Chequers Brexit proposals were rejected by the EU. And May is being bashed by media at home. Yen isn’t the second weakest one though, as it’s also paring some of this week’s loss. Canadian Dollar gets not support from stronger than expected retails and is trading mixed.

Quick update: Sterling dives further after May declares Brexit negotiation an impasse.

Technically, EUR/GBP’s break of 0.8935 minor resistance suggests earlier than expected bottoming in the cross. GBP/USD’s sharp pull back is an early signal of rejection by 1.3316 fibonacci resistance. EUR/USD breached 1.1779 fibonacci resistance earlier today but it’s now back below. Focus will now turn to 1.3096 minor support in GBP/USD and 1.1723 in EUR/USD for more sign of bottoming for the greenback.

Released from Canada, headline retail sales rose 0.3% mom in July, matched expectation. Ex-auto sales rose 0.9% mom, above expectation of 0.6% mom. Headline CPI slowed from 3.0% yoy to 2.8% yoy in August as expected. Core CPI common rose from 1.9% to 2.0%. Core CPI Media rose from 2.0% to 2.1%. Core CPI trim rose from 2.1% to 2.2%. The set of data should be Canadian Dollar supportive, but we haven’t seen it manifested in the markets yet.

UK PM May bashed by British media for failure at EU summit

UK media generally bashed Prime Minister Theresa May’s performance at the informal EU summit in Austria. There are headlines today like “May humiliated,” “Humiliation for May,” “Embarrassing rebuff for PM in Salzburg,” “Your Brexit’s broken,”etc. It’s rather common for UK politicians to get the harshest words back at home. Comments from the EU were so far rather gentle.

However, Scottish First Minister Nicola Sturgeon said, “Now that the EU has explicitly rejected it, the Chequers pretence has to stop. At the very least, single market/customs union membership must be back on the table and the Article 50 clock stopped to avoid a cliff edge”.

Separately, European Commission President Jean-Claude Juncker urge EU and UK to be like “two loving hedgehogs”. And, “when two hedgehogs hug each other, you have to be careful that there will be no scratches.”

May is expected to make a statement today to defend her pathetic Chequers plan, which is disliked by EU as well as Brexiteers.

Eurozone PMIs: Slowdown limited to manufacturing.

Eurozone PMI manufacturing dropped to 53.3 in September, down from 54.4 and missed expectation of 54.5. That’s also the lowest reading in 28 months. PMI services rose to 54.7, up from 54.5 and beat expectation of 54.5. PMI composite dropped to 54.2, down from 54.5. Still, growth in service sector offset weakness in manufacturing. And the survey data still pointed to solid 0.5% growth in Q3.

Chris Williamson, Chief Business Economist at IHS Markit said that “a near stagnation of exports contributed to one of the worst months for the Eurozone economy for almost two years. Trade wars, Brexit, waning global demand (notably in the auto industry), growing risk aversion, destocking and rising political uncertainty both within the Eurozone and further afield all fuelled the slowdown in business activity… Thankfully, the slowdown was limited to manufacturing. A buoyant service sector, boosted in part by domestic demand being supported by strong job gains, means the survey data are running at a level indicative of the economy growing by a solid 0.5% in the third quarter”

Also released, Germany PMI manufacturing dropped to 53.7 in September, down from 55.9 and missed expectation of 55.8. That’s also lowest in 25 months PMI services rose to 56.5, up from 55.0 and beat expectation of 55.1. PMI composite dropped to 55.3, down from 55.6 and hit 2-month low.

France PMI manufacturing dropped to 52.5 in September, down from 55.3, missed expectation of 53.3. {MI services dropped to 54.3, down from 55.4, missed expectation of 55.4. PMI composite dropped to 53.6, down from 54.9 and hit a 21-month low.

Japan PMI manufacturing rose to 52.9, international trade tensions weigh on sentiments

Japan PMI manufacturing rose to 52.9 in September, up from 52.5, but missed expectation of 53.1. Markit noted that input cost inflation accelerated at the fastest pace since March 2011. Also, geopolitical tensions weigh on sentiment, with Future Output Index dipping further.

Joe Hayes, Economist at IHS Markit, said “manufacturing sector business cycle continued along its upward path”. Also, “business conditions remained robust despite a number of natural disasters over the past month.” “Recent demand pressures have been primarily driven by the domestic market, latest flash data pointed to the first rise in export sales since May amid ongoing global trade frictions.” However, “business sentiment dipped further in September to a 22-month low as firms remain uncertain to how international trade tensions could impact the Japanese economy”.

Japan core CPI ticked up to 0.9% yoy, core-core sluggish at 0.4% yoy

Japan all item CPI rose 0.5% mom 1.3% yoy in August. Core CPI (ex-fresh food) rose 0.3% mom, 0.9% yoy. Core-core CPI (ex-fresh food and energy) rose 0.2% mom, 0.4% yoy. While core CPI ticked up from 0.8% yoy in July, it’s still way off BoJ’s target of 2%. More importantly, the core-core continued to show sluggishness in underlying inflation.

GBP/USD Mid-Day Outlook

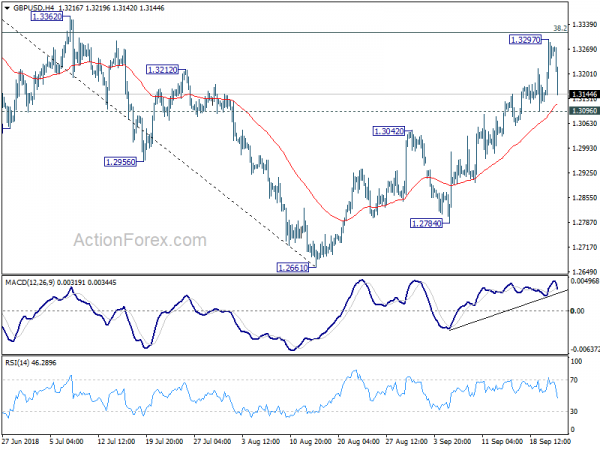

Daily Pivots: (S1) 1.3169; (P) 1.3233; (R1) 1.3335; More…

GBP/USD’s sharp fall suggests temporary topping at 1.3297 and intraday bias is turned neutral first. On the downside, break of 1.3096 will indicate rejection from 1.3316 key fibonacci resistance. That would be in line with our original view. In that case, corrective rebound from 1.2661 could have completed and intraday bias will be turned back to the downside for 1.2784 support. However, decisive break of 1.3315 will dampen our view and extend the rebound to next fibonacci level at 1.3721 instead.

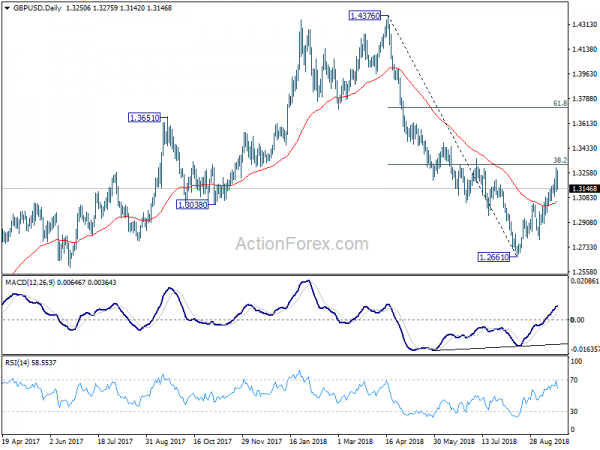

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4062). The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Aug | 0.90% | 0.90% | 0.80% | |

| 00:30 | JPY | PMI Manufacturing Sep P | 52.9 | 53.1 | 52.5 | |

| 04:30 | JPY | All Industry Activity Index M/M Jul | 0.00% | 0.20% | -0.80% | -0.90% |

| 06:45 | EUR | French GDP Q/Q Q2 F | 0.20% | 0.20% | 0.20% | |

| 07:15 | EUR | France Manufacturing PMI Sep P | 52.5 | 53.3 | 53.5 | |

| 07:15 | EUR | France Services PMI Sep P | 54.3 | 55.4 | 55.4 | |

| 07:30 | EUR | Germany Manufacturing PMI Sep P | 53.7 | 55.8 | 55.9 | |

| 07:30 | EUR | Germany Services PMI Sep P | 56.5 | 55.1 | 55 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Sep P | 53.3 | 54.4 | 54.4 | |

| 08:00 | EUR | Eurozone Services PMI Sep P | 54.7 | 54.5 | 54.5 | |

| 08:30 | GBP | Public Sector Net Borrowing (GBP) Aug | 5.9B | 3.0B | -2.9B | -3.9B |

| 12:30 | CAD | Retail Sales M/M Jul | 0.30% | 0.30% | -0.20% | |

| 12:30 | CAD | Retail Sales Ex Auto M/M Jul | 0.90% | 0.60% | -0.10% | |

| 12:30 | CAD | CPI M/M Aug | -0.10% | -0.10% | 0.50% | |

| 12:30 | CAD | CPI Y/Y Aug | 2.80% | 2.80% | 3.00% | |

| 12:30 | CAD | CPI Core – Common Y/Y Aug | 2.00% | 1.90% | ||

| 12:30 | CAD | CPI Core – Median Y/Y Aug | 2.10% | 2.00% | ||

| 12:30 | CAD | CPI Core – Trim Y/Y Aug | 2.20% | 2.10% | ||

| 13:45 | USD | US Manufacturing PMI Sep P | 55.1 | 54.7 | ||

| 13:45 | USD | US Services PMI Sep P | 54.9 | 54.8 |