The markets are now in full risk-seeking mode. DOW jumped 0.95% to record high at 26656.98 overnight. S&P also made new record at 2930.75, up 0.78%. The sentiments carried forward to Asian session with Nikkei up 1.13%, Hong Kong HSI up 1.20%, China Shanghai SSE up 1.71% and Singapore Strait Times up 1.30% at the time of writing. In particular, Nikkei is now very close to 2018 high at 24129.34, which is also a key resistance level.

In the currency markets, for today, Yen is the weakest one without a doubt. Sterling follows as the second weakest only because it’s consolidating this week’s strong rally. For similar reason. Canadian Dollar is the third weakest. New Zealand Dollar and Australian Dollar are the strongest ones today.

For the week, weakness in Yen, and just to a slightly lesser extent Dollar, is overwhelming. New Zealand Dollar and Australian Dollar are the strongest ones. However, Euro is having an eye on the top position for the week with rebound in EUR/AUD.

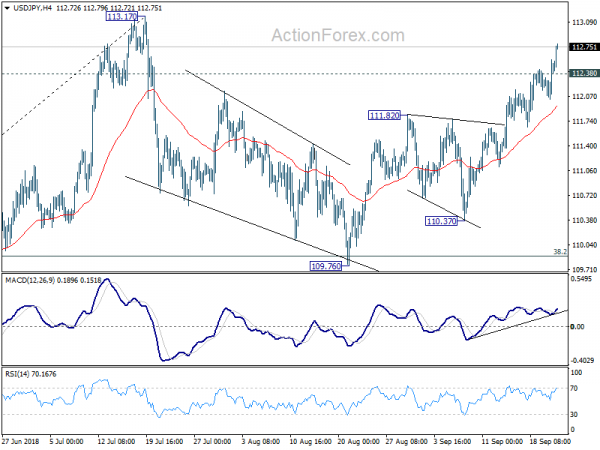

Technically, Dollar is now at a critical juncture. The big question is whether 1.1779 and 1.3316 fibonacci resistance in EUR/USD and GBP/USD would be taken out decisively to indicate stronger medium term rebound. Or, both pairs would be rejected from these levels to pave the way to retest medium term bottom at 1.1300 and 1.2661 respectively. Meanwhile, USD/JPY is extending recent rebound from 109.76 with uptick in momentum. USD/JPY would be targeting a test on 113.17 resistance next.

Japan PMI manufacturing rose to 52.9, international trade tensions weigh on sentiments

Japan PMI manufacturing rose to 52.9 in September, up from 52.5, but missed expectation of 53.1. Markit noted that input cost inflation accelerated at the fastest pace since March 2011. Also, geopolitical tensions weigh on sentiment, with Future Output Index dipping further.

Joe Hayes, Economist at IHS Markit, said “manufacturing sector business cycle continued along its upward path”. Also, “business conditions remained robust despite a number of natural disasters over the past month.” “Recent demand pressures have been primarily driven by the domestic market, latest flash data pointed to the first rise in export sales since May amid ongoing global trade frictions.” However, “business sentiment dipped further in September to a 22-month low as firms remain uncertain to how international trade tensions could impact the Japanese economy”.

Japan core CPI ticked up to 0.9% yoy, core-core sluggish at 0.4% yoy

Japan all item CPI rose 0.5% mom 1.3% yoy in August. Core CPI (ex-fresh food) rose 0.3% mom, 0.9% yoy. Core-core CPI (ex-fresh food and energy) rose 0.2% mom, 0.4% yoy. While core CPI ticked up from 0.8% yoy in July, it’s still way off BoJ’s target of 2%. More importantly, the core-core continued to show sluggishness in underlying inflation.

Abe vs Trump, Motegi vs Lighthizer. Next week

Japan Prime Minister Shinzo Abe, just newly re-elected ruling LDP leader, has confirmed a formal summit with Trump on September 26. The meeting will be held on the sidelines of Abe’s visit to New York to attend a United Nations General Assembly. Before that, Abe and Trump plan to have a dinner together on September 23.

In between, Japanese Economy Minister Toshimitsu Motegi will meet US Trade Representative Robert Lighthizer on September 24, as follow-up to their August meeting on trade. Motegi said “based on the common understanding we built in the first round of talks, we’ll seek a ‘win-win’ outcome that benefits both countries.” It’s a known that the US is forcing Japan into bilateral free trade agreement but Motegi said “I don’t think that will happen”.

October the momentum of truth for Brexit negotiation

European Council President Donald Tusk said after meeting between EU leaders yesterday that “everybody shared the view that while there are positive elements in the Chequers proposal, the suggested framework for economic cooperation will not work, not least because it risks undermining the single market.” And, he added “the moment of truth for Brexit negotiations will be the October European Council. In October we expect maximum progress and results in the Brexit talks.”

On the other hand, UK Prime Minister Theresa May insisted that her Chequers plan is the only Brexit proposal that’s on the table. She said, “there is no counter proposal on the table at the moment that actually deals, delivers on what we need to do and respects the integrity of the United Kingdom and respects the result of the referendum.”

Canada demand US dropping auto tariff threats. It’s not a stupid nation

A new deadlock emerged in Canada-US NAFTA negotiation as Canada demanded the withdrawal of auto tariff threat before making a deal. Canadian Foreign Minister Chrystia Freeland said “we discussed some tough issues today,”after meeting USTR Robert Lighthizer yesterday, without giving any details. Freeland also ignored the US imposed deadline of October 1 and insisted on getting a deal that was good for Canadians.

The request to drop auto tariffs threat based on national security is supported within the Canadian business world. Jerry Dias, president of Unifor, Canada’s largest private-sector union said “Why would Canada sign a trade agreement with the United States … and then have Donald Trump impose a 25 percent tariff on automobiles?” He added, “That for us is a deal breaker. It doesn’t make a stitch of sense. … We are a small nation, we’re not a stupid nation.”

OECD downgrades global outlook, trade tensions are starting to bite

In its interim economic outlook, OECD downgraded global growth forecast for 2018 and 2019. More importantly, almost all countries covered were downgraded, in either year or both, except Australia, Japan, China, Russia and Saudi Arabia. OECD warned that “escalating trade tensions, tightening financial conditions in emerging markets and political risks could further undermine strong and sustainable medium-term growth worldwide.

OECD Chief Economist Laurence Boone:

- Trade tensions are starting to bite, and are already having adverse effects on confidence and investment plans.

- Trade growth has stalled, restrictions are having marked sectoral effects and the level of uncertainty on trade stances remains high.

- It is urgent for countries to end the slide towards further protectionism, reinforce the global rules‑based international trade system and boost international dialogue, which will provide business with the confidence to invest

- With tighter financial conditions creating stress on a number of emerging economies, especially Turkey and Argentina, a strong and stable policy framework will be key to avoid further turbulence.

USD/JPY Daily Outlook

Daily Pivots: (S1) 112.17; (P) 112.38; (R1) 112.71; More…

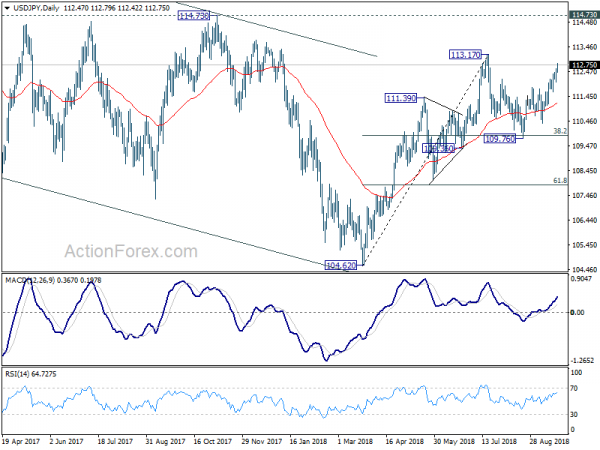

USD/JPY’s rally resumed after brief consolidation and reaches as high as 112.79. Intraday bias is back on the upside for 113.17 resistance. Decisive break there will resume whole rally from 104.62 and target 114.73 resistance next. On the downside, below 112.38 minor support will turn intraday bias neutral first. But near term outlook will now stay cautiously bullish as long as 111.82 resistance turned support holds.

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.36 support holds. However, decisive break of 109.36 will mix up the outlook again. And deeper fall should be seen back to 61.8% retracement of 104.62 to 113.17 at 107.88 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:30 | JPY | National CPI Core Y/Y Aug | 0.90% | 0.90% | 0.80% | |

| 0:30 | JPY | PMI Manufacturing Sep P | 52.9 | 53.1 | 52.5 | |

| 4:30 | JPY | All Industry Activity Index M/M Jul | 0.00% | 0.20% | -0.80% | -0.90% |

| 6:45 | EUR | French GDP Q/Q Q2 F | 0.20% | 0.20% | ||

| 7:15 | EUR | France Manufacturing PMI Sep P | 53.3 | 53.5 | ||

| 7:15 | EUR | France Services PMI Sep P | 55.4 | 55.4 | ||

| 7:30 | EUR | Germany Manufacturing PMI Sep P | 55.8 | 55.9 | ||

| 7:30 | EUR | Germany Services PMI Sep P | 55.1 | 55 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Sep P | 54.4 | 54.4 | ||

| 8:00 | EUR | Eurozone Services PMI Sep P | 54.5 | 54.5 | ||

| 8:30 | GBP | Public Sector Net Borrowing (GBP) Aug | 3.0B | -2.9B | ||

| 12:30 | CAD | Retail Sales M/M Jul | 0.30% | -0.20% | ||

| 12:30 | CAD | Retail Sales Ex Auto M/M Jul | 0.60% | -0.10% | ||

| 12:30 | CAD | CPI M/M Aug | -0.10% | 0.50% | ||

| 12:30 | CAD | CPI Y/Y Aug | 2.80% | 3.00% | ||

| 12:30 | CAD | CPI Core – Common Y/Y Aug | 1.90% | |||

| 12:30 | CAD | CPI Core – Median Y/Y Aug | 2.00% | |||

| 12:30 | CAD | CPI Core – Trim Y/Y Aug | 2.10% | |||

| 13:45 | USD | US Manufacturing PMI Sep P | 55.1 | 54.7 | ||

| 13:45 | USD | US Services PMI Sep P | 54.9 | 54.8 |