Dollar and Yen are back under selling pressure today. In particular, USD/CHF and GBP/JPY take the lead in resuming recent moves. GBP/USD is following closely with eye on 1.3142 minor resistance. Both currencies received no special lift from news that Trump is going to impose new tariffs on China. Trump tweeted that “tariffs have put the U.S. in a very strong bargaining position”. But there was no hint on when the tariffs will be formally announced. Traders could turn a bit cautious and won’t commit until it’s formalized. Secondly, the rumored 10% tariffs are much lower than the original figure of 25%. And the impact would possibly be a notch down.

In other markets, global equities are generally down but losses are so far limited too. At the time of writing, FTSE is down -0.22%, DAX id won -0.46%, CAC is down -0.16%. Earlier today, Hong Kong HSI closed down -1.3% and Singapore Strait Times lost -0.63%. Nikkei was on holiday. China’s Shanghai SSE dropped -1.11% to 2651.79, lowest in nearly four years. Key support level at 2638.30 looks more vulnerable than ever. However, it’s unsure whether downside momentum will pick up again when this key support is broken. Gold continues to gyrate in tight range below 1200.

Technically, focus is first on 1.3142 temporary in GBP/USD. Then 1.1733 in EUR/USD and 131.10 in EUR/JPY will be watched to see in Euro can catch up with Swiss Franc and Sterling. Or, EUR/GBP will break 0.8875 temporary low and leave the Euro behind.

Released in US session, US Empire State manufacturing index dropped to 19 in September, down from 25.6, missed expectation of 23.2. Canada International securities transactions rose to CAD 12.65B in July.

IMF: Disruptive Brexit could lead to a significantly worse outcome

In an IMF report on UK, the organization expect growth to remain “moderate in the near term”, averaging around 1.5% in 2018 and 2019. However, it wanted that ” A more disruptive departure from the EU could lead to a significantly worse outcome, especially if it were to occur without an implementation period. “. On the other hand, “an agreement featuring fewer impediments to trade than currently expected could buoy business and consumer confidence, leading to faster growth.”.

IMF Managing Director Christine Lagarde also said, “compared with today’s smooth single market, all the likely Brexit scenarios will have costs for the economy and to a lesser extent as well for the EU.” And she warned that “The larger the impediments to trade in the new relationship, the costlier it will be. This should be fairly obvious, but it seems that sometimes it is not.”

In addition to Brexit, UK also faces a range of other economic challenges. These include “persistently lackluster productivity growth, large public debt, and the wide current account deficit.” Nonetheless, UK’s “sound macroeconomic framework, regulatory environment, and deep capital and flexible labor markets will be advantages in implementing reforms to address them.”

UK Chancellor of Exchequer Philip Hammond urged the government to listen to the “clear warnings” of the IMF of no-deal Brexit. Though, he also noted that no-deal outcome is unlikely even though it’s not impossible.

UK PM May believes parliament will vote for her Brexit deal with EU

UK Prime Minister Theresa May expressed her confidence that the parliament will vote for any Brexit deals that she strikes with the EU. She added that “parliament will vote for a deal because people will see the importance of a deal that maintains a good trading relationship with the EU … but gives us the freedom to take the benefits and opportunities of Brexit.”

Also regarding the possibility of being rejected by the Parliament, she said “do we really think … we’ve been through this negotiation we get to the point where we’ve agreed a deal that if parliaments was to say no go back and get a better one, do you really think the European Union is going to give a better deal at that point.” And, “the alternative to that will be having no deal.”

Separately, Austrian Chancellor Sebastian Kurz said EU should “do everything possible to avoid a hard Brexit”. French President Emmanuel Macron said “it’s indispensable that we reach an agreement and that European Union rules be fully maintained.”

BCC downgraded UK growth forecasts, economy to grow at a snail’s pace

The British Chambers of Commerce downgraded UK growth forecasts, citing “weaker outlook for trade and investment” as main reasons. Key points in the new forecasts:

- 2018 GDP growth at 1.1%, down from 1.3%. 2019 GDP growth at 1.3%, down from 1.4%. 2020 GDP growth at 1.6%, unchanged.

- 2018 exports growth at 1.7% only, down from 2.8% in prior forecast.

- 2018 total investment growth at 1.4%, down from 1.8%. 2019 at 1.4% and 2020 at 1.5%.

- BoE expected to hike in Q1 2019 and Q2 2020. Bank rate to hit 1.25% by the end of the forecast period.

Adam Marshall, Director General of the BCC said that the UK economy as a whole is set to grow at a “snail’s pace”. Brexit uncertainty “continues to weigh heavily on many firms” as “most of the practical questions” remained unanswered. And, the “lack of precision” of future relationship with the EU “is lowering expectations for both business investment and export growth.” He also warned that “the drag effect on investment and trade would intensify in the event of a ‘messy’ and disorderly Brexit”.

Bundesbank: Germany just went through temporary period of weakness

Bundesbank’s monthly economic report noted that the economic growth in Germany remains fundamentally intact. Slowdown during the summer was mainly due to car makers. And, “as soon as the conversion problems in the automotive industry have been solved, the pace of macroeconomic expansion should pick up again significantly”

It also said “continued positive mood of businesses, which according to the Ifo Institute’s surveys has recently also improved in industry, points to a temporary period of weakness.”

Both Bundesbank and the Economy Ministry expect manufacturing to shift to a higher gear in the common months.

ECB Coeure wants more clarity on pace of rate hike when conditions warrant

ECB Executive Board member Benoit Coeure urged the central to give more details in the forward guidance, regarding the pace of rate hike when it starts. He said, “should economic conditions warrant, there might be a case for the Governing Council to go beyond the timing to lift-off (rates) in further clarifying the pace at which it expects to remove policy accommodation.”

And, “a further clarification of our reaction function might help market participants and the broader public to better anticipate the likely future path of short-term interest rates.”

Currently, ECB’s plan is to half the monthly asset purchase to EUR 15B starting October, and stop it after December. Interest rates would stay at present levels through the summer of 2019.

ECB Makuch: Unguided missile Trump is the biggest threat to Eurozone economy

ECB Governing Council member Jozef Makuch said risks to the Eurozone are broadly balanced and the central bank’s stance was correct. He added policy makers were “not underestimating the risks” but “analyzing them”. And, “based on what we know now, the development is stable, risks are balanced, with some downside risks to GDP growth.” He also noted there is no reason to “spread gloomy mood or panic”.

Makuch also pointed out that Trump is like an “unguided missile” and the unpredictably of his policies is the biggest risks of the Eurozone economy. He noted that the erratic nature of Trump as “he says something and in the end something else happens”. Meanwhile, he played down risks from emerging markets and said the governing council sees no signs of spillover.

Meanwhile, Makuch is considering stepping down early as head of Slovakia’s central bank. He’s term supposedly end in 2021. He noted that the elections in spring 2020 would be highly divisive. That could lead to the post being vacant for an extended period. To him, Finance Minister Peter Kazimir would be a “good governor” to replace him. He hailed that Kazimir “Ecofin deals with all important monetary issues”, so the lack of experience in central banking is not a problem.

Eurozone CPI finalized at 2.0%, Core CPI at 1.0%

Eurozone CPI was finalized at 2.0% in August, down from 2.1% in July. That was still notably higher than 1.5% back in August 2017. Core CPI was finalized at 1.0% yoy. EU CPI was finalized at 2.1%, down from July’s 2.2%.

Highest contribution to Eurozone CPI was from energy (0.87%), followed by services (0.59%), food, alcohol & tobacco (0.48%) and non-energy industrial goods (0.09%).

USD/CHF Mid-Day Outlook

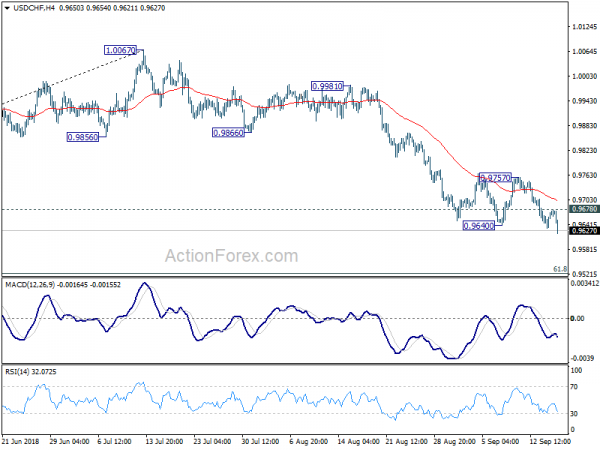

Daily Pivots: (S1) 0.9647; (P) 0.9662; (R1) 0.9689; More…..

USD/CHF’s decline resumes after brief consolidation and hits as low as 0.9621 so far. Intraday bias is back on the downside. Current fall from 1.0067 should target 0.9523 fibonacci level next. On the upside, break of 0.9678 minor resistance will turn intraday bias neutral again. But near term outlook will stay bearish as long as 0.9757 resistance holds.

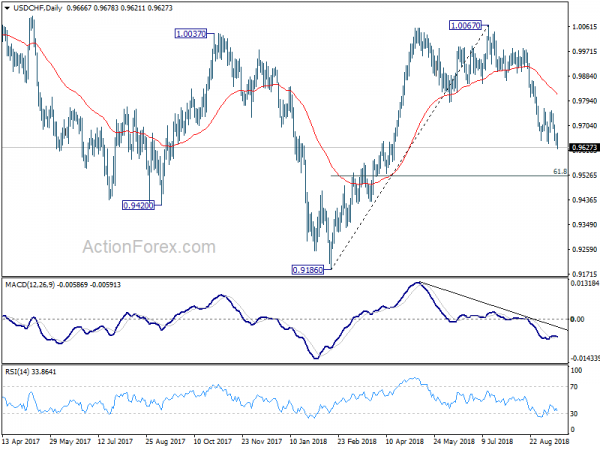

In the bigger picture, rise from 0.9186 low has completed at 1.0067, after failing to sustain above 1.0037 resistance. Fall from 1.0067 could extend to 61.8% retracement of 0.9816 to 1.0067 at 0.9523 and below. But for now, we don’t expect a break of 0.9186 low. On the upside, firm break of 0.9866 support turned resistance will suggests that fall from 1.0067 has completed and rise from 0.9186 is resuming.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | Rightmove House Prices M/M Sep | 0.70% | -2.30% | ||

| 09:00 | EUR | Eurozone CPI M/M Aug | 0.20% | -0.30% | -0.30% | |

| 09:00 | EUR | Eurozone CPI Y/Y Aug F | 2.00% | 2.10% | 2.10% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Aug F | 1.00% | 1.00% | 1.00% | |

| 12:30 | CAD | International Securities Transactions (CAD) Jul | 12.65B | 4.35B | 11.55B | 10.30B |

| 12:30 | USD | Empire State Manufacturing Index Sep | 19 | 23.2 | 25.6 |