Dollar is trading mixed as markets are turning their focus to employment data from US today. Non-farm payroll is expected to show 180k growth in April. Unemployment rate is expected to climb back to 4.6%. Average hourly earnings are expected to rise 0.3% mom. Looking at other employment related data, ADP private payroll growth slowed to 177k in April, down from 255k. Employment component of ISM manufacturing dropped sharply from 58.9 to 52.0, hitting the lowest level this year. Employment component of ISM services was nearly unchanged but stayed low at 51.4. Conference Board consumer confidence dropped to 120.3, down from 124.9, but was solid. Overall, other employment data argue that we won’t have much chance of an upside surprise in today’s NFP. Nonetheless, some attention would be on revision to March’s poor number of 98k. Also, expectations is high on the 0.3% wage growth which leaves room for disappointment.

Six Fed officials to speak

There is no change in the expectation of Fed’s rate path after this week’s FOMC meeting. Markets are expecting another two hikes this year before Fed having a brief pause to start shrinking its balance sheet. Fed fund futures are pricing in more than 70% chance of a hike in June. Markets will also listen to speeches of six Fed officials today. The list include Fed Chair Janet Yellen, Boston Fed President Eric Rosengren, Fed Vice Chairman Stanley Fischer, San Francisco Fed President John Williams, Chicago Fed President Charles Evans, and St. Louis Fed President James Bullard.

ECB Praet: A little upside risk for Q2

ECB chief economist Peter Praet sounded upbeat in a conference yesterday. He said that "there may be a little upside risk for Q2" and the "balance of risks has improved". There are speculations that ECB may tweak the statement towards the hawkish side again in June. And the central bank could also revise up economic projections then. But Praet emphasized that the "fundamental features of our forward guidance have a clear logic". And, "all other features of our forward guidance are of a parametric nature and can be recalibrated depending on incoming data." That is taken as the emphasize that the order of steps that ECB would take will remain unchanged. And that is, ECB will still end the asset purchase program before considering to raise interest rates.

Macron extends lead over Le Pen

Euro is trading as the strongest major currency together with Swiss Franc and markets look forward to French presidential election this Sunday. Pro-EU centrist Emmanuel Macron extended his lead over EU-sceptic far right Marine Le Pen. According to and Elabe poll for BFM TV and L’Express, Macron is set to get 62% of votes in the run-off. And Le Pen will only get 38%. That’s a 24 pts lead, up 3 pts from the last Elabe poll. Macron was also voted as the most convincing one in the last pre-election debate earlier this week.

Oil selloff accelerates

WTI crude oil’s selloff accelerated after taking out 47.01 key support level yesterday. WTI reaches as low as 43.76 in Asian session before recovering mildly. OPEC hinted that it is likely for the output cut deal to be extended with the same terms, i.e. reducing production by 1.8M bpd, for 6 months. According to an official who preferred to stay anonymous, "the willingness to extend the current understanding is strong among OPEC and non-OPEC participants". However, it is unlikely that "more cuts will be discussed as the current agreement is yielding a positive outcome". Meanwhile, Russian Energy Minister Alexander Novak indicated that the country was inclined to join the extension.

The market was disappointed as they had hoped for bigger reduction in the "new" deal. The goal of the output cut deal, announced late last year and effective in January 2017, is to rescue the massive selloff of oil prices. However, price performance signal that the cartel has probably lost control. The market is more concerned over the persistent increase in US oil production with the number of US oil rigs hitting a 2-year high last week.

Elsewhere…

Swiss foreign currency reserves rose to CHF 696b in April. Eurozone retail PMI will be featured in European session. Canada will also release employment data and Ivey PMI today.

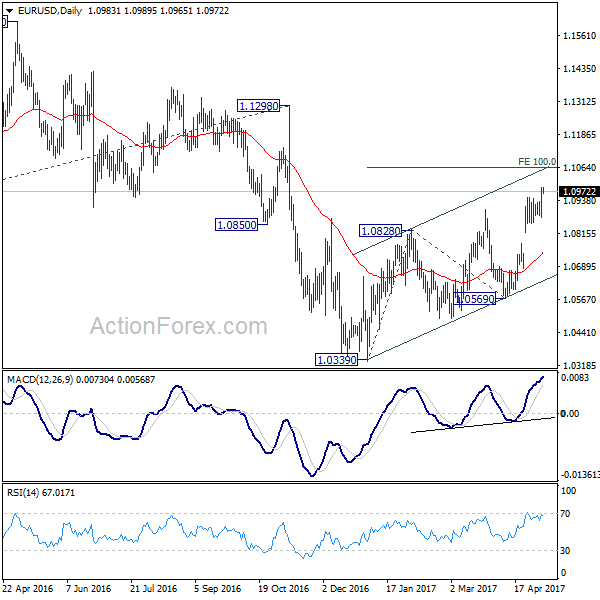

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.0909; (P) 1.0948 (R1) 1.1022; More….

EUR/USD’s rise resumed by taking out 1.0949 and reaches as high as 1.0989 so far. Intraday bias is back on the upside for 100% projection of 1.0339 to 1.0828 from 1.0569 at 1.1058. At this point, rise from 1.0339 is still seen as a corrective move. Hence we’d expect strong resistance from 1.1058 projection to limit upside and bring near term reversal. On the downside, break of 1.0874 support will turn bias back to the downside for 1.0569 support first.

In the bigger picture, as long as 1.1298 key resistance holds, whole down trend from 1.6039 (2008 high) is still expected to continue. Break of 1.0339 low will send EUR/USD through parity to 61.8% projection of 1.3993 to 1.0461 from 1.1298 at 0.9115. However, considering bullish convergence condition in weekly MACD, break of 1.1298 will indicate term reversal. This would also be supported by sustained trading above 55 week EMA.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 01:30 | AUD | RBA Statement on Monetary Policy | ||||

| 07:00 | CHF | Foreign Currency Reserves Apr | 696B | 683B | ||

| 08:10 | EUR | Eurozone Retail PMI Apr | 49.5 | |||

| 12:30 | CAD | Net Change in Employment Apr | 20.0K | 19.4K | ||

| 12:30 | CAD | Unemployment Rate Apr | 6.70% | 6.70% | ||

| 12:30 | USD | Change in Non-farm Payrolls Apr | 180K | 98K | ||

| 12:30 | USD | Unemployment Rate Apr | 4.60% | 4.50% | ||

| 12:30 | USD | Average Hourly Earnings M/M Apr | 0.30% | 0.20% | ||

| 14:00 | CAD | Ivey PMI Apr | 62.3 | 61.1 |