Risk appetite was given a strong boost overnight on news that US and China were going to re-start trade talks before now round of tariffs take effect. The news was further confirmed by White House economic advisor Larry Kudlow after the bell. Australian Dollar surged sharply on the news and was given another lift by solid job data today. Dollar, on the other hand, weakened together with Yen on easing trade threats. For now, Canadian Dollar is the strongest for the week, followed by Australian Dollar and then Sterling. Yen is the weakest one, followed by Swiss Franc and then Dollar. Focus will turn to ECB and BoE meeting today.

While stocks were shot up by US-China trade news, it should be noted that the momentum didn’t last. DOW hit as high as 26145.72 but closed up just 0.11% at 25998.92. That’s just slightly above open at 25989.07.S&P 500 actually showed little reaction, and hit 2894.65 day high before closing at 2888.92, up only 0.04%. NASDAQ dropped -0.23% to 7954.23.

In Asian markets, China Shanghai SSE opened higher and hit 2689.06. But there was no follow through buying to help it reclaim 2700 handle. SSE then subsequently gyrated down and is up only 0.14% at 2659 at the time of writing. Nikkei is up 0.99%, Hong Kong HSI is up 1.46% while Singapore Strait Times is up 0.15%. All in all, investors haven’t showed much commitment to the easing trade tension yet.

Technically, the forex markets are indeed staying in family range, with the exception of Aussie pairs. Further rise is in favor in EUR/USD and GBP/USD with 1.1525 and 1.2896 minor supports intact. USD/CHF and USD/JPY are range bound. Australia Dollar could have bottomed against both Dollar and Euro in near term, and more upside is in favor as corrective recovery.

WH Kudlow: Communications with China picked up a notch

White House top economic advisor Larry Kudlow said yesterday that communications with Beijing had “picked up a notch”. He also confirmed that Treasury Secretary Steven Mnuchin had sent an invitation letter to senior Chinese officials to restart trade talks. Also, “there’s some discussions and information that we’ve received that the top of the Chinese government wishes to pursue talks.”

Kudlow also added that “most of us think it’s better to talk than not to talk, and I think the Chinese government is willing to talk.” And, if they come to the table in a serious way to generate some positive results, yes, of course. That’s what we’ve been asking for months and months.” But he also cautioned that “I guarantee nothing.”

Overnight, the WSJ reported that the US was proposing new round of trade talk with China. That could happen in the near future before Trump imposes the new round of 25% tariffs on USD 200B in Chinese goods. It’s reported that Treasury Secretary Steven Mnuchin sent an invitation to Chinese officials, proposing a meeting in the next few weeks to discuss trade issues.

The proposal could be resulted from public hearing ended last week. Or, it could also be in response to outcries from American businesses. Over 60 US industry groups formed a coalition “Americans for Free Trade” to launch a campaign against Trump’s tariffs and trade policies.

Contrasting comments from Fed Brainard and Bullard

There were some contrasting comments from Fed officials yesterday.

Fed Governor Lael Brainard said that “with fiscal stimulus in the pipeline and financial conditions supportive of growth, the shorter-run neutral interest rate is likely to move up somewhat further, and it may well surpass the longer-run equilibrium rate for some period.” And to her, gradual interest rate hikes are likely to be appropriate.

On the other hand, St. Louis Fed President James Bullard emphasized that “you can’t just say, ‘unemployment is 3.9 percent, obviously we have to raise rates’; or, ‘growth is fast, obviously we have to raise rates.'” He noted that “I don’t think that feedback to inflation is very strong to be able to make that argument.”

Strong 44k job growth in Australia, unemployment rate unchanged at 5.3%

Australia job market grew 44k in August, well pass expectation of 18.4k. Full time employment grew strongly by 33.7k. Part time jobs added 10.2k. Unemployment was unchanged at 5.3%, matched expectation. Labor force participation rate rose to 65.7%, up from 65.6%.

Overall, the set of data affirmed RBA’s view that spare capacity is gradually being taken out, which is a prelude to meaningful wage growth. However, wages have actually need to show the increase before RBA is convinced that eventually there is enough upward pressure on inflation. Talk of rate hike is premature based on just today’s data.

Japan core machine orders jumped 11.0% yoy in July

In Japan, private machinery orders, excluding volatile ones, rose 11.0% yoy in July, well above expectation of 5.8% yoy. Total machinery orders rose 18.8% yoy. The strong growth suggests that companies were keen to invest despite the threat of trade protectionism. And rising capex will likely add to economic growth. So far, trade war worries haven’t materialized in economic data yet.

Also released, domestic CGPI rose 3.0% yoy in August, below expectation of 3.1% yoy.

ECB and BoE in focus but may turn out to be non-events

ECB and BoE rate decisions are the main focuses today, but both would likely be non-events. ECB is widely expected to keep main refinancing rate unchanged at 0.00%, and there is no chance of surprise in the regard. The central bank will also reiterate the plan to halve monthly asset purchase size to EUR 15B in October and then stop it after December. There might be more information on the subsequent reinvestment plan thereafter.

The more interesting part of ECB announce would be on the new economic projections. Back in June, ECB projected real GDP growth to stand at 2.1% in 2018 and slowed to 1.9% in 2019 and then 1.7% in 2020. HICP inflation was projected to be at 1.7% in 2018, 2019 and 2020.

BoE is also widely expected to keep monetary policies unchanged today. Back in August, the central bank raised Bank Rate by 25bps to 0.75% in August, on unanimous vote. The August Inflation Report was a rather dovish one indicating that BoE may only have one rate hike in 2019, depending on incoming data and Brexit outcome. Headline CPI’s rise to 2.5% in July was expected in the Inflation Report. Other data like wage growth were strong. But they’re not enough to alter BoE’s path yet.

More on ECB and BoE:

- ECB to Affirm QE Reduction from October and Downgrade Inflation Forecasts

- ECB to Keep the Same Forward Guidance; Eyes on Fresh Economic Projections

- Will We Get Fireworks from BoE and ECB?

- BOE Preview- Upbeat about Recent Economic Developments, but Cautious over Brexit

- Bank of England to Hold Rates as Brexit Talks Intensify

Also featured…

Germany will release CPI final. Swiss will release PPI. Later in the day, main focus will be on US CPI and jobless claims. Canada will also release new housing price index.

AUD/USD Daily Outlook

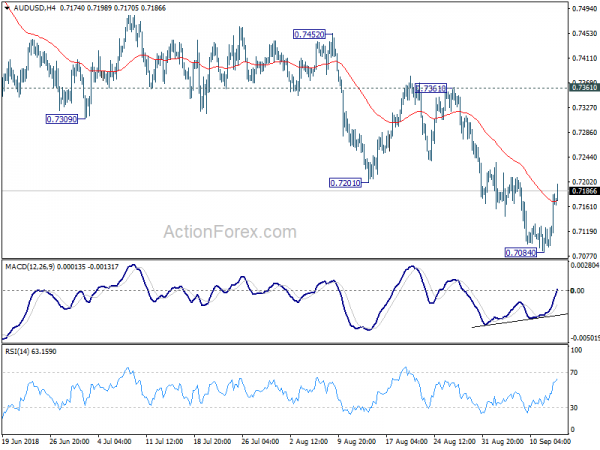

Daily Pivots: (S1) 0.7115; (P) 0.7149; (R1) 0.7205; More…

Intraday bias in AUD/USD stays mildly on the upside at this point. A short term bottom is in place at 0.7084 on bullish convergence condition in 4 hour MACD. Further rebound could be seen towards 55 day EMA (now at 0.7322). But upside should be limited well below 0.7361 resistance to bring down trend resumption. On the downside, break of 0.7084 will resume the fall from 0.8135 for key support level at 0.6826. However, sustained break of 0.7361 will carry larger bullish implication.

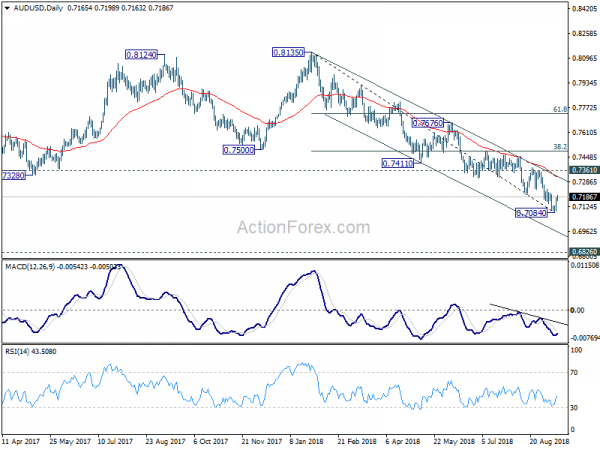

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). Current downside momentum as seen in daily and weekly MACD support this bearish case. Firm break of 0.6826 will target 0.6008 key support next (2008 low). On the upside, break of 0.7361 resistance, however, argues that a medium term bottom is possibly in place, and stronger rebound could follow. We’ll assess the medium term outlook later if this happens.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | RICS House Price Balance Aug | 2% | 2% | 4% | |

| 23:50 | JPY | Domestic CGPI Y/Y Aug | 3.00% | 3.10% | 3.10% | 3.00% |

| 23:50 | JPY | Machine Orders M/M Jul | 11.00% | 5.80% | -8.80% | |

| 01:00 | AUD | Consumer Inflation Expectation Sep | 4.00% | 4.00% | ||

| 01:30 | AUD | Employment Change Aug | 44.0K | 18.4K | -3.9K | -4.3K |

| 01:30 | AUD | Unemployment Rate Aug | 5.30% | 5.30% | 5.30% | |

| 06:00 | EUR | German CPI M/M Aug F | 0.10% | 0.10% | ||

| 06:00 | EUR | German CPI Y/Y Aug F | 2.00% | 2.00% | ||

| 07:15 | CHF | Producer & Import Prices M/M Aug | 0.10% | 0.10% | ||

| 07:15 | CHF | Producer & Import Prices Y/Y Aug | 3.40% | 3.60% | ||

| 11:00 | GBP | BoE Bank Rate | 0.75% | 0.75% | ||

| 11:00 | GBP | BoE Asset Purchase Target Sep | 435B | 435B | ||

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | ||

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | ||

| 11:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | ||

| 12:30 | EUR | ECB Press Conference | ||||

| 12:30 | CAD | New Housing Price Index M/M Jul | 0.10% | 0.10% | ||

| 12:30 | USD | CPI M/M Aug | 0.10% | 0.20% | ||

| 12:30 | USD | CPI Y/Y Aug | 2.70% | 2.90% | ||

| 12:30 | USD | CPI Core M/M Aug | 0.20% | 0.20% | ||

| 12:30 | USD | CPI Core Y/Y Aug | 2.40% | 2.40% | ||

| 12:30 | USD | Initial Jobless Claims (SEP 8) | 210K | 203K | ||

| 14:30 | USD | Natural Gas Storage | 63B | |||

| 18:00 | USD | Monthly Budget Statement Aug | -183.0B | -76.9B |