Dollar dips slightly against the Japanese Yen in early US session after weaker than expected inflation data. But loss is so far limited. And, the forex markets continue to lack a general, committed direction. Yen is trading as the strongest one for today so far, but upside is limited below yesterday’s high. Aussie is trading as the second strongest, followed by Canadian Dollar. On the other hand, Sterling is the weakest one even though recent Brexit communications have been generally positive. The problem seems to be within the UK as there are rumors that some MPs are playing to oust Prime Minister Theresa May. Euro follows as the second weakest. But it should be noted that the picture could change drastically before daily close.

In other markets, US stocks open the day nearly flat, with some weakest seen in NASDAQ. European indices are trading firmer today. At the time of writing, FTSE is up 0.21%, DAX up 0.18%, CAC up 0.71%. German 10 year bund yield fall slightly by -0.025 but stays above 0.4000 handle. Italian 10 year yield rises 0.033 but it kept well off 3.000. Crude oil is staying above 70 for now while gold is still struggling to reclaim 1200. Earlier today Asian markets closed mostly in red, with Nikkei down -0.27%, China Shanghai SSE down -0.33%, HSI down -0.29%. But Singapore Strait Times gained 0.47%.

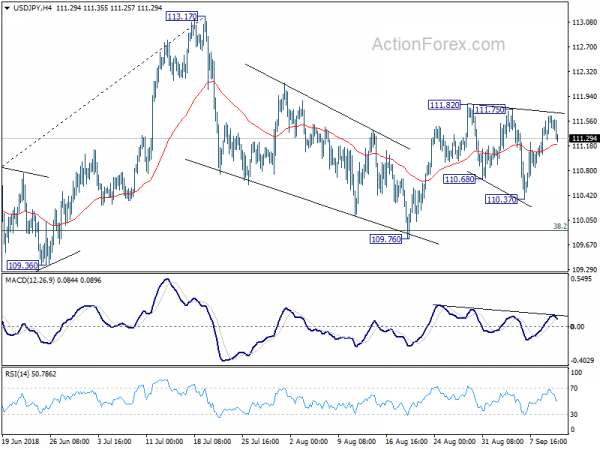

Technically, the levels to watch are basically unchanged. USD/JPY and USD/CHF weakens slightly today but remains close to 111.82 and 0.9766 resistance respectively. EUR/USD is holding in very tight range above 1.1525 support and thus, more upside is in favor. Despite losing much downside momentum, AUD/USD is held below 0.7131 minor resistance and favors more decline sooner rather than later.

US PPI posted first monthly decline since Feb 2017

In August, US headline PPI dropped -0.1% mom versus expectation of 0.2% mom rise. Year-over-year rate also slowed from 3.3% yoy to 2.8% yoy, below expectation of 3.2% yoy. Core PPI dropped -0.1% mom versus expectation of 0.2% mom. Year-over-year rate also slowed from 2.7% yoy to 2.3% yoy, below expectation of 2.8% yoy. That’s also the first monthly decline in 1.5 years February 2017. Decline in food prices and trade serves offset the increase in energy costs.

Also released today, Canada capacity utilization rose to 85.5% in Q2. Eurozone industrial production dropped -0.8% mom in July. Japan BSI large manufacturing rose to 6.5 in Q3, but missed expectation of 8. Australia Westpac consumer confidence dropped more than expected by -3.0% mom in September.

5-Star Movement denied threatening to oust EM Tria on budget

In Italy, there were rumors that the 5-Star Movement, one of the anti-establishment coalition party, threatened to oust Economy Minister Giovanni Tria if he didn’t allow EUR 10B of funding in 2019 budget for its flagship campaign. But the news was denied by 5-Star Movement. The party said in a statement “that 5-Star is putting pressure on minister Tria is unfounded, as is any reference to (requesting) his possible resignation.”

Recent comments from Tria, and leaders of both the 5-Star Movement and the League suggested that they will stick to fiscal discipline for now. That helped stabilize Italian bond markets and eased some pressure on the Euro. The more progressive measures were promised to be rolled out gradually over the next few years. Separately, Massimo Bitonci, an undersecretary at the economy ministry and a member of the League, said in a newspaper interview at the weekend that both parties would have EUR 5B each to implement their campaign promises in the 2019 budget.

Pro-Brexit MPs discussed ousting PM May, who pledged to fight on

In the UK, BBC reported that around 50 pro-Brexit MPs met to discuss how to oust Prime Minister Theresa May. The so called European Research Group, who prefers a clearer divorce with the EU, met yesterday with comments like “everyone I know says she has to go”, “she’s a disaster” and “this can’t go on,” flowing around. It’s clearly that Brexiteers are unhappy with the Chequers plan for the close tie with EU after Brexit.

May’s spokesman said today that she would fight any attempt by her lawmakers to oust her. Also,the spokesman added “we have been working on the issue of the Northern Irish border for two years and we have looked at a significant number of potential solutions and we believe that the plan put forward by Chequers is the only credible and negotiable one.”

EU Juncker pushes to strengthen Europe’s role in the world stage

In his annual State of the Union address, European Commission President Jean-Claude Juncker urged the EU to “become a more sovereign actor on the world stage.” He added that “if Europe were to unite all the political, economic and military might of its nations, its role in the world could be strengthened.” And, “we will always be a global payer but it is time we started being a global player too.”

His proposals include promoting the euro currency abroad to compete with the US dollar, maintaining close ties with the UK after Brexit through free trade agreement, new rules to crack down on cross-border terrorism, tackling migration by increasing resources to the EU border and coastguard and, a trade deal with Africa for attracting investments and job creation.

On Brexit, Juncker said “I welcome Prime Minister May’s proposal to develop an ambitious new partnership for the future, after Brexit. We agree with the statement made in Chequers that the starting point for such a partnership should be a free trade area between the United Kingdom and the European Union.”

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 111.22; (P) 111.43; (R1) 111.81; More…

USD/JPY dips mildly after failing to break out 111.75/82 resistance zone. But downside is contained above 4 hour 55 EMA (now at 111.20) so far. Intraday bias remains neutral at this point. And intraday bias stays neutral first. On the upside, break of 111.73 minor resistance will suggest that the rise from 109.76 is resuming. And intraday bias will be turned back to the upside for retesting 113.17 high. Decisive break there will resume larger rally from 104.62. On the downside, below 110.37 will bring deeper fall. But strong support is expected from 38.2% retracement of 104.62 to 113.17 at 109.90 to contain downside and bring rebound.

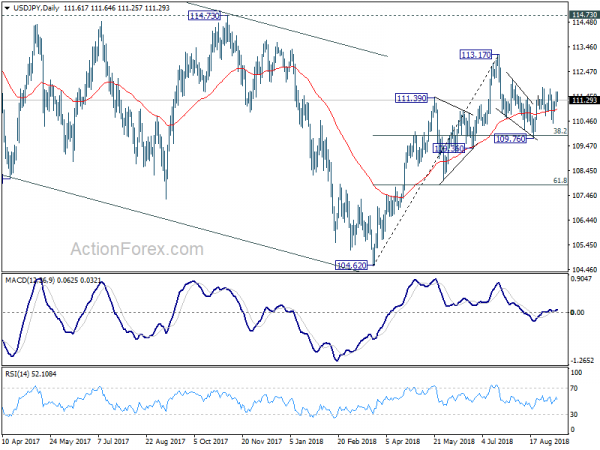

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.36 support holds. However, decisive break of 109.36 will mix up the outlook again. And deeper fall should be seen back to 61.8% retracement of 104.62 to 113.17 at 107.88 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BSI Large Manufacturing Q/Q Q3 | 6.5 | 8 | -3.2 | |

| 00:30 | AUD | Westpac Consumer Confidence M/M Sep | -3.00% | -2.30% | ||

| 09:00 | EUR | Eurozone Industrial Production M/M Jul | -0.80% | -0.50% | -0.70% | |

| 12:30 | CAD | Capacity Utilization Rate Q2 | 85.50% | 86.90% | 86.10% | 83.70% |

| 12:30 | USD | PPI M/M Aug | -0.10% | 0.20% | 0.00% | |

| 12:30 | USD | PPI Y/Y Aug | 2.80% | 3.20% | 3.30% | |

| 12:30 | USD | PPI Core M/M Aug | -0.10% | 0.20% | 0.10% | |

| 12:30 | USD | PPI Core Y/Y Aug | 2.30% | 2.80% | 2.70% | |

| 14:30 | USD | Crude Oil Inventories | -1.3M | -4.3M | ||

| 18:00 | USD | Federal Reserve Beige Book |