Sterling surged sharply today as once against lifted by Brexit. The direct trigger isn’t clear but it’s believed to be comments by EU Barnier. Dollar is following as the second strongest with help from another set of solid non-farm payroll data. In particular, wage growth beat an already high expectation. Despite a terribly week job report, Canadian Dollar is still trading as the third strongest one. BoC Senior Deputy Governor Carolyn Wilkins assured the market yesterday that it’s on track for more rate hike despite NAFTA uncertainties

Australian Dollar and New Zealand Dollar are trading as the weakest ones for today. Worries over escalation of US-China trade war are weighing on these two currencies. The public hearing on US 25% tariffs on USD 200B in Chinese goods has completed. Trump is ready to fire another shot any time. And, without a doubt, China’s retaliation of USD 60B in US imports will follow. Euro is following as the third weakest for now, partly due to heavy selling in EUR/GBP.

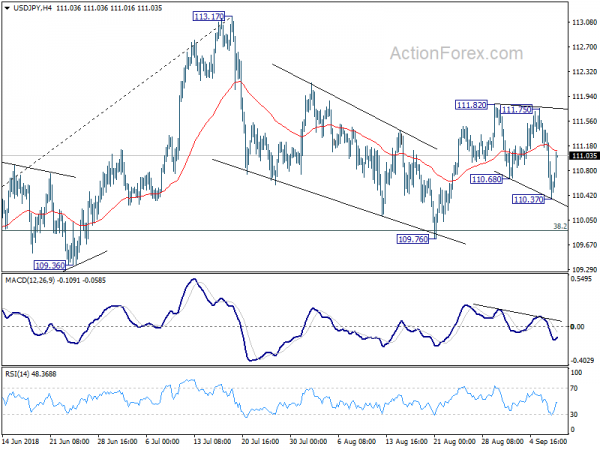

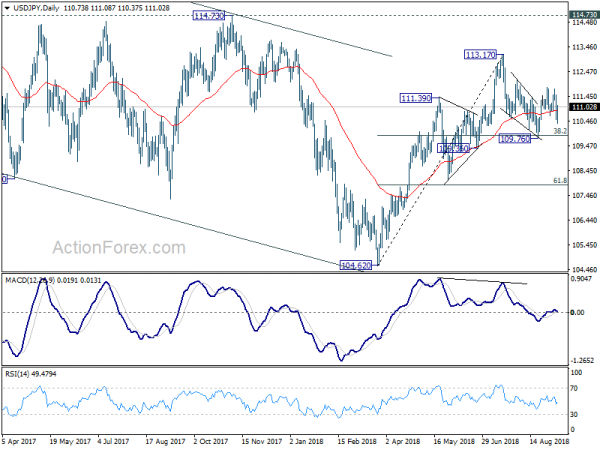

Technically, EUR/GBP’s break of 0.8937 support now indicates near term reversal. That is, rise from 0.8620 might have completed earlier than expected. Near term outlook is turned bearish for deeper fall. GBP/USD is having its sight on 1.3042 resistance for resuming the corrective rebound form 1.2661. On the other hand, EUR/USD is having its sight on 1.1529 for completing equivalent corrective rebound from 1.1300. USD/CHF looks like having defended 0.9651 support and could recover further towards 0.9766 minor resistance. USD/JPY and USD/CAD could be heading back to 111.82 and 1.3225 resistance respectively.

Dollar surges as NFP added 201k, wage grew 0.4%, Canadian pressured after terrible job data

Dollar surges in after another set of strong non-farm payroll report. The headline number showed 201k growth in August, comparing to expectation of 194k. Prior month’s figure was revised down from 157k to 147k though. Unemployment rate was unchanged at 3.9%. The bigger surprise, and Dollar driving one, is average hourly earnings which showed 0.4% mom growth, above expectation of 0.3% mom.

Canadian job data is very disappointing. The employment market contracted by -51.6k in August, nearly undoing all the 54.1k growth in July. That’s also was below expectation of 5.1k growth. Unemployment rate also rose to 6.0%, up from 5.8% and higher than expectation of 5.9%.

EU Barnier on Brexit: no-deal scenario is not our scenario; it is not my scenario

Sterling surges broadly today in mid European session. There is no apparent trigger or Brexit headline flowing through. Some pointed to a transcript of EU chief negotiator Michel Barnier at the UK House of Commons, where he mentioned that EU is “open to discussing other backstops” regarding the Irish order, as a trigger. But we’d say, if that document is the cause of the rally, then it’s more likely that Barnier said “no-deal scenario is not our scenario; it is not my scenario.”

China FX reserve dropped $8.2B in Aug, no large scale direction intervention yet

China’s foreign currency holding dropped slightly by USD 8.2B to USD 3.110T in August, down from USD 3.118T. But that’s still lower than market expectation of USD 3.115T. Nonetheless the data showed that China’s capital control measures worked reasonable well so far and thus, there was no imminent need to large scale direct intervention.

Back in August, China restarted a reserve requirement on foreign exchange forward trading. Also, a counter-cyclical factor in daily pricing of Yuan was reinstated. USD/CNH (off-shore Yuan) surged sharply since March low at 6.2359 to as high as 6.9586 as trade tension with US escalated.

On the data front

Eurozone GDP was finalized at 0.4% qoq in Q2. Germany trade surplus narrowed to EUR 15.8B in July, industrial production dropped -1.1% mom in July. Swiss foreign current reserves dropped to CHF 731B in August, unemployment was unchanged at 2.6%. Australia AiG performance on construction dropped to 51.8 in August, down from 52.0. Home loans rose 0.4% mom in July versus expectation of -0.1% mom. Japan household spending rose 0.1% yoy in July versus expectation of -0.8% yoy. Labor cash earnings rose 1.5% yoy versus expectation of 2.4% yoy.

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 110.32; (P) 110.93; (R1) 111.34; More…

USD/JPY’s strong rebound surges that corrective fall from 111.89 has completed with three waves down to 110.37. Intraday bias is back on the upside for 111.82 first. Break will resume the rebound from 109.76 and target 113.17. For now, we’re holding on to the view that correction from 113.17 has completed at 109.76. Hence, even in case of another decline, we’d continue to expect strong support from 38.2% retracement of 104.62 to 113.17 at 109.90 to contain downside and bring rebound.

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.36 support holds. However, decisive break of 109.36 will mix up the outlook again. And deeper fall should be seen back to 61.8% retracement of 104.62 to 113.17 at 107.88 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Aug | 51.8 | 52 | ||

| 23:30 | JPY | Overall Household Spending Y/Y Jul | 0.10% | -0.80% | -1.20% | |

| 00:00 | JPY | Labor Cash Earnings Y/Y Jul | 1.50% | 2.40% | 3.60% | 3.30% |

| 01:30 | AUD | Home Loans M/M Jul | 0.40% | -0.10% | -1.10% | -0.80% |

| 05:00 | JPY | Leading Index CI (JUL P) | 103.50% | 103.50% | 104.70% | |

| 05:45 | CHF | Unemployment Rate Aug | 2.60% | 2.60% | 2.60% | |

| 06:00 | EUR | German Trade Balance (EUR) Jul | 15.8B | 19.1B | 19.3B | |

| 06:00 | EUR | German Industrial Production M/M Jul | -1.10% | 0.20% | -0.90% | |

| 07:00 | CHF | Foreign Currency Reserves (CHF) Aug | 731B | 750B | ||

| 07:30 | GBP | Halifax House Prices M/M Aug | 0.10% | 0.50% | 1.40% | |

| 09:00 | EUR | Eurozone GDP Q/Q Q2 F | 0.40% | 0.40% | 0.40% | |

| 12:30 | CAD | Net Change in Employment Aug | -51.6K | 5.1K | 54.1K | |

| 12:30 | CAD | Unemployment Rate Aug | 6.00% | 5.90% | 5.80% | |

| 12:30 | USD | Change in Non-farm Payrolls Aug | 201K | 194K | 157K | 147K |

| 12:30 | USD | Unemployment Rate Aug | 3.90% | 3.90% | 3.90% | |

| 12:30 | USD | Average Hourly Earnings M/M Aug | 0.40% | 0.30% | 0.30% | |

| 14:00 | CAD | Ivey PMI Aug | 62.3 | 61.8 |