After sharp volatility overnight, the forex markets relatively calm in Asian session. Australian Dollar is trading as the weakest one so far with larger than expected trade surplus providing no support. Dollar follows as the second weakest as it turned soft after the rally attempt failed. Canadian Dollar and New Zealand Dollar are also weak. On the other hand, Swiss Franc and Japanese Yen are back in control with the help of risk aversion. Yesterday’s selloff in European stocks were rather serious with key levels taken out. Sentiments stabilized in US and Asia, but sentiments are rather vulnerable.

One development to note was the sharp volatility in Sterling. It was firstly shot up by a Bloomberg report saying that Germany and UK made concessions on Brexit negotiation. But then the Pound was knocked down after German government spokesman cleared the air and said the position on Brexit is unchanged. Also, the spokesman said Germany has full trust in EU chief negotiator Michel Barnier. Bloomberg, and Reuters too, have been frequently used by unnamed sources to distribute false information. The motive of yesterday’s news was uncertain and maybe someone wanted to undermine Barnier’s position. But we have to be very careful on theses types of market moving news. Anyway, it shows once again that Sterling is very sensitive to Brexit headlines.

Technically, we’d like to point out the development in European indices first. FTSE lost -1% , DAX down -1.39% and CAC down -1.54% yesterday. CAC has broken 5281.78 support and the key one, 5242.64 is in sight. DAX was even worse with 12104.41 support taken out rather firmly. DAX also broke out from a triangle pattern. Further decline would likely be seen back to 11726.62 next. It’s a factor that could weigh down Euro and lift Swiss Franc.

In the currency markets, yesterday’s rebound in EUR/USD and GBP/USD suggests that Dollar’s correction is not finished yet. The two pairs could revisit 1.1733 and 1.3042 respectively. USD/CHF was also rejected by 0.9975 resistance and it’s heading back to 0.9651 support. Dollar will look into ISM services today and non-farm payrolls tomorrow for rescue.

US-Canada trade talk resumed, making good progress

Canadian Foreign Affairs Minister Chrystia Freeland returned to the table with US Trade Representative Robert Lighthizer yesterday. She said the talks were constructive and they’re “making good progress”. She added that “we continue to get a deeper and deeper understanding of the concerns on both sides.” But Freeland declined to comment on how close the two sides were. The negotiation is still work in progress as Freeland’s team have sent the US “a number of issues to work on and they will report back to us in the morning (Thursday), and we will then continue our negotiations.”

Trump continued his bluff as he told reporters that if the talk doesn’t work out, “that’s going to be fine for the country, for our country.” However, “It won’t be fine for Canada”. He also reiterated that the US has a “very strong position” in the negotiation. At the same time, Canada and other countries “have been taking advantage of the United States for many years.”

Canadian Prime Minister Justin Trudeau reiterated his firm stance on the Chapter 19 dispute resolution mechanism, that was seen as a “red line” Trump. Trudeau emphasized that “We need to keep the Chapter 19 dispute resolution because that ensures that the rules are actually followed. And we know we have a president who doesn’t always follow the rules as they’re laid out.”

BoC stood pat, affirmed October hike

Yesterday, BOC left the policy rate unchanged at 1.5%. Comments from Governor Stephen Poloz also signaled that a rate hike in October is highly likely. Yet, the market interpreted the message sent in the meeting was more cautious than previously. While acknowledging strong growth in the second quarter, the members affirmed that the economy is “closely in line” with projections. While noting accelerated inflation in July, the members blamed the idiosyncratic factors as causing volatility. While admitting that the economy has been “operating near capacity for some time:, it warned of the ongoing moderate wage growth. While guiding the next policy action as a rate hike, the central bank emphasized the uncertainty of NAFTA negotiations on inflation outlook. More in BOC Affirmed the Case of October Rate Hike, Downplayed Strong Growth and Inflation.

Also on BoC:

Fed Bullard: Yield curve and TIPS suggest monetary policy already neutral or somewhat restrictive

St. Louis Fed President James Bullard gave remarks titled “How to Extend the U.S. Expansion: A Suggestion” today. There he argued that empirical Phillips curve relationships have largely broken down in the last two decades. That is, the relationship between inflation and unemployment “began to disappear”. He suggested Fed to consider financial market information in its monetary policy setting. The yield curve is taken as a good predictor of future real economic activity. The Treasury Inflation-Protected Securities (TIPS) provides indications on inflation expectations.

Bullard said:

- The yield curve information suggests that financial markets do not see excessive real growth or excessive inflationary pressure over the forecast horizon.

- The TIPS-based inflation compensation data suggest that markets do not expect the FOMC to achieve the 2 percent inflation target on average on a PCE basis over the next decade.

Combined, theses two market indicators argued that “current monetary policy stance is already neutral or possibly somewhat restrictive.”

BoJ Kataoka criticizes move to allow wider JGB yield band

BoJ board member Goushi Kataoka criticized the central bank’s recent move to allow 10 year JGB yield to fluctuate in a larger range of -0.1% to 0.1%. He said in a speech that “there’s no need to allow long-term interest rates to move in a wider range at a time when the BOJ is cutting its inflation forecasts.” He added that “allowing long-term rates to rise at a time inflation and inflation expectations aren’t heightening much could delay achievement of the BoJ’s price target.” Also, Kataoka warned “global trade frictions are intensifying and there’s no room for complacency”.

Kataoka is a known dove who dissented the decision to keep policy unchanged in every meeting since joining the board in 2017. Instead, he persistently pushed for more aggressive easing, targeting to keep JGB yields at 0% beyond 10 year maturity.

On the data front

Australia trade surplus narrowed to AUD 1.55B in July, slightly above expectation of AUD 1.46B. Swiss GDP and Germany factory orders will be released in European session.

US data is the major focus today. ADP employment, jobless claims, ISM services and factory orders will be featured. Canada will also release building permits later in the day.

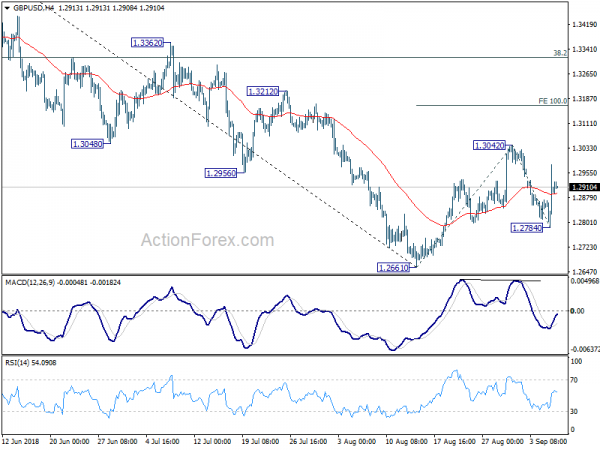

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2799; (P) 1.2891; (R1) 1.2997; More…

Intraday bias in GBP/USD remains mildly on the upside at this point. Current development suggests that corrective rebound from 1.2661 hasn’t completed yet. Break of 1.3042 will target 100% projection of 1.2661 to 1.3042 from 1.2784 at 1.3165. But upside should be limited by 1.3316 key fibonacci level to complete the corrective rise and bring near term reversal. On the downside, below 1.2784 support will bring retest of 1.2661 low.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4099). The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend. And this will be the preferred case as long as 38.2% retracement of 1.4376 to 1.2661 at 1.3316 holds. However, firm break of 1.3316 would bring stronger rebound to 61.8% retracement at 1.3721. And, the eventual depth of the fall from 1.4376, and the chance of hitting 1.1946 low, will depend on the strength of the interim corrective rebound from 1.2661.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | Trade Balance (AUD) Jul | 1.55B | 1.46B | 1.87B | 1.94B |

| 5:45 | CHF | GDP Q/Q Q2 | 0.50% | 0.60% | ||

| 6:00 | EUR | German Factory Orders M/M Jul | 1.60% | -4.00% | ||

| 11:30 | USD | Challenger Job Cuts Y/Y Aug | -4.20% | |||

| 12:15 | USD | ADP Employment Change Aug | 188K | 219K | ||

| 12:30 | CAD | Building Permits M/M Jul | 0.70% | -2.30% | ||

| 12:30 | USD | Initial Jobless Claims (SEP 1) | 214K | 213K | ||

| 12:30 | USD | Nonfarm Productivity Q2 F | 2.90% | 2.90% | ||

| 12:30 | USD | Unit Labor Costs Q2 F | -0.90% | -0.90% | ||

| 13:45 | USD | Services PMI Aug F | 55.2 | 55.2 | ||

| 14:00 | USD | ISM Non-Manufacturing/Services Composite Aug | 56.9 | 55.7 | ||

| 14:00 | USD | Factory Orders Jul | -0.10% | 0.70% | ||

| 14:30 | USD | Natural Gas Storage | 70B | |||

| 14:30 | USD | Crude Oil Inventories | -2.6M |