Euro suffers broad based selling today, except versus Australian Dollar, as Turkish Lira crisis re-emerges. Notable rally is seen in USD/TRY which is up around 3% at the time of writing. On the other hand, Sterling, Swiss Franc and Dollar take advantage of the situation and rises broadly. Canadian Dollar is mildly softer as markets are awaiting day 2 of trade talks between Canada and the US. “MILK” is believed to be a main issue as White House top economic advisor Larry Kudlow indicated. But given then Mexico has concessions in their part, the progress could be quick for US and Canada.

In other markets, European stocks are mixed with FTSE trading down -0.31% at the time of writing. DAX is up 0.11% while CAC is up 0.20%. German 10 year bund yield is up 0.019 an breaches 0.4 handle. The move is driven by news that German government could eventually provide financial aid to Turkey to guard off contagion. The rise in German yield could continue to push US treasury yield higher today. Gold is now in consolidative mode but appears to be holding 1200 handle well.

Released in US Q2 GDP growth was revised up to 4.2% qoq, from 4.1% qoq. GDP price index was unrevised at 3.0%. Canada currency account deficit narrowed to CAD -15.9B in Q2.

Turkish Lira down another 3% on concern of funding crisis

The Turkish Lira suffers another round off selling today with USD/TRY up over 3% above 6.45. It started as Moody’s downgraded credit rating of twenty Turkish financial institutions yesterday. Moody’s warned that “there is a heightened risk of a downside funding scenario, where a deterioration in investor sentiment limits access to market funding.” And, “Turkish banks are highly reliant on foreign currency funding.”

Moody’s also warned that “In the next 12 months around USD77 billion of foreign currency wholesale bonds and syndicated loans, or 41% of the total market funding, needs to be refinanced. The Turkish banks hold around USD48 billion of liquid assets in foreign currency and have USD57 billion compulsory reserves with the Central Bank of Turkey, which would not be entirely available.”

The Turkish central bank CBRT said today that it’s altering banks’ borrowing limits for overnight transactions, which effectively tightens liquidity by ending unrestricted funding it has offered since Aug. 13. However, adding to other measures of the central bank, there is no sustainable impact on the weakness in the Lira, not to mention tackling double-digit inflation and widening current-account deficit.

USD/TRY is rising another 3% today and hits as high as 6.4732. Break of 6.346 minor resistance confirms resumption of rebound from 5.6919. Further rise would be seen to 61.8% retracement to of 7.2068 to 5.6919 at 6.6281. Firm break there will put 7.000 handle back into focus. And such development could weigh on Euro again.

German Gfk consumer climate dropped -0.1 to 10.5, mixed consumer mood

German Gfk consumer climate for September dropped -0.1 to 10.5 , below expectation of 10.6. Gfk noted that consumer mood “did not present a uniform picture”. There was improvement in economic expectations, stopping multi-month downswing. consumers believed in the economy’s solid growth trend despite trade conflict with the US. But income expectations and propensity to buy declined. Higher energy prices could have been a reason. Also, savings are increasingly losing value due to inflation.

Over all, Gfk noted that “the positive outlook for the consumer economy will only continue as is if the job market remains stable, which is the current assumption, and there are no additional risks threatening from the price front. A further increase in inflation would certainly dampen the consumer climate. ”

From France, Q2 GDP grew 0.2% qoq, unrevised from initial estimate.

UK in shop price inflation for the first time in five years

UK BRC shop price index rose 0.1% yoy in August, up from July’s -0.3% yoy fall. More importantly, that’s the first rise in over five years, breaking a deflation cycle of 63 months. BRC noted in the release that “both higher food price inflation and lower non-food price deflation contributed to the return of Shop Prices to inflation”. However, Shop Price inflation remains well below headline CPI as a result of “high levels of competition”.

BRC Chief Executive Helen Dickinson noted that for now, “retailers are keeping price increases faced by consumers to a minimum”. However, “current inflationary pressures pale in comparison to potential increases in costs retailers will face in the event the we leave the EU without a deal”. And if that happens, “retailers will not be able to shield consumers from price increases.” She also urged that “the EU and UK negotiating teams must deliver a Withdrawal Agreement in the coming weeks to avoid the severe consequences that would result from such a cliff edge scenario next March.”

EUR/USD Mid-Day Outlook

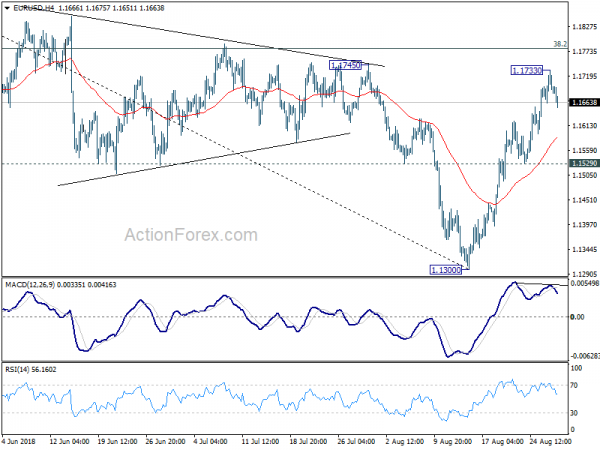

Daily Pivots: (S1) 1.1661; (P) 1.1698; (R1) 1.1732; More…..

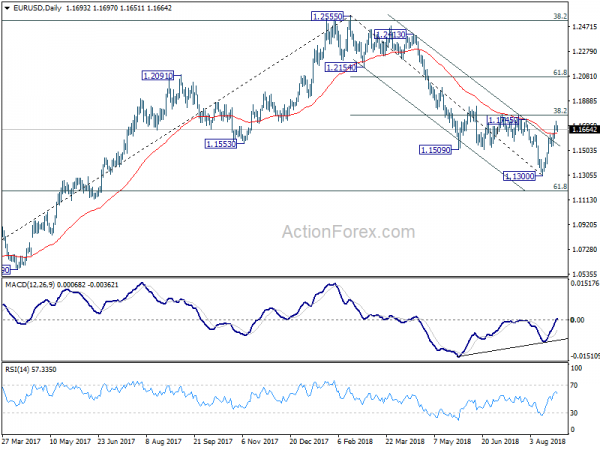

A temporary top is in place at 1.1733 in EUR/USD with today’s retreat. Intraday bias is turned neutral first. While further rise cannot be ruled out yet, we’d continue to expect strong resistance from 38.2% retracement of 1.2555 to 1.1300 at 1.1779 to limit upside, at least on first attempt, to bring near term reversal. On the downside, break of 1.1529 minor will indicate completion of the rebound and turn bias to the downside for retesting 1.1300 low. After all, consolidation from 1.1300 will extend for a while before completion.

In the bigger picture, a medium term bottom should be in place at 1.1300, on bullish convergence condition in daily MACD and some consolidations would be seen. But still, note that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Thus, we’d expect fall from 1.2555 high to resume after consolidation completes. Below 1.1300 should send EUR/USD through 61.8% retracement of 1.0339 to 1.2555 at 1.1186. And, in that case, EUR/USD would head to retest 1.0339 (2017 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Aug | 0.10% | -0.30% | ||

| 05:00 | JPY | Consumer Confidence Index Aug | 43.3 | 43.4 | 43.5 | |

| 06:00 | EUR | German GfK Consumer Confidence Sep | 10.5 | 10.6 | 10.6 | |

| 06:45 | EUR | French GDP Q/Q Q2 P | 0.20% | 0.20% | 0.20% | |

| 12:30 | CAD | Current Account Balance (CAD) Q2 | -15.9B | -18.0B | -19.5B | -17.5B |

| 12:30 | USD | GDP Annualized Q/Q Q2 S | 4.20% | 4.00% | 4.10% | |

| 12:30 | USD | GDP Price Index Q2 S | 3.00% | 3.00% | 3.00% | |

| 14:00 | USD | Pending Home Sales M/M Jul | 0.30% | 0.90% | ||

| 14:30 | USD | Crude Oil Inventories | -0.7M | -5.8M |