Canadian Dollar remains firms today as Canada-US trade negotiation restarted. Initial signs are positive but more work is needed to be done, swiftly. Australian and New Zealand Dollar follow as Asians stocks strengthen mildly. Yen is trading as the weakest one on risk appetite, followed by Sterling as there is no progress on Brexit talks. For the weak, Canadian Dollar is the strongest one, followed by Swiss Franc. Dollar is in red across the board, followed by Yen.

In other markets, Nikkei is up 0.68% at 22968.18 at the time of writing, still off key resistance at 23050.39. Hong Kong HSI is up 0.14% and Singapore Strait Times is up 0.17%. China Shanghai SSE continues to lag behind other Asian indices and is down -0.35%. The development suggests that the US is softening its stance on trade with key allies. But it’s not even time for a talk with China yet. Overnight, DOW closed up 0.06%. S&P 500 and NASDAQ were up 0.03% and 0.15% respectively. Gold lost some momentum after hitting 1214 and has turned into consolidation, back pressing 1200.

Technically, the first thing to note is the lost of momentum in stocks. Despite making new record highs, both S&P 500 and NASDAQ were bounded in tight range overnight. Both have also closed down yesterday’s open. Similarly, DAX and CAC also reversed gains yesterday despite trade optimism, with DAX down -0.09% and CAC 0.11%. Nikkei is feeling some strong resistance ahead of 23050 resistance. Hence, barring any drastic news, we’d probably see risk appetite eases a bit.

Secondly, Sterling and Aussie are both rather weak indeed even though the headlines are on Dollar and Yen. As risk appetite recedes, there’s a chance for Dollar and Yen to have a mild come back. And in that case, GBP/USD, AUD/USD, GBP/JPY and AUD/JPY could face some pressure.

Canada Freeland had very constructive meeting with Lighthizer, but MILK is the word

Canadian Dollar trades firmer in Asian session today and remains the strongest one for the week. All eyes are on the trade negotiations between Canada and the US. Canadian Foreign Minister Chrystia Freeland, who cut short a European trip to Washington, said she had “very constructive meeting” with US Trade Representative Robert Lighthizer yesterday, and the meeting will continue today. She failed that Mexico had made some “significant concessions” in the are of labor and auto rules of original. And that has “really paved the way for what Canada believes will be a good week”.

Dairy products is believed to be a key area that the US will press Canada on. White House top economic adviser Larry Kudlow said in a TV interview that “there’s a word that Canada has trouble with and it’s M-I-L-K. Milk. Anything to do with milk and dairy — they have this government-run, centrally planned system and some tariffs run upwards of 300 per cent. They’re going to have to fix that.” And, Kudlow warned that “the president did say if he cannot satisfactorily negotiate with [Canada] he may have to go to a large 20 to 25 per cent tax on Canadian automobiles headed for the U.S.” Trump also imposed a Friday deadline for Canada to join the U.S, and Mexico, which is when the administration plans to give Congress its mandatory 90-day notification of the new trade deal.

According to a report by the Globe and Mail, Canada is ready to make a major concession on Diary products.

UK in shop price inflation for the first time in five years

UK BRC shop price index rose 0.1% yoy in August, up from July’s -0.3% yoy fall. More importantly, that’s the first rise in over five years, breaking a deflation cycle of 63 months. BRC noted in the release that “both higher food price inflation and lower non-food price deflation contributed to the return of Shop Prices to inflation”. However, Shop Price inflation remains well below headline CPI as a result of “high levels of competition”.

BRC Chief Executive Helen Dickinson noted that for now, “retailers are keeping price increases faced by consumers to a minimum”. However, “current inflationary pressures pale in comparison to potential increases in costs retailers will face in the event the we leave the EU without a deal”. And if that happens, “retailers will not be able to shield consumers from price increases.” She also urged that “the EU and UK negotiating teams must deliver a Withdrawal Agreement in the coming weeks to avoid the severe consequences that would result from such a cliff edge scenario next March.”

IMF: Substantial time lag in transmission of Eurozone labor market improvements to inflation

In an IMF blog article titled “Euro Area Inflation: Why Low For So Long?“, the puzzle of the broken relationship of core inflation and unemployment was discussed. The study found that the key is “strong persistence of euro area inflation”. That is, for example, “coefficient on past inflation is high, much higher than for US inflation”. Also, “coefficient on inflation expectations is much lower for the euro area than for the US”.

In layman terms, the implication is that “in the euro area, following a period of weak demand and low inflation, it will take a much longer period of strong demand to get inflation back to the inflation objective”. Or in more technical term, ” there is a substantial time lag in the transmission of improving labor market developments to prices.”

The implication to ECB’s monetary policy is that it reinforces the case for being “patient, prudent and persistent”. And, that will “support the slow process of returning inflation to its objective, through both stronger demand and well anchored inflation expectations.”

Looking ahead

German Gfk consumer sentiment and French Q2 GDP will be featured in European session. Later in the day, US will release Q2 GDP revision and pending home sales. Canada will release current account for Q2.

USD/CAD Daily Outlook

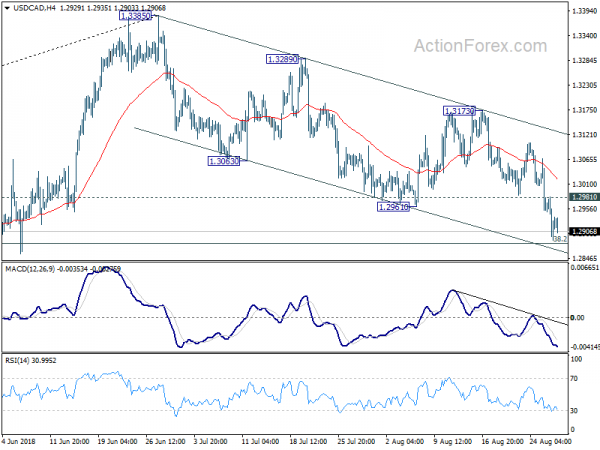

Daily Pivots: (S1) 1.2884; (P) 1.2934; (R1) 1.2979; More…

USD/CAD reaches as low as 1.2886 so far and intraday bias stays on the downside. Sustained break of 1.2879 fibonacci level will add to the case of medium term reversal and target next fibonacci level at 1.2567. On the upside, above 1.2981 minor resistance will turn intraday bias neutral first. But for now, near term outlook will stay cautiously bearish as long as 1.3173 resistance holds.

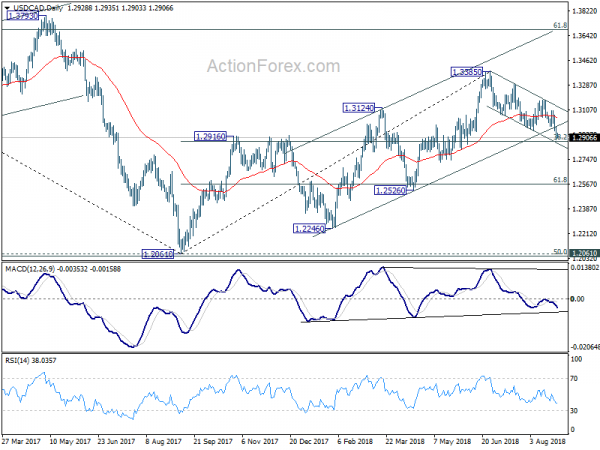

In the bigger picture, the break of channel support (now at 1.2988), argues that rise from 1.2246, as well as that from 1.2061, has completed at 1.3385. Focus is back on 38.2% retracement of 1.2061 to 1.3385 at 1.2879. Decisive break there will affirm the case of medium term reversal and target 61.8% retracement at 1.2567 and below. That will also put key long term support at 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048 into focus. On the upside, break of 1.3173 resistance will revive the bullish case and target 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:01 | GBP | BRC Shop Price Index Y/Y Aug | 0.10% | -0.30% | ||

| 5:00 | JPY | Consumer Confidence Index Aug | 43.4 | 43.5 | ||

| 6:00 | EUR | German GfK Consumer Confidence Sep | 10.6 | 10.6 | ||

| 6:45 | EUR | French GDP Q/Q Q2 P | 0.20% | 0.20% | ||

| 12:30 | CAD | Current Account Balance (CAD) Q2 | -18.0B | -19.5B | ||

| 12:30 | USD | GDP Annualized Q/Q Q2 S | 4.00% | 4.10% | ||

| 12:30 | USD | GDP Price Index Q2 S | 3.00% | 3.00% | ||

| 14:00 | USD | Pending Home Sales M/M Jul | 0.60% | |||

| 14:30 | USD | Crude Oil Inventories | -5.8M |