Be it NAFTA or United States-Mexico Trade Agreement, the markets global markets cheer the conclusion of the bilateral deal. DOW ended up 1.01% at 26049.54. S&P 500 and NASDAQ extended record runs, gained 0.77% to 2896.74 and 0.91% to 8017.909 respectively. Asian markets are also generally higher. At the time of writing, Nikkei is up 0.40%, Singapore Strait Times is up 0.96%, Hong Kong HSI is up 0.24%. But China Shanghai SSE is flat only. Gold is pressing 1210 as recent rebound is in progress.

In the currency markets, Dollar recovers some ground today after yesterday’s selloff. Euro follows as the second strongest for today, and then Canadian Dollar. Australian Dollar and New Zealand Dollar are the first and second weakest for today. For the week as a whole, Euro is overwhelmingly the strongest one followed by Canadian Dollar. Both are boosted by hope of trade deal with the US and material decrease in auto-tariffs threat. Aussie and Kiwi are also the weakest ones as they’re passer-by in the current trade development. Yen also turns weaker following risk appetite finally.

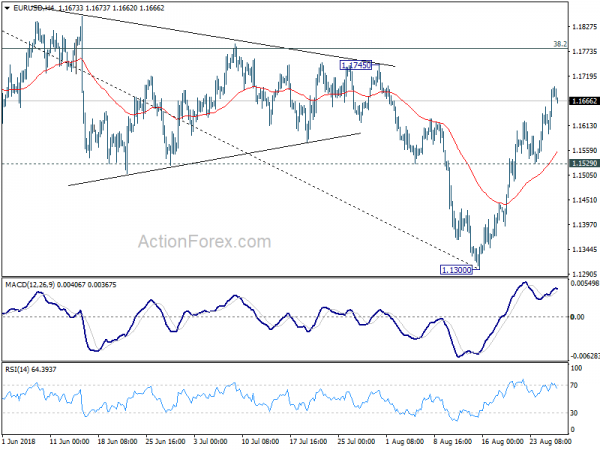

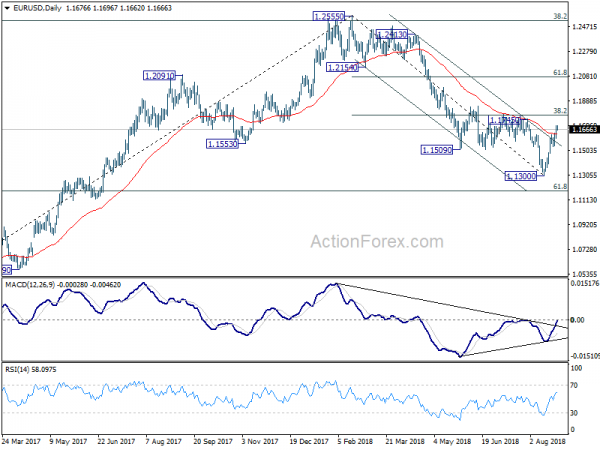

Technically, USD/CAD’s break of medium term channel support carries some bearish implications And focus will be turned to 1.2879 fibonacci level. EUR/USD is on track to 1.1745 resistance as rebound from 1.1300 is still in good shape. Euro is indeed having solid upside momentum against Sterling and Yen too. GBP/USD and AUD/USD, however, are staying in familiar range. A recovery in Dollar could put 1.1798 in GBP/USD and 0.7237 in AUD/USD in to focus.

Trump’s concession on sunset clause shows willingness to deal with key allies

The most notable breakthrough in the US-Mexico negotiation is Trump’s concession on the so called “sunset clause”. In the original NAFTA re-negotiation, the US demanded that the agreement would automatically terminate every five years unless all the countries agreed to continue. This has been one of the show stoppers all the way . But now, US Trade Representative Robert Lighthizer, said both countries agreed to review the trade deal every six years. If problems cannot be resolved, the agreement can be terminated 10 a decade after the review. If one of the parties refuses to renew, a yearly review would take effect to address the issues.

The move showed that the Trump is backing down from his hard line stance, for business pressures ahead of election, or whatever reason. Such softening in stance could give way to more concessions to major allies of the US, like Canada, and more importantly the EU. Now, the threat of auto tariffs have materially diminished after the US-Mexico breakthrough. The White House also said that German Chancellor Angel Merkel talked to Trump on phone yesterday. And the two leaders “strongly supported ongoing discussions between Washington and Brussels to remove barriers to a deeper trading relationship.”

The movements in the forex markets clearly reflect the implications of the development. Euro is trading as the strongest one for the week, followed by Canadian Dollar.

Canada in tricky but positive spot in trade negotiation with US

Canadian Foreign Minister Chrystia Freeland is expected to travel to Washington to “reset” the trade talks today. And the situation is tricky for the country. Trump appeared to want to play an upper hand by saying that “we’ll give them a chance to have a separate deal, or we could put it into this deal.” On the other hand, Freeland’s office sounded firm and said Canada “will only sign a new NAFTA that is good for Canada and good for the middle class.”

And what’s more confusing is that Trump made himself clear again he is ditching NAFTA, which is a “ripoff”. But Mexican president Enrique Peña Nieto constantly refer to the name of NAFTA, sounding like this is the agreement in negotiation. And, Republicans are also clear that a final agreement should include Canada. Sen. John Cornyn also indicated that a final agreement with Canada has “bipartisan support”.

Technically, in the US-Mexico agreed deal, percentage of auto-parts must be produced in North America increases from 62% to 75%. And, at least 40% of vehicles must come from suppliers paying at least USD 16 an hour on workers. Mexico’s Economy Minister Ildefonso Guajardo said that “the whole issue of rules of origin is considered trilaterally, so if we go forward with a bilateral model it would need to be rethought.” And he added that “it’s not the same having integration between three countries as two.”

So, Trump’s verbal threats to Canada are more likely bluffs than substance. Good news is more likely than bad when Freeland comes out of Washington.

Trump: Not the right time for trade talk with China

There is breakthrough in US-Mexico trade talk, which will likely pave the way for Canada. There is progress in US-EU trade talks too. But how about China? Trump is clear with his priority as he said yesterday that “it’s just not the right time to talk right now, to be honest with China.” He went further and added that “it’s too one-sided for too many years and too many decades, and so it’s not the right time to talk.” Though, he said “eventually I’m sure that we’ll be able to work out a deal with China.” US Trade Representative Robert Lighthizer said that “we have to change the way we work with China”, without giving any detail.

This could explain why all Asian stocks surge today but China SSE is left behind. Yuan was lifted since the PBoC reintroduced measures last Friday that acts counter-cyclical to market forces to keep Yuan from falling too quickly. But the Yuan is quickly losing some momentum already.

On the data front

Eurozone will release M3 money supply in European session. US will release trade balance, wholesale inventories, S&P Case-Shiller house price and consumer confidence later in the day.

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1618; (P) 1.1657; (R1) 1.1718; More…..

EUR/USD surges to as high as 1.1696 so far today as rebound from 1.1300 extends. Intraday bias remains on the upside for 38.2% retracement of 1.2555 to 1.1300 at 1.1779. We’d expect upside to be limited there, at least on initial attempt, to bring near term reversal. However, break of 1.1529 minor support is needed to signal completion of the rebound first. Otherwise, further rise will remain in favor even in case of retreat. Break of 1.1529 will bring retest of 1.1300 low. After all, consolidation from 1.1300 will extend for a while before completion.

In the bigger picture, a medium term bottom should be in place at 1.1300, on bullish convergence condition in daily MACD and some consolidations would be seen. But still, note that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Thus, we’d expect fall from 1.2555 high to resume after consolidation completes. Below 1.1300 should send EUR/USD through 61.8% retracement of 1.0339 to 1.2555 at 1.1186. And, in that case, EUR/USD would head to retest 1.0339 (2017 low).

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 08:00 | EUR | Eurozone M3 Money Supply Y/Y Jul | 4.40% | 4.40% | ||

| 12:30 | USD | Advance Goods Trade Balance (USD) Jul | -68.6B | -67.9B | ||

| 12:30 | USD | Wholesale Inventories M/M Jul P | 0.10% | 0.10% | ||

| 13:00 | USD | S&P/Case-Shiller Composite-20 Y/Y Jun | 6.40% | 6.50% | ||

| 14:00 | USD | Consumer Confidence Index Aug | 127 | 127.4 |