In US, long term treasury yields jumped after Treasury Secretary Steven Mnuchin said yesterday that ultra-long bonds are "something that could absolutely make sense for us at Treasury." 30 year yield rose 0.059 to close at 3.011, back above 3.000 handle and took out 55 day EMA. 10 year yield also rose 0.043 to close at 2.325, but was limited below last week’s high and 55 day EMA. Mnuchin also said that it will probably take two years to hit 3% growth, with the help of tax and regulatory reforms, as well as better international trade agreements. He emphasized that USD 2% in revenue can be generally over 10 years if growth is boosted from 2% to 3%. Dollar is trading mixed after weaker than expected ISM manufacturing released overnight. NASDAQ extended the record run and rose 0.73% to close at 6091.6. S&P 500 also rose 0.17% but was limited below 2400 handle. DJIA lost -0.13%.

Aussie mildly higher after RBA stands pat

Aussie trades mildly higher after RBA left cash rate unchanged at 1.50% as widely expected. RBA noted in the statement that the "forecasts for the Australian economy are little changed." Growth is expected to accelerate over the new few years to 3%. But "indicators of the labour market remain mixed". Meanwhile, "outlook continues to be supported by the level of interest rates". The central bank also reiterated that appreciation in exchange rate would "complicate" the transition from mining boom. Underlying inflation is expected to pickup as the economy strengthens. RBA also remained concerned with the housing markets. And to conclude, RBA "judged that holding the stance of monetary policy unchanged at this meeting would be consistent with sustainable growth in the economy and achieving the inflation target over time."

BoJ minutes: Members agreed to closely monitor prices

BoJ released the minutes of March 15-16 meeting today. The minutes noted that board members generally agreed to closely monitor consumer prices due to the lack of upward momentum. Meanwhile, one policymaker noted that BoJ had to significantly raise government debt purchases to curb rising yield back in February. And that was seen as a weakness in the Yield Curve Control framework. Last week, BoJ kept monetary policies unchanged. The central bank raised growth forecast for the current fiscal year, but lowered inflation forecast. Also from Japan, monetary base rose 19.8% yoy in April.

China Caixin PMI manufacturing showed downward pressure emerged

China’s Caixin/ Markit manufacturing PMI fell -0.9 point to 50.3, the lowest point since September, in April. The market had anticipated a modest rise to 51.4. As the accompanying statement suggested, "the sub-indexes of output and new business both fell to the weakest levels since September, while the employment index dropped to the lowest in three months". It added that "the downward pressure on manufacturing gradually emerged in April, with all indicators weakening. The Chinese economy may be starting to embrace a downward trend in the near term as prices of industrial products decline and active restocking comes to an end". Over the weekend, the government reported its official report, showing that manufacturing index had dropped -0.6 point to 51.2 in April. The non-manufacturing PMI declined -1.1 points to 54 for the month.

Looking ahead…

PMI data is the main focus today. Swiss will release SVME PMI. Eurozone will release PMI manufacturing final. UK will release PMI manufacturing. Eurozone will also release unemployment rate.

AUD/USD Daily Outlook

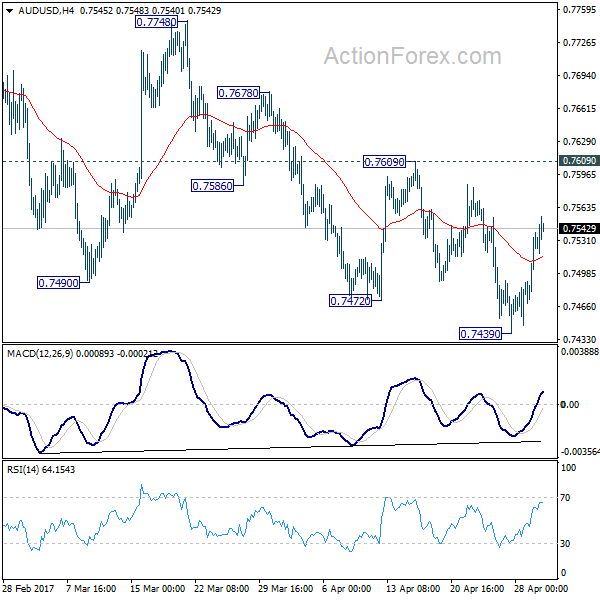

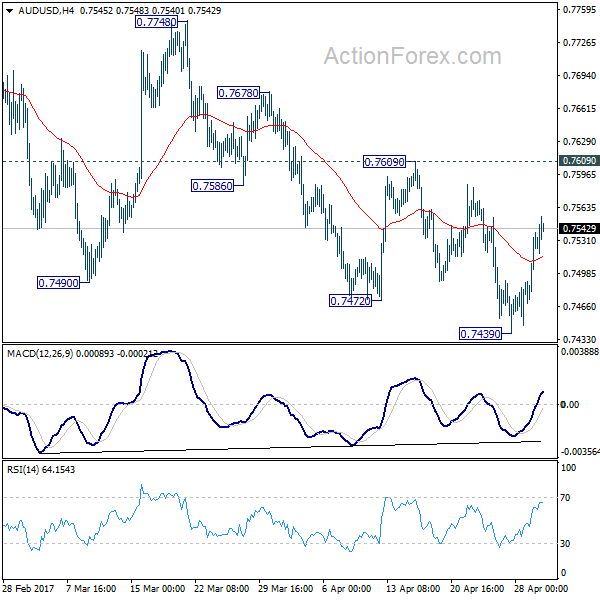

Daily Pivots: (S1) 0.7479; (P) 0.7509; (R1) 0.7555; More…

AUD/USD’s rebound form 0.7439 extends higher today. But it’s limited below 0.7609 resistance and intraday bias remains neutral. At this point, we’re favoring the case that rise from 0.7158 has completed at 0.7748 already. And deeper decline is expected. Break of 0.7439 will turn bias to the downside and target a test on 0.7144/7158 support zone. At this point, there is no clear sign of larger down trend resumption yet. Hence we’ll be cautious on strong support from0.7144/58 to contain downside and bring rebound. On the upside, break of 0.7609 will argue that the fall from 0.7748 has completed. In such case, bias will be turned back to the upside for 0.7748 resistance.

In the bigger picture, we’re still treating price actions from 0.6826 low as a correction pattern. And, as long as 38.2% retracement of 0.9504 to 0.6826 at 0.7849 holds, long term down trend from 1.1079 is expected to resume sooner or later. Break of 0.6826 low will target 0.6008 key support level. However, firm break of 0.7849 will indicate that rise from 0.6826 is developing into a medium term rebound, rather than a sideway pattern. In such case, stronger rise should be seen to 55 month EMA (now at 0.8118) and above.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Minutes of March 15-16 Meeting | ||||

| 23:50 | JPY | Monetary Base Y/Y Apr | 19.80% | 21.20% | 20.30% | |

| 1:45 | CNY | Caixin Manufacturing PMI Apr | 50.3 | 51.4 | 51.2 | |

| 4:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 7:30 | CHF | SVME PMI Apr | 58.2 | 58.6 | ||

| 7:45 | EUR | Italy Manufacturing PMI Apr | 55.9 | 55.7 | ||

| 7:50 | EUR | France Manufacturing PMI Apr F | 55.1 | 55.1 | ||

| 7:55 | EUR | Germany Manufacturing PMI Apr F | 58.2 | 58.2 | ||

| 8:00 | EUR | Eurozone Manufacturing PMI Apr F | 56.8 | 56.8 | ||

| 8:30 | GBP | PMI Manufacturing SA Apr | 54 | 54.2 | ||

| 9:00 | EUR | Eurozone Unemployment Rate Mar | 9.40% | 9.50% |