Dollar and Yen are pressured by all other major currencies throughout the day. The greenback continues to be weighed down by Trump’s attack on Fed, and Jerome Powell personally, regarding rate hikes. Nonetheless, the greenback is showing a little sign of stabilization and sell focus turns to Yen. At the time of writing, Swiss Franc is trading as the strongest one, followed by New Zealand Dollar and then Sterling. Euro pares back some of earlier gains and trades mixed,

But for now, there is little sign for Dollar to start a real come back yet. Dollar could look into Jackson Hole symposium for some inspirations to regain strengthened We find two areas where “expansive money” Fed chair Jerome Powell’s comments might trigger volatility. That is, will there be early end of balance sheet reduction. And, will Fed return to pre-crisis channel system monetary policy? More in this report. Jackson Hole Symposium Preview: Two Questions on Fed’s Monetary Policy.

The stock markets are relatively steady. At the time of writing, CAC is up 0.79% and DAX is up 0.69%. FTSE reversed earlier loss and is trading flat. 10 year Italian yield is down -0.072 at 2.965. 10 year German bund yield is up 0.020 at 0.326. Narrowing German-Italian yield spread is an indication of easing concerns over Italy. Earlier in the day, Nikkei ended up 0.09%, Hong Kong HSI rose 0.56%, China Shanghai SSE gained 1.31%, Singapore Strait Times dropped -0.15%.

Technically, whether S&P 500 will have a take on 2827.87 record high is a focus today. Gold’s seems to have lost some momentum in its recovery. It hit 1196.37 earlier today but lacks follow through buying to push through 1200 handle. It’s now back pressing 1190. USD/JPY recovers after a brief breach of 109.90 fibonacci level. We’ll see if it can build on the rebound to reverse the near term corrective fall.

EU considering unscheduled summit in November to handle Brexit

UK Brexit Minister Dominic Raab is meeting with EU chief Brexit negotiator Michel Barnier in Brussels today. Reuters reported that the EU is definitely having a real push for concluding the negotiation by October 18-19 EU summit. But it’s not optimistic base on current progress. In particular, there is no concrete proposal, from EU’s point of view, that would work on the Irish border issue.

The next scheduled summit on December 13-14 is seen as too late by EU. That would leave too little time for ratification of an agreement before formal Brexit in March 2019. Also, that’s too hard for businesses to start implementing contingency plans. Hence, an idea of a interim, unscheduled summit in November to handle the issue is floating around. It’s seen as the last moment for the negotiations.

UK launches ambitious strategy to boost exports from 30% to 35% of GDP

UK Department for International Trade launches an “ambitious” strategy to boosts exports to 35% of GDP. In a statement released today, it’s noted that the country exported GBP 620B in goods and services last year. That accounted for 30% of UK GDP. The department noted estimated that 400,000 businesses believe they could export by don’t. And from overseas is “only growing”.

The key elements of the strategy are:

- encourage and inspire more businesses to export

- inform businesses by providing information, advice and practical assistance on exporting

- connect UK businesses to overseas buyers, markets and each other

- put finance at the heart of our offer

International Trade Secretary is expected to tell business audience in a speech that “UK has the potential to be a 21st century exporting superpower”. And, “as we leave the EU, we must set our sights high and that is just what this Export Strategy will help us achieve.”

The strategy draws strong support from the business sectors. CBI Diretor-General Carolyn Fairbain said in the statement that “The CBI strongly supports the ambition to make exports 35% of GDP, which will put the UK out in front of many of our international competitors.” And, “firms will work with the strong team in place at the Department for International Trade to ensure these plans are now rigorously carried out.”

Director General of the British Chambers of Commerce Adam Marshall also said that “we welcome the government’s pledge in the new Export Strategy to work hand-in-hand with business to unlock opportunities for UK firms all across the globe.”

Director General of the Institute of Directors Stephen Martin also said “we will be encouraging our members to engage with government to make sure this strategy really takes off and enables British firms to realize their full trading potential.”

Former top treasury official blasts Trump as woefully wide of the mark on Yuan manipulation

Mark Sobel, a former top US Treasury Official criticized Trump’s remark regarding Chinese currency manipulation as “woefully wide of the mark”. And, Trump’s focus on bilateral balances as “silly”. And, to suspect a country of currency manipulation, there are criteria of “material ‘excessive’ current account surplus, an undervalued currency, and ample and rising reserves”.

In an article titled “Trump wide of mark on ‘manipulation‘”, Sobel point to facts that “China’s current account surplus is falling to under 1% of GDP. The renminbi, hit by capital outflows between early 2015 and the end of 2016, rose sharply against the dollar up to April 2018. The renminbi trade-weighted index rose too. Since then, the renminbi has fallen on both measures, but the depreciation reflects the dollar’s strength across the board. There is little evidence of more than scant Chinese foreign exchange market intervention.”

He noted “a currency manipulating country should have a significant current account surplus”. And, “the US Treasury in its foreign exchange reports uses a 3% of GDP threshold.” While a currency manipulating country might also have an “undervalued currency” one should “look at a country’s real effective exchange rate, not its bilateral dollar rate.” Additionally, the country may intervene heavily in the markets, “buying dollars to hold its currency down, resulting in an increase in its foreign reserve holdings.” But there might be “good reasons” to do so such as building up of reserves. There are many useful gauges of reserve adequacy to examine – reserves/GDP; reserves/short-term maturing debt; reserves/imports.

Sobel also completed that “a focus on bilateral balances is silly, even if the US Treasury is required to do so by statute and the president seems obsessed with them. Such an emphasis neglects to consider that certain countries specialize in certain goods and hold comparative advantage in such spheres.”

Mark Sobel is US Chairman of OMFIF. He is a former Deputy Assistant Secretary for International Monetary and Financial Policy at the US Treasury and until earlier this year US representative at the International Monetary Fund.

RBA minutes indicated optimism over consumer markets

The RBA minutes of the August meeting contained little news, in particular after release of the quarterly Statement of Monetary Policy two weeks ago and Governor Philip Lowe’s parliamentary testimony last week. The minutes reiterated, on interest rates, the next move “would more likely be an increase than a decrease”. But there was “no strong case for a near-term adjustment”.

Meanwhile, the minutes revealed the members optimism over the consumer market. As suggested in the minutes, the second quarter retail sales affirmed “steady growth” in consumption, as supported by “growth in labour income”. Policymakers indicated that the data released between the July and August meetings, together with the more recent increase in minimum wages, the announcement of future tax cuts and expectations of a further tightening in labour market conditions, had “reduced some of the uncertainty around the outlook for consumption”.

But we wonder if the surprising decline in consumer sentiment would affect the members’ view at the upcoming meeting.

More in RBA Too Early to be Confident over Consumer Spending

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 109.80; (P) 110.24; (R1) 110.52; More…

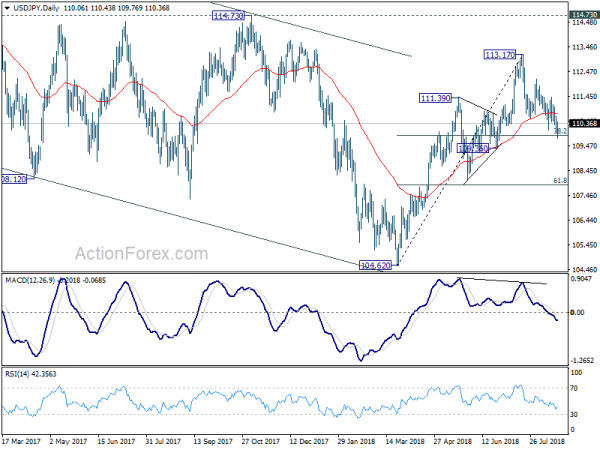

USD/JPY recovers strongly after breaching 38.2% retracement of 104.62 to 113.17 at 109.90 briefly to 109.76. Intraday bias is turned neutral again. At this point, we’d still expect strong support around 109.90 to bring rebound. On the upside, above 111.42 will turn bias back to the the upside for retesting 113.17 first. However, sustained break of 109.90 will put 109.36 key support level in focus. Break of 109.36 will carry larger bearish implications.

In the bigger picture, corrective fall from 118.65 (2016 high) should have completed with three waves down to 104.62. Decisive break of 114.73 resistance will likely resume whole rally from 98.97 (2016 low) to 100% projection of 98.97 to 118.65 from 104.62 at 124.30, which is reasonably close to 125.85 (2015 high). This will stay as the preferred case as long as 109.36 support holds. However, decisive break of 109.36 will mix up the outlook again. And deeper fall should be seen back to 61.8% retracement of 104.62 to 113.17 at 107.88 and below.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Net Migration M/M Jul | 0.60% | -3.50% | -3.60% | |

| 01:30 | AUD | RBA Meeting Minutes Aug | ||||

| 06:00 | CHF | Trade Balance (CHF) Jul | 2.26B | 2.85B | 2.59B | |

| 08:30 | GBP | Public Sector Net Borrowing (GBP) Jul | -2.90B | -2.1B | 4.5B | 3.3B |

| 10:00 | GBP | CBI Industrial Order Expectations | 7 | 10 | 11 | |

| 12:30 | CAD | Wholesale Trade Sales M/M Jun | -0.80% | 0.80% | 1.20% | 0.90% |