The strong stock rallies in the US generally carry through to Asian session. At the time of writing, Nikkei is up trading up 0.45%, Hong Kong HSI up 0.58%, Singapore Strait Times up 0.52%. That followed the impressive 1.58% rebound in DOW overnight, with S&P 500 gained 0.79% and NASDAQ rose 0.42%. 10 year yield also rose 0.019 to 2.871. However, Chinese stocks are quick to reverse gains. The Shanghai SSE is down -0.39% at 2694.52 currently, losing 2700 handles. It suggests that Chinese investors couldn’t care less about the resumption of US-China trade talks. Nor do their care about the State Council’s plan to boost private investments.

In the currency markets, Swiss Franc is trading as the weakest one today, followed by Dollar and then Yen. Reduced safe haven flow is the key factor in the softness in these three. But it should be noted that we’re not seeing equivalent momentum between stocks rally and selloff in these three. On the other hand, New Zealand Dollar is leading Australian and Canadian Dollar higher on improved sentiments. Euro and Sterling are mixed. Gold continues to consolidate above yesterday’s temporary low at 1160.37 but struggles to regain 1180 handle.

For the week, New Zealand Dollar is so far the strongest one but that’s mainly because it’s digesting recent sharp loss. Yen is the the second strongest, followed by Dollar but both have pared some of this week gains. Sterling is the weakest one followed by Australian Dollar and then Euro. The Pound received no support from this week’s set of solid job, inflation and retail sales data. Brexit negotiation remains the key for Sterling to have a turnaround.

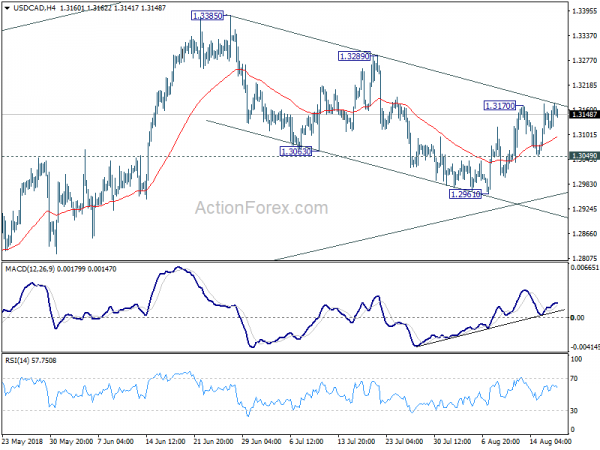

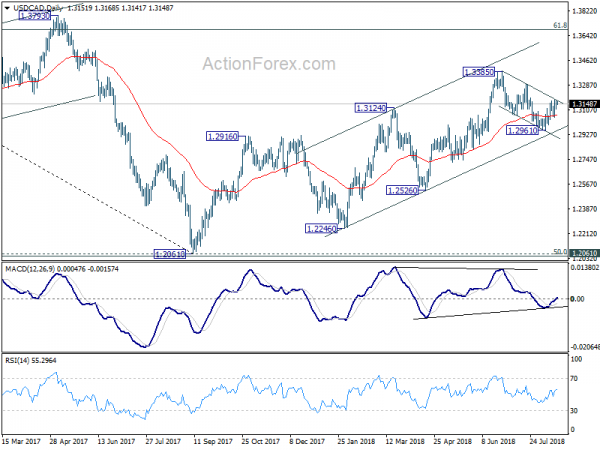

Technically, the forex markets are, generally speaking, in consolidation mode. The recoveries in EUR/USD, GBP/USD, EUR/JPY and GBP/JPY lack convincing momentum to warrant bullish reversal. Risks in these pairs stay on the downside for the near term. USD/CHF and USD/JPY are bounded in familiar range. USD/CAD continues to attempt to extend the rebound from 1.2961, but there is no follow through buying. The pair might need Canadian CPI to released today to help make up its mind.

USTR Lighthizer: A breakthrough in NAFTA talks in the next several days

US Trade Representative Robert Lighthizer said yesterday that he’s “hopeful” that there will be a “breakthrough” in NAFTA talks with Mexico in the “next several days”. But he didn’t offer any details. It’s reported that the two sides have largely agreed on the new rules regarding auto trade. And Lighthizer appeared to be willing to ease on the request of sunset clause in exchange for some concessions from Mexico.

On the other hand, Mexican Economy Minister Ildefonso Guajardo urged that “everybody has got to show some flexibility. And he added that “we have everything on the table, there are no preconditions and we’ll see at the end how the whole thing falls into place.” Also, Guajardo said the sunset clause will be among the “very last times” to be dealt with.

While there appears to be some progresses, it should be noted that Canada is not involved in the bilateral talks between the US and Mexico. And is unsure how Canada would be reengaged.

Japan manufacturers sentiment hit 7-month high, but non-manufacturing at 1.5 year low

Reuters Tankan manufacturers index rose to 30 in August, up from 25. However, the non-manufacturers index dropped sharply to 25, down from 34.

With the sharp 5 pts rise in index, manufacturer’s sentiment, hit the highest level since January. Back then it was an 11-year high of 35. The index is expected to improve further in the new few months. It highlights the robustness of the manufacturing sector despite rising global trade tension and emerging markets risks.

On the other hand, services sentiments tumbled sharply by -9 to the lowest level since December 2016. It’s partly due to once-off factors including abnormal whether including flood rains and heat waves. But the deterioration still indicates fragility in the sector and thus casts doubt on domestic demand. Domestic weakness could amply should there be deterioration in global trade tensions.

RBA Lowe warned of trade tension and highly unusual US fiscal stimulus

RBA Governor Philip Lowe appeared before the House of Representatives Standing Committee on Economics today. He reiterated the three points in communications about monetary policy. Firstly, employment and inflation are “moving in the right direction”. Secondly, the next move is interest rates is “to be up”. Thirdly, progresses is expected to be “gradual” and there is “not a strong case for near term adjustment in interest rates.

Lowe also highlighted a few global risks. Firstly, in some countries, businesses are delaying investment due to rising trade tensions. If it become a “more general story”, it’s the channel through which trade tensions would “sap the current positive momentum” in the global economy.

Secondly, it’s “highly unusual” for the US to have “sizeable fiscal stimulus” at a time of “limited capacity”. Growth could “surprise on the upside. And Lowe is “less relaxed” than others on the implications on inflation. He warned that Fed could have to withdraw monetary accommodation “more quickly than currently projected”with possibly disruptive consequences in financial markets.

A third set of global risks are from individual economies with “country-specific structural and/or institutional vulnerabilities”, including Argentina, Brazil, Italy and Turkey.

China State Council to boost private investments, remove obstacles

China’s official news agency Xinhua reported that the State Council decided on a host of measures to boost private investment, at a meeting yesterday. And, a number of projects should be identified for attracting private investments. Additionally, the State Council meeting called for lowering thresholds, shoring up the weak links, boosting domestic demand, promoting employment and strengthening the impetus for long-term development.

The measures will include tax and fee cutting for private businesses, VAT reforms, improvements in financing transmission mechanism, and risk compensation mechanism. In particular, obstacles in fields like healthcare and aged-care would be removed, including regulations on land use, funding support and personnel training.

Premier Li Keqiang was quoted saying that “the potential of consumption as a driver for growth need to be further unlocked. At the same time, more efforts need to be made to reduce business costs, support export, and make better use of foreign investment.”

On the data front

New Zealand PPI input rose 1.0% qoq in Q2 versus expectation of 0.2% qoq. PPI output rose 0.9% qoq versus expectation of 0.1% qoq.

Eurozone current account, CPI will be featured in European session. Canada CPI is the main focus in US session. Canada will also release international securities transactions. US will release leading index and U of Michigan sentiment.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3123; (P) 1.3149; (R1) 1.3185; More…

USD/CAD edges higher again and breaches 1.3170 but upside momentum remains unconvincing. Nonetheless, we’re staying cautiously bullish in the pair. The corrective pull back from 1.3385 should have completed at 1.2961 already. Further rise should be seen to 1.3289 resistance for confirmation. Break there will also likely resume larger rise from 1.2061 through 1.3385 high. On the downside, though, break of 1.3049 minor support will dampen this bullish view and turn focus back to 1.2961 low instead.

In the bigger picture, as long as channel support (now at 1.2958) holds, we’re holding to the bullish view. That is, fall from 1.4689 (2015 high) has completed at 1.2061, ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen for 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above. However, sustained break of the channel support will argue that rise from 1.2061 has completed and will bring deeper fall to 1.2526 support to confirm.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | PPI Input Q/Q Q2 | 1.00% | 0.20% | 0.60% | |

| 22:45 | NZD | PPI Output Q/Q Q2 | 0.90% | 0.10% | 0.20% | |

| 08:00 | EUR | Eurozone Current Account (EUR) Jun | 23.2B | 22.4B | ||

| 09:00 | EUR | Eurozone CPI M/M Jul | 0.10% | 0.10% | ||

| 09:00 | EUR | Eurozone CPI Y/Y Jul F | 2.00% | 2.00% | ||

| 09:00 | EUR | Eurozone CPI Core Y/Y Jul F | 1.10% | 1.10% | ||

| 12:30 | CAD | International Securities Transactions (CAD) Jun | 4.91B | 2.18B | ||

| 12:30 | CAD | CPI M/M Jul | -0.10% | 0.10% | ||

| 12:30 | CAD | CPI Y/Y Jul | 2.40% | 2.50% | ||

| 12:30 | CAD | CPI Core – Common Y/Y Jul | 1.90% | |||

| 12:30 | CAD | CPI Core – Median Y/Y Jul | 2.00% | |||

| 12:30 | CAD | CPI Core – Trim Y/Y Jul | 2.00% | |||

| 14:00 | USD | Leading Index Jul | 0.40% | 0.50% | ||

| 14:00 | USD | U. of Mich. Sentiment Aug P | 98.1 | 97.9 |