While the financial markets are staying in risk averse mode generally, two development helped stabilized sentiments mildly. Firstly, Qatar offered to inject investments in Turkey as an act of “friendship”. The news helped lifted DOW from day low of 24965.77 to close at 25162.41, just down -0.54%. Secondly, China and US are going to resume trade talks. The MOFCOM’s announce also lifted Asian indices mildly higher from session low. Nonetheless, Asian indices remain in red at the time of writing. Nikkei is down -0.17%, Hong Kong HSI is down -0.61%, China Shanghai SSE is down -0.87% and breached 2700 handle, Singapore Strait Times is down -0.52%.

In the currency markets, Yen trades broadly lower today, as the weakest one. That’s most likely due to recent rally being exhausted. It should be noted that both EUR/JPY and GBP/JPY are in downside deceleration, ahead of 124.61 and and 139.29 key support levels. Recovery in both crosses also helped lifted EUR/USD and GBP/USD mildly. And Dollar is trading as the second weakest one for today. On the other hand, mild stabilization in markets is helping Australian Dollar, Euro and New Zealand Dollar recover.

Over the week, Swiss Franc is so far the strongest one, followed by Yen and Canadian Dollar. Resistance of the Loonie is worth a note. WTI crude oil dived sharply overnight following larger than expected increase in US oil inventory. WTI breached 65 handle and is struggling around there. But the Loonie isn’t too bothered after initial selling. Meanwhile. Australian Dollar is still the weakest one for the week despite today’s recovery. Sterling follows as the second weakest.

US-China to resume low level trade talks

China’s Ministry of Commerce said in a statement that accepting invitation by the US to resume trade discussions. Chinese Vice Commerce Minister Wang Shouwen will meet with US Secretary for International Affairs David Malpass in late August.

In the statement, China reiterated that “it opposes unilateralism and trade protectionism and does not accept any unilateral trade restrictions”. And, “China welcomes dialogue and communication on the basis of reciprocity, equality and integrity.”

The news is certainly a positive. But such low level meeting shouldn’t carry much significance in the near term. The trade war is on and the meeting is more gestures than anything with substance.

Nonetheless, the news does give the Chinese Yuan a lift. USD/CNH (offshore Yuan) is now back below 6.9 after hitting as high as 6.9586 overnight. But there is no clear indication of reversal yet. USD/CNH is still more likely to hit 7 handle than not.

Australia employment dropped -3.9k, but details solid

Australian job market contracted -3.9k in July, worse than expectation of 15.3k growth. Nonetheless, that’s primarily due to -23.2k contraction in part time jobs. There was an impressive 19.3k growth in full-time jobs.

Unemployment rate also dropped -0.1% to 5.3% while participation rate also dropped -0.1% to 65.5%. Monthly hours worked rose 0.2%. Overall, the set of data is rather solid despite the headline miss.

Also from Australia, consumer inflation expectation rose to 4.0% in August, up from 3.9%.

Turkey not asking for IMF aid, Qatar to inject $15B, USD/TRY drops through 6.0

IMF said there is no indication that Turkey is considering to seek its financial assistance. But it urged in a statement that “in light of recent market volatility, the new administration will need to demonstrate a commitment to sound economic policies to promote macroeconomic stability and reduce imbalances.”

Instead, Qatar has pledged USD 15B of direct investment in Turkey to help strengthen the Lira. President Recep Tayyip Erdogan’s spokesman Ibrahim Kalin tweeted: “Turkish-Qatari relations are based on solid foundations of true friendship and solidarity.”

Turkish Lira’s rebound extended overnight and with USD/TRY hit as low as 5.8578. While downside momentum is diminishing mildly, it seems USD/TRY could now start to stabilize below 6.0 handle.

South Korea to increase fiscal spending amid weakened job growth and economic polarization

South Korea Finance Minister Kim Dong-yeon said today that the government is going to raise fiscal spending to counter the weakening of the job market and economic polarization. 2019 budget spending will increase far more than the original plan of 5.7%. The spending will be on supporting research and development of advance artificial intelligence, big data and hydrogen vehicles.

Kim described that the job market is “the worst since financial crisis”. And “the government’s big challenge is how to support the job market through fiscal policies.” Additionally. “Polarization issue is very perplexing”, and “economic growth and innovation would be difficult to sustain without addressing the issue”.

Earlier, the government cut job growth forecast to 180k this year, down from 320k prior estimate.

Looking ahead

UK retail sales and Eurozone trade balance will be featured in European session. Later in the day, US will release housing starts and building permits, Philly Fed survey and jobless claims. Canada will release manufacturing sales.

USD/CAD Daily Outlook

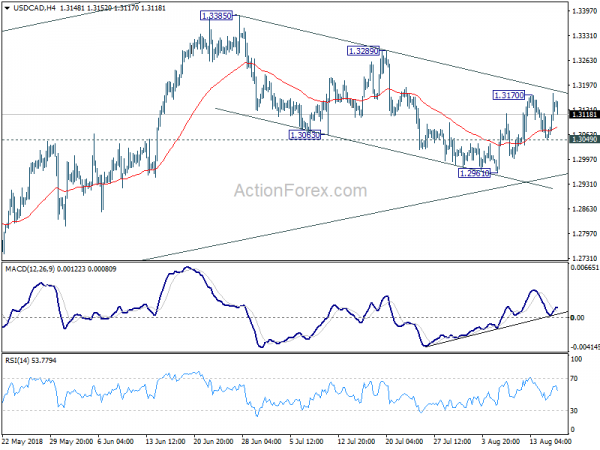

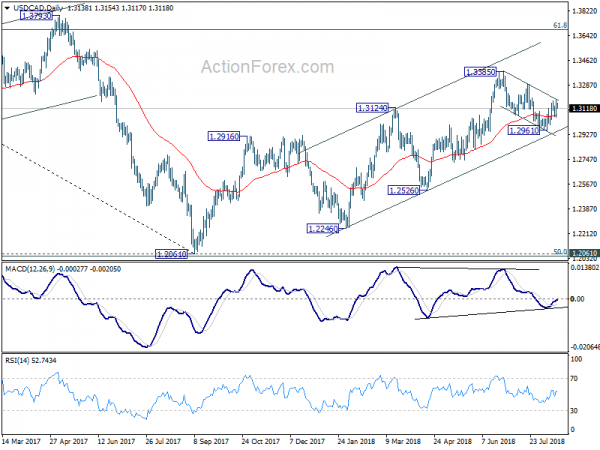

Daily Pivots: (S1) 1.3068; (P) 1.3122; (R1) 1.3194; More…

Despite breaching 1.3170 minor resistance, there was no follow through buying in USD/CAD. And it quickly retreats. Intraday bias stays neutral first. Still, as long as 1.3049 minor support holds, we’re favoring the bullish case. That is, correction from 1.3385 should have completed with three waves down to 1.2961. On the upside, firm break of 1.3170 will target 3289 resistance first. Break there will likely resume larger rise from 1.2061 through 1.3385 high. On the downside, though, break of 1.3049 minor support will dampen this bullish view and turn focus back to 1.2961 low instead.

In the bigger picture, as long as channel support (now at 1.2950) holds, we’re holding to the bullish view. That is, fall from 1.4689 (2015 high) has completed at 1.2061, ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen for 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above. However, sustained break of the channel support will argue that rise from 1.2061 has completed and will bring deeper fall to 1.2526 support to confirm.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | Trade Balance (JPY) Jul | -0.05T | 0.02T | 0.07T | 0.08T |

| 01:00 | AUD | Consumer Inflation Expectation Aug | 4.00% | 3.90% | ||

| 01:30 | AUD | Employment Change Jul | -3.9K | 15.3K | 50.9K | 58.2K |

| 01:30 | AUD | Unemployment Rate Jul | 5.30% | 5.40% | 5.40% | |

| 08:30 | GBP | Retail Sales M/M Jul | 0.20% | -0.50% | ||

| 09:00 | EUR | Eurozone Trade Balance Jun | 16.5B | 16.9B | ||

| 12:30 | CAD | Manufacturing Sales M/M Jun | -0.10% | 1.40% | ||

| 12:30 | USD | Initial Jobless Claims (AUG 11) | 215K | 213K | ||

| 12:30 | USD | Housing Starts Jul | 1.27M | 1.17M | ||

| 12:30 | USD | Building Permits Jul | 1.31M | 1.29M | ||

| 12:30 | USD | Philadelphia Fed Business Outlook Aug | 22.3 | 25.7 | ||

| 14:30 | USD | Natural Gas Storage | 46B |