The forex markets are rather steady today. Turkish turmoil seemed to have passed its climax for the near term. Swiss Franc and Yen are trading lower as that part of risk aversion receded. Meanwhile, New Zealand, Canadian and Australian Dollar are generally higher, together with Sterling. Though, it remains to be seen if stock market selloff will extend for reasons other than Turkey. Meanwhile, we want to point out the relatively shallow retreat in Dollar against Euro, Sterling and Aussie so far. Gold’s medium term down trend has just resumed and is set to take on 1190. They could be indications that Dollar might take over the driving seat from Yen in the next move.

While the trouble of Turkey Lira might be over temporarily, the stocks markets are still rather vulnerable. DOW closed down -0.50% at 25187.70 overnight. S&P 500 lost -0.40% and NASDAQ dropped -0.25%. S&P 500 has been losing much momentum ahead of 2827.82 record high, indicating risk of rejection. Similarly, NASDAQ also faces risk of rejection from 7933.31 record high. In Asia, Nikkei is benefiting from Yen’s pull back and trades up 1.85% at the time of writing. But Hong Kong HSI is down -0.97%, China Shanghai SSE is down -0.45%, Singapore Strait Times is down -0.16%.

Technically, Yen crosses should have turned into near term consolidations, with risk of stronger recovery. The same applies for Swiss Franc crosses too. USD/CHF and USD/JPY will be two pairs to watch today. Break of 0.9984 in USD/CHF and 111.17 in USD/JPY will indicate near term strength in Dollar against the two safe-haven currencies. And that could prompt stronger rally in Dollar against others as the greenback regains control.

Australia NAB business conditions extended slide to 14, confidence recovered

Australia NAB business conditions dropped -2pts to 14 in July. Business confidence rose 1pt to 7. Alan Oster, NAB Group Chief Economist noted in the release that the business conditions index “has now fallen considerably since April”. But business conditions remain “above average”, suggesting “favourable conditions have continued to persist through the middle of 2018”. The weakness in profitability and trading conditions was partially offset by improvement in employment.

Overall, the survey results were broadly in line with NAB’s outlook. Business sector looks “relatively healthy”. Growth in employment will reduce spare capacity gradually. And that should bring in a “rise in wage and a more general lift in inflation”. However, trends in forward indicators will be watched, which may be signaling slowdown.

Weaker than expected data show further cool down in China

A batch of weaker than expected July economic data from China showed the economy has cooled further. Retail sales grew 8.8% yoy, down from prior 9.0% and missed expectation of 9.2% yoy. Industrial production grew 6.0% yoy, unchanged from prior 6.0% yoy but missed expectation of 6.3% yoy. Fixed asset investment growth slowed to 5.5% ytd yoy, down from 6.0% yoy and missed expectation of 6.0% yoy. Unemployment rate rose to 5.1%, up from 4.8%.

In particular, fixed asset investment growth was the slowest on record since early 1996. That suggested weakening business confidence that could be hurt by rising trade tensions with the US, as well as China’s own deleveraging policy. Weak retail sales highlights the difficulty of shift focus to domestic consumption for growth momentum, in case of a full-blown trade war.

Suggested reading on China: Chinese Growth Continued to Shrink in July, Despite Stimulus Measures

Looking ahead

The economic calendar in European session is rather jam-packed today. From UK, employment data will be closely watched, in particular wage growth. Eurozone will release Q2 GDP and industrial production. Germany will release Q2 GDP, CPI final and ZEW economic sentiment. US will release import price index later.

AUD/USD Daily Outlook

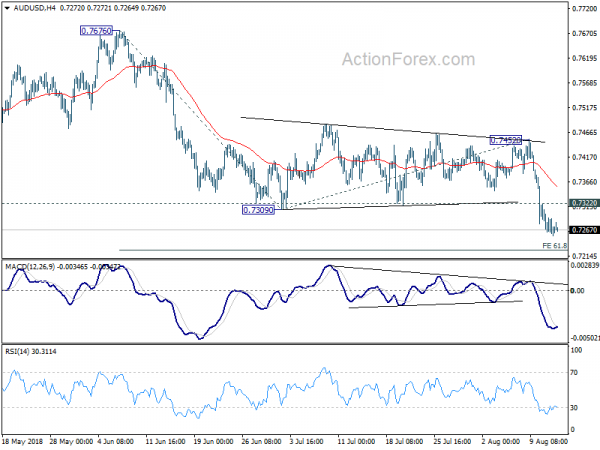

Daily Pivots: (S1) 0.7252; (P) 0.7276; (R1) 0.7296; More…

Intraday bias in AUD/USD remains on the downside with 0.7322 minor resistance intact. Current fall is part of the down trend from 0.8135 high. Deeper decline should be seen to 61.8% projection of 0.7676 to 0.7309 from 0.7452 at 0.7225 first. Break will target 100% projection at 0.7085 next. On the upside, above 0.7322 minor resistance will turn intraday bias and bring consolidation. But recovery should be limited below 0.7452 resistance to bring fall resumption.

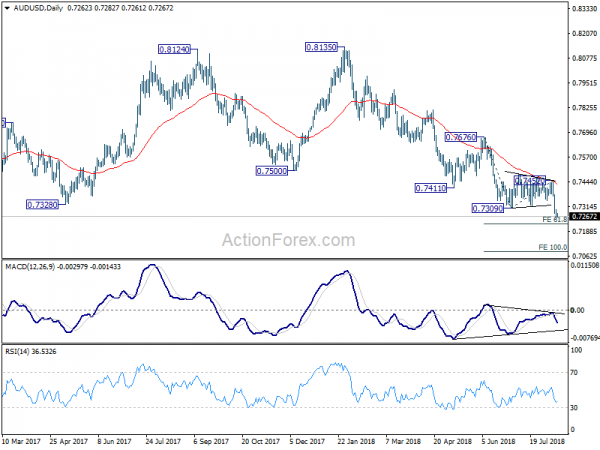

In the bigger picture, medium term rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Sustained break of 0.7328 cluster support (61.8% retracement of 0.6826 to 0.8135 at 0.7326) should pave the way to retest 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). But we’ll look at downside momentum to assess at a later stage. On the upside, break of 0.7452 resistance might indicate medium term bottoming. But we’ll continue to favor the bearish view as long as 0.7676 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 1:30 | AUD | NAB Business Conditions Jul | 12 | 15 | 14 | |

| 1:30 | AUD | NAB Business Confidence Jul | 7 | 6 | ||

| 2:00 | CNY | Unemployment Rate Jul | 5.10% | 4.80% | ||

| 2:00 | CNY | Retail Sales Y/Y Jul | 8.80% | 9.20% | 9.00% | |

| 2:00 | CNY | Industrial Production Y/Y Jul | 6.00% | 6.30% | 6.00% | |

| 2:00 | CNY | Fixed Assets Ex Rural YTD Y/Y Jul | 5.50% | 6.00% | 6.00% | |

| 4:30 | JPY | Industrial Production M/M Jun F | -1.80% | -2.10% | -2.10% | |

| 6:00 | EUR | German GDP Q/Q Q2 P | 0.40% | 0.30% | ||

| 6:00 | EUR | German CPI M/M Jul F | 0.30% | 0.30% | ||

| 6:00 | EUR | German CPI Y/Y Jul F | 2.00% | 2.00% | ||

| 7:15 | CHF | Producer & Import Prices M/M Jul | 0.10% | 0.20% | ||

| 7:15 | CHF | Producer & Import Prices Y/Y Jul | 3.40% | 3.50% | ||

| 8:30 | GBP | Jobless Claims Change Jul | 7.8K | |||

| 8:30 | GBP | Claimant Count Rate Jul | 2.50% | |||

| 8:30 | GBP | ILO Unemployment Rate 3Mths Jun | 4.20% | 4.20% | ||

| 8:30 | GBP | Average Weekly Earnings 3M/Y Jun | 2.50% | 2.50% | ||

| 8:30 | GBP | Weekly Earnings ex Bonus 3M/Y Jun | 2.60% | 2.70% | ||

| 9:00 | EUR | Eurozone Industrial Production M/M Jun | -0.30% | 1.30% | ||

| 9:00 | EUR | Eurozone GDP Q/Q Q2 P | 0.30% | 0.30% | ||

| 9:00 | EUR | German ZEW Economic Sentiment Aug | -20.1 | -24.7 | ||

| 9:00 | EUR | German ZEW Current Situation Aug | 72.4 | |||

| 9:00 | EUR | Eurozone ZEW Economic Sentiment Aug | -16.4 | -18.7 | ||

| 12:30 | USD | Import Price Index M/M Jul | 0.10% | -0.40% |