With a near empty economic calendar, the focus is entirely on development in Turkey. Turkish central bank’s announcements did calm the markets. While USD/TRY breached 7.2 earlier, it dipped to as low as 6.4136 after CBRT’s announcement. At the time of writing, it’s back at 6.9 with an eye on 7.0 handle. There is no sign of reversal yet but at least for now, the pair is in consolidation. Still, Yen remains the strongest one for today, followed by Swiss Franc. Australian Dollar remains the weakest, but it’s now followed by Canadian Dollar, as Euro recovers.

The easier sentiment is also clearly seen in European stocks. CAC dipped to as low as 5385.19 earlier today but it’s now at 5418.48, up 0.07%. DAX also pared back much losses, hitting as low as 12323.20 but it’s now at 12374, down -0.4%. Comparatively, Asian markets performed much worse. Nikkei was also hit by the strength in Yen and closed down -1.98%. Hong Kong HSI closed down -1.52%, Singapore Strait Times closed down -1.20%. However, China’s Shanghai SSE showed some resilience and closed down just -0.34% at 2785.87.

On point to note is that just entering into US session, there was a rumor that American pastor Andrew Brunson will be released from house arrest by August 15. That’s a totally ungrounded news passing through social media. Yet. yen pares back much of its earlier gain even the US Embassy in Ankara, Turkey, quickly comes out and denies that it released any related statement. While the rumor is denied, the reactions in the markets argue that traders are ready to take any positive news to close out their positions. The worst of Turkish crisis might be temporarily over.

CBRT announced measures on Lira and FX liquidity management

The Turkish central bank CBRT announced measures on Lira and FX liquidity management today. In short, CBRT pledged to provide “all the liquidity the banks need”. Discount rates for collateral against Lira transactions will be revised. Collateral FX deposit limits is raised from EUR 7.2B to EUR 20B. Banks are allowed to borrow FX despite in one-month maturity, in addition to one-week maturity. CBRT will release intermediary function as at the FX deposit markets. CBRT will also continue to buy foreign banknotes within their pre-determined limits at the Foreign Exchange and Banknotes Markets. Full statement here.

Separately, CBRT also announced to lower Lira reserve requirement ratios by 250bps for all maturities. RRR for non-core FX liabilities were lowered by 400bps, from 14-24% to 10-20%. Maximum average maintenance facility for FX liabilities has been raised to 8 percent. And, in addition to US dollars, euro can be used for the maintenance against Turkish lira reserves under the reserve options mechanism.

Gold finally breaks 1200 as down trend resumes

On development to note today is that Gold finally resumes recent down trend and breaches 1200 handle to as low as 1194.95. As the down trend from 1365.24 has resumed. Near term outlook will now stay bearish as long as 1217.31 resistance holds. Next target is 1172.07 fibonacci level. On the upside, though, break of 1217.31 will indicate short term bottoming. And rebound could be seen back to 55 day EMA (now at 1247.14 before staging another decline.

Currently decline from 1365.24 is viewed as part of the long term sideway pattern from 1046.54 (2015 low). Sustained break of 61.8% retracement of 1045.65 to 1375.15 will pave the way to 1046.54/1122/81 support zone. At this point, we’re not expecting a break there to resume long term down trend yet. Hence, we’ll look for bottoming signal below 1122.81.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1352; (P) 1.1445 (R1) 1.1502; More…..

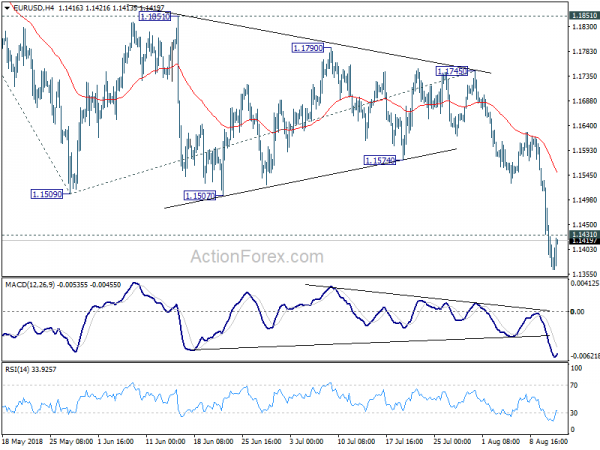

With 1.1431 minor resistance intact, intraday bias in EUR/USD stays on the downside for 61.8% projection of 1.2413 to 1.1509 from 1.1745 at 1.1186. Note that it’s a cluster level with 61.8% retracement of 1.0339 to 1.2555 at 1.1186. Hence, we’ll tentatively look for short term bottoming around 1.1186. On the upside, above 1.1431 minor resistance will turn bias neutral and bring consolidations first, before staging another decline.

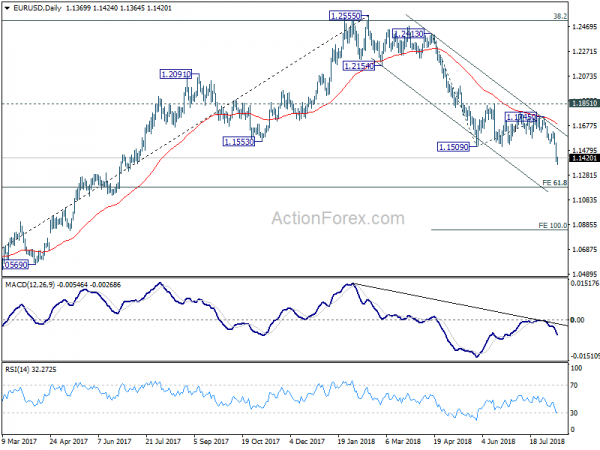

In the bigger picture, the down trend from 1.2555 medium term is in progress for 61.8% retracement of 1.0339 to 1.2555 at 1.1186. Note again that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Sustained break of 1.1186 could pave the way back to retest 1.0339 low. For now, outlook will remain bearish as long as 1.1851 resistance holds, even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 02:00 | CNY | M2 Money Supply Y/Y Jul | 8.20% | 8.20% | 8.00% | |

| 02:00 | CNY | New Loans (CNY) Jul | 1450B | 1210B | 1840B |