Dollar, Yen and Swiss Franc are trading as the strongest ones today as supported by solid safe haven flow. The free fall in Turkish Lira raised concerns of contagion to Eurozone financial system. Such worries sends the Euro broadly lower, even though Australian Dollar performs even worse. Crisis speech of Turkish President Erdogan doesn’t ease the worries a little bit. Euro remains generally weak and is vulnerable to deeper fall. Adding to that, Dollar is also firm after stronger than expected core inflation reading. Canadian Dollar is supported by stellar job data. Sterling, however, gets not support on a mixed batch of data.

In other markets, European indices are trading in deep red today with DAX down -1.78% at the time of writing, CAC down -1.29% and FTSE down -0.71%. Earlier today, major Asian indices closed lower, except China. Nikkei closed down -1.33%, Hong Kong HSI down -0.84%, Singapore Strait Times down -1.26%. But Shanghai SSE closed up 0.03% at 2795.31, even though it still could get 2800 in pocket. Despite a strong Dollar, Gold is still bounded in sideway trading around 1210. WTI crude oil is back above 67.

Technically, USD/CHF and USD/JPY are both bounded in tight range for the moment. It’s so far uncertain which one of USD, JPY and CHF will win the race for the near term. Similarly, USD/CAD is also staying in tight range below 1.3119 temporary top. But the bullish outlook in USD/CAD is relatively clearer than USD/JPY and USD/CHF. Elsewhere in the forex markets, the stories are already very clearly written in the charts. It’s just a matter whether the fast moving pairs will take a breath before weekly close. The more interesting development could be in treasury yield. 10 year yield is pressing 2.9 handle as bonds are boosted by flight to safety

Turkish President Erdogan asks citizens to buy Lira to response to economic attack

Turkish President Tayyip Erdogan delivers a crisis speech the Lira extends recent free fall on US sanctions. Erdogan urges again the Turks to reach for their foreign exchange savings, and exchange dollar and gold for Lira. He said this is the most effective response to the west. And he named the economic attack against Turkey is due to “small differences of opinion” with certain powers”. He condemned that such attacks damaged their relationship with Turkey to a point where it’s impossible to repair. In short, Erdogan showed no sign of backing down.

Suggested reading on Turkey: Erdogan is to Blame For Turkish Lira’s Free Fall

Euro in deep worry of Turkish contagion

The free fall in Turkish Lira is seen as a factors that heavily weighing on Euro today. It’s reported that ECB officials are increasingly worried about contagion from Turkey, due to the deep tie with Eurozone financial system.

According to Bank for International Settlements data, Spanish banks are are owed USD 83.3B by Turkish borrowers; French lenders are owed USD 38.4B; and banks in Italy are owed USD 17B. Meanwhile, the Financial Times noted that Spain’s BBVA, Italy’s UniCredit, and France’s BNP Paribas could be particularly impacted by the ongoing depreciation of the lira.

It’s seen that a complete banking crisis in Turkey will inevitably have huge impact on Eurozone banks, and even trigger credit crunch. Though, such a worst case scenario is seen as unlikely so far.

UK GDP grew 0.4% qoq in Q2, but June missed expectations

UK GDP grew 0.4% qoq in Q2, doubled that of Q1’s 0.2% qoq and met expectations. Year-over-year, GDP grew 1.3% yoy in Q2, also matched expectation. Nonetheless, June GDP grew only 0.1% mom, below expectation of 0.2% mom, notably slower than May’s 0.3% mom. Total business investment rose 0.5% qoq in Q2, much stronger than expectation of 0.2% qoq and an impressive rebound from Q1’s -0.4% qoq.

Industrial production rose 0.4% mom, 1.1% yoy in June versus expectation of 0.2% mom, 1.9% yoy. Manufacturing production rose 0.4% mom, 1.5% yoy versus expectation of 0.3% mom, 1.9% yoy. Visible trade deficit narrowed to GBP -11.4B versus expectation of -11.9B.

Japan’s consumption-led GDP growth beat expectation

Japan GDP grew 0.5% qoq, 1.9% annualized in Q2. That’s way stronger than expectation of 0.3% qoq, 1.4% annualized. It’s also a strong rebound from prior quarter’s -0.2% qoq, -0.6% annualized contraction. Q1 was an unexpected interruption in the best run in the economy since 1980s. In Q2, GDP deflator rose 0.1% yoy, also beat expectation of -0.2% yoy fall.

Private consumption, which accounts for 60% of the economy, grew an impressive 0.7%. The solid growth could be an indication of finally a changing “social mood” in the country. And people are more willing to spend based on the expectation that wages will eventually rise. Getting out of such “social mood” is important for Japan to beat the persistent trend of sluggish low inflation. Such development should be very welcomed by BoJ Meanwhile, Capital expenditure rose 1.3%, strongest since Q4 2016.

Also from Japan, Domestic CGPI rose 3.1% yoy in July versus expectation of 2.9% yoy. Tertiary industry index, however, dropped -0.5% mom in June versus expectation of -0.2% mom.

RBA SoMP reiterates no urgency for rate hike, economic projections largely unchanged

The RBA Statement on Monetary Policy revealed nothing new give then Governor Philip Lowe had delivered an update in a speech earlier this week. In the SoMP, RBA, reiterated that “higher interest rates are likely to be appropriate at some point, if the economy continues to evolve as expected.” That is, the next move is “up not down”. But, Given the gradual nature of the improvement, however, the Board does not see a strong case to adjust the cash rate in the near term.

RBA’s new economic forecasts appear to be largely unchanged from the May SoMP.

- Four-quarter GDP growth is projected to be at 3.25% in Q4 2018, 3.25% in Q2 2019 (revised down from 3.50%), 3.25% in Q4 2019, 3.00% in Q2 2020 and 3.00% in Q4 2020 (new).

- Unemployment rate is projected to be at 5.5% in Q4 2018, 5.25% in Q2 2019, 5.25% in Q4 2019, 5.25% in Q2 2020 and 5.00% in Q4 2020 (new).

- Headline CPI is projected to be at 1.75% in Q4 2018 (revised down from 2.25%), 2.0% in Q2 2019 (revised down from 2.25%), 2.25% in Q4 2019, 2.25% in Q2 2020 and 2.25% in Q4 2020 (new).

- Underlying inflation is projected to be at 1.75% in Q4 2018 (revised down from 2.00%), 2.00% in Q2 2019, 2.00% in Q4 2019, 2.25% in Q2 2020, 2.25% in Q2 2020 (new).

Also released down under, New Zealand BusinessNZ manufacturing PMI dropped to 51.2 in July, down from 52.8.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1495; (P) 1.1558 (R1) 1.1590; More…..

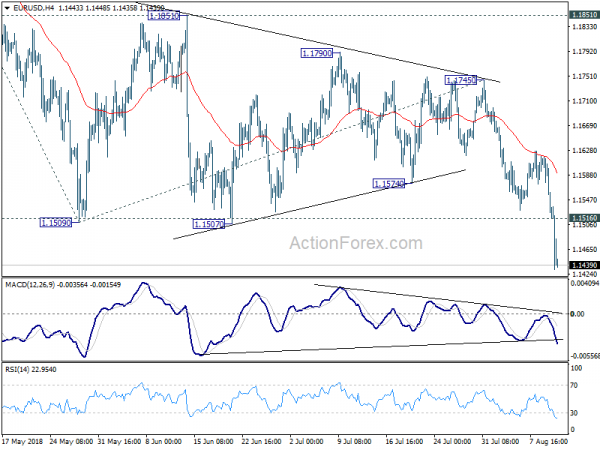

Intraday bias in EUR/USD remains on the downside as the larger down rend from 1.2555 resumes today. Further decline should be seen to 61.8% projection of 1.2413 to 1.1509 from 1.1745 at 1.1186. Note that it’s a cluster level with 61.8% retracement of 1.0339 to 1.2555 at 1.1186. Hence, we’ll tentatively look for short term bottoming around 1.1186. On the upside, above 1.1516 minor resistance will turn bias neutral and bring consolidations first, before staging another decline.

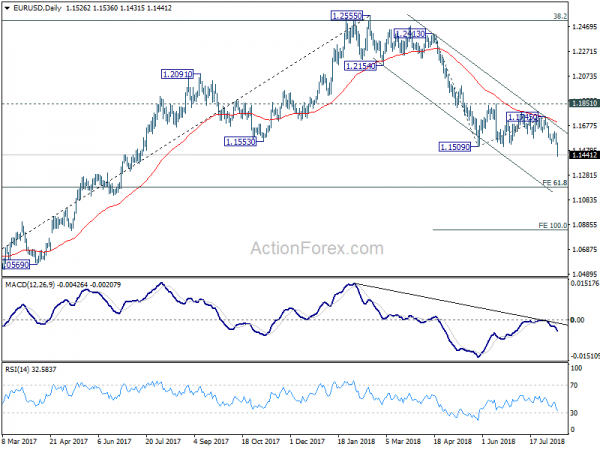

In the bigger picture, the down trend from 1.2555 medium term is in progress for 61.8% retracement of 1.0339 to 1.2555 at 1.1186. Note again that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Sustained break of 1.1186 could pave the way back to retest 1.0339 low. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1851 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | NZD | BusinessNZ Manufacturing PMI Jul | 51.2 | 52.8 | ||

| 23:50 | JPY | Domestic CGPI Y/Y Jul | 3.10% | 2.90% | 2.80% | |

| 23:50 | JPY | GDP Q/Q Q2 P | 0.50% | 0.30% | -0.20% | |

| 23:50 | JPY | GDP Deflator Y/Y Q2 P | 0.10% | -0.20% | 0.50% | |

| 01:30 | AUD | RBA Monetary Policy Statement | ||||

| 04:30 | JPY | Tertiary Industry Index M/M Jun | -0.50% | -0.20% | 0.10% | |

| 08:30 | GBP | Visible Trade Balance (GBP) Jun | -11.4B | -11.9B | -12.4B | -12.5B |

| 08:30 | GBP | Industrial Production M/M Jun | 0.40% | 0.20% | -0.40% | -0.20% |

| 08:30 | GBP | Industrial Production Y/Y Jun | 1.10% | 1.90% | 0.80% | 1.20% |

| 08:30 | GBP | Manufacturing Production M/M Jun | 0.40% | 0.30% | 0.40% | 0.60% |

| 08:30 | GBP | Manufacturing Production Y/Y Jun | 1.50% | 1.90% | 1.10% | 1.50% |

| 08:30 | GBP | Construction Output M/M Jun | 1.40% | -0.50% | 2.90% | |

| 08:30 | GBP | GDP M/M Jun | 0.10% | 0.20% | 0.30% | |

| 08:30 | GBP | GDP Q/Q Q2 P | 0.40% | 0.40% | 0.20% | |

| 08:30 | GBP | Index of Services 3M/3M Jun | 0.50% | 0.60% | 0.40% | |

| 08:30 | GBP | Total Business Investment Q/Q Q2 P | 0.50% | 0.20% | -0.40% | |

| 12:30 | CAD | Net Change in Employment Jul | 54.1K | 24.0K | 31.8K | |

| 12:30 | CAD | Unemployment Rate Jul | 5.80% | 5.80% | 6.00% | |

| 12:30 | USD | CPI M/M Jul | 0.20% | 0.20% | 0.10% | |

| 12:30 | USD | CPI Y/Y Jul | 2.90% | 3.00% | 2.90% | |

| 12:30 | USD | CPI Core M/M Jul | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | CPI Core Y/Y Jul | 2.40% | 2.30% | 2.30% |