New Zealand Dollar is clearly the biggest loser today after more dovish than expected RBNZ rate decision. Sterling is following as the second weakest, continues to be weighed down by no-deal Brexit worries. On the other hand, Canadian Dollar is staging a strong rebound as markets look pass the tensions with Saudi Arabia. Australian Dollar follows as the second strongest as boosted by the strong rebound in Chinese stocks. For the week as a whole so far, Australian Dollar is the strongest one, New Zealand Dollar and Sterling are the weakest ones.

In other markets, US equities pared back some gains overnight with DOW closed down -0.18%, S&P 500 lost -0.03%. But NASDAQ squeezed out 0.06% gain to 7888.33, very close to record high at 7933.31. US treasury yields were relatively steady with 10 year yield down -0.002 at 2.971. In Asia, Nikkei closed down -0.2% at 22598.39. China Shanghai SSE breached 2800 handle earlier today and stays firm at 2796 at the time of writing, up 1.9%. Hong Kong HSI is up 1.17% while Singapore Strait Times is down -0.4%. WTI crude oil dropped notably overnight and is now pressing 67 handle. Gold continues to range bound around 1210.

Technically, Sterling remains in clear down trend against Dollar, Euro, Yen and Swiss Franc. But oversold condition could start to limit downside potential. While Euro recovered this week, there is no follow through buying against Dollar. Similarly, even AUD/USD also lacks decisive up side momentum. A focus will be on whether these two pairs will head back towards recent range bottom at 1.1507 and 0.7309. USD/CAD spiked higher to 1.3066 but quickly retreated deeply back to 1.3000. For now, we’re still favoring that recent correction from 1.3385 has completed at 1.2961. Thus, we’re anticipating another strong rally in USD/CAD soon.

RBNZ kept OCR unchanged at 1.75, overall more dovish than expected

RBNZ’s announcement comes in more dovish than anticipated. While leaving the Official Cash Rate (OCR) unchanged at 1.75%, the members pushed backward expectations for the next interest rate adjustment. OCR is expected to be kept low, “but for longer”, through 2019 and into 2020. RBNZ also reiterated that the next move “could be up or down”.

According to the new Monetary Policy Statement (MPS), RBNZ is now conditioning a full 25bps hike to 2.00% in December quarter of 2020. That’s notably later than March quarter in 2020 as in May MPS. GDP growth forecasts were revised down to 2.7% in 2018 (2.8% in May MPS), 2.6% in 2019 (3.1%), 3.4% in 2020 (3.3%) and 3.2% in 2021 (3.1%). CPI forecasts were kept unchanged at 1.1% in 2018, 1.6% in 2019, 1.8% in 2020, and 2.0% in 2021.

More in RBNZ Delays Timing for Rate Change and Inflation to Reach +2%, Kiwi Slumps

And quick comments: NZDUSD, NZDJPY resume down trend after dovish RBNZ

77% economists expect no BoJ stimulus exit until 2020 or later

According to a Reuters poll, 73% of economists surveyed expected that BoJ will not start unwinding stimulus until 2020 or later. That’s nearly double of 37% last month. Around one third said BoJ’s July announcement as a small step on crafting the exit strategy. BoJ explicitly talked about allowing 10 year JGB yield to move between -0.1% and 0.1%. 77% of economists believed that would help bond market functioning.

On the economy, economists projected core CPI, excluding sales tax hike impact, to rise 0.9% in the fiscal year to March 2019, same as the prior fiscal year. That’ notably lower than BoJ’s own forecasts of 1.1% in fiscal 2019 and fiscal 2019. Economists also saw Japan GDP to grow 1.1% this fiscal year and then slow to 0.8% next.

Released from Japan, M2 rose 3.0% yoy in July, below expectation of 3.1% yoy. Machine orders dropped sharply by -8.8% mom in June versus expectation of -0.8% mom. Machine tool orders rose 13.0% yoy in July.

China Shanghai SSE breaches 2800 as tech stocks boosted by government focus

Chinese stocks are enjoying a strong rally today. The Shanghai SSE breaches 2800 handle and is holding 2% gain. Tech stocks led the way higher as the government indicated strong focus in development in the sector. Yesterday, the State Council renewed the ” National Science, Technology and Education Leading Group” to “National Science and Technology Leading Group”, showing the dedication in science and technology.

The group is headed by Premier Li Keqiang with Vice-Premier Liu He as deputy. Fourteen high level officials from National Development and Reform Commission, the Ministry of Education, and the Ministry of Science and Technology are also part of the group.

The major responsibilities of the group include studying and reviewing national strategies, plans and major policies for sci-tech development; deliberating major national scientific tasks and projects, and coordinating major sci-tech affairs among ministries, departments and local authorities.

Released from China, CPI accelerated to 2.1% yoy in July, up from 1.9% yoy, above expectation of 2.0% yoy. PPI slowed to 4.6% yoy, down from 4.7% yoy, matched expectations.

Canadian Dollar recovers as Trudeau said tension with Saudi just diplomatic difference of opinion

Selling pressure on Canadian appears to have eased after Canadian Prime Minister Justin Trudeau tried to tone down the tension with Saudi Arabia. Trudeau referred to recent events as a matter of “diplomatic difference of opinion” only. And he emphasized that “we don’t want to have poor relations with Saudi Arabia.” Trudeau went further and hailed that Saudi Arabia is a “country that has great significance in the world, that is making progress in the area of human rights.”

Nonetheless, Trudeau also stood firm on Canada’s position. He noted that “Canadians have always expected our government to speak strongly, firmly, clearly and politely about the need to respect human rights at home and around the world. We will continue to do that, we will continue to stand up for Canadian values and indeed for universal values and human rights at any occasion,”

The tension started last Friday when Canada expressed concerns over arrests of women rights activist in Saudi Arabia. The latter responded to the criticism by freezing new trade with Canada and expelled Canadian ambassador. It’s reported yesterday by the Financial Times that Saudi central bank and state pensions ordered their overseas asset managers to sell their Canadian assets, including equities, bonds and cash holdings “no matter the cost”. Saudi Arabia’s foreign minister also said there is “nothing to mediate” with Canada.

USD/CAD spiked higher to 1.3119 yesterday but it’s now back pressing 1.3000.

Looking ahead

ECB will release economic bulletin today. Canada will release housing starts and new housing price index. US will release PPI, wholesale inventories and jobless claims.

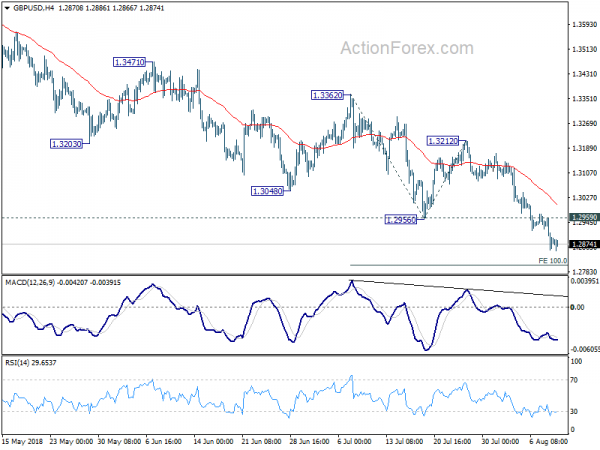

GBP/USD Daily Outlook

Daily Pivots: (S1) 1.2838; (P) 1.2899; (R1) 1.2946; More…

Intraday bias in GBP/USD remains on the downside at this point. Current decline, as part of the down trend from 1.4376, should target 100% projection of 1.3362 to 1.2956 from 1.3212 at 1.2806 first. Break will target 161.8% projection at 1.2555 next. On the upside, above 1.2959 minor resistance will turn bias neutral and bring consolidation. But upside should be limited below 1.3212 resistance to bring fall resumption.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4141). Fall from 1.4376 has met 61.8% retracement of 1.1946 (2016 low) to 1.4376 at 1.2874 already. Decisive break of 1.2874 will raise the chance of long term down trend resumption through 1.1946 low. On the upside, break of 1.3212 resistance is needed to be the first indication of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% | 1.75% | |

| 23:01 | GBP | RICS House Price Balance Jul | 4% | 4% | 2% | 3% |

| 23:50 | JPY | Japan Money Stock M2+CD Y/Y Jul | 3.00% | 3.10% | 3.20% | 3.10% |

| 23:50 | JPY | Machine Orders M/M Jun | -8.80% | -0.80% | -3.70% | |

| 1:30 | CNY | CPI Y/Y Jul | 2.10% | 2.00% | 1.90% | |

| 1:30 | CNY | PPI Y/Y Jul | 4.60% | 4.60% | 4.70% | |

| 5:45 | CHF | Unemployment Rate Jul | 2.60% | 2.60% | 2.60% | |

| 6:00 | JPY | Machine Tool Orders Y/Y Jul P | 13.00% | 11.40% | ||

| 8:00 | EUR | ECB Economic Bulletin | ||||

| 12:15 | CAD | Housing Starts Jul | 218K | 248K | ||

| 12:30 | CAD | New Housing Price Index M/M Jun | 0.00% | 0.00% | ||

| 12:30 | USD | Initial Jobless Claims (AUG 4) | 217K | 218K | ||

| 12:30 | USD | PPI M/M Jul | 0.30% | 0.30% | ||

| 12:30 | USD | PPI Y/Y Jul | 3.40% | 3.40% | ||

| 12:30 | USD | PPI Core M/M Jul | 0.30% | 0.30% | ||

| 12:30 | USD | PPI Core Y/Y Jul | 2.80% | 2.80% | ||

| 14:00 | USD | Wholesale Inventories M/M Jun F | 0.00% | 0.00% | ||

| 14:30 | USD | Natural Gas Storage | 35B |