Euro trades broadly higher in Asian session today, except versus New Zealand Dollar. The common currency is extending this week’s powerful rebound. Meanwhile, Canadian Dollar is trading as the weakest one, followed but Dollar as the second weakest. For the week, Euro remains the strongest one on a powerful rebound. It’s followed by Australian Dollar as the second strongest. Canadian Dollar is the weakest one, paring back some of this month’s gain. Sterling is the second weakest on worries over no-deal Brexit.

The strength in Euro can firstly be explained by Dollar’s failure in breaking through key resistance level. That is, EUR/USD rebounded strongly after defending 1.1507 key support level. The greenback is apparently troubled by the recovery in the Chinese Yuan follow PBoC measure. EUR/GBP also takes advantage of the no-deal Brexit worries to surge through 0.8967 key resistance level. Resumption of medium term rise from 0.8620 in EUR/GBP could help lift Euro elsewhere.

Thirdly, the common currency appears to be benefited from China trade data. The set of data clearly showed that China is turning to the EU for trade, in rather drastic and speedy way in July. Since early part of the year, Dollar has always benefit from Trump’s escalation in trade conflicts. But going forward, it’s worth a watch on Euro’s reactions to Trump’s comments on trade with China.

China’s import from EU jumped 20.5% mom, trade surplus shrank -31.0% mom, as US-China trade war starts

China’s July trade data revealed some interesting findings as US-China trade war formally started. Import from the EU jumped as massive 20.% mom, 19.7% yoy. Trade surplus with EU dropped -31.0% mom, -7.9% yoy. On the other hand, trade surplus with US dropped a mere -3.0%, with -2.5% decline in export and -1.5% mom fall in imports. Looks like the EU could have the last laugh over Trump’s trade policy.

Here are the details:

Overall –

- China trade surplus in CNY term narrowed to CNY 177B in July, down from CNY 262B, missed expectation of CNY 225B. Exports rose 6.0% yoy to CNY 1390B while imports jumped 20.9% yoy to CNY 1213B. Year-to-Jul, exports rose 5.0% yoy to CNY 8894B while imports rose 12.9% yoy to CNY 7826B, with CNY 1068B surplus.

- In USD term, trade surplus narrowed to USD 28.1B, down from USD 41.6B and missed expectation of USD 39.1B. Exports rose 12.2% yoy to USD 215.6B while imports rose 27.3% yoy to USD 187.5B. Year-to Jul, exports rose 12.6% yoy to USD 1387B while imports rose 21.0% yoy to USD 1221B, with USD 166B surplus.

With EU –

- EU remains China’s largest trading partner with total trade risen 5.9% mom, 13.4% yoy to USD 60.7B in July. Exports dropped -2.3% mom, rose 9.4% yoy to USD 35.9B. Imports rose a massive 20.5% mom and 19.7% yoy to USD 24.7B. For July, trade surplus with EU dropped -31.0% mom, -7.9% yoy to USD 11.2B.

- For year-to-July, China’s total trade with EU rose 12.7% yoy to USD 383B. Exports rose 10.8% yoy to USD 227B. Imports rose 15.6% yoy to USD 155B. Total trade surplus merely grew 1.6% yoy to USD 72.1B.

With US –

- With the US, total trade dropped -2.3% mom, rose 11.2% yoy to USD 55.0B in July. Exports dropped -2.5% mom rose 11.2% yoy to USD 35.9B. Imports dropped -1.5% mom, rose 11.1% yoy to USD 24.7B. Trade surplus dropped -3.0% mom, rose 11.3% yoy to USD 28.1B.

- For year-to July, China’s total trade with US rose 12.2% yoy USD 357B. Exports rose 12.5% yoy to USD 259.1B. Imports rose 11.4% yoy to 97.5B. Trade surplus rose 13.2% yoy to USD 161.6B.

USTR: 25% tariffs on $16B of Chinese goods to start on Aug 23

The US Trade Representative announced to start to collect 25% tariffs on USD 16B of Chinese imports starting August 23. The announced lists contains 279 of the original 284 tariff lines that were proposed back on June 15. This is the second tranche of tariffs as part of the Section 301 intellectual property investigations. The first tranche of 25% tariffs on USD 34B of Chinese goods already took effect on July 6. The upcoming 25% tariffs on USD 200B in Chinese goods are work in progress.

In the statement, USTR reiterated China’s bad practices as revealed by Section 301 investigation. The practices include:

- China uses joint venture requirements, foreign investment restrictions, and administrative review and licensing processes to require or pressure technology transfer from U.S. companies.

- China deprives U.S. companies of the ability to set market-based terms in licensing and other technology-related negotiations.

- China directs and unfairly facilitates the systematic investment in, and acquisition of, U.S. companies and assets to generate large-scale technology transfer.

- China conducts and supports cyber intrusions into U.S. commercial computer networks to gain unauthorized access to commercially valuable business information.

BoJ: Allowing long-term yields to rise may contribute to sluggish prices

BoJ released the Summary of Opinions at the July 30/31 monetary policy meeting today. There BoJ added forward guidance to ” maintain the current extremely low levels of short- and long-term interest rates for an extended period of time”. Also, BoJ is allowing 10 year JGB yield to move between -0.1% and +0.1%, as Governor Haruhiko Kuroda noted in the press conference.

The summary of opinions noted that it’s “extremely important” to introducing forward guidance as a new measure. And, that would strengthen its commitment to achieving the price stability target, in order to ensure public confidence in its strong stance toward achieving the target.”

Also, the summary noted that “controlling the long-term yields in a flexible manner is likely to contribute to maintaining and improving market functioning.” Rise in interest rates “is expected to be effective in alleviating the cumulative impact on the functioning of financial intermediation and enhancing the sustainability of the Bank’s policy.

Additionally, “referring to the recent developments in long-term interest rates in major economies, it can be considered appropriate for interest rate control in Japan to allow the yields to move upward and downward by around 0.25 percent.” Though, most member agreed that it should be “made clear at the press conference” that currently yield may move between -0.1% to 0.1%.

However, the summary also noted concerns that ” when medium- to long-term inflation expectations are weak, making policy adjustments that could allow the long-term yields to rise may lead to an increase in real interest rates and thereby contribute to sluggish prices.”

RBA Lowe reiterated next move is up not down

RBA Governor Philip Lowe delivered a speech titled “Demographic Change and Recent Monetary Policy” today. There he reiterated that “the next move in interest rates to be up, not down”. But the timing will depends upon the “speed of the progress” in “reducing the unemployment rate and having inflation return to around the midpoint of the target range on a sustained basis.” And in the Q&A, Low also noted that there is no strong case for a near term move.

On the economy, Lowe’s comments were similar to those in yesterday’s RBA statement. That is, GDP is expected to average a bit above 3% in 2018 and 2019. Unemployment rate is expected to drop over time to 5% at some point over the next few years. And Australia could “go lower than this on a sustained basis”. Due to once-off factors, inflation could slow to 1.75% in 2018. But over the forecast period, inflation is projected to rise to 2.5% in 2020.

Lowe also pointed to steady increased in job vacancies with vacancy rate hitting highest level in many years. And, there was an increased in number of businesses reporting hiring difficulties. The tightening of labor market will lead to higher wages as a “more general story”.

On financial market risks, Lowe noted that borrowing by investors has “slowed considerably” because of “reduced demand” and “tightening of credit standards”. And the change in financial trends has helped reduce the build-up of risk.”

Released from Australia, home loans dropped -1.1% mom in June versus expectation of 0.1% mom rise.

Looking ahead

The economic calendar is rather empty today with Canada building permits and US crude oil inventories as main feature.

EUR/USD Daily Outlook

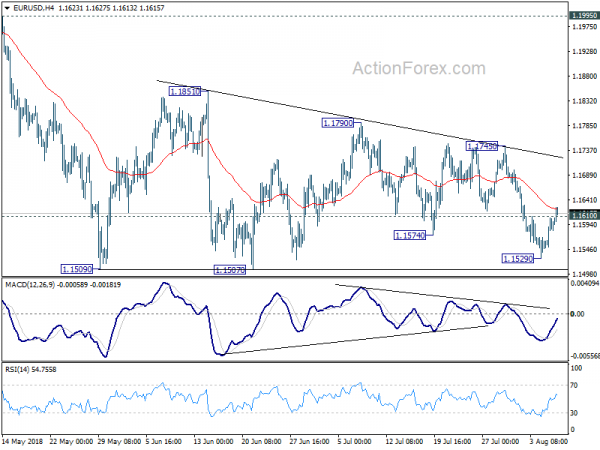

Daily Pivots: (S1) 1.1562; (P) 1.1586 (R1) 1.1622; More…..

EUR/USD’s break of 1.1610 minor resistance confirms bottoming at 1.1529. And, the consolidation pattern from 1.1509 has started another rising leg. Intraday bias is mildly on the upside for the moment. Stronger rise could be seen back to 1.1745 resistance. But after all, upside should be limited by 1.1851 to bring down trend resumption eventually. On the downside, decisive break of 1.1507 key support will resume larger down trend from 1.2555 through 50% retracement of 1.0339 to 1.2555 at 1.1447.

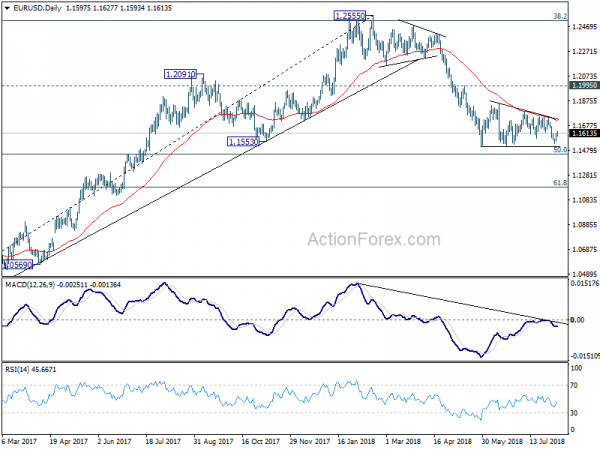

In the bigger picture, EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BOJ Summary of Opinions Jul | ||||

| 23:50 | JPY | Current Account (JPY) Jun | 1.76T | 1.84T | 1.85T | |

| 23:50 | JPY | Bank Lending incl Trusts Y/Y Jul | 2.00% | 2.30% | 2.20% | |

| 1:30 | AUD | Home Loans M/M Jun | -1.10% | 0.10% | 1.10% | 1.00% |

| 3:05 | CNY | Trade Balance (USD) Jul | 28.1B | 39.1B | 41.6B | |

| 3:05 | CNY | Trade Balance (CNY) Jul | 177B | 255B | 262B | |

| 5:00 | JPY | Eco Watchers Survey Current Jul | 46.6 | 47.8 | 48.1 | |

| 12:30 | CAD | Building Permits M/M Jun | -2.70% | 4.70% | ||

| 14:30 | USD | Crude Oil Inventories | 3.8M | |||

| 21:00 | NZD | RBNZ Rate Decision | 1.75% | 1.75% |