Dollar trades broadly lower today and selloff accelerates in early US session. EUR/USD’s reversal ahead of 1.1507 key support level is a factor pressing the greenback. The Chinese Yuan is also attempting another rebound after yesterday’s brief setback, with USD/CNH back pressing 6.82.

The overall development helps lifted global equities too. At the time of writing, DAX is up 0.86%, CAC up 0.83% and FTSE up 0.99%. Earlier in the Asia, Nikkei closed up 0.69%, Singapore Strait Times gained 1.66% while Hong Kong HSI increased 1.54%. China Shanghai SSE defended 2700 handle again and jumped 2.74% to 2779.37.

With the help of easing risk aversion, Australian Dollar is trading as the strongest one today, followed by Euro. Sterling is the second weakest one as worries over no-deal Brexit continues to weigh.

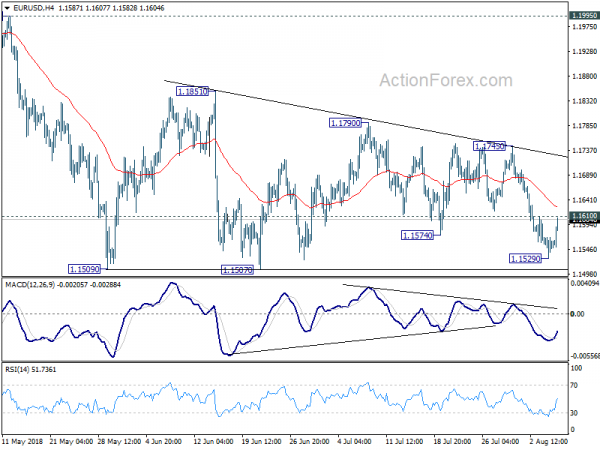

Technically, Euro is a major focus in the current session. EUR/USD’s immediate focus in on 1.1610 minor resistance. Break will confirm bottoming and EUR/USD should then start another rising leg in the consolidation pattern from 1.1509, targeting 1.1745 resistance EUR/GBP is now pressing 0.8957 key resistance. Decisive break there will resume medium term rally from April low at 0.8620.

German trade surplus narrowed, industrial production dropped

Euro shrugs off another batch of weak German economic data. Released from Germany, trade surplus narrowed to EUR 21.8B (EUR 19.3B seasonally adjusted) in June. Exports rose 7.8% yoy to EUR 115.5B. Imports rose 10.2% yoy to 93.7B. Industrial production dropped -0.9% mom in June, worse than expectation of -0.5%. Also from Europe, Swiss foreign currency reserves rose to CHF 750B in July. UK Halifax house prices rose 1.4% mom in July.

China foreign exchange reserves rose 0.19% in July

The Chinese State Administration of Foreign Exchange said in its website that at the end of July this year, the country was holding USD 3.1179T in foreign exchange reserves, up USD 5.8B, or 0.19% from end of June.

SAFE said that cross-border capital flows were generally stable. And, supply and demand in the foreign exchange markets was balanced. The jump in FX reserve was primarily due to non-US dollar currency exchange rate conversion and asset price changes

However, SAFE also noted the volatility in global financial markets and the “double rally” in USD exchange rates and interest rates. Some emerging markets were hit hard because of that. Additionally, “external uncertainties” increased due to escalating trade conflicts.

RBA left the cash rate unchanged at 1.50%

RBA left the cash rate unchanged at 1.50% for the 22nd meeting today. The accompanying statement continued to deliver a “neutral” tone on the future path of the monetary policy. Since the last meeting, domestic economic growth has stayed, and will stay, “above trend” while the job market has continued to improve.

Wage growth has remained soft but the worst is likely over. Hopefully, this would help lift household consumption which has been RBA’s major concern. The statement had more coverage of inflation that the previous one. The discussion signals that RBA might downgrade its inflation forecast at the upcoming Statement of Monetary Policy.

Inflation has been “in line” with RBA’s expectations with headline CPI and core CPI at 2.1% and close to 2%, respectively, in the past year. It suggested that the central forecast is “for inflation to be higher in 2019 and 2020 than it is currently”. Meanwhile, it noted that “once-off declines in some administered prices in the September quarter are expected to result in headline inflation in 2018 being a little lower than earlier expected, at 1.75%”. This signals that we might see downward revision in inflation forecast at the Statement of Monetary Policy due Friday.

More in RBA Keeps Policy Rate at Record Low for Two Years; Might Downgrade 2018 Inflation Forecast

Japan real wages grew at fastest pace since 1997

Japan nominal labor cash earnings rose strongly by 3.6% yoy in June versus expectation of 1.7% yoy. Real wages grew 2.8% yoy, the fastest pace in 21 years since January 1997. Looking at the details, regular pay grew 1.5% yoy. One-off payment including bonuses jumped an impressive 7.0% yoy. Overtime pay also rose 3.5% yoy, a notable acceleration of 2.0% yoy in May. The set of data should be welcomed by BoJ. Nonetheless, persistent strength is needed to eventually change the “social mode” of deflation mind set, which suppresses inflation pressures.

Also from Japan, overall household spending dropped -1.2% yoy in June, matched expectations. Leading index dropped to 105.2 in June, down from 106.9 and missed expectation of 105.4.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1532; (P) 1.1552 (R1) 1.1574; More…..

EUR/USD’s rebound suggests bottoming at 1.1529. Focus is back on 1.1610 minor resistance. Break will indicates that the consolidation pattern from 1.1509 has started another rise leg. Intraday will be turned back to the upside for 1.1745 resistance, and possibly above. Still, we’d expect strong resistance from 1.1851 to limit upside to bring down trend resumption eventually. On the downside, decisive break of 1.1507 key support will resume larger down trend from 1.2555 through 50% retracement of 1.0339 to 1.2555 at 1.1447.

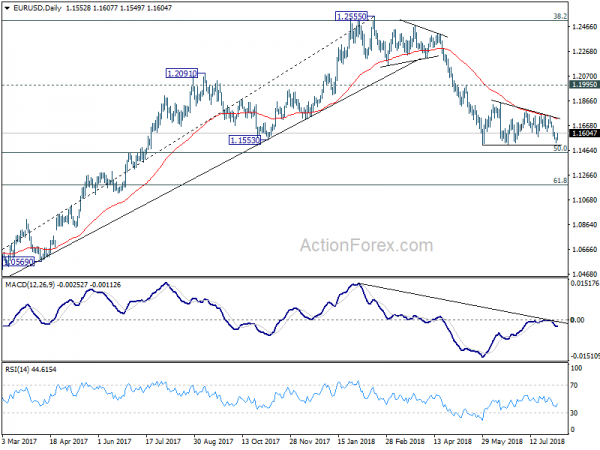

In the bigger picture, EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Construction Index Jul | 52 | 50.6 | ||

| 23:01 | GBP | BRC Retail Sales Monitor Y/Y Jul | 0.50% | 1.30% | 1.10% | |

| 23:30 | JPY | Overall Household Spending Y/Y Jun | -1.20% | -1.20% | -3.90% | |

| 0:00 | JPY | Labor Cash Earnings Y/Y Jun | 3.60% | 1.70% | 2.10% | |

| 4:30 | AUD | RBA Rate Decision | 1.50% | 1.50% | 1.50% | |

| 5:00 | JPY | Leading Index Jun P | 105.2 | 105.4 | 106.9 | |

| 6:00 | EUR | German Trade Balance Jun | 19.3B | 21.4B | 20.3B | |

| 6:00 | EUR | German Industrial Production M/M Jun | -0.90% | -0.50% | 2.60% | |

| 7:00 | CHF | Foreign Currency Reserves (CHF) Jul | 750B | 749B | 748B | |

| 7:30 | GBP | Halifax House Prices M/M Jul | 1.40% | 0.20% | 0.30% | 0.90% |

| 14:00 | CAD | Ivey PMI Jul | 64.2 | 63.1 |